A Currency Transaction Report is a report that financial institutions must file with the Financial Crimes Enforcement Network (FinCEN) of the US Department of Treasury for certain currency transactions. It is important to note that financial institutions are required to file CTRs for certain currency transactions that exceed a specific threshold. The threshold for filing a CTR is $10,000 or more in cash transactions in a single business day. This includes deposits, withdrawals, and exchanges of currency. By requiring financial institutions to report on these large currency transactions, the government can better monitor the movement of funds and detect patterns that may indicate criminal activity. A CTR must contain the following elements: Financial institutions must provide their identifying information, including name, address, and taxpayer identification number, when filing a CTR. Financial institutions must provide identifying information for the customer involved in the transaction, including name, address, social security number, and date of birth. Financial institutions must describe the nature and purpose of the transaction in the CTR. The report should indicate whether the transaction is a deposit, withdrawal, transfer, or exchange. Financial institutions must indicate the amount of currency involved in the transaction. If the transaction involves a check or other instrument, the financial institution must convert the amount to its equivalent in cash. Financial institutions must maintain records of the CTR for five years and make them available for examination upon request. The Bank Secrecy Act of 1970 is a federal law that requires financial institutions to report currency transactions exceeding $10,000 in a single business day. The BSA's primary objective is to prevent money laundering and other illicit financial activities. The BSA requires financial institutions to file CTRs with FinCEN. The BSA also mandates that financial institutions maintain records of currency transactions of $3,000 or more. Financial institutions must also comply with the reporting requirements set by FinCEN. The Financial Crimes Enforcement Network is a United States Department of the Treasury Bureau that collects and analyzes information about financial transactions to combat money laundering, terrorist financing, and other financial crimes. Under the BSA, financial institutions must file a CTR for any currency transaction exceeding $10,000, regardless of whether it is conducted in a single transaction or multiple transactions that are related. If the transactions are conducted over a period of time, they are considered related if the financial institution has knowledge, suspicion, or reason to believe that the transactions are designed to avoid the CTR reporting requirements. Noncompliance with CTR requirements can result in severe legal and financial repercussions for financial institutions. Financial institutions that fail to comply with CTR requirements may face civil and criminal penalties, fines, and legal repercussions. Noncompliance can also lead to reputational damage, loss of customer trust, and increased regulatory scrutiny. Deposits, withdrawals, transfers, and exchanges are examples of transactions that may trigger a CTR. Financial institutions must file a CTR for any currency transaction exceeding $10,000, regardless of whether it is conducted in a single transaction or multiple transactions that are related. Financial institutions must also file a CTR for any transactions that they suspect may be structured to avoid reporting requirements. Financial institutions must file a CTR for any cash deposits exceeding $10,000 in a single business day. Deposits of less than $10,000 made over time and that the financial institution has knowledge, suspicion, or reason to believe are designed to avoid reporting requirements must also be reported. Financial institutions must file a CTR for any cash withdrawals exceeding $10,000 in a single business day. Similar to deposits, withdrawals made over a period of time that the financial institution suspects are structured to avoid reporting requirements must also be reported. Financial institutions must file a CTR for any currency transfers exceeding $10,000 in a single business day. Transfers can be between accounts held by the same customer or between different customers. Currency exchanges involving cash also trigger CTR reporting requirements. Financial institutions must file a CTR for any currency exchange involving more than $10,000 in cash in a single transaction or multiple transactions that are related. Financial institutions must file a CTR for transactions involving foreign entities or individuals, those that appear structured to avoid reporting requirements, and those that involve suspicious customers or activities. Multiple Transactions That Appear to Be Structured to Avoid CTR Reporting One example of a transaction that appears to be structured to avoid CTR reporting is when a customer makes several deposits or withdrawals in smaller amounts over a period of time, with the total amount exceeding $10,000. Transactions Involving a Suspicious Customer or Activity Financial institutions must file a CTR for transactions that involve suspicious customers or activities. Suspicious activity may include transactions involving high-risk customers, such as politically exposed persons, or those with a history of criminal activity. Transactions Involving Foreign Entities or Individuals Financial institutions must file a CTR for transactions involving foreign entities or individuals. The financial institution must report the identifying information for both the sender and the recipient of the funds. Financial institutions must comply with the CTR requirements, which can result in increased compliance costs. Financial institutions must also maintain customer privacy and provide an excellent customer experience while fulfilling their regulatory obligations. Compliance with CTR requirements can be time-consuming and expensive for financial institutions. Customers who conduct large currency transactions may experience increased scrutiny, which can affect their banking relationship. Financial institutions must balance their regulatory obligations with maintaining customer privacy and providing an excellent customer experience. Financial institutions must file CTRs accurately and timely to avoid penalties and legal repercussions. Failure to comply with CTR requirements can result in civil and criminal penalties, fines, and legal repercussions. Noncompliance can also lead to reputational damage, loss of customer trust, and increased regulatory scrutiny. A Currency Transaction Report is a report that financial institutions must file with the Financial Crimes Enforcement Network of the US Department of Treasury for certain currency transactions that exceed $10,000 or more in cash transactions in a single business day. CTRs help to detect and deter money laundering, tax evasion, terrorist financing, and other illicit financial activities. The report must contain identifying information for the financial institution, customer, description of the transaction, amount of currency involved, and recordkeeping requirements. Failure to comply with CTR requirements can result in severe legal and financial repercussions, including civil and criminal penalties, fines, and legal repercussions. Financial institutions must balance their regulatory obligations with maintaining customer privacy and providing an excellent customer experience. It is crucial to file CTRs accurately and timely to avoid penalties and legal repercussions, as noncompliance can lead to reputational damage, loss of customer trust, and increased regulatory scrutiny.What Is a Currency Transaction Report (CTR)?

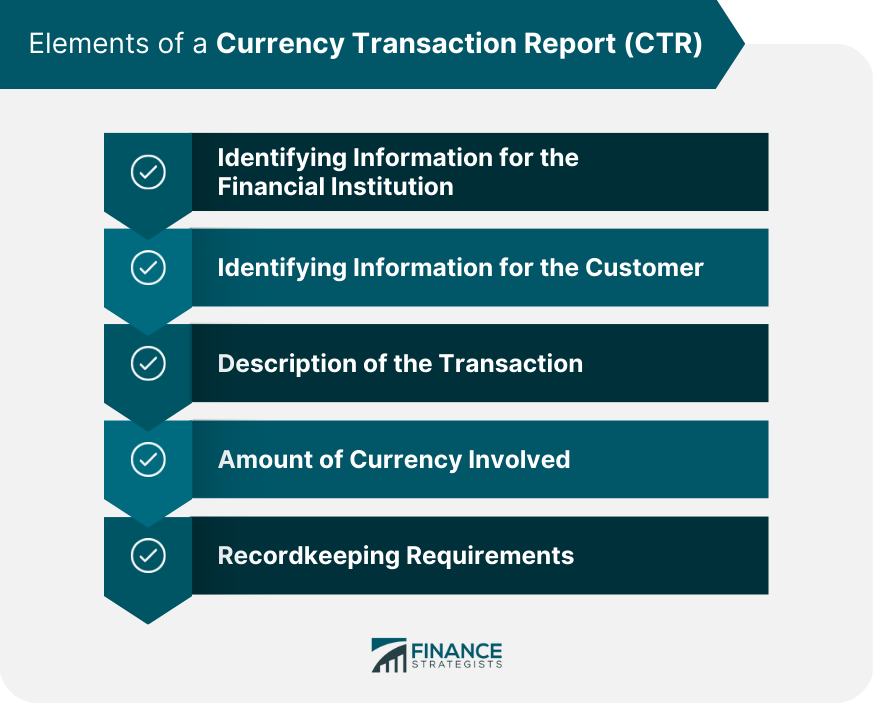

The purpose of a CTR is to provide information to law enforcement agencies about potentially suspicious or illegal financial activities, particularly those related to money laundering, tax evasion, and terrorist financing. Elements of a CTR

Identifying Information for the Financial Institution

Identifying Information for the Customer

Description of the Transaction

Amount of Currency Involved

Recordkeeping Requirements

The records must include the date of the transaction, the amount of currency involved, the nature and purpose of the transaction, and the identifying information for the financial institution and the customer.

Legal Requirements for a CTR

The Bank Secrecy Act (BSA)

Financial Crimes Enforcement Network

FinCEN also provides support to law enforcement agencies in their investigations of financial crimes.Reporting Thresholds for a CTR

If the transactions are conducted in a single business day, they are considered related, and a CTR must be filed. Consequences for Noncompliance With CTR Requirements

Types of Transactions That Trigger a CTR

Deposits

Examples of such transactions include deposits made by different individuals or entities under the same name or deposits made in smaller amounts to avoid the $10,000 reporting threshold.Withdrawals

Transfers

The financial institution must report the identifying information for both the sender and the recipient of the funds.Exchanges

Examples of Currency Transaction Reporting Scenarios

In this scenario, the financial institution must file a CTR as the transactions are related and structured to avoid the reporting requirements.Impact of CTRs on Financial Institutions and Customers

Increased Regulatory Compliance Costs for Financial Institutions

Financial institutions must train their employees to identify and report suspicious activity, implement risk management programs, and ensure that their systems and processes are adequate for CTR reporting.Potential Negative Impact on Customer Experience and Privacy

Importance of Accurate and Timely Reporting to Avoid Penalties and Legal Repercussions

Conclusion

Currency Transaction Report (CTR) FAQs

A Currency Transaction Report (CTR) is a report that financial institutions must file with the Financial Crimes Enforcement Network (FinCEN) of the US Department of Treasury for certain currency transactions.

Financial institutions must file a CTR for any currency transaction exceeding $10,000, regardless of whether it is conducted in a single transaction or multiple transactions that are related. This includes deposits, withdrawals, transfers, and exchanges.

The Bank Secrecy Act (BSA) mandates that financial institutions file a CTR for currency transactions exceeding $10,000 in a single business day. Financial institutions must also maintain records of currency transactions of $3,000 or more.

Noncompliance with CTR requirements can result in civil and criminal penalties, fines, and legal repercussions. Financial institutions may also face reputational damage, loss of customer trust, and increased regulatory scrutiny.

Compliance with CTR requirements can be time-consuming and expensive for financial institutions. Customers who conduct large currency transactions may experience increased scrutiny, which can affect their banking relationship. However, accurate and timely reporting is crucial to avoid penalties and legal repercussions and maintain customer trust.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.