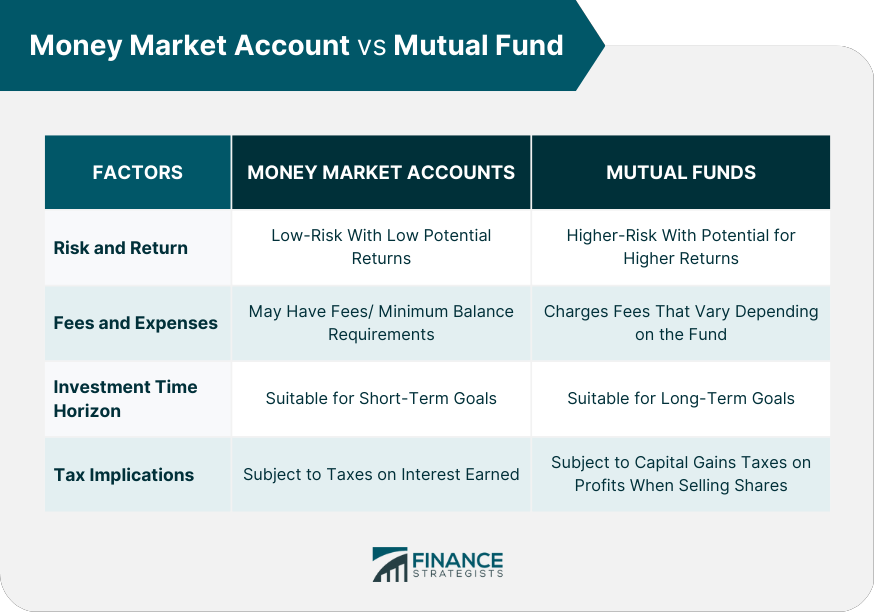

Individuals looking for low-risk investment options may consider money market accounts or mutual funds. Despite sharing similarities, it is crucial to note significant differences between the two when deciding on the best investment option. A money market account is a type of savings account that typically pays a higher interest rate than a traditional savings account. Money market accounts are FDIC-insured up to a certain amount, making them a low-risk investment option. They invest in short-term, high-quality debt securities, such as certificates of deposit and U.S. Treasury bills. In contrast, a mutual fund is an investment option where multiple investors pool resources to create a diversified portfolio of various securities, including bonds, stocks, and other assets. Fund managers who are professionals are responsible for making investment decisions on behalf of the investors. Money market accounts are considered a type of savings account and often provide higher interest rates than traditional savings accounts. Banks and credit unions offer these accounts and are FDIC-insured. This means your money is protected up to a certain amount if the bank fails. Money market accounts typically require a minimum balance to open and maintain, and some may charge fees if your balance falls below a certain threshold. Some of the features of money market accounts include: Higher Interest Rates: Individuals seeking low-risk investments with reasonable returns may find money market accounts appealing since they offer higher interest rates than traditional savings accounts. Low Risk: Money market accounts to invest in short-term, high-quality debt securities, such as certificates of deposit and U.S. Treasury bills. This makes them a low-risk investment option. FDIC-Insured: Money market accounts are FDIC-insured up to a certain amount, making them a safe investment option. Minimum Balance Requirements: Money market accounts typically require a minimum balance to open and maintain. Investors may find money market accounts advantageous due to the following benefits: Low Risk: Money market accounts are considered low-risk investments, making them a good option for individuals who want to earn a reasonable rate of return without taking on too much risk. FDIC-Insured: Money market accounts are FDIC-insured up to a certain amount, making them a safe investment option. Reasonable Returns: For individuals seeking low-risk investment options with reasonable returns, money market accounts can be attractive since they offer higher interest rates than traditional savings accounts. There are also some drawbacks associated with money market accounts, including the following: Low Returns: While money market accounts offer reasonable returns, they are relatively low compared to other investment options. Withdrawal Limitations: Some money market accounts may have limitations on withdrawals or transfers, which can be a disadvantage if you need quick access to your funds. Managed by professional fund managers, a mutual fund combines funds from multiple investors to develop a diversified portfolio of securities, including stocks, bonds, and other assets. Some features of mutual funds include: Diversification: Investing in a range of securities, such as stocks, bonds, and other assets, allows mutual funds to diversify their portfolio and spread out the investment risk. Professional Management: Professional fund managers are responsible for making investment decisions on behalf of investors who have put their resources into mutual funds. Variety of Options: Mutual funds come in various options, including stock funds, bond funds, and balanced funds. Mutual funds may be considered advantageous because of the following reasons: Diversification: Investing in a mutual fund means acquiring a portfolio of various securities such as stocks, bonds, or other assets. This investment strategy can aid in diversifying your risk. Professional Management: Professional and experienced fund managers are responsible for making investment decisions on behalf of the investors who have invested in mutual funds. Potential for Higher Returns: Mutual funds offer higher returns than money market accounts. While there are advantages to mutual funds, there are disadvantages too. Consider the following: Market Risk: The returns of mutual funds can be impacted by market fluctuations, making them susceptible to market risks. Fees and Expenses: Mutual funds charge fees and expenses that can decrease your returns over time. Lack of Control: Investing in mutual funds means relinquishing control of investment decisions to the fund manager. When choosing between a money market account and a mutual fund, several factors must be considered. Here are some important factors to consider when comparing the two options: One of the main differences between money market accounts and mutual funds is the level of risk and potential return. Money market accounts are considered low-risk investments with relatively low potential returns. Mutual funds, on the other hand, are higher-risk investments with the potential for higher returns. Money market accounts invest in short-term, high-quality debt securities, which makes them a low-risk investment option. However, their returns are relatively low compared to other investment options. On the other hand, mutual funds invest in a diversified portfolio of stocks, bonds, or other securities, which makes them a higher-risk investment option. However, they offer the potential for higher returns than money market accounts. Another important factor to consider when choosing between money market accounts and mutual funds is the fees and expenses associated with each option. Money market accounts may have fees or minimum balance requirements, while mutual funds charge fees and expenses that can vary widely depending on the fund. Investment time horizon is another important factor to consider when choosing between money market accounts and mutual funds. If you are investing for the short-term, such as saving for a down payment on a home or a car, a money market account may be a good choice. If you are investing for the long-term, such as saving for retirement, a mutual fund may be a better fit, as it has the potential to earn higher returns over time. Another factor to consider when choosing between money market accounts and mutual funds is the tax implications of each option. Money market accounts are subject to taxes on interest earned, while mutual funds are subject to capital gains taxes on any profits earned when selling shares. When choosing between money market accounts and mutual funds, examining your financial circumstances and goals is essential. This will enable you to determine which investment option is suitable for you. If you are seeking a low-risk investment option with reasonable returns and the ability to access your funds quickly, a money market account may be a good choice. Money market accounts are FDIC-insured, meaning your investment is protected up to a certain amount. This investment option is also suitable for individuals with short-term financial goals, such as saving for a vacation or a down payment on a home. Additionally, money market accounts are ideal for risk-averse investors who want to avoid exposing themselves to too much financial risk. On the other hand, if you are willing to take on higher risk for the potential of higher returns over the long term and have a longer investment time horizon, a mutual fund may be a better fit. Mutual funds offer investors the potential to earn higher returns than money market accounts. However, mutual funds are subject to market fluctuations, which means that investors risk losing some or all of their investments if the market performs poorly. This investment option is also suitable for individuals with long-term financial goals, such as retirement savings. Ultimately, deciding whether to invest in a money market account or a mutual fund depends on your financial situation and goals. It is essential to conduct thorough research on both investment options and consult with a wealth management professional before making any investment decisions. This will enable you to make an informed decision that aligns with your financial objectives and helps you achieve long-term financial success. Money market accounts and mutual funds are popular low-risk investment options with unique features, advantages, and disadvantages. Money market accounts are ideal for those seeking low-risk investments with reasonable returns and quick access to funds. In contrast, mutual funds are suited for those willing to take on higher risk for the potential of higher returns over the long term with a longer investment time horizon. Considerations such as risk and return, fees and expenses, investment time horizon, and tax implications are all important when deciding between the two options. Ultimately, it is crucial to carefully evaluate your financial situation and goals before making any investment decisions. Consulting with a wealth management professional can help you make an informed decision that aligns with your financial objectives and helps you achieve long-term financial success.An Overview of Money Market Account vs Mutual Fund

Money Market Accounts

Features of Money Market Accounts

Advantages of Money Market Accounts

Disadvantages of Money Market Accounts

Mutual Funds

Features of Mutual Funds

Advantages of Mutual Funds

Disadvantages of Mutual Funds

Comparison of Money Market Accounts vs Mutual Funds

Risk and Return

Fees and Expenses

Investment Time Horizon

Tax Implications

Which Option Is Right for You?

The Bottom Line

Money Market Account vs Mutual Fund FAQs

A money market account is a low-risk investment option that provides reasonable returns with quick access to funds. In contrast, a mutual fund is a higher-risk investment option that offers the potential for higher returns over the long term with a longer investment time horizon.

Yes, money market accounts are FDIC-insured up to a certain amount, making them a safe investment option.

Yes, mutual funds charge fees and expenses, which can vary widely depending on the fund, and these costs can eat into your returns over time.

A money market account is a good investment option for individuals with short-term financial goals, such as saving for a vacation or a down payment on a home, as they offer reasonable returns and quick access to funds.

A mutual fund is a suitable investment option for individuals with long-term financial goals, such as saving for retirement, as they offer the potential for higher returns over the long term with a longer investment time horizon.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.