Couch potato investing is a passive investment strategy that involves investing in a diversified portfolio of low-cost index funds or exchange-traded funds (ETFs) and holding them for the long term. The idea behind this approach is to minimize fees and transaction costs while maximizing diversification and potential returns. This investment strategy is called "couch potato" because it requires minimal effort and time. Once the portfolio is set up, the investor simply needs to rebalance it periodically to maintain the desired asset allocation. One of the main benefits of couch potato investing is the low fees and transaction costs associated with investing in low-cost index funds or ETFs. Active investing often involves higher fees and expenses due to the costs of research, analysis, and management. By contrast, passive investing aims to replicate the performance of a broad market index, resulting in lower fees and expenses. Another benefit of couch potato investing is the passive approach to investing. This approach is ideal for investors who prefer a hands-off approach to investing and want to avoid the fees and complexity of actively managed funds. Passive investing is also more predictable than active investing, as it aims to track the performance of a benchmark index rather than trying to outperform it. Couch potato investing provides investors with a diversified portfolio of index funds or ETFs. This diversification helps to spread risk across different asset classes, reducing the overall risk of the portfolio. Diversification also allows investors to capture the potential returns of various market segments, resulting in a potentially higher overall return on investment. The Securities and Exchange Commission (SEC) bulletin provides helpful information about index funds, including how they work, their potential benefits and risks, and what investors should consider before investing. Couch potato investing is a long-term investment strategy. By holding a diversified portfolio of index funds or ETFs, investors can benefit from the long-term growth of the market. This is because the stock market tends to increase in value over time, even with fluctuations in the short term. With couch potato investing, investors can capture this long-term growth potential. Setting up a couch potato portfolio involves several steps that can help investors achieve a diversified, low-cost investment strategy with long-term growth potential. Before setting up a couch potato portfolio, investors should determine their risk tolerance and investment goals. Risk tolerance refers to the level of risk an investor is comfortable taking on, while investment goals refer to the investor's objectives for their investments, such as growth or income. By determining these factors, investors can select appropriate index funds or ETFs for their portfolio. Investors should select appropriate index funds or ETFs based on their risk tolerance and investment goals. For example, if an investor has a higher risk tolerance and is seeking growth, they may select index funds or ETFs that invest in stocks. If an investor has a lower risk tolerance and is seeking income, they may select index funds or ETFs that invest in bonds or other fixed-income securities. Once appropriate index funds or ETFs are selected, investors should establish their asset allocation. Asset allocation refers to the percentage of the portfolio that is invested in each asset class, such as stocks, bonds, and cash. This allocation should be based on the investor's risk tolerance and investment goals. It is important to periodically review and rebalance the portfolio to maintain the desired asset allocation. Finally, investors should periodically review and rebalance their couch potato portfolio. This means adjusting the allocation of the portfolio to maintain the desired asset allocation. For example, if stocks have performed well and have increased in value, the percentage of the portfolio invested in stocks may exceed the desired asset allocation. To rebalance the portfolio, the investor would sell some of the stocks and invest the proceeds in other asset classes to maintain the desired allocation. Although couch potato investing can be an effective and low-cost investment strategy, it is important to consider the potential risks and factors that may impact your investment performance. While couch potato investing can be an effective strategy, it is important to remember that all investments carry some degree of risk, and past performance is not a guarantee of future results. One of the primary risks associated with couch potato investing is market volatility. The value of the index funds or ETFs in the portfolio can fluctuate significantly based on market conditions. This volatility can result in significant losses for investors who panic and sell their investments during market downturns. Another consideration when setting up a couch potato portfolio is the importance of research and due diligence. While passive investing involves minimal research and analysis, investors still need to do their due diligence to select appropriate index funds or ETFs. This includes researching the performance, fees, and expenses associated with each investment. Investors may also benefit from seeking advice from a financial advisor when setting up a couch potato portfolio. A financial advisor can provide guidance on selecting appropriate index funds or ETFs, establishing asset allocation, and rebalancing the portfolio. They can also help investors determine their risk tolerance and investment goals and provide education on the potential risks and benefits of passive investing. When it comes to investing, there are two main approaches: passive and active. While passive investing, such as couch potato investing, aims to replicate the performance of a benchmark index, active investing involves trying to outperform the market through the buying and selling of individual securities or mutual funds. Each approach has its own advantages and disadvantages, and investors should consider these factors when selecting an investment strategy. One of the main advantages of active investing is the potential for higher returns than passive investing. This is because active investors aim to outperform the market by buying and selling individual securities or mutual funds based on their research and analysis. Active investing also offers investors greater control over their investments, as they can make decisions based on their own research and analysis. However, active investing also comes with some disadvantages. One of the main disadvantages is higher fees and transaction costs associated with research, analysis, and management. These costs can significantly reduce returns, making it harder to outperform the market. Active investing also requires more time and effort on the part of the investor, as they need to research and analyze individual securities or mutual funds. Numerous studies have shown that passive investing outperforms active investing over the long term. This is largely due to the lower fees and expenses associated with passive investing. According to Morningstar, over the past 10 years, the average annual expense ratio for passive funds was 0.15%, compared to 0.69% for actively managed funds. In addition, a study by S&P Dow Jones Indices found that over a 15-year period, 92% of large-cap fund managers, 95% of mid-cap fund managers, and 96% of small-cap fund managers failed to outperform their respective benchmarks. In conclusion, couch potato investing is a passive investment strategy that is easy to implement and requires minimal effort. It involves investing in a diversified portfolio of low-cost index funds or ETFs and holding them for the long term. This approach provides numerous benefits, including low fees and transaction costs, a passive approach to investing, diversification through index funds or ETFs, and potential for long-term growth. To set up a couch potato portfolio, investors should determine their risk tolerance and investment goals, select appropriate index funds or ETFs, establish asset allocation, and periodically rebalance the portfolio. Investors should also be aware of the potential risks associated with market volatility and the importance of research and due diligence. Seeking advice from a financial advisor can also be beneficial. While passive investing may not be suitable for all investors, it is a viable option for those who prefer a hands-off approach to investing and want to avoid the fees and complexity associated with active investing. Whether an investor chooses passive or active investing, seeking the advice of a financial professional or wealth management firm can be instrumental in creating a successful investment strategy that aligns with their goals, risk tolerance, and unique financial situation.What Is Couch Potato Investing?

Benefits of Couch Potato Investing

Low Fees and Transaction Costs

Passive Approach to Investing

Diversification Through Index Funds or ETFs

Potential for Long-Term Growth

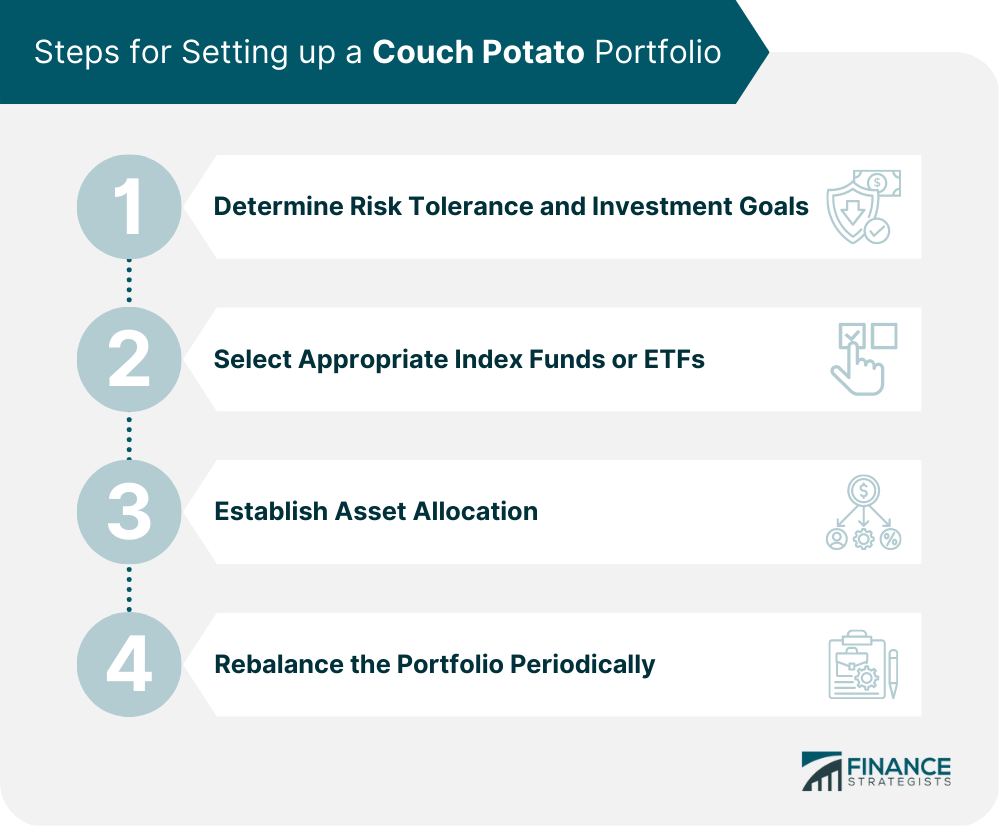

Setting up a Couch Potato Portfolio

Determining Risk Tolerance and Investment Goals

Selecting Appropriate Index Funds or ETFs

Establishing Asset Allocation

Rebalancing the Portfolio Periodically

Risks and Considerations

Market Volatility and Risk of Loss

Importance of Research and Due Diligence

Seeking Advice From a Financial Advisor

Comparing Couch Potato Investing to Active Investing

Advantages of Active Investing

Disadvantages of Active Investing

Comparison of Performance and Costs Between the Two Approaches

Final Thoughts

Couch Potato Investing FAQs

Couch potato investing is a passive investment strategy that involves investing in a diversified portfolio of low-cost index funds or ETFs and holding them for the long term.

The benefits of couch potato investing include low fees and transaction costs, a passive approach to investing, diversification through index funds or ETFs, and the potential for long-term growth.

To set up a couch potato portfolio, investors should determine their risk tolerance and investment goals, select appropriate index funds or ETFs, establish asset allocation, and periodically rebalance the portfolio.

The primary risks associated with couch potato investing are market volatility and the potential for loss. It is important to do research and due diligence when selecting index funds or ETFs and to periodically review and rebalance the portfolio.

Passive investing, like couch potato investing, involves minimal research and analysis and aims to replicate the performance of a benchmark index. Active investing involves buying and selling individual securities or mutual funds in an attempt to outperform the market. While active investing can potentially result in higher returns, passive investing typically outperforms over the long term due to lower fees and expenses.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.