Key rate duration is a measure of interest rate risk that focuses on the sensitivity of a bond or bond portfolio to specific points along the yield curve. This concept helps investors better assess potential changes in the value of their fixed-income investments due to interest rate fluctuations. In fixed-income portfolios, understanding key rate duration helps investors to effectively manage risk and implement hedging strategies. This deeper insight into interest rate risk can lead to more informed investment decisions and better overall performance. Duration is a measure that expresses the weighted average time to receive a bond's cash flows, indicating how sensitive the bond's price is to interest rate changes. The longer the duration, the greater the bond's price sensitivity to interest rate movements. While Macaulay duration represents the weighted average time to receive a bond's cash flows, modified duration measures the percentage change in the bond's price for a given change in yield. Key rate duration, on the other hand, focuses on the bond's price sensitivity to changes in specific segments of the yield curve, providing a more nuanced understanding of interest rate risk. Key rate duration is a concept used in finance to measure the sensitivity of a bond's price to changes in interest rates, and understanding how it works is essential for any investor looking to manage their portfolio effectively. Key rate duration measures the sensitivity of a bond or bond portfolio to changes in interest rates at specific points along the yield curve. By doing so, it allows investors to assess the impact of interest rate shifts on their fixed-income investments more accurately. Key rate tenors represent specific points along the yield curve, such as 2-year, 5-year, or 10-year maturities. Key rate durations are calculated for each of these tenors, providing a detailed understanding of the bond's interest rate sensitivity across the curve. Partial durations represent the sensitivity of a bond or bond portfolio to changes in interest rates at individual key rate tenors. These partial durations help investors identify the segments of the yield curve that have the most significant impact on their fixed-income investments. There are two types of key rate durations that investors use to assess the risks and potential returns of different bonds, each with its unique characteristics and applications in financial analysis. One-factor models assume that all key rate durations are influenced by a single factor, such as a parallel shift in the yield curve. These models are simpler but may not accurately capture the complexities of real-world interest rate movements. Multi-factor models consider multiple factors that can impact key rate durations, such as changes in the shape of the yield curve. These models provide a more comprehensive and accurate representation of interest rate risk but can be more complex to implement and analyze. Key rate duration is a valuable tool for investors and analysts as it provides a comprehensive and nuanced view of how changes in interest rates can affect the value of a bond or portfolio, which can help them make more informed investment decisions and manage risks more effectively. Key rate duration allows investors to gain deeper insight into the interest rate risk of their fixed-income portfolios. This knowledge can lead to more effective portfolio management and better investment decisions. By measuring the sensitivity of a bond or bond portfolio to specific segments. The previous model used in this conversation is unavailable. We've switched you to the latest default model of the yield curve, key rate duration provides a more nuanced understanding of interest rate risk. This insight enables investors to more accurately assess potential risks and returns, leading to better-informed investment decisions. Key rate duration also plays a vital role in hedging strategies. By identifying the segments of the yield curve that have the most significant impact on a fixed-income investment, investors can implement targeted hedges to reduce their exposure to interest rate risk. While key rate duration can be an essential metric for assessing the risks of bond investments, it is also important to understand the potential limitations and risks associated with relying on this measure to make investment decisions. While key rate duration provides a more nuanced understanding of interest rate risk, it is still limited in its predictive capabilities. Changes in the shape of the yield curve or unexpected shifts in interest rates can result in significant deviations from key rate duration predictions. Key rate duration assumes that changes in interest rates at specific points along the yield curve will occur in a parallel fashion. However, shifts in the shape of the yield curve can significantly impact key rate duration calculations and lead to inaccurate predictions of interest rate risk. Key rate duration calculations rely on certain assumptions and models that may not accurately reflect real-world conditions. Inaccurate assumptions or modeling can result in significant deviations from predicted interest rate risk. Key rate duration is a valuable tool in fixed-income portfolio management. It provides a more nuanced understanding of interest rate risk and enables investors to make better-informed investment decisions. However, it is essential to understand the limitations and risks associated with key rate duration and to use it in conjunction with other risk management tools to ensure effective risk management. As fixed-income markets continue to evolve, key rate duration will undoubtedly play a vital role in helping investors navigate the ever-changing landscape.What Is Key Rate Duration?

How Key Rate Duration Works

Measurement of Interest Rate Sensitivity

Key Rate Tenors

Partial Durations

Types of Key Rate Durations

One-Factor Models

Multi-Factor Models

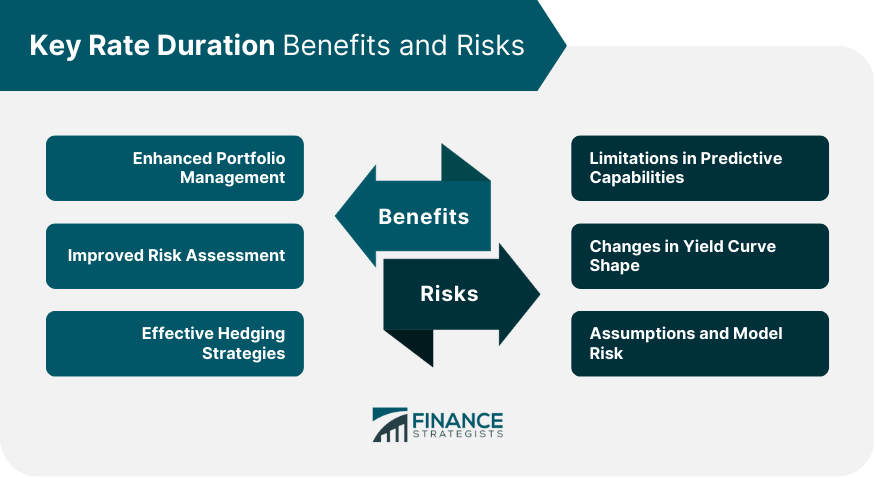

Benefits of Key Rate Duration

Enhanced Portfolio Management

Improved Risk Assessment

Effective Hedging Strategies

Risks Associated with Key Rate Duration

Limitations in Predictive Capabilities

Changes in Yield Curve Shape

Assumptions and Model Risk

Final Thoughts

Key Rate Duration FAQs

Key rate duration is a measure of the sensitivity of the bond's price to small changes in a particular key interest rate.

Key rate duration works by breaking down the overall interest rate risk of a bond into several key rates, allowing investors to better manage risk.

The benefits of key rate duration include enhanced portfolio management, improved risk assessment, and effective hedging strategies.

The risks of key rate duration include limitations in predictive capabilities, changes in yield curve shape, and assumptions and model risk.

Key rate duration can be beneficial for fixed-income investors, portfolio managers, and financial analysts who want to better understand and manage interest rate risk in their investments.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.