Blue Sky Laws refer to state-level securities laws that regulate the sale of securities within the United States. The term "blue sky" is believed to have originated from a comment made by a judge in a case involving an unscrupulous securities promoter who claimed to have the ability to sell a piece of the sky to investors. Since then, the term "blue sky" has been used to describe securities laws that aim to protect investors from fraudulent investment schemes. The purpose of Blue Sky Laws is to ensure that securities offerings are made in a manner that is fair and transparent to investors. They require issuers of securities to register their offerings with state regulators and provide detailed information about the securities being offered, the issuer's financial condition, and the risks associated with the investment. Blue Sky Laws also impose restrictions on fraudulent practices, such as misrepresentation or omission of material information, and provide investors with civil remedies for violations. While Blue Sky Laws are state-level regulations, they are often modeled after federal securities laws and regulations and complement the Securities Act of 1933 and the Securities Exchange Act of 1934. Common securities offerings covered by Blue Sky Laws include: Blue Sky Laws require issuers of stocks to register their offerings with state regulators, unless an exemption applies. Issuers must provide detailed information about the securities being offered, including the number of shares, the price per share, the intended use of proceeds, and the risks associated with the investment. State regulators review the registration statement to ensure that it contains all required information and that the offering is fair and transparent to investors. Like stocks, bonds are also subject to registration requirements under Blue Sky Laws, unless an exemption applies. Providers of bonds must provide detailed information about the securities being offered, including the principal amount, the interest rate, the maturity date, and the intended use of proceeds. Bond offerings are subject to more stringent registration requirements than stock offerings, as bonds typically involve larger sums of money and are often sold to institutional investors. Mutual funds are investment vehicles that pool money from multiple investors to purchase a diversified portfolio of securities. Blue Sky Laws require mutual funds to register with state regulators, unless an exemption applies. Blue Sky Laws require issuers of options to register their offerings with state regulators, unless an exemption applies. Detailed information about the options being offered, such as the strike price, the expiration date, and the risks associated with the investment must be available. Limited partnership interests are ownership interests in a limited partnership, which is a type of partnership that consists of at least one general partner and one limited partner. Blue Sky Laws require issuers of limited partnership interests to register their offerings with state regulators, unless an exemption applies. There must be detailed information about the limited partnership, such as the investment objectives, the risks associated with the investment, the fees and expenses, and the performance history. Blue Sky Laws require issuers of securities to register their offerings with state regulators, unless an exemption applies. The registration process involves submitting a registration statement to the state securities regulator, which must include detailed information about the securities being offered, the issuer's financial condition, and the risks associated with the investment. The purpose of registration is to ensure that investors have access to adequate information to make informed investment decisions. Registration applies to both public and private securities offerings. The requirements for registering public and private offerings may differ depending on the state. Public offerings are securities offerings that are marketed to the general public, while private offerings are securities offerings that are made to a limited number of investors. The specific registration requirements under Blue Sky Laws may vary from state to state, but generally, they require issuers to provide information about the securities being offered, the issuer's business and financial condition, and the risks associated with the investment. The registration statement may also need to include information about the issuer's management, the use of proceeds, and any material agreements related to the securities being offered. The costs associated with registration under Blue Sky Laws may include registration fees, attorney fees, accounting fees, and other expenses related to preparing the registration statement. The fees may vary depending on the state and the type of securities being offered. In addition to the initial costs of registration, issuers may also be required to pay ongoing fees and expenses, such as renewal fees, filing fees for amendments, and fees for state securities law compliance. While Blue Sky Laws generally require issuers of securities to register their offerings with state regulators, there are certain exemptions that may apply: Exempted securities may include offerings to accredited investors, offerings to a limited number of investors, offerings of securities that are already publicly traded, and offerings that meet certain other conditions. The specific exemptions may vary from state to state. To qualify for an exemption under Blue Sky Laws, issuers must typically meet certain conditions, such as limiting the number of investors or ensuring that the securities are only offered to accredited investors. Issuers may need to file a notice or other documentation with the state securities regulator to claim an exemption. Exemptions under Blue Sky Laws may be subject to certain limitations and conditions, such as restrictions on the resale of securities, limitations on the amount of securities that may be offered, and requirements to provide certain disclosures to investors. It is important for issuers to carefully review the requirements and limitations of any exemption that they intend to claim to ensure that they are in compliance with state securities laws. Compliance with Blue Sky Laws is essential for issuers and broker-dealers who wish to offer securities to the public. It involves meeting registration and disclosure requirements and ensuring that the offering is fair and transparent to investors. Compliance requirements may differ depending on the state and the type of securities being offered. Failure to comply with Blue Sky Laws can result in penalties, such as fines, cease and desist orders, and even criminal charges in some cases. State securities regulators have broad powers to investigate potential violations and enforce compliance with Blue Sky Laws. Non-compliance with Blue Sky Laws can result in significant penalties for issuers and broker-dealers. Penalties may vary depending on the severity of the violation and the state in which the violation occurred. Penalties may include fines, cease and desist orders, and even criminal charges in some cases. State securities regulators have broad powers to investigate potential violations and enforce compliance with Blue Sky Laws. It is important for issuers and broker-dealers to take compliance with state securities laws seriously and work with state securities regulators to avoid potential penalties for non-compliance. Compliance can help to ensure that securities offerings are made in a fair and transparent manner and can help to build trust and confidence among investors. They are responsible for reviewing registration statements, investigating potential violations, and enforcing penalties for non-compliance. State securities regulators also provide guidance and education to issuers, broker-dealers, and investors to ensure that they understand the requirements of Blue Sky Laws. While Blue Sky Laws are intended to protect investors from fraudulent investment schemes, they have been criticized for the following concerns: The compliance requirements impose a significant burden on small businesses and other issuers who may not have the resources to comply with the full registration requirements. The costs and fees associated with compliance can be prohibitive, particularly for startups and other early-stage companies. The costs and fees associated with compliance can be excessive and may deter issuers from making securities offerings. The fees charged by state securities regulators for registration, renewal, and amendments can be prohibitive, particularly for small businesses and startups. The potential for inconsistent application across different states can be a barrier to capital formation and can create confusion for issuers and investors. They argue that federal preemption of state securities laws would provide a more consistent and efficient regulatory framework for securities offerings. A single set of federal securities laws and regulations would simplify the process of making securities offerings and would provide issuers with greater certainty and predictability. However, others argue that state securities laws provide important protections for investors and that federal preemption could weaken these protections. Blue Sky Laws refer to state-level securities laws that regulate the sale of securities within the United States. The purpose of Blue Sky Laws is to ensure that securities offerings are made in a manner that is fair and transparent to investors. They require issuers of securities to register their offerings with state regulators and provide detailed information about the securities being offered, the issuer's financial condition, and the risks associated with the investment. Blue Sky Laws also impose restrictions on fraudulent practices and provide investors with civil . It is important for investors, issuers, and securities professionals to understand Blue Sky Laws to ensure compliance and to avoid potential penalties. Non-compliance with Blue Sky Laws can result in significant penalties, such as fines, cease and desist orders, and even criminal charges in some cases. Understanding Blue Sky Laws can ensure that securities offerings are fair and can build trust and confidence among investors. Investors, issuers, and securities professionals who need assistance in understanding and complying with Blue Sky Laws can turn to wealth management services for help. Wealth management services can provide guidance and education on Blue Sky Laws.Definition of Blue Sky Laws

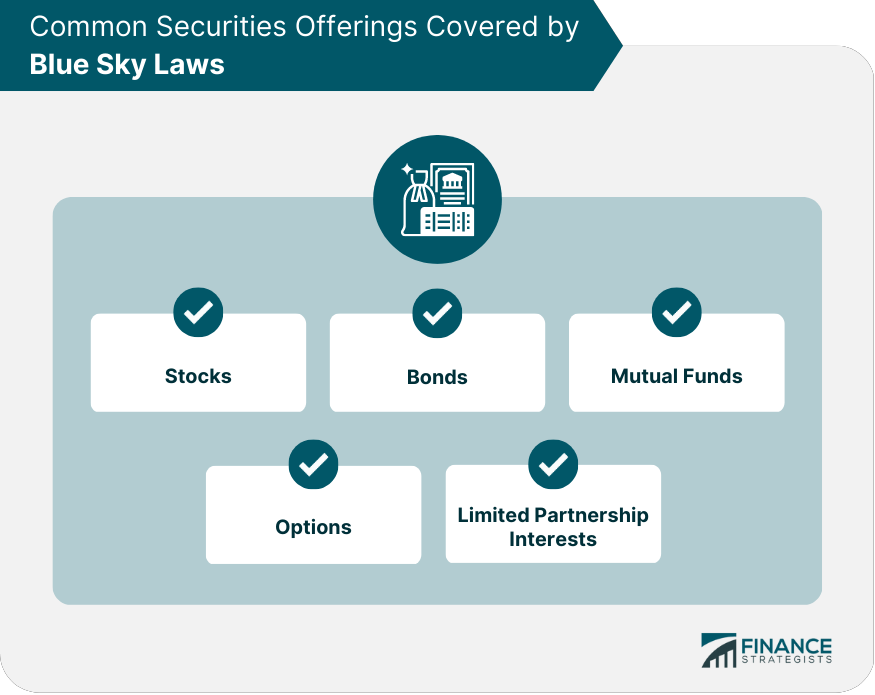

Coverage of Blue Sky Laws

Stocks

Bonds

Mutual Funds

Options

Limited Partnership Interests

Registration Under Blue Sky Laws

Registration Process

Who Must Register

Registration Requirements

Costs Associated

Exemptions from Registration

Types of Securities Offerings Exempt from Registration

Qualifying for Exemptions under Blue Sky Laws

Limitations and Conditions of Exemptions under Blue Sky Laws

Compliance with Blue Sky Laws

Penalties for Non-compliance

Role of State Securities Regulators

Criticisms of Blue Sky Laws

Regulatory Burden

Costs and Fees Associated with Compliance

Potential for Inconsistent Application

Federal Preemption of State Securities Laws

Bottom Line

Blue Sky Laws FAQs

Blue Sky Laws are state-level securities laws that regulate the sale of securities within the United States. They require issuers of securities to register their offerings with state regulators and provide detailed information about the securities being offered, the issuer's financial condition, and the risks associated with the investment.

Both issuers of securities and broker-dealers who sell securities to the public need to comply with Blue Sky Laws. Compliance requirements may differ depending on the state and the type of securities being offered.

Non-compliance with Blue Sky Laws can result in significant penalties, such as fines, cease and desist orders, and even criminal charges in some cases. State securities regulators have broad powers to investigate potential violations and enforce compliance with Blue Sky Laws.

The types of securities offerings that are exempt from registration under Blue Sky Laws may include offerings to accredited investors, offerings to a limited number of investors, offerings of securities that are already publicly traded, and offerings that meet certain other conditions.

Blue Sky Laws have been criticized for imposing a regulatory burden on issuers and broker-dealers and for potentially hindering the development of small businesses and startups. Some critics argue that federal preemption of state securities laws would provide a more consistent and efficient regulatory framework for securities offerings.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.