Special retirement supplements are additional benefits provided to eligible retirees to bridge the gap between early retirement and eligibility for Social Security benefits. These supplements ensure financial stability and support during this period. The main purpose of special retirement supplements is to help individuals maintain their financial well-being during early retirement years. The supplements assist retirees in meeting their financial obligations until they are eligible for full Social Security benefits. Eligibility for special retirement supplements depends on various factors such as age, years of service, and type of retirement plan. Understanding these criteria is essential for retirees to maximize their benefits and plan for a secure retirement. The FERS supplement is designed for federal employees who retire before they are eligible for Social Security benefits. It provides additional income to bridge the gap between retirement and Social Security eligibility. FERS supplement eligibility is based on age, years of service, and retirement type. Generally, employees who retire under the FERS system before the age of 62 with at least 30 years of service, or at the age of 60 with at least 20 years of service, are eligible for the supplement. The FERS supplement amount is calculated based on the retiree's years of service and the estimated Social Security benefits they would receive at age 62. The supplement is designed to replace a portion of the Social Security benefit that the retiree is not yet eligible for. The FERS supplement is subject to federal income tax, but it is not subject to Social Security or Medicare taxes. Understanding the tax implications of the supplement is crucial for retirees to manage their financial resources effectively. Social Security-related supplements are strategies that individuals can use to maximize their Social Security benefits during retirement. These strategies can help retirees increase their overall retirement income and financial security. The restricted application strategy allows individuals who have reached full retirement age to claim spousal benefits while delaying their own retirement benefits. This enables the individual to earn delayed retirement credits, which can result in a higher benefit amount when they eventually claim their own benefits. The file and suspend strategy involves filing for Social Security benefits and then immediately suspending them, allowing the retiree's spouse to claim spousal benefits while the retiree's own benefits continue to grow. This strategy is no longer available for new retirees, but those who had already implemented the strategy can continue to benefit from it. Delayed retirement credits are awarded to individuals who choose to delay claiming Social Security benefits past their full retirement age. These credits increase the retiree's benefit amount, providing a higher monthly income when they eventually claim their benefits. The age of the retiree is a critical factor in determining eligibility for special retirement supplements. Different supplements and strategies have varying age requirements, making it important for retirees to be aware of their options based on their age. The number of years of service an individual has accrued plays a significant role in determining their eligibility for special retirement supplements. Longer service periods can result in higher supplement amounts and increased financial security during retirement. A retiree's earnings history can impact the amount of their special retirement supplements. Higher lifetime earnings can lead to higher Social Security benefits and retirement supplements, providing a more substantial financial cushion during retirement. Marital status can influence the availability and amount of certain retirement supplements. Spousal benefits and strategies like the restricted application strategy depend on the marital status of the retiree, making it essential for retirees to understand how their marital status affects their benefits. The GPO affects individuals who receive a government pension and are eligible for Social Security benefits based on their spouse's work history. The GPO may reduce or eliminate spousal or survivor benefits, making it crucial for affected retirees to account for this potential reduction in their retirement planning. The WEP affects individuals who receive a pension from employment not covered by Social Security and are also eligible for Social Security benefits. This can reduce the amount of Social Security benefits a retiree receives, impacting their overall retirement income and financial security. The timing of retirement is a key factor in maximizing special retirement supplements. By considering factors such as age, years of service, and supplement eligibility, retirees can choose the optimal retirement date to maximize their benefits. Maximizing earnings history can positively impact retirement supplement amounts. Higher lifetime earnings can lead to higher Social Security benefits and retirement supplements, providing a more substantial financial cushion during retirement. Coordinating special retirement supplements with Social Security benefits can help retirees maximize their overall retirement income. This may involve strategies such as the restricted application strategy or optimizing the timing of claiming benefits. Spousal benefits can play a significant role in maximizing retirement income. By understanding and taking advantage of spousal benefits, retirees can increase their overall financial security during retirement. Special retirement supplements can provide additional financial security during retirement. By supplementing other sources of income, they help ensure retirees have the necessary resources to meet their financial needs. Special retirement supplements offer retirees more flexibility in their retirement decisions. With the additional income provided by supplements, retirees may have more freedom to choose when to retire or adjust their retirement plans as needed. Special retirement supplements have the potential to increase overall retirement income. By optimizing strategies and maximizing benefits, retirees can enjoy a higher standard of living during retirement. The additional income provided by special retirement supplements can positively impact long-term financial goals. With increased financial security, retirees may have the resources to invest in their future, pursue hobbies, or support family members. Funding and sustainability concerns have been raised about special retirement supplements. As the population ages and the demand for these supplements increases, ensuring their long-term viability becomes a pressing issue. Potential legislative changes could impact special retirement supplements in the future. It is essential for retirees to stay informed about proposed changes to retirement benefits, as these changes may affect their retirement planning and financial security. Public opinion and advocacy efforts play a role in shaping the future of special retirement supplements. By staying informed and participating in advocacy efforts, retirees can help protect and improve these essential benefits. Special retirement supplements provide additional income to eligible retirees to bridge the gap between early retirement and eligibility for Social Security benefits, ensuring financial stability during this period. Eligibility for these supplements depends on factors such as age, years of service, and type of retirement plan. Special retirement supplements include the FERS supplement and Social Security-related supplements such as the restricted application strategy, file and suspend strategy, and delayed retirement credits. Factors affecting special retirement supplements include age, years of service, earnings history, marital status, GPO, and WEP. Strategies for maximizing special retirement supplements include timing of retirement, maximizing earnings history, coordination with Social Security benefits, and utilizing spousal benefits. The benefits of special retirement supplements include increased financial security, flexibility in retirement decisions, potential for increased retirement income, and effect on long-term financial goals. Challenges and potential changes to special retirement supplements include funding and sustainability concerns, potential legislative changes, and public opinion and advocacy efforts.What Are Special Retirement Supplements?

Types of Special Retirement Supplements

Federal Employees Retirement System (FERS) Supplement

Eligibility Requirements

Calculation of FERS Supplement Amount

Tax Implications

Social Security-Related Supplements

Restricted Application Strategy

File and Suspend Strategy

Delayed Retirement Credits

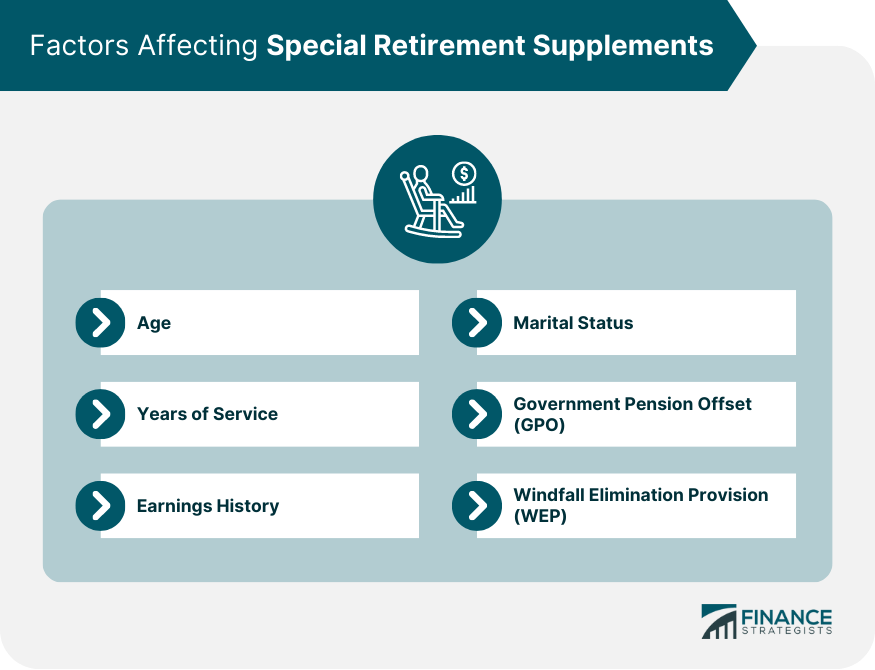

Factors Affecting Special Retirement Supplements

Age

Years of Service

Earnings History

Marital Status

Government Pension Offset (GPO)

Windfall Elimination Provision (WEP)

Strategies for Maximizing Special Retirement Supplements

Timing of Retirement

Maximizing Earnings History

Coordination with Social Security Benefits

Utilizing Spousal Benefits

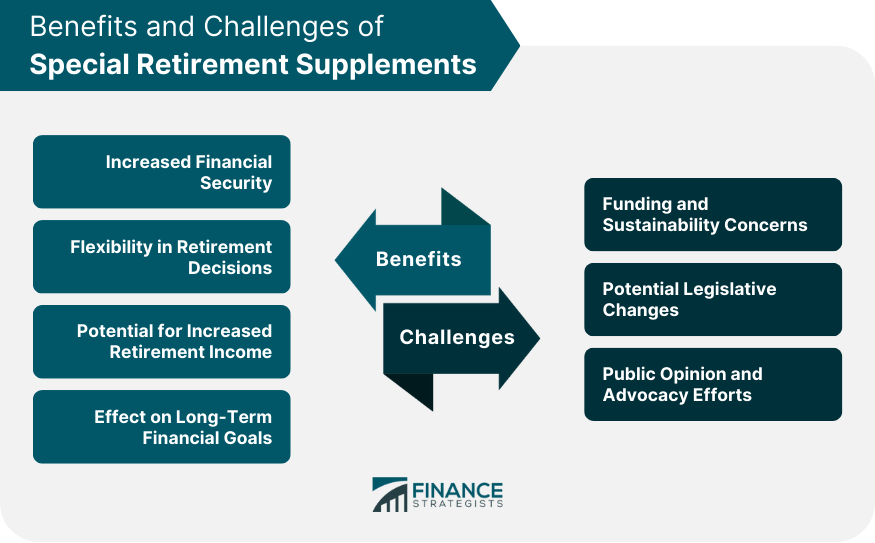

Benefits of Special Retirement Supplements on Retirement Planning

Increased Financial Security

Flexibility in Retirement Decisions

Potential for Increased Retirement Income

Effect on Long-term Financial Goals

Challenges and Potential Changes to Special Retirement Supplements

Funding and Sustainability Concerns

Potential Legislative Changes

Public Opinion and Advocacy Efforts

Final Thoughts

Special Retirement Supplements FAQs

Special retirement supplements are additional benefits provided to eligible retirees to bridge the gap between early retirement and eligibility for Social Security benefits. These supplements help maintain financial stability and support for retirees during this period.

Eligibility for special retirement supplements depends on various factors such as age, years of service, and type of retirement plan. Different supplements and strategies have varying eligibility requirements, making it essential for retirees to understand their options based on their specific circumstances.

Retirees can maximize their special retirement supplements by considering factors such as timing of retirement, maximizing earnings history, coordinating with Social Security benefits, and utilizing spousal benefits. Proper planning and understanding of available options can help retirees make the most of these supplements.

Special retirement supplements can have a significant impact on retirement planning and financial security. They provide additional financial resources that can increase overall retirement income, offer flexibility in retirement decisions, and help retirees achieve their long-term financial goals.

Staying up-to-date with changes to special retirement supplements is crucial for retirees to adjust their strategies and make the most of the benefits available to them. Retirees can stay informed by following relevant news sources, participating in advocacy efforts, and seeking professional retirement planning services that specialize in special retirement supplements.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.