A Summary Plan Description is a document that provides a comprehensive overview of an employee benefit plan, such as a retirement or health plan, governed by the Employee Retirement Income Security Act (ERISA). The SPD serves as a primary communication tool between plan sponsors or administrators and plan participants, outlining essential plan information in a clear and concise manner. The SPD aims to inform plan participants and beneficiaries about the key features of their benefit plans, including eligibility, benefits, contributions, and rights under the plan. By providing this information in a user-friendly format, the SPD helps participants make informed decisions about their benefits and financial planning. ERISA regulates employee benefit plans in the United States and mandates the creation and distribution of SPDs to ensure that participants have access to accurate and up-to-date information about their plans. The SPD should clearly indicate the name of the employee benefit plan being described. Include the plan number as assigned by the plan sponsor or administrator for easy reference. Identify the plan sponsor or administrator responsible for overseeing the plan and providing the benefits described in the SPD. Outline the criteria that employees must meet to become eligible for participation in the plan, such as age, service, or employment status requirements. Describe the process for enrolling in the plan, including any required forms, documentation, or deadlines. Explain when an eligible employee's participation in the plan will begin and any conditions that must be met. List the various benefits provided under the plan, such as retirement savings, health coverage, or disability insurance. Detail the methods used to calculate the amount of benefits that participants will receive, including any applicable formulas or factors. Explain the different options available for receiving benefit payments, such as lump-sum distributions, annuities, or periodic payments. Describe the rules governing employee contributions to the plan, including any required or voluntary contributions, contribution limits, and available investment options. Outline the employer's obligations for contributing to the plan, such as matching contributions, profit-sharing contributions, or other forms of employer support. Specify any limits on the amount of contributions that can be made by employees or employers, in accordance with applicable laws and regulations. Explain the vesting schedules that determine when participants gain full ownership of employer-contributed assets, including any cliff or graded vesting provisions. Describe the circumstances under which participants may forfeit their rights to employer-contributed assets, such as termination of employment or failure to meet vesting requirements. Detail the rules governing loans from the plan, including eligibility criteria, loan amounts, repayment terms, and interest rates. Explain the various options for receiving distributions from the plan, as well as any conditions or restrictions that may apply, such as age requirements or triggering events. Describe the potential tax consequences associated with plan loans, distributions, and contributions, including any penalties for early withdrawals or excess contributions. Outline the process for filing claims to receive benefits under the plan, including required forms, supporting documentation, and submission deadlines. Appeal Procedures Explain the procedures for appealing denied claims, including the steps that participants must follow, the timeframes for submitting appeals, and the rights and responsibilities of both participants and plan administrators during the appeal process. Specify the timeframes within which participants must file claims and appeals, as well as the timeframes for plan administrators to review and respond to these submissions. Describe the processes and conditions under which the plan sponsor or administrator may amend the plan, including any notice requirements or restrictions on amendments. Detail the provisions governing the termination of the plan, including the rights and responsibilities of participants, plan sponsors, and plan administrators upon termination. Plan administrators may distribute SPDs as hard copies mailed directly to participants' homes. SPDs can also be delivered electronically via email or other secure electronic means, provided that participants have given their consent to receive electronic communications. SPDs may be made available on the plan's website or online portal, as long as participants are notified of the updates and can access the information easily. ERISA requires that SPDs be provided to new participants within 90 days of their enrollment in the plan. Plan administrators must distribute updated SPDs to participants whenever material modifications are made to the plan, typically within 210 days following the end of the plan year in which the changes were adopted. Every five years, plan administrators must distribute updated SPDs to participants, even if no changes have been made. If significant changes have occurred, the SPD must be updated and distributed within 120 days after the end of the plan year in which the changes were adopted. Failure to provide SPDs within the specified time frame can result in penalties or fines imposed by the Department of Labor (DOL) and may expose plan administrators to potential legal action by participants. Ensure that the SPD uses plain language that is easily understood by plan participants. Avoid technical jargon or complex terminology that may be confusing. Provide a thorough explanation of the plan's features without overwhelming participants with excessive detail. Focus on the most important aspects and their potential impact on participants and beneficiaries. Maintain a consistent format and design throughout the SPD to make it visually appealing and easy to read. This includes the use of headings, subheadings, bullet points, and font styles. Periodically review and update the SPD as needed to ensure that it accurately reflects the current status of the plan and any recent modifications. Work closely with legal and compliance professionals to ensure that the SPD complies with all applicable laws, regulations, and best practices. SPDs play a critical role in maintaining transparency and ensuring compliance with ERISA requirements for employee benefit plans. By providing participants with comprehensive information about their plans, SPDs help promote trust, engagement, and informed decision-making. SPDs enable participants to understand the key features of their benefit plans and make informed decisions regarding their contributions, investments, and overall financial planning. Plan sponsors, administrators, and participants must continue to prioritize education and awareness about SPD requirements to ensure that all parties remain informed and compliant with ERISA regulations. This will help maintain the integrity of employee benefit plans and support the financial well-being of plan participants.What Is a Summary Plan Description (SPD)?

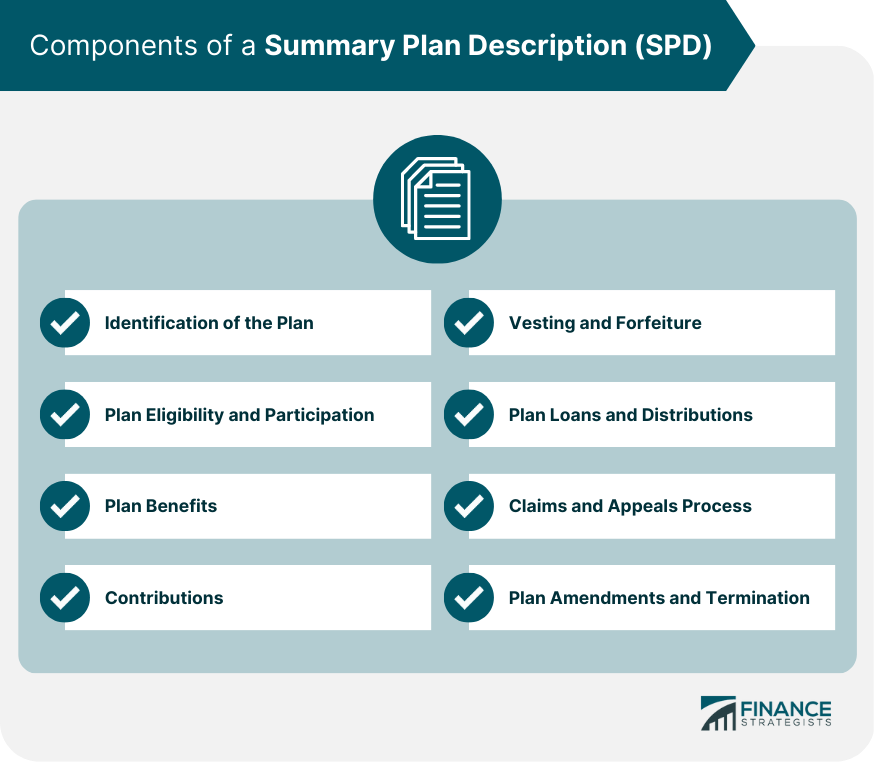

Components of Summary Plan Description

Identification of the Plan

Plan Name

Plan Number

Plan Sponsor or Administrator

Plan Eligibility and Participation

Eligibility Requirements

Enrollment Process

Participation Commencement

Plan Benefits

Types of Benefits Offered

Benefit Calculations

Benefit Payment Options

Contributions

Employee Contributions

Employer Contributions

Contribution Limits

Vesting and Forfeiture

Vesting Schedules

Forfeiture Provisions

Plan Loans and Distributions

Loan Provisions

Distribution Options and Conditions

Tax Implications

Claims and Appeals Process

Filing Claims for Benefits

Timeframes for Claims and Appeals

Plan Amendments and Termination

Procedures for Amending the Plan

Termination Provisions

SPD Delivery and Timing

Delivery Methods

Mailed Hard Copies

Electronic Distribution

Plan Website or Portal

Timing Requirements

Initial Distribution to New Participants

Updated SPD Distribution

Periodic Distribution

Penalties for Non-compliance

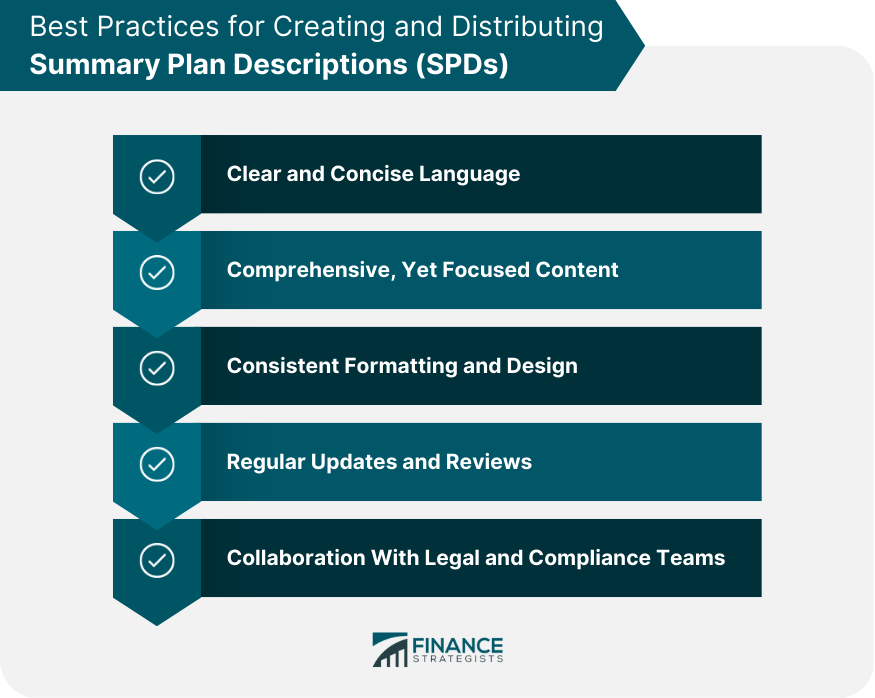

Best Practices for Creating and Distributing SPDs

Clear and Concise Language

Comprehensive, Yet Focused Content

Consistent Formatting and Design

Regular Updates and Reviews

Collaboration With Legal and Compliance Teams

Conclusion

Summary Plan Description (SPD) FAQs

A Summary Plan Description is a document that provides an overview of an employee benefit plan, including information about plan rules, eligibility, benefits, and claims procedures.

The plan administrator is required by law to provide an SPD to all plan participants, including active employees, retirees, and beneficiaries.

An SPD typically includes information about the plan's eligibility requirements, benefits, claims procedures, appeal rights, and plan rules. It may also include information about the plan's funding and investments.

A plan administrator is required to provide an SPD to all plan participants within 90 days after they become covered by the plan or within 120 days after the plan is established, whichever is later. The plan administrator must also provide a revised SPD to all participants every five years, or within two years after any material changes are made to the plan.

An SPD is important because it provides plan participants with important information about their benefits, eligibility, and rights under the plan. It helps participants make informed decisions about their benefits and provides transparency into the plan's operations. Additionally, the SPD is a legal document that can be used to enforce a participant's rights under the plan.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.