A Qualified Default Investment Alternative (QDIA) is a type of investment option within a defined contribution retirement plan, such as a 401(k). Its purpose is to provide a default investment for plan participants who do not make an active investment choice. The role of a QDIA in retirement plans is to ensure participants have access to professionally managed, diversified investments that align with their retirement goals, even when they do not actively select their own investments. Target-date funds (TDFs) are designed to automatically adjust asset allocation based on the participant's projected retirement date. This means the fund becomes more conservative as the participant approaches retirement, reducing risk exposure. Balanced funds offer a diversified mix of stocks, bonds, and other assets in a single fund. The fund's investment mix remains relatively constant, aiming to provide both growth and income while managing risk. Managed accounts are personalized investment portfolios created and managed by professional investment advisors. They are tailored to individual participants, taking into account factors such as age, risk tolerance, and retirement goals. Stable value funds are conservative, low-risk investment options that aim to provide stable returns and preserve capital. They typically invest in high-quality, short-term fixed-income securities and are often backed by insurance contracts. Diversification is a crucial feature of QDIA, as it helps to spread risk across different asset classes and reduce the impact of market fluctuations on the participant's investment portfolio. QDIAs are designed with a long-term focus, prioritizing the participant's retirement goals over short-term market fluctuations. This helps to reduce the influence of market volatility on retirement savings. QDIAs incorporate risk management strategies, such as periodic rebalancing and adjusting asset allocation based on the participant's age or proximity to retirement, to help minimize the potential for large losses. Automatic enrollment in a QDIA is a common feature of retirement plans, helping to encourage employee participation and increase retirement savings rates for those who might not otherwise actively choose an investment option. Periodic rebalancing is a key feature of QDIAs, ensuring that the investment mix remains in line with the participant's risk tolerance and retirement goals, and helping to reduce the risk of overexposure to certain asset classes. The Department of Labor (DOL) has established guidelines for QDIAs to ensure that plan sponsors meet fiduciary responsibilities and offer appropriate default investment options to plan participants. QDIAs must comply with ERISA Section 404(c) regulations, which provide plan sponsors with relief from fiduciary liability when participants are defaulted into a QDIA, as long as certain requirements are met. Plan sponsors have a fiduciary responsibility to select and monitor QDIAs, ensuring they are appropriate for plan participants and meet the necessary regulatory requirements. Plan sponsors must provide plan participants with adequate notice and disclosure about the QDIA, including information about the investment strategy, fees, and risks associated with the default investment option. When selecting a QDIA, plan sponsors should consider factors such as the investment strategy, fees, performance history, and participant demographics to ensure the chosen option is suitable for their plan participants. Plan sponsors should regularly evaluate the performance of the QDIA, comparing it to relevant benchmarks and other available investment options to ensure it remains a suitable default option for participants. Benchmarking is an essential part of selecting and monitoring QDIAs, as it allows plan sponsors to compare the QDIA's performance to that of similar investment options and ensure it remains competitive. Plan sponsors should conduct regular reviews and updates of the QDIA to ensure it continues to align with participants' needs and make any necessary adjustments to the investment strategy or underlying investments. QDIAs can lead to improved retirement outcomes by providing participants with diversified, professionally managed investments that are designed to align with their retirement goals, even if they do not actively choose their investments. By offering a QDIA, plan sponsors can reduce their fiduciary liability under ERISA Section 404(c), as long as they meet certain requirements and provide participants with adequate notice and disclosure about the default investment option. The automatic enrollment feature of QDIAs can help encourage employee participation in retirement plans, increasing the likelihood that participants will accumulate sufficient retirement savings over time. QDIAs simplify investment decision-making for plan participants by providing a default investment option that is designed to meet their retirement needs, removing the need for them to actively choose and manage their own investments. A potential drawback of QDIAs is their one-size-fits-all approach, which may not adequately address the unique needs and risk tolerance of individual plan participants. QDIA fee structures can vary, and higher fees can have a negative impact on participants' long-term investment returns, potentially reducing their retirement savings. QDIAs generally offer limited customization options, which can limit participants' ability to tailor their investments to their specific needs, goals, and risk tolerance. QDIAs, like all investments, are subject to market fluctuations and investment risk, which can result in losses for plan participants and impact their retirement savings. Effective employee communication and education about the QDIA, its features, and its benefits can help increase participant understanding and engagement, leading to better retirement outcomes. Conducting periodic reviews and updates of the QDIA, its investment strategy, and performance can help ensure it remains a suitable default investment option for plan participants and meets their evolving needs. Aligning the QDIA with the overall goals and objectives of the retirement plan can help ensure that it supports participants in achieving their retirement goals and fosters a successful retirement plan. Plan sponsors can benefit from leveraging third-party expertise, such as investment advisors and consultants, to help select, monitor, and manage the QDIA, ensuring it remains a suitable default option for participants. A Qualified Default Investment Alternative (QDIA) is a default investment option for participants who do not actively choose their investments within a defined contribution retirement plan. There are several types of QDIAs, including target-date funds, balanced funds, managed accounts, and stable-value funds. QDIAs have key features, such as diversification, a long-term focus, risk management, automatic enrollment, and periodic rebalancing. Regulations and compliance include DOL guidelines, ERISA Section 404(c) compliance, fiduciary responsibility, and notice and disclosure requirements. QDIAs offer benefits, such as improved retirement outcomes, lower plan sponsor liability, encouraging employee participation, and simplified investment decision-making, but they also have potential drawbacks and risks. Best practices for implementing QDIAs include employee communication and education, periodic reviews and updates, aligning QDIA with plan goals, and leveraging third-party expertise.What Is a Qualified Default Investment Alternative (QDIA)?

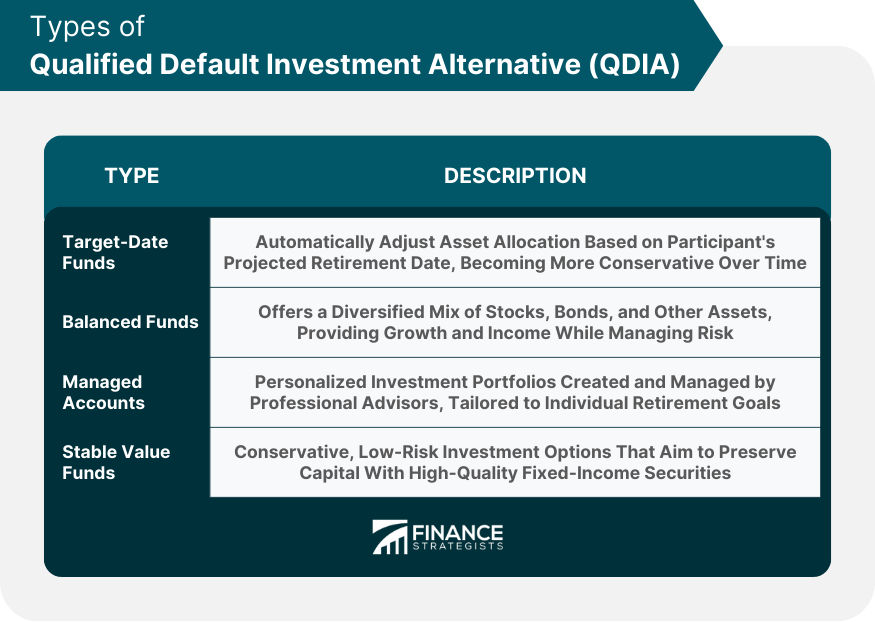

Types of QDIA

Target-Date Funds

Balanced Funds

Managed Accounts

Stable Value Funds

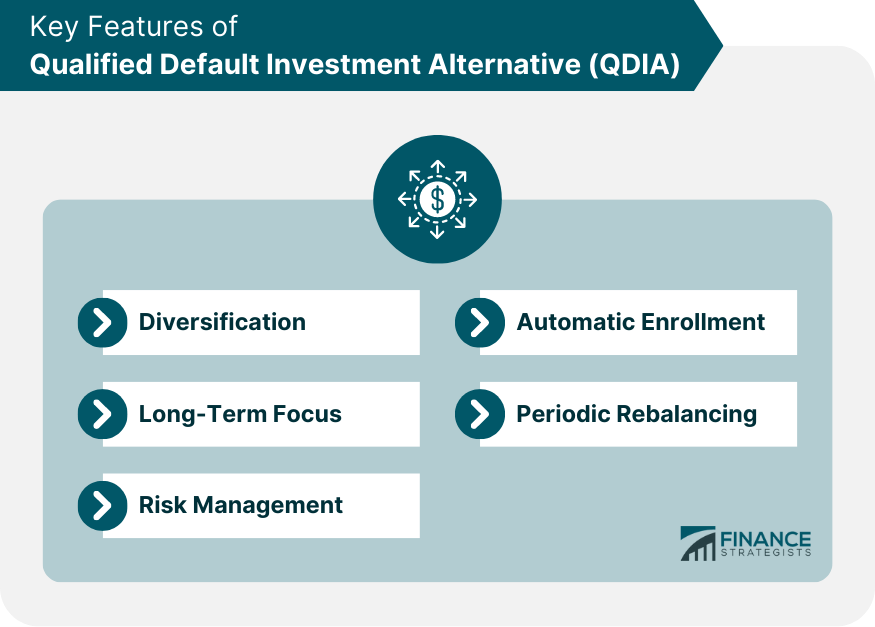

Key Features of QDIA

Diversification

Long-Term Focus

Risk Management

Automatic Enrollment

Periodic Rebalancing

QDIA Regulations and Compliance

Department of Labor (DOL) Guidelines

ERISA Section 404(c) Compliance

Fiduciary Responsibility

Notice and Disclosure Requirements

Selecting and Monitoring QDIA

Plan Sponsor Considerations

Performance Evaluation

Benchmarking

Regular Review and Updates

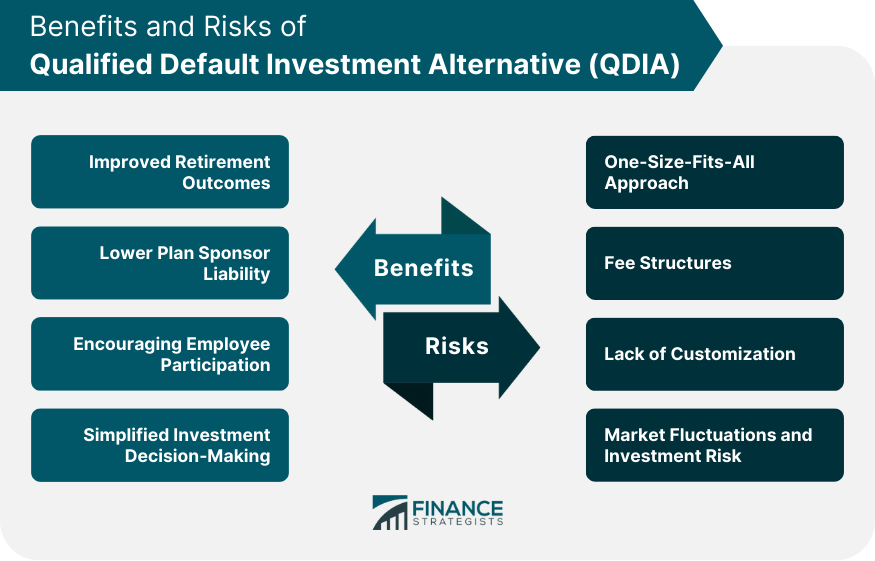

Benefits of QDIA

Improved Retirement Outcomes

Lower Plan Sponsor Liability

Encouraging Employee Participation

Simplified Investment Decision-Making

Potential Drawbacks and Risks of QDIA

One-Size-Fits-All Approach

Fee Structures

Lack of Customization

Market Fluctuations and Investment Risk

Best Practices for Implementing QDIA

Employee Communication and Education

Periodic Reviews and Updates

Aligning QDIA with Plan Goals

Leveraging Third-Party Expertise

Final Thoughts

Qualified Default Investment Alternative (QDIA) FAQs

A Qualified Default Investment Alternative (QDIA) is a type of investment option within a defined contribution retirement plan that serves as the default investment for plan participants who do not make an active investment choice. QDIAs play a crucial role in retirement planning by providing professionally managed, diversified investments that align with participants' retirement goals, helping to improve retirement outcomes and encourage plan participation.

There are four main types of QDIAs: target-date funds, balanced funds, managed accounts, and stable value funds. Each type offers unique investment strategies and risk profiles, ensuring that plan participants have access to a variety of professionally managed investment options that align with their retirement goals and risk tolerance.

By offering a QDIA that complies with Department of Labor (DOL) guidelines and ERISA Section 404(c) regulations, plan sponsors can reduce their fiduciary liability. This is because they are provided relief from liability for investment losses when participants defaulted into a QDIA, as long as they meet certain requirements and provide participants with adequate notice and disclosure about the default investment option.

Some potential drawbacks and risks of QDIAs include the one-size-fits-all approach, which may not address the unique needs of individual plan participants, varying fee structures that could impact long-term investment returns, limited customization options, and exposure to market fluctuations and investment risk inherent in all investment options.

Best practices for implementing and managing QDIAs include effective employee communication and education, periodic reviews and updates of the QDIA's investment strategy and performance, aligning the QDIA with the overall goals of the retirement plan, and leveraging third-party expertise to help select, monitor, and manage the QDIA.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.