A plan sponsor portal is a digital platform designed for managing employee benefits programs such as retirement plans, health plans, and other related benefits. This portal allows plan sponsors to administer their benefits plan effectively, monitor participant data, and maintain regulatory compliance. Plan sponsor portals play a crucial role in employee benefits management by streamlining processes, improving communication between stakeholders, and enhancing the participant experience. They allow plan sponsors to focus on strategic decision-making while reducing the burden of plan administration. The primary stakeholders involved in plan sponsor portals include plan sponsors, plan participants, third-party administrators, financial advisors, and investment managers. Each stakeholder benefits from the efficient management and communication features provided by these portals. Plan setup and configuration involves creating and customizing the benefits plan according to the organization's specific needs. The portal enables plan sponsors to define plan rules, match contributions, and configure vesting schedules with ease. Investment options and selection features help plan sponsors choose from a variety of investment vehicles for their plans. The portal typically offers research tools, performance metrics, and due diligence reports to support informed decision-making. Plan compliance and reporting features ensure that the plan adheres to regulatory requirements and allows plan sponsors to generate essential reports. These reports may include financial statements, compliance testing, and participant disclosures. Enrollment and eligibility features simplify the process of enrolling employees in the plan and determining their eligibility for benefits. Plan sponsors can use these tools to manage enrollment windows, define eligibility criteria, and track participant status. Contribution tracking and management features allow plan sponsors to monitor and manage both employer and employee contributions. They help in ensuring accurate and timely processing of contributions, applying contribution limits, and monitoring catch-up contributions. Loan and distribution processing tools streamline the process of managing participant loans and withdrawals from the plan. These features automate calculations, track outstanding loans, and ensure compliance with applicable rules and regulations. Beneficiary designation features enable plan sponsors to manage and maintain participant beneficiary information. These tools help ensure that beneficiary data is accurate and up-to-date, reducing the risk of complications in case of a participant's death. Plan updates and announcements features allow plan sponsors to share important information about the plan with participants. This may include plan changes, investment updates, or relevant regulatory information. Participant education and financial wellness resources provide plan sponsors with tools to educate participants about their benefits and promote financial literacy. These resources may include webinars, articles, calculators, and personalized advice. Secure messaging and document-sharing features enable plan sponsors to communicate with other stakeholders and share plan-related documents safely. This promotes efficient collaboration and helps protect sensitive information. Plan sponsor portals simplify plan administration processes and reduce the likelihood of errors. Automated features and integrated systems help eliminate manual data entry and ensure accuracy, contributing to a more efficient administration experience. A user-friendly plan sponsor portal can enhance the participant experience by providing easy access to plan information, educational resources, and communication tools. This helps participants stay informed and engaged with their benefits, leading to better retirement outcomes. Plan sponsor portals help ensure compliance with regulatory requirements by providing automated compliance testing, reporting tools, and alerts. By centralizing and streamlining compliance processes, plan sponsors can more easily navigate complex regulations and mitigate the risk of penalties or litigation. By automating manual tasks and integrating with other systems, plan sponsor portals improve overall efficiency and reduce the administrative burden. This leads to cost savings for both plan sponsors and participants, as resources can be redirected to more strategic initiatives. Integration with payroll and HR systems allows plan sponsor portals to sync employee data, streamline contribution processing, and ensure accurate recordkeeping. This reduces the risk of errors and ensures a seamless flow of information between different systems. Integrating with recordkeeping and third-party administration services enables plan sponsor portals to centralize plan data and support efficient plan management. This integration allows plan sponsors to collaborate more effectively with service providers, resulting in better plan outcomes. Plan sponsor portals can also integrate with a financial advisor and investment management platforms to streamline investment selection and monitoring processes. This integration helps plan sponsors make informed investment decisions and monitor plan performance more effectively. When selecting a plan sponsor portal, it's essential to consider the ease of use and user experience for both plan sponsors and participants. A user-friendly interface, intuitive navigation, and clear instructions can significantly impact the success of the portal. The ability to customize and scale the plan sponsor portal to meet the organization's specific needs and growth is another critical consideration. A flexible and scalable platform will enable plan sponsors to adapt to changing business and regulatory environments. Data security and privacy are paramount in a plan sponsor portal, as it houses sensitive employee and financial data. Look for a portal that adheres to industry standards, offers robust encryption, and has established security protocols in place. Choose a plan sponsor portal with strong customer support and ongoing training to ensure your organization maximizes its investment in the platform. Access to knowledgeable support staff and training resources can help navigate any challenges that may arise. Choosing the right plan sponsor portal is crucial to ensure the efficient management of your organization's employee benefits program. A well-designed and feature-rich portal will streamline administration, improve participant outcomes, and support long-term success. Plan sponsor portals play a critical role in simplifying plan administration by automating manual tasks, centralizing data, and providing essential tools for plan management. As a result, they contribute to improved participant outcomes by enhancing communication, providing educational resources, and promoting informed decision-making. To ensure the success of your organization's employee benefits program, consider partnering with professional retirement planning services. These experts can help you navigate the complexities of plan administration, select the right plan sponsor portal, and develop strategies to optimize participant outcomes.What Is a Plan Sponsor Portal?

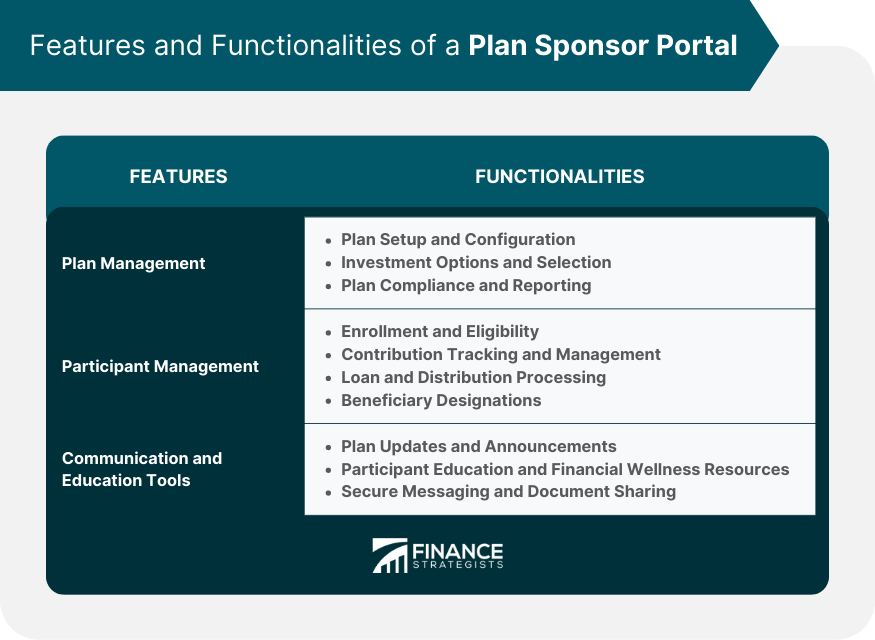

Features and Functionalities of a Plan Sponsor Portal

Plan Management

Plan Setup and Configuration

Investment Options and Selection

Plan Compliance and Reporting

Participant Management

Enrollment and Eligibility

Contribution Tracking and Management

Loan and Distribution Processing

Beneficiary Designations

Communication and Education Tools

Plan Updates and Announcements

Participant Education and Financial Wellness Resources

Secure Messaging and Document Sharing

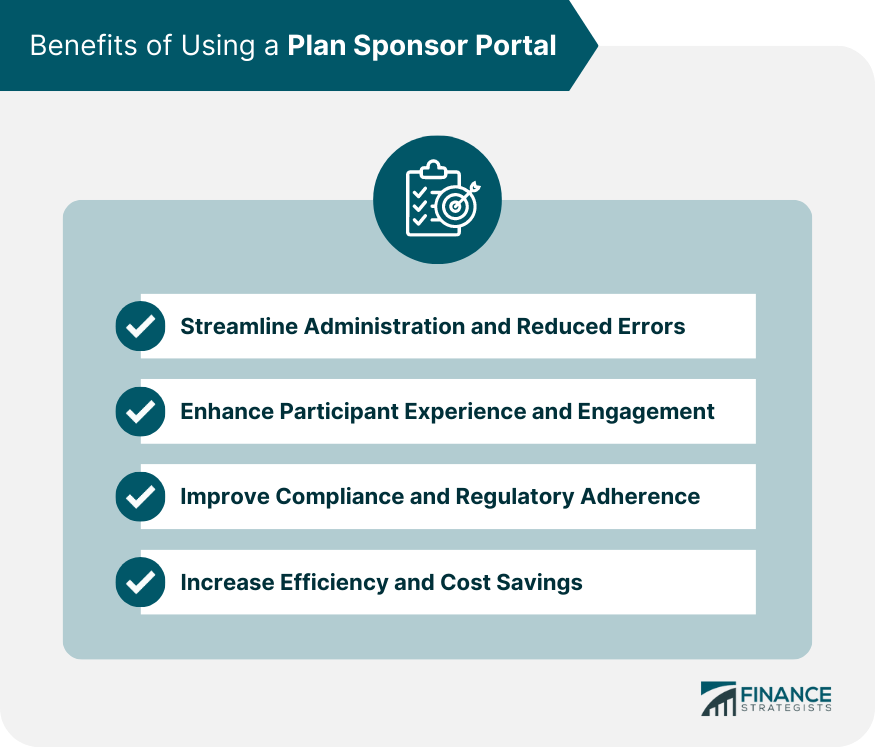

Benefits of Using a Plan Sponsor Portal

Streamlined Administration and Reduced Errors

Enhanced Participant Experience and Engagement

Improved Compliance and Regulatory Adherence

Increased Efficiency and Cost Savings

Integration with Other Platforms and Services

Payroll and HR Systems

Recordkeeping and Third-Party Administration Services

Financial Advisor and Investment Management Platforms

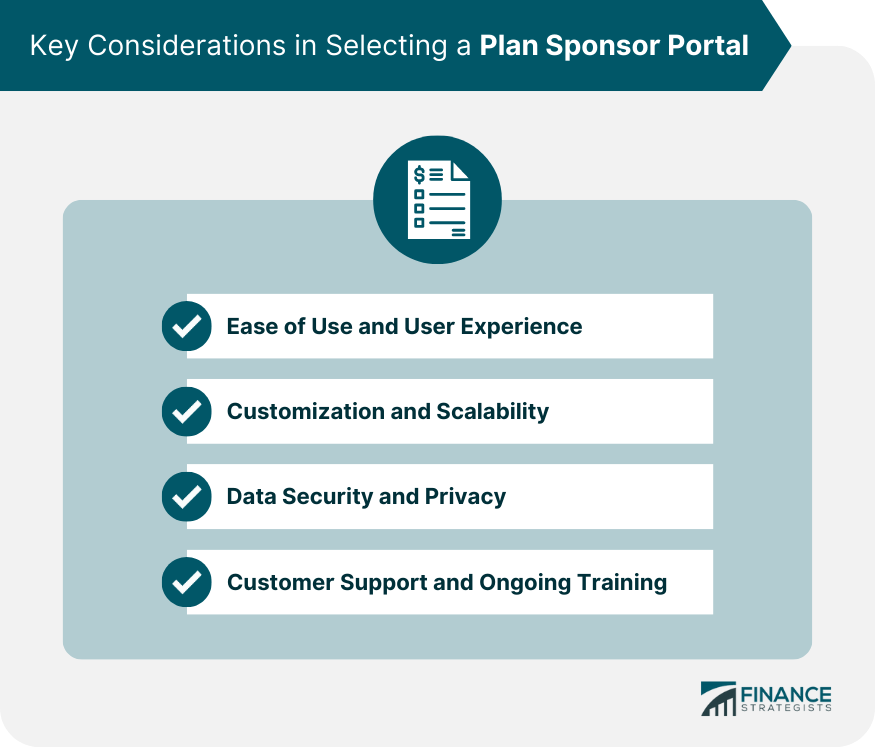

Key Considerations in Selecting a Plan Sponsor Portal

Ease of Use and User Experience

Customization and Scalability

Data Security and Privacy

Customer Support and Ongoing Training

Final Thoughts

Plan Sponsor Portal FAQs

Plan sponsor portals offer various features, such as plan management, participant management, and communication and education tools. These features simplify plan administration by automating tasks, streamlining processes, and improving communication between stakeholders.

Plan sponsor portals to improve compliance and regulatory adherence by providing automated compliance testing, reporting tools, and alerts. These features help plan sponsors navigate complex regulations and mitigate the risk of penalties or litigation.

Yes, plan sponsor portals can integrate with payroll and HR systems, recordkeeping and third-party administration services, and financial advisor and investment management platforms. This integration streamlines data management, reduces errors, and improves overall plan efficiency.

When selecting a plan sponsor portal, important considerations include ease of use and user experience, customization and scalability, data security and privacy, and customer support, and ongoing training. These factors contribute to the success of the portal and ensure it meets the organization's needs.

Plan sponsor portals improve participant outcomes by providing easy access to plan information, educational resources, and communication tools. This enhanced experience helps participants stay informed and engaged with their benefits, leading to better retirement and financial outcomes.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.