Plan Error Correction refers to the process of identifying, rectifying, and remedying mistakes, inconsistencies, or noncompliance issues within an employer-sponsored retirement or welfare benefit plan. This process is vital for maintaining the plan's compliance with legal and regulatory requirements, ensuring the plan operates as intended and safeguarding the best interests of both the employer and plan participants. Eligibility errors occur when plan administrators improperly include or exclude employees from participating in the retirement plan. This can result from incorrect interpretation of eligibility requirements, administrative oversights, or miscommunication between departments. Contribution errors involve the improper allocation of employee and employer contributions to participant accounts. These can arise from calculation errors, payroll system glitches, or misapplication of contribution limits and matching rules. Distribution errors involve mistakes in the payment of benefits, including incorrect payment amounts, payment timing, or payment type. Examples include early or late distributions, Required Minimum Distribution (RMD) failures, and incorrect rollover processing. Plan document errors involve inconsistencies between the plan's terms and its operation or failure to update plan documents to comply with regulatory changes. Examples include not adopting mandatory amendments, operational discrepancies, and incorrect plan language. Nondiscrimination testing errors involve failure to meet the Internal Revenue Service (IRS) requirements for ensuring plan benefits are equitably distributed among highly compensated and non-highly compensated employees. Common issues include failing to perform required tests or incorrect testing methodology. The SCP allows plan sponsors to correct certain operational errors without notifying the IRS or paying a fee. To use SCP, the errors must be considered insignificant, and the plan sponsor must take corrective action within a specified timeframe. The VCP allows plan sponsors to correct certain errors by submitting a formal application to the IRS, outlining the error, the proposed correction, and any applicable fees. The IRS reviews the application and provides a compliance statement if the proposed correction is accepted. The Audit CAP is used when a plan error is discovered during an IRS audit. Plan sponsors must negotiate a closing agreement with the IRS and pay a negotiated penalty to correct the error. Plan sponsors must assess the nature and severity of the error to determine which correction program is most suitable. It is crucial to consult with experienced professionals to ensure accurate evaluation and implementation of the correction process. The first step in the error correction process is to identify potential errors through regular plan reviews, internal audits, or employee feedback. Once an error is identified, plan sponsors must evaluate the scope of the error, determine the affected participants, and estimate the potential financial impact. After assessing the error, plan sponsors should develop a correction strategy that complies with IRS guidelines and is appropriate for the specific error. Plan sponsors must implement the chosen correction method and document all corrective actions taken, including any communications with employees or the IRS. Regular monitoring of plan operations can help prevent future errors and ensure ongoing compliance with regulatory requirements. Conducting periodic plan reviews and internal audits can help identify potential errors before they become significant issues. Plan sponsors and administrators should stay informed about regulatory changes and update plan documents and operations accordingly to maintain compliance. Working with knowledgeable professionals, such as ERISA attorneys, third-party administrators, or consultants, can provide valuable guidance and expertise in the error correction process. Proper training and education for plan administrators are essential to ensure they understand their responsibilities, regulatory requirements, and best practices for maintaining plan compliance. Failure to correct errors in a timely manner can lead to plan disqualification, resulting in the loss of the plan's tax-advantaged status and severe financial consequences for both employers and employees. Uncorrected errors can trigger tax consequences, such as additional taxes on contributions or distributions and potential penalties for plan sponsors and participants. The IRS may impose fines and penalties on plan sponsors for uncorrected errors, depending on the severity and duration of noncompliance. In addition to financial consequences, uncorrected errors can lead to legal issues, including employee lawsuits and regulatory enforcement actions. Plan Error Correction is a critical process in maintaining retirement or welfare benefit plan compliance and safeguarding the best interests of both employers and plan participants. Common plan errors can involve eligibility, contributions, distributions, plan documents, or nondiscrimination testing. Utilizing error correction programs such as the Self-Correction Program, Voluntary Correction Program, or Audit Closing Agreement Program can help address and rectify these errors. Determining the appropriate program and following the error correction process, including identifying errors, assessing their impact, developing a correction strategy, implementing corrections, and monitoring plan compliance, are vital steps. Best practices involve regular plan reviews, staying updated on regulatory changes, engaging with experienced professionals, and providing training for plan administrators. Failure to correct errors can lead to severe consequences, including plan disqualification, tax implications, fines, penalties, and legal ramifications. Therefore, it is essential for organizations to prioritize plan error correction to maintain compliance and ensure the continued success of their retirement or welfare benefit plans.Definition of Plan Error Correction

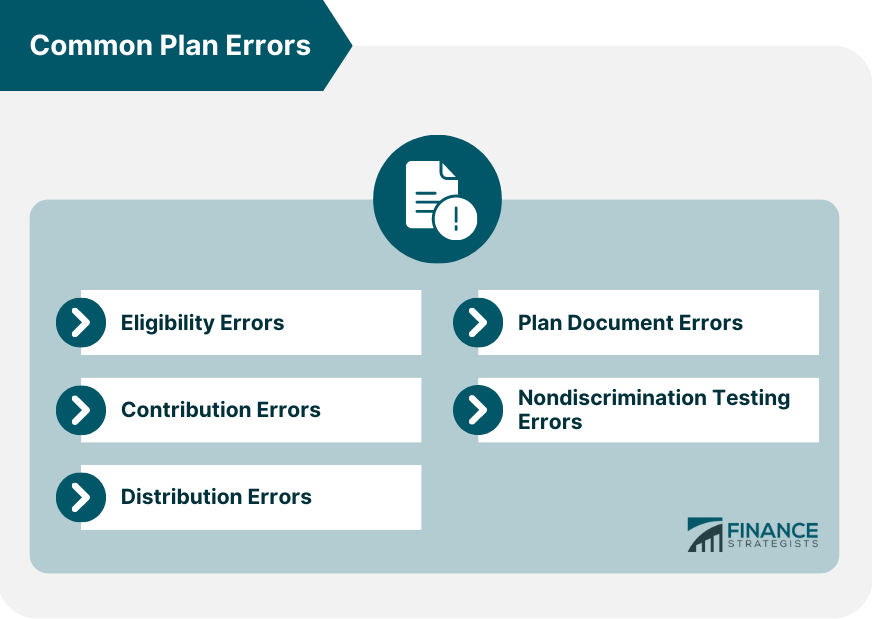

Common Plan Errors

Eligibility Errors

Contribution Errors

Distribution Errors

Plan Document Errors

Nondiscrimination Testing Errors

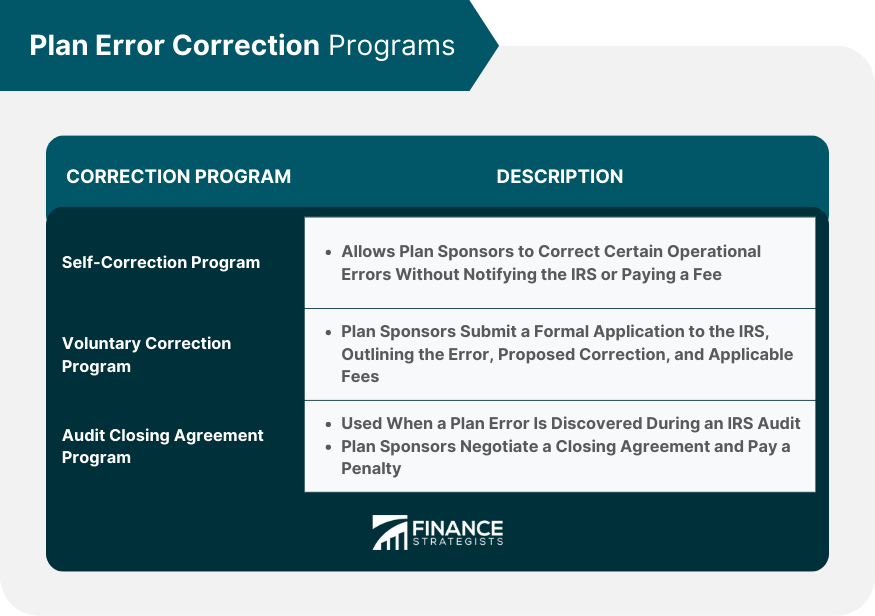

Plan Error Correction Programs

Self-Correction Program (SCP)

Voluntary Correction Program (VCP)

Audit Closing Agreement Program (Audit CAP)

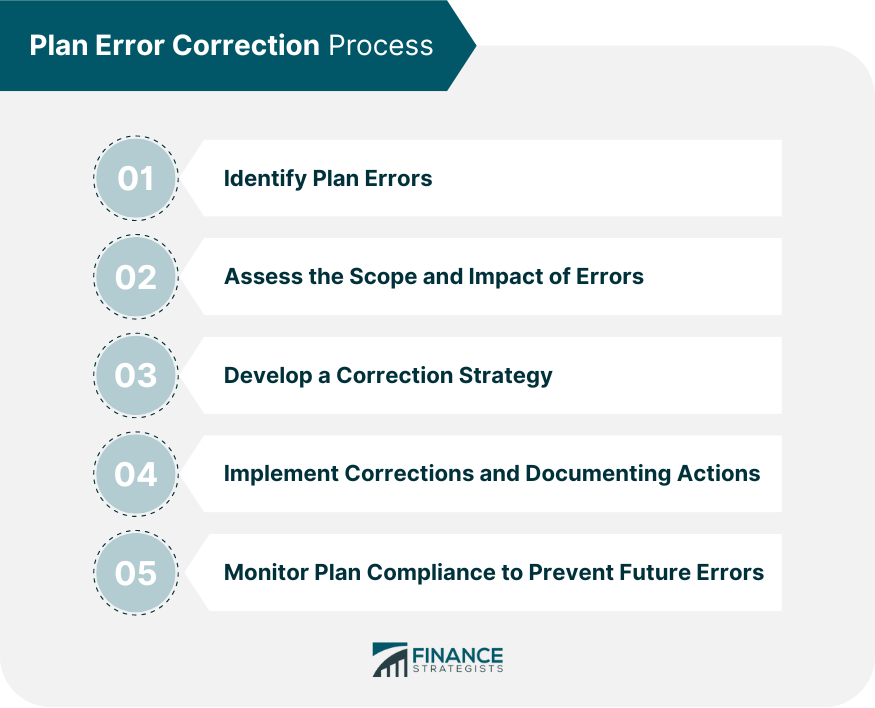

Error Correction Process

Identifying Plan Errors

Assessing the Scope and Impact of Errors

Developing a Correction Strategy

Implementing Corrections and Documenting Actions

Monitoring Plan Compliance to Prevent Future Errors

Best Practices for Plan Error Correction

Regular Plan Review and Internal Audits

Staying Updated on Regulatory Changes

Engaging With Experienced Professionals for Guidance

Training and Educating Plan Administrators

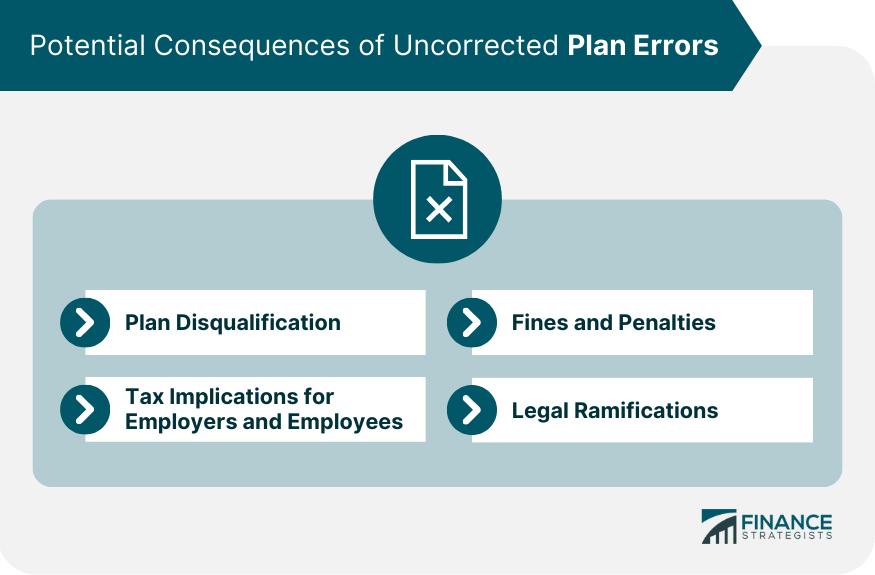

Potential Consequences of Uncorrected Errors

Plan Disqualification

Tax Implications for Employers and Employees

Fines and Penalties

Legal Ramifications

Bottom Line

Plan Error Correction FAQs

Common types of Plan Error Corrections include eligibility errors, contribution errors, distribution errors, plan document errors, and nondiscrimination testing errors.

The main programs available for Plan Error Correction are the Self-Correction Program (SCP), the Voluntary Correction Program (VCP), and the Audit Closing Agreement Program (Audit CAP).

Plan sponsors can identify potential Plan Error Corrections through regular plan reviews, internal audits, and employee feedback.

Failure to address Plan Error Corrections can lead to plan disqualification, tax implications for employers and employees, fines and penalties, and legal ramifications.

Best practices for preventing and addressing Plan Error Corrections include conducting regular plan reviews and internal audits, staying updated on regulatory changes, engaging with experienced professionals for guidance, and training and educating plan administrators.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.