A participant recordkeeping fee is a fee charged to participants in employer-sponsored retirement plans, such as 401(k) plans, to cover the cost of recordkeeping and administrative services provided by the plan's service provider. These fees can include expenses associated with maintaining accurate records of individual participant accounts, processing contributions and withdrawals, preparing statements, and providing customer service to participants. These services are essential to the effective functioning of a retirement plan, and participant recordkeeping fees ensure that they are provided efficiently and effectively. Participant recordkeeping fees can have a significant impact on retirement savings, as they reduce the amount of funds available for investment and can lead to a shortfall in retirement income if not managed carefully. Understanding participant recordkeeping fees is therefore essential for effective retirement planning. Asset-based fees are calculated as a percentage of the assets in a participant's retirement account. The fee is typically assessed on a yearly basis. The asset-based fee structure can be beneficial for participants with large account balances, as the fee percentage decreases as the account balance increases. Flat fees are charged at a fixed rate, regardless of the size of the participant's retirement account. The fee is typically assessed on a yearly or quarterly basis. The flat fee structure can be beneficial for participants with small account balances, as the fee remains constant regardless of the account balance. Per participant fees are charged on a per-participant basis, and are typically assessed on a yearly or quarterly basis. The per participant fee structure can be beneficial for retirement plans with a large number of participants, as the fee is not dependent on the size of the participant's account balance. Participant Recordkeeping Fees can have a direct impact on retirement savings, as they reduce the amount of funds available for investment. For example, a participant with a $100,000 retirement account balance and an asset-based fee of 0.5% would pay $500 in fees annually. Over 20 years, this fee would amount to $10,000, reducing the overall value of the retirement account. These fees can lead to lower returns over time, which can significantly impact retirement savings. Participant Recordkeeping Fees can also have an indirect impact on retirement savings. High fees can discourage participation in the retirement plan, as participants may view the plan as too expensive and choose not to enroll. Additionally, high fees can affect investment decisions, as participants may opt for lower-risk investments with lower fees, which can result in lower overall returns over time. Retirement plans are often administered by service providers who charge fees to participants. Regulations have been put in place to ensure that participants are fully informed of all fees associated with their retirement plans. The Department of Labor (DOL) has issued regulations that require retirement plan service providers to disclose all fees and expenses associated with the plan to participants. The regulation, known as the 408(b)(2) regulation, requires service providers to disclose any fees or expenses that may be charged to participants in connection with the plan. This includes recordkeeping fees, investment fees, and administrative fees. The regulation also requires service providers to provide a detailed explanation of the services that will be provided in exchange for these fees. The Employee Retirement Income Security Act (ERISA) also requires retirement plan service providers to disclose all fees and expenses associated with the plan to participants. ERISA imposes fiduciary responsibilities on plan sponsors and service providers, requiring them to act in the best interests of the plan participants. This means that they must ensure that the fees charged are reasonable and that the services provided are of high quality. In addition to the regulations issued by the DOL and ERISA, other regulations may also apply to participant recordkeeping fees. For example, the Securities and Exchange Commission (SEC) has issued regulations requiring investment advisers to provide disclosure documents to their clients. These documents must include information about the fees that will be charged and how those fees will be calculated. State securities regulators may also have regulations that require disclosure of fees charged to retirement plan participants. One effective strategy to minimize Participant Recordkeeping Fees is to negotiate with service providers. Plan sponsors and participants can compare fees across providers and select the most cost-effective option. Negotiating with providers can also result in fee reductions, as providers may be willing to lower fees to retain clients. Consolidating retirement accounts can help to minimize Participant Recordkeeping Fees by reducing the number of accounts and associated fees. Participants can consolidate their retirement accounts by rolling over 401(k) plans from previous employers into their current plan, or by consolidating IRA accounts. Consolidating accounts can also simplify retirement planning and make it easier to manage retirement savings. Investing in low-cost funds, such as index funds and exchange-traded funds (ETFs), can also help to minimize Participant Recordkeeping Fees. These types of funds have lower investment expenses and transaction costs compared to actively managed funds, which can result in lower overall fees. Additionally, low-cost funds have been shown to outperform higher-cost alternatives over the long term, leading to greater returns for retirement savings. Participant recordkeeping fees are essential fees charged to participants in employer-sponsored retirement plans to cover the cost of recordkeeping and administrative services. There are different types of fees such as asset-based, flat fees, and per-participant fees, and they can have a direct and indirect impact on retirement savings. It's important to understand these fees for effective retirement planning. Regulations such as those issued by the Department of Labor and ERISA require retirement plan service providers to disclose all fees and expenses associated with the plan to participants. Comparison of participant recordkeeping fees among different types of retirement plans reveals significant differences in fees. Strategies to minimize participant recordkeeping fees include negotiation with service providers, consolidation of retirement accounts, and investment in low-cost funds. Understanding these strategies can help participants minimize fees and ultimately maximize retirement savings.What Is a Participant Recordkeeping Fee?

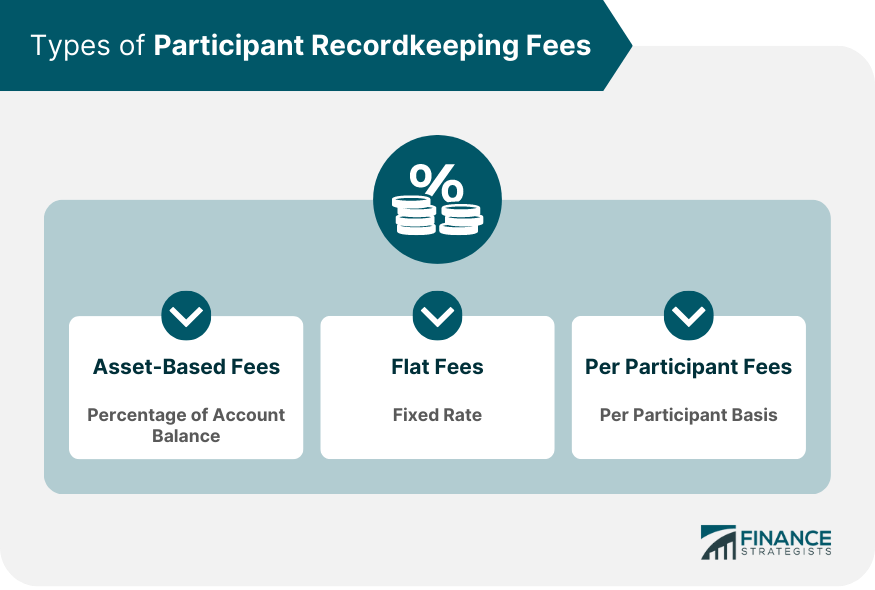

Types of Participant Recordkeeping Fees

Asset-Based Fees

Flat Fees

Per Participant Fees

Impact of Participant Recordkeeping Fees on Retirement Savings

Direct Impact on Retirement Savings

Indirect Impact on Retirement Savings

Regulations on Participant Recordkeeping Fees

Department of Labor (DOL) Regulations

Employee Retirement Income Security Act (ERISA) Regulations

Other Regulations

Strategies to Minimize Participant Recordkeeping Fees

Negotiation With Service Providers

Consolidation of Retirement Accounts

Investment in Low-Cost Funds

Conclusion

Participant Recordkeeping Fee FAQs

Participant Recordkeeping Fees are charged by retirement plan service providers to cover the cost of maintaining participant accounts.

The three types of Participant Recordkeeping Fees are Asset-based Fees, Flat Fees, and Per Participant Fees.

Participant Recordkeeping Fees can impact retirement savings directly by reducing the account balance and indirectly by limiting investment options.

Yes, the Department of Labor (DOL) and the Employee Retirement Income Security Act (ERISA) regulate Participant Recordkeeping Fees.

You can minimize Participant Recordkeeping Fees by negotiating with service providers, consolidating retirement accounts, and investing in low-cost funds.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.