The 401(k) is a tax-advantaged retirement savings plan in the US, enabling workers to invest earnings pre-tax. Taxes are applied when withdrawn, usually during retirement. It acts as a building block for a secure retirement, offering financial stability through compound interest and tax benefits. Making consistent contributions enables exponential growth over time, effortlessly multiplying savings. Self-employed individuals and freelancers can also benefit from this, with the Solo 401(k), granting them the same saving opportunities as traditionally employed counterparts. This variant ensures a broader reach, allowing more people to prepare for a financially stable future. The Solo 401(k) is a retirement savings plan designed specifically for self-employed individuals, freelancers, and small business owners with no full-time employees other than a spouse. This plan essentially gives you the advantages of both an employer and an employee, as you can make contributions in both capacities. One of the significant benefits of the Solo 401(k) is its high contribution limits. For instance, in 2024, you can contribute up to $23,000 as an employee, plus an additional 25% of your compensation as an employer, capped at a total of $69,000. If you're 50 or older, the limit increases due to catch-up contributions. To open a Solo 401(k), certain criteria need to be met. You must have some form of self-employment income. This could be from consulting, freelancing, or owning a small business. Also, you should not have any full-time employees working for you, though employing a spouse or having part-time employees does not affect your eligibility. Essentially, it is designed for people who work for themselves. The first step in opening a Solo 401(k) is to ensure you meet the eligibility criteria discussed above. Confirming that you have self-employment income and verifying that you do not employ any full-time workers are crucial at this stage. Next, it's essential to choose the right provider for your Solo 401(k) plan. Various financial institutions such as banks, brokerage firms, and specialized financial service companies offer these plans. When deciding on a provider, it is important to consider factors such as fees, available investment options, customer service quality, and any additional features they offer. After choosing a provider, you need to establish your Solo 401(k) plan. This process involves completing a plan adoption agreement that spells out the specifics of your plan. Then, you'll need to set up a Solo 401(k) account with the provider to begin making investments. Once your account is set up, you can start making contributions. Remember that you're both the employer and employee in this scenario, so you'll make contributions in both capacities. You're allowed to make both elective deferrals and profit-sharing contributions. Once your Solo 401(k) is up and running, it's crucial to manage and track your account. This means being aware of your contributions and how your investments are performing. This monitoring will ensure you stay within the annual contribution limits and help you keep track of your retirement savings growth. If you are self-employed or do not have access to an employer-sponsored 401(k), there are several other retirement savings options available to you. Individual Retirement Accounts (IRAs) are self-initiated retirement savings accounts. Two main types of IRAs exist: Traditional and Roth IRAs. Traditional IRAs operate on pre-tax contributions and tax deductions at the time of withdrawal, while Roth IRAs work with post-tax contributions and tax-free withdrawals in retirement. This flexibility allows you to choose an IRA based on your specific financial situation. The Simplified Employee Pension (SEP) IRA is another retirement savings option particularly suited to self-employed individuals and small business owners. SEP IRAs typically allow for higher contribution limits compared to Traditional or Roth IRAs, making them a solid choice if you wish to save more aggressively. Setting up a SEP IRA involves completing an IRS Form 5305-SEP and opening an account with a financial institution of your choice. The Savings Incentive Match Plan for Employees (SIMPLE) IRA is an additional retirement plan option, particularly beneficial for small businesses. If you're self-employed, a SIMPLE IRA can also be a viable retirement savings tool. To set one up, you need to fill out an IRS Form 5304-SIMPLE or Form 5305-SIMPLE, depending on your preference for the financial institution that will receive the contributions. Before you proceed with opening a Solo 401(k) or any other self-directed retirement savings plan, you must understand the tax implications. For instance, Solo 401(k) contributions are typically tax-deductible, reducing your taxable income in the year you make the contribution. However, in retirement, your distributions will be taxed as regular income. Understanding contribution limits for each retirement plan is a key consideration when choosing a savings strategy. For example, for a Solo 401(k), the maximum total contributions for 2024 cannot exceed $69,000 or $76,500 if you're 50 or older. This includes both your contributions as an employee and employer. The amount you can contribute to your retirement savings plan, be it a Solo 401(k) or a SEP IRA, is dependent on your self-employment income. The more you earn from your self-employment ventures, the more you can contribute up to the prescribed limits. This connection means your earning power directly affects your retirement savings capacity. Proper record-keeping is an essential part of managing your retirement savings. It's crucial to keep track of all your contributions, investment gains and losses, and any distributions you make from your account. Proper records can help you manage your investment strategy, ensure compliance with contribution limits, and simplify your tax filing process. Planning for retirement without an employer might seem intimidating, but a range of options, including the Solo 401(k), Traditional and Roth IRAs, SEP, and SIMPLE IRAs, offer ample opportunities. These plans afford self-employed individuals, freelancers, and small business owners the same security of retirement savings as those with employer-sponsored plans. However, critical considerations such as tax implications, contribution limits, earnings, and diligent record-keeping are essential for effectively managing these accounts. Utilizing the expertise of a financial advisor can help demystify the complexities of retirement planning and guide you toward a strategy that best suits your financial circumstances. Embarking on your retirement journey independently doesn't have to be daunting, but rather, with informed choices and consistent contributions, it can lead to a financially secure future. Your future starts today, so reach out to a retirement planning service to start building your nest egg.Overview of 401(k) Without an Employer

How to Open a 401(k) Without an Employer: Solo 401(k) Option

Solo 401(k)

Eligibility Criteria

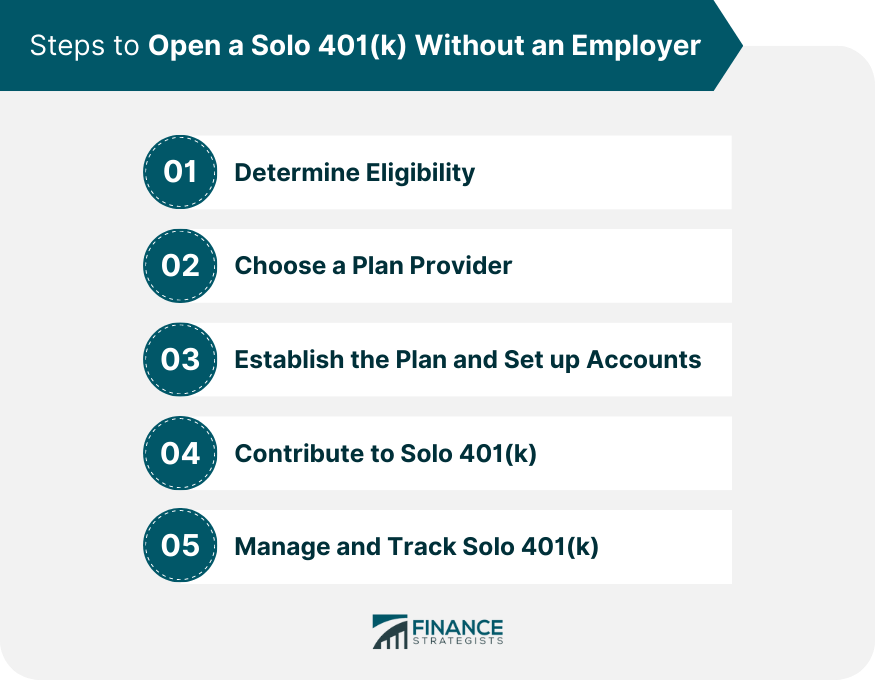

How to Open a Solo 401(k)

Determine Eligibility

Choose a Plan Provider

Establish the Plan and Set up Accounts

Contribute to Solo 401(k)

Manage and Track Solo 401(k)

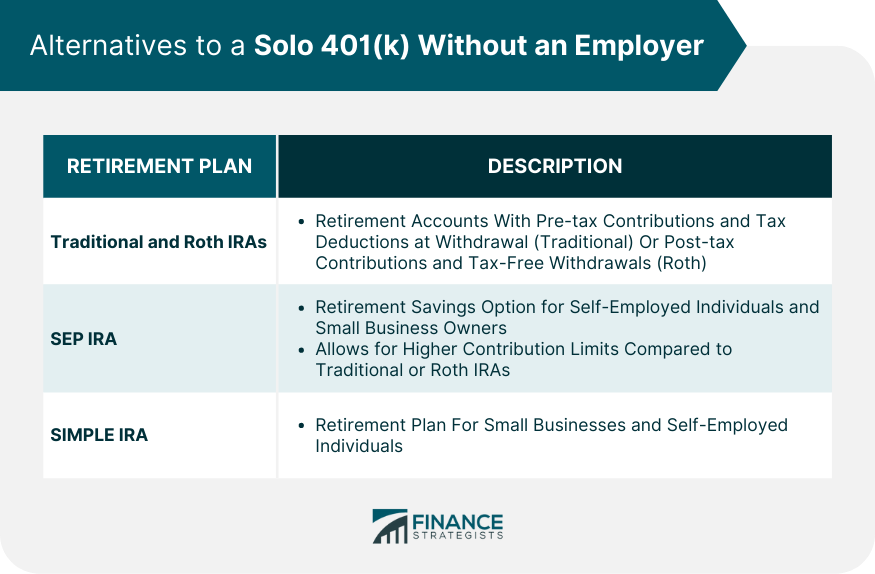

Alternatives to a 401(k) Without an Employer

Traditional and Roth IRAs

SEP IRA

SIMPLE IRA

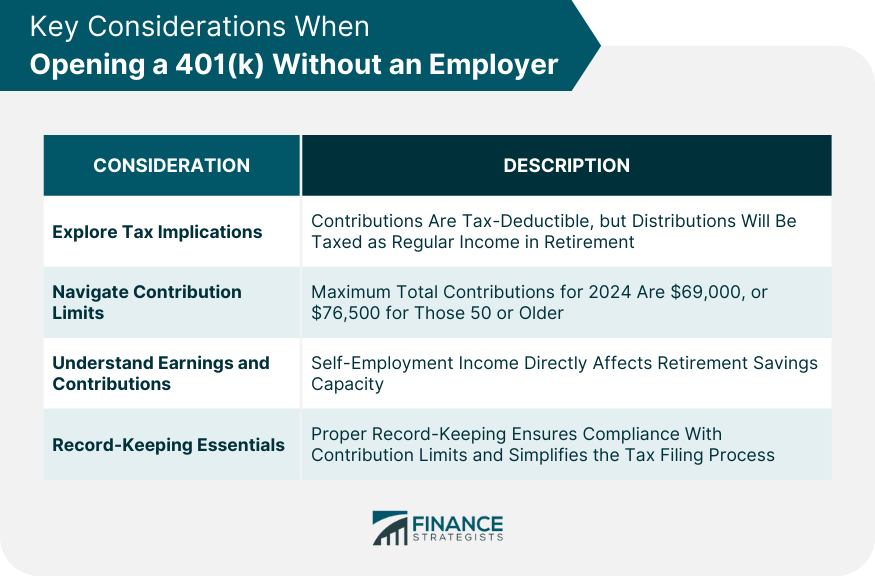

Important Considerations When Opening a 401(k) Without an Employer

Exploring Tax Implications

Navigating Contribution Limits

Understanding Earnings and Contributions

Record-Keeping Essentials

Bottom Line

How to Open a 401(k) Without an Employer FAQs

A Solo 401(k) is a retirement savings plan for self-employed individuals, freelancers, and small business owners with no full-time employees.

You can open a Solo 401(k) by determining your eligibility, choosing a plan provider, setting up the plan, making contributions, and tracking progress.

Alternatives include Traditional and Roth IRAs, Simplified Employee Pension (SEP) IRAs, and Savings Incentive Match Plan for Employees (SIMPLE) IRAs.

Contributions to a Solo 401(k) are tax-deductible, reducing your taxable income for that year. However, distributions will be taxed as regular income in retirement.

A financial advisor can help you select the right retirement plan, develop a strategic investment approach, offer tax planning advice, and manage your investments.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.