Financial scams targeting seniors are schemes that specifically target elderly individuals with the goal of stealing their money or personal information. These scams can take many forms, including phishing emails, fake charity solicitations, and fraudulent investment opportunities. Seniors and their loved ones need to be aware of these scams and take steps to protect themselves. Many seniors may need to be more well-versed in modern financial practices or digital technologies, making them susceptible to scams that involve online transactions, digital currencies, or internet-based communication. As individuals age, they may experience cognitive decline or health issues, which can lead to impaired judgment and increased vulnerability to scams. Seniors often have more significant savings and assets due to a lifetime of earning, saving, and investing, making them attractive targets for scammers. Many seniors come from a generation that values trust, politeness, and social decorum. Scammers may exploit these traits to manipulate seniors into providing sensitive information or making unwise financial decisions. Scammers pose as representatives of legitimate charities or create fake charities to solicit donations from seniors over the phone. Seniors are informed that they have won a lottery or sweepstakes but must pay taxes or fees to claim their prize. Scammers pose as tech support personnel, claiming that the senior's computer has a virus or needs an update, and request payment for their services. Scammers promise high returns on investments by using money from new investors to pay returns to earlier investors, creating the illusion of a profitable business. Scammers sell fake or unregistered promissory notes, which are short-term debt instruments, to seniors by promising high returns with minimal risk. Scammers convince seniors to invest in precious metals, rare coins, or other commodities with false claims of significant appreciation and low risk. Scammers sell counterfeit prescription drugs to seniors, which may be ineffective or dangerous to their health. Scammers pose as insurance agents, offering seniors fraudulent or nonexistent health insurance policies. Scammers sell unnecessary or counterfeit medical equipment to seniors, often billing Medicare for fraudulent transactions. Scammers impersonate government officials, claiming that the senior's benefits are in jeopardy and requiring immediate action or payment. Scammers pose as romantic interests, often online, and manipulate seniors into providing financial support or gifts. Scammers pose as a grandchild or other family member in distress, requesting money for an emergency or urgent need. Scammers pose as Internal Revenue Services (IRS) agents, claiming that the senior owes back taxes and must make an immediate payment to avoid penalties. Scammers steal seniors' personal information, such as Social Security numbers or financial account information, to commit fraud or other crimes. Organize educational events in the community to inform seniors about common financial scams and how to avoid them. Direct seniors to reliable online resources that provide information on financial scams and prevention strategies, such as government websites and consumer protection organizations. Encourage seniors to discuss their financial decisions and any suspicious encounters with trusted family members or friends. Regularly review seniors' financial accounts for unauthorized transactions or other signs of fraudulent activity. Enroll seniors in account alerts for large transactions or other suspicious activity to provide early detection of potential scams. Keep up to date with the latest scams targeting seniors by following news reports, government alerts, and consumer protection resources. Ensure seniors shred sensitive documents, such as bank statements or credit card offers, before discarding them. Help seniors create strong, unique passwords for online accounts and encourage the use of password managers for added security. Encourage seniors to secure their mail by using a locked mailbox and implementing two-factor authentication for online accounts. Enroll seniors in call-blocking services to reduce the number of telemarketing and scam calls they receive. Report the scam to local law enforcement to help them track and potentially apprehend the scammers. File a complaint with the Federal Trade Commission (FTC), which collects information on scams and provides resources for victims. Contact the state attorney general's office to report the scam and inquire about any available resources for victims. Close any compromised financial accounts and open new ones to prevent further unauthorized transactions. Work with financial institutions to dispute fraudulent charges and recover lost funds, if possible. Encourage seniors to monitor their credit reports for signs of identity theft or other fraudulent activity. Rely on family members and community resources, such as support groups or counseling services, to help seniors recover emotionally and financially from the scam. Financial scams targeting seniors are schemes that specifically target elderly individuals with the goal of stealing their money or personal information. Seniors and their loved ones need to be aware of these scams and take steps to protect themselves. Seniors are targeted for various reasons, including generational differences in financial literacy, cognitive decline and vulnerability, accumulated wealth and assets, and a trusting and polite nature. These scams can take many forms, including telemarketing scams, charity scams, lottery and sweepstakes scams, and identity theft. Preventive measures include educating seniors on financial scams, encouraging open communication with family and friends, establishing financial safeguards, staying informed about current scams, protecting personal information, and utilizing call-blocking services. If a senior falls victim to a scam, steps to take include reporting the scam, contacting financial institutions, monitoring credit reports, and seeking support from family and community resources. It is essential to be vigilant and take the necessary steps to protect seniors from financial scams.Overview of Financial Scams Targeting Seniors

Reasons Seniors Are Targeted by Financial Scammers

Generational Differences in Financial Literacy

Cognitive Decline and Vulnerability

Accumulated Wealth and Assets

Trusting and Polite Nature

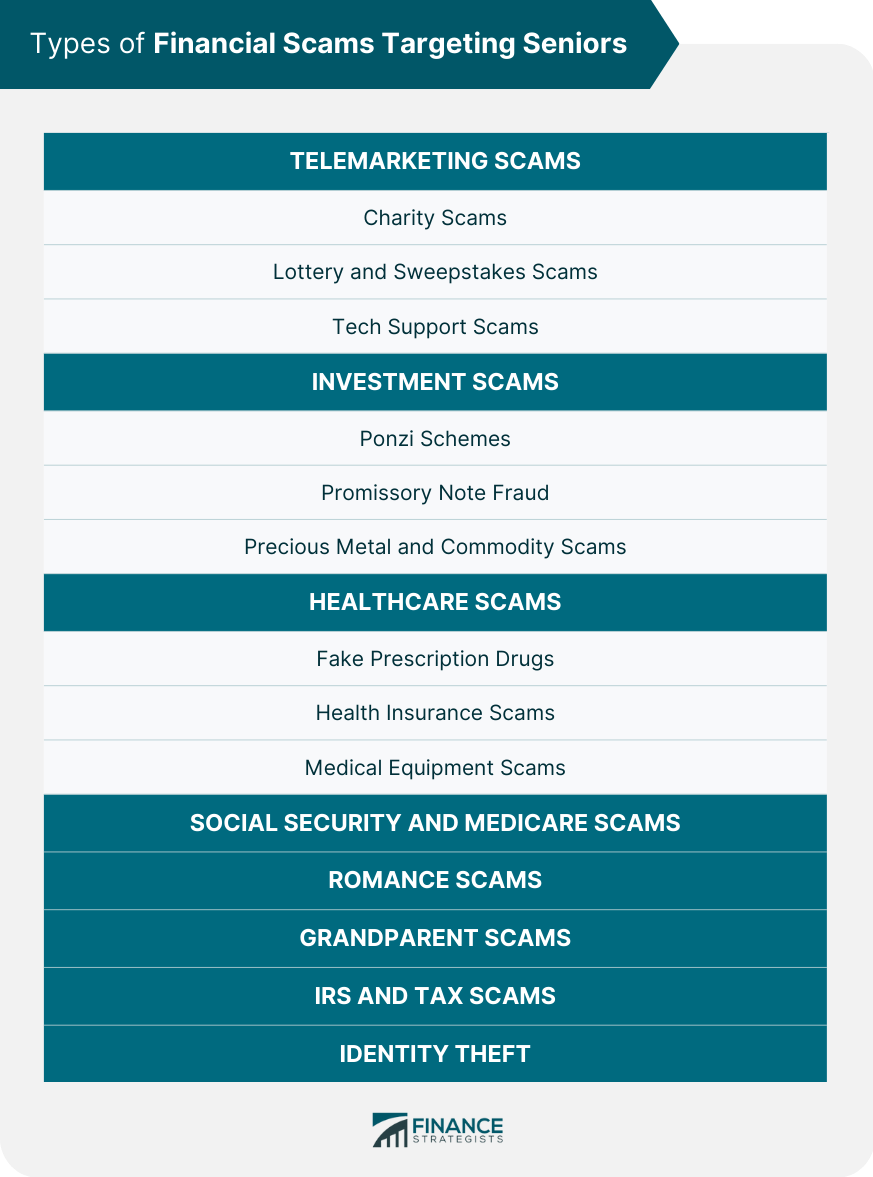

Types of Financial Scams Targeting Seniors

Telemarketing Scams

Charity Scams

Lottery and Sweepstakes Scams

Tech Support Scams

Investment Scams

Ponzi Schemes

Promissory Note Fraud

Precious Metal and Commodity Scams

Healthcare Scams

Fake Prescription Drugs

Health Insurance Scams

Medical Equipment Scams

Social Security and Medicare Scams

Romance Scams

Grandparent Scams

IRS and Tax Scams

Identity Theft

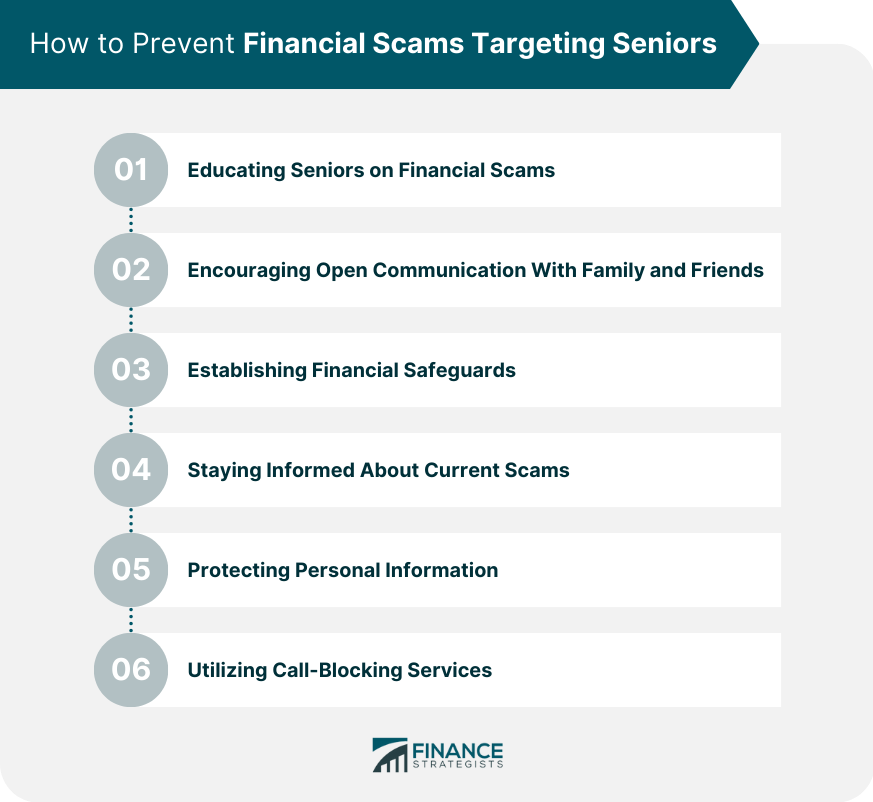

How to Prevent Financial Scams Targeting Seniors

Educating Seniors on Financial Scams

Community Seminars and Workshops

Online Resources

Encouraging Open Communication With Family and Friends

Establishing Financial Safeguards

Monitoring Financial Accounts

Setting up Alerts for Suspicious Activity

Staying Informed About Current Scams

Protecting Personal Information

Shredding Documents

Using Strong Passwords

Securing Mail and Online Accounts

Utilizing Call-Blocking Services

Steps to Take If a Senior Falls Victim to a Scam

Reporting the Scam

Local Law Enforcement

Federal Trade Commission (FTC)

State Attorney General's Office

Contacting Financial Institutions

Closing Compromised Accounts

Disputing Fraudulent Charges

Monitoring Credit Reports

Seeking Support From Family and Community Resources

Conclusion

Financial Scams Targeting Seniors FAQs

Financial scams targeting seniors are schemes that specifically target elderly individuals with the goal of stealing their money or personal information. These scams can take many forms, including phishing emails, fake charity solicitations, and fraudulent investment opportunities.

Scammers target seniors by using tactics such as posing as a government official, creating fake online profiles, and using high-pressure sales tactics. They may also prey on the loneliness or cognitive decline that can be common among older adults.

Common examples of financial scams targeting seniors include fake tech support calls, phony lottery or sweepstakes scams, and investment scams that promise high returns with little risk. Scammers may also pose as IRS agents or Medicare representatives to try to obtain personal information or money.

Seniors can protect themselves from financial scams by being wary of unsolicited phone calls or emails, verifying the legitimacy of any request for personal information or money, and talking to a trusted family member or financial advisor before making any major financial decisions.

If a senior falls victim to a financial scam, they should report it to their bank or financial institution immediately, as well as to the police and the Federal Trade Commission (FTC). They should also monitor their credit reports and take steps to protect themselves from identity theft.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.