Boiler room operations in the financial sector refer to fraudulent practices used by unethical brokers or salespeople to manipulate markets and deceive investors. These schemes typically involve high-pressure sales tactics and false information to sell worthless or overvalued stocks, often resulting in significant financial losses for the victims. In a pump and dump scheme, operators manipulate the price of a stock by artificially inflating its value through false and misleading information. Once the stock price has risen, they sell their shares for a profit, leaving unsuspecting investors with substantial losses when the stock price collapses. Boiler room operators often use aggressive sales tactics to persuade investors to buy stocks quickly, without conducting proper research. These tactics include urgency, scarcity, and playing on emotions to pressure investors into making impulsive decisions. Penny stocks are low-priced, thinly traded stocks that are susceptible to price manipulation. Boiler room operators often target these stocks, exploiting their low liquidity and limited public information to deceive investors into believing they are buying into the next big thing. Offshore investment scams involve promoting investments in foreign companies or jurisdictions with little or no regulation. These scams often promise high returns with minimal risk, while taking advantage of the difficulty in verifying the legitimacy of the investment opportunity. In the realm of cryptocurrencies, boiler room operators may promote fraudulent initial coin offerings (ICOs), where they sell tokens for non-existent or fraudulent projects. Investors may lose their entire investment when the project fails or disappears. Unsolicited contact from brokers or salespeople, either through phone calls or emails, can be a sign of a boiler room operation. Legitimate financial professionals typically do not engage in cold-calling potential clients. If a broker or salesperson uses high-pressure sales tactics to push an investment, it may indicate a boiler room scam. Reputable financial professionals should provide accurate information and allow investors time to research and make informed decisions. Boiler room operators often promise unrealistic returns with minimal risk to entice investors. Any investment opportunity that sounds too good to be true likely is. Fraudulent operators often avoid providing transparent information and documentation about their recommended investments. Legitimate investments should have verifiable financial statements and be registered with regulatory agencies. Investing in unfamiliar markets or industries can be a red flag, as boiler room operators often exploit the lack of knowledge and regulation to promote scams. The SEC plays a crucial role in regulating the financial markets and protecting investors from fraud. It investigates and prosecutes boiler room operations and other fraudulent activities. FINRA is responsible for regulating and overseeing brokerage firms and their registered representatives. They ensure compliance with industry rules and take enforcement actions against those who violate them. Boiler room operations often cross national borders, requiring international cooperation and coordination among regulatory and law enforcement agencies to combat these scams. Boiler room operators can face civil and criminal penalties, including fines, restitution, and imprisonment, depending on the nature and extent of their fraudulent activities. Educating investors about boiler room operations and the warning signs of scams is essential in preventing financial fraud. Investors should learn to conduct thorough research before making any investment decisions. Investors should perform due diligence on any investment opportunity by verifying its legitimacy, checking the registration of the broker or investment adviser, and reviewing financial statements and other relevant documentation. Individuals who suspect they have been targeted by boiler room operators should report the activity to the appropriate regulatory and law enforcement agencies. Reporting can help prevent others from falling victim to the scam and assist authorities in taking action against the perpetrators. Regulatory agencies play a critical role in detecting and preventing boiler room scams through ongoing monitoring, investigations, and enforcement actions against fraudulent operators. Emerging technologies, such as artificial intelligence and machine learning, can help regulators and law enforcement agencies identify and analyze patterns of fraudulent behavior, making it easier to detect and shut down boiler room operations. The ongoing threat of boiler room operations in finance emphasizes the importance of vigilance, education, and regulatory oversight. Investors must be cautious and conduct thorough research before making any investment decisions, while regulatory agencies and law enforcement must continue to work together to detect, prevent, and prosecute these fraudulent schemes. As technology evolves and the financial landscape changes, the challenges and opportunities in combating financial scams will continue to demand innovative solutions and collaboration among all stakeholders.What Are Boiler Room Operations?

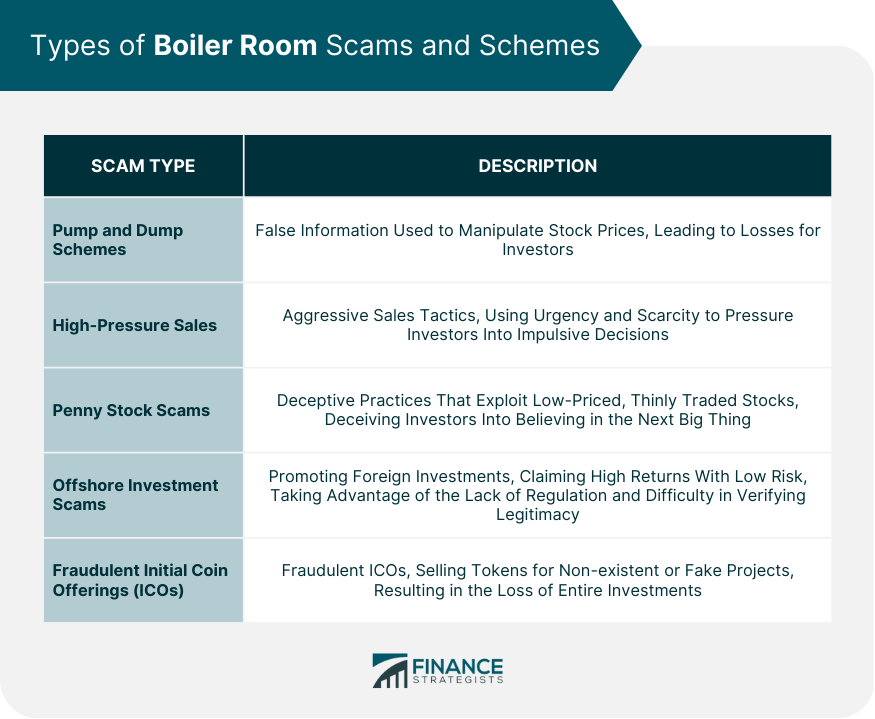

Types of Boiler Room Scams and Schemes

Pump and Dump Schemes

High-Pressure Sales Tactics

Penny Stock Scams

Offshore Investment Scams

Fraudulent Initial Coin Offerings (ICOs)

Red Flags and Warning Signs

Unsolicited Contact From Brokers

Aggressive Sales Tactics

Promises of High Returns With Low Risk

Lack of Transparency and Documentation

Investment Opportunities in Unfamiliar or Unregulated Markets

Legal and Regulatory Framework

Securities and Exchange Commission (SEC) Involvement

Financial Industry Regulatory Authority (FINRA) Role

International Cooperation and Coordination

Penalties and Consequences for Boiler Room Operators

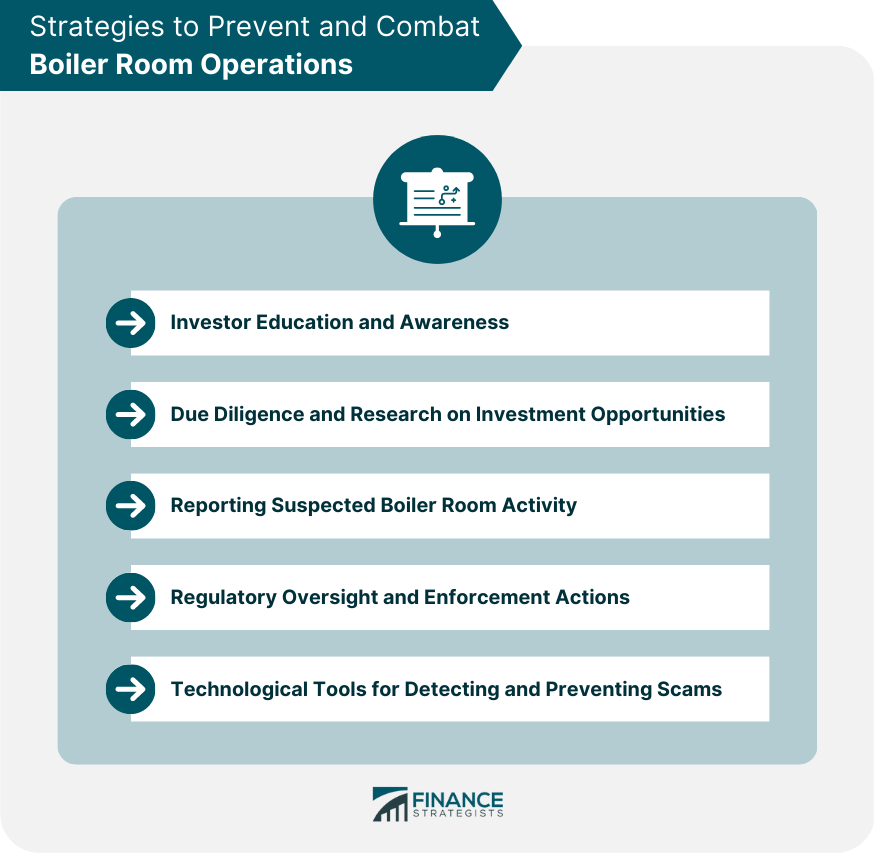

Strategies to Prevent and Combat Boiler Room Operations

Investor Education and Awareness

Due Diligence and Research on Investment Opportunities

Reporting Suspected Boiler Room Activity

Regulatory Oversight and Enforcement Actions

Technological Tools for Detecting and Preventing Scams

The Bottom Line

Boiler Room Operations FAQs

A boiler room operation is a fraudulent and illegal scheme in which a group of individuals use high-pressure sales tactics to persuade people to invest in fictitious or worthless securities.

Boiler room operations typically involve cold-calling potential investors and using aggressive sales tactics to convince them to invest in fraudulent securities. The operators of the scheme often use fake credentials and misrepresent the potential returns on the investment to lure in victims.

Some common signs of a boiler room operation include unsolicited phone calls or emails, high-pressure sales tactics, promises of guaranteed returns or insider information, and requests for immediate investment without proper due diligence. Additionally, boiler room operations often use fake or unregulated brokers and investment firms.

Investing in a boiler room operation can result in significant financial loss for the victim. The fraudulent securities are often worthless, and the high-pressure sales tactics used by the operators can make it difficult for victims to make informed decisions about their investments.

If you suspect that you are involved in a boiler room operation, you should immediately stop communication with the operators and report the incident to the appropriate authorities, such as the Securities and Exchange Commission (SEC) or the Financial Industry Regulatory Authority (FINRA). Additionally, it is recommended that you seek legal counsel to help you recover any lost funds.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.