A financial power of attorney (POA) is a legal document that grants an individual, known as the agent or attorney-in-fact, the authority to manage the financial affairs of another person, referred to as the principal. This arrangement is particularly important in situations where the principal is unable to manage their finances due to illness, injury, or other circumstances. A general power of attorney gives the agent broad authority to manage the principal's financial affairs. This includes tasks such as paying bills, managing investments, and handling real estate transactions. A general POA typically becomes ineffective if the principal becomes incapacitated. A limited or special power of attorney grants the agent authority to handle specific financial matters on behalf of the principal. This type of POA is often used for a particular purpose, such as managing a single bank account or handling a specific real estate transaction. A durable power of attorney remains in effect even if the principal becomes incapacitated. This type of POA is particularly useful for individuals who wish to ensure that their financial affairs will be properly managed in the event of a sudden illness or accident. A springing power of attorney becomes effective upon the occurrence of a specific event, such as the principal's incapacity. This type of POA provides an additional layer of protection, as it only comes into effect when certain conditions are met. When selecting an agent, it is crucial to consider the individual's trustworthiness, financial knowledge and experience, and availability and willingness to act in the role. The agent should be someone who understands the principal's financial goals and can be relied upon to make decisions in the principal's best interest. In some cases, it may be appropriate to consider alternatives to a single agent. Co-agents can be appointed to share responsibilities, while successor agents can be named to take over in case the primary agent is unable or unwilling to continue serving. Professional fiduciaries, such as financial institutions or trust companies, may also be considered agents, particularly for individuals with complex financial affairs. An agent is legally and ethically obligated to act in the best interest of the principal, making decisions that align with the principal's financial goals and values. The agent is responsible for managing the principal's assets, including investments, real estate, and bank accounts. They must also make financial decisions, such as paying bills and filing taxes, on behalf of the principal. An agent must keep detailed records of all financial transactions and decisions made on behalf of the principal. In some cases, the agent may be required to provide regular reports to the principal, their family members, or a court. The agent's authority may be limited by the terms of the financial power of attorney, state laws, or court orders. It is essential for the agent to understand these limitations and act within the bounds of their authority. When creating a financial power of attorney, it is crucial to consider state-specific requirements, as laws governing POAs can vary between states. The document should be drafted with clear language and scope, outlining the agent's authority and any limitations on their powers. To ensure the document is legally binding, the principal must sign the financial power of attorney in the presence of a notary public or witnesses, as required by state law. Proper execution and notarization help to prevent potential challenges to the validity of the document. The original financial power of attorney should be kept in a safe and secure location, such as a safe deposit box or with an attorney. Copies should be provided to the agent, relevant financial institutions, and any other parties who may need to be aware of the agent's authority. A principal may wish to revoke or amend their financial power of attorney due to changes in their personal or financial circumstances, or if they no longer trust their chosen agent. To revoke or amend a financial power of attorney, the principal should draft a written document stating their intention to revoke or modify the existing POA. This document should be executed and notarized in the same manner as the original POA. After revoking or amending a financial power of attorney, the principal should notify all relevant parties, including the agent, financial institutions, and any other individuals or entities that may be affected by the change. Financial powers of attorney are governed by state laws and regulations. It is essential for both the principal and the agent to understand and comply with these legal requirements to ensure the validity and enforceability of the POA. Unfortunately, financial powers of attorney can be susceptible to abuse and exploitation by unscrupulous agents. Safeguards, such as appointing a trusted agent, limiting the agent's authority, or requiring regular reporting, can help protect the principal's interests. To minimize the risk of abuse or exploitation, the principal should carefully consider the choice of agent, the scope of their authority, and any additional safeguards that may be appropriate, such as requiring co-agents or regular reporting to a third party. Having a financial power of attorney is an essential part of planning for the future. It ensures that an individual's financial affairs will be managed in their best interest should they become unable to do so themselves. By understanding the different types of financial powers of attorney, choosing a trustworthy agent, and carefully drafting and executing the document, individuals can gain peace of mind and protect their financial well-being. Consulting with legal and financial professionals is always recommended to ensure that the document meets all legal requirements and accurately reflects the principal's wishes.What Is Financial Power of Attorney (POA)?

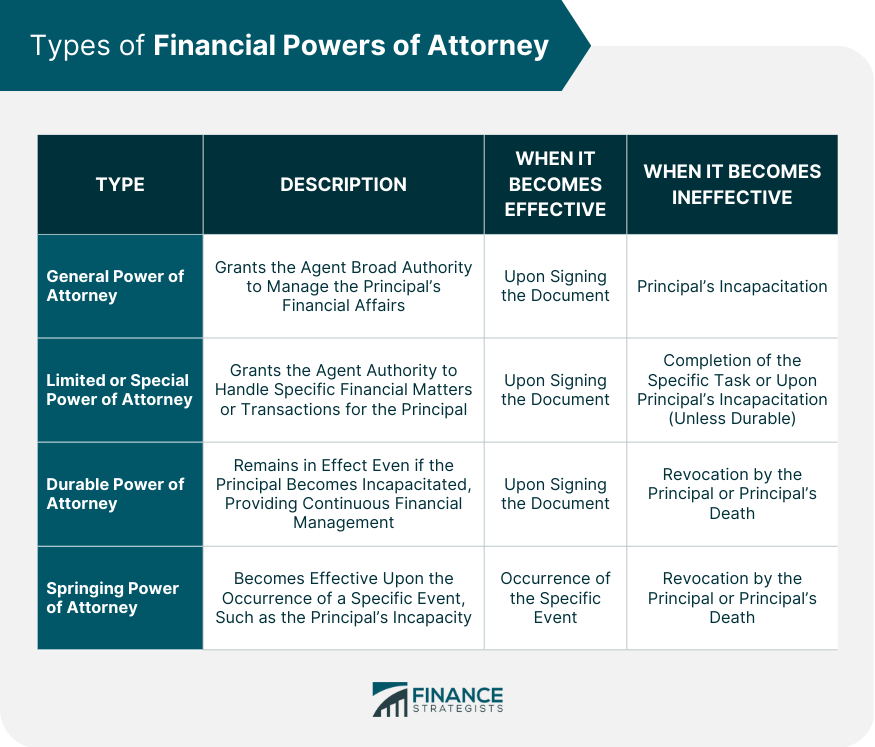

Types of Financial Powers of Attorney

General Power of Attorney

Limited or Special Power of Attorney

Durable Power of Attorney

Springing Power of Attorney

Choosing an Agent

Factors to Consider When Selecting an Agent

Alternatives to an Individual Agent

Roles and Responsibilities of an Agent

Acting in the Principal's Best Interest

Managing Assets and Making Financial Decisions

Record-Keeping and Reporting Requirements

Limitations on the Agent's Authority

Creating a Financial Power of Attorney

Drafting the Document

Execution and Notarization

Safekeeping and Accessibility

Revoking or Amending a Financial Power of Attorney

Circumstances That Warrant Revocation or Amendment

Steps to Revoke or Amend the Document

Informing Relevant Parties

Legal and Ethical Considerations

State Laws and Regulations

Potential for Abuse and Exploitation

Safeguards to Protect the Principal's Interests

Conclusion

Financial Power of Attorney (POA) FAQs

A financial power of attorney is a legal document that grants a designated person, called an agent, the authority to manage the financial affairs of another person, known as the principal. It is important because it ensures the proper management of the principal's finances in situations where they are unable to do so themselves due to illness, injury, or other circumstances.

When selecting an agent for your financial power of attorney, consider the individual's trustworthiness, financial knowledge and experience, and their availability and willingness to act in the role. The agent should be someone who understands your financial goals and can be relied upon to make decisions in your best interest.

Yes, a financial power of attorney can be revoked or amended by the principal. To do so, the principal should draft a written document stating their intention to revoke or modify the existing POA, execute and notarize it in the same manner as the original POA, and notify all relevant parties, including the agent and financial institutions.

To protect against potential abuse of a financial power of attorney, consider appointing a trusted agent, limiting the agent's authority, or requiring regular reporting to a third party. Other safeguards include using co-agents, who must agree on decisions, or appointing a professional fiduciary, such as a financial institution or trust company, as the agent.

A durable financial power of attorney remains in effect even if the principal becomes incapacitated, ensuring the continuous management of their financial affairs. A springing financial power of attorney, on the other hand, becomes effective only upon the occurrence of a specific event, such as the principal's incapacity. The main difference lies in when the agent's authority becomes effective and the conditions under which it remains active.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.