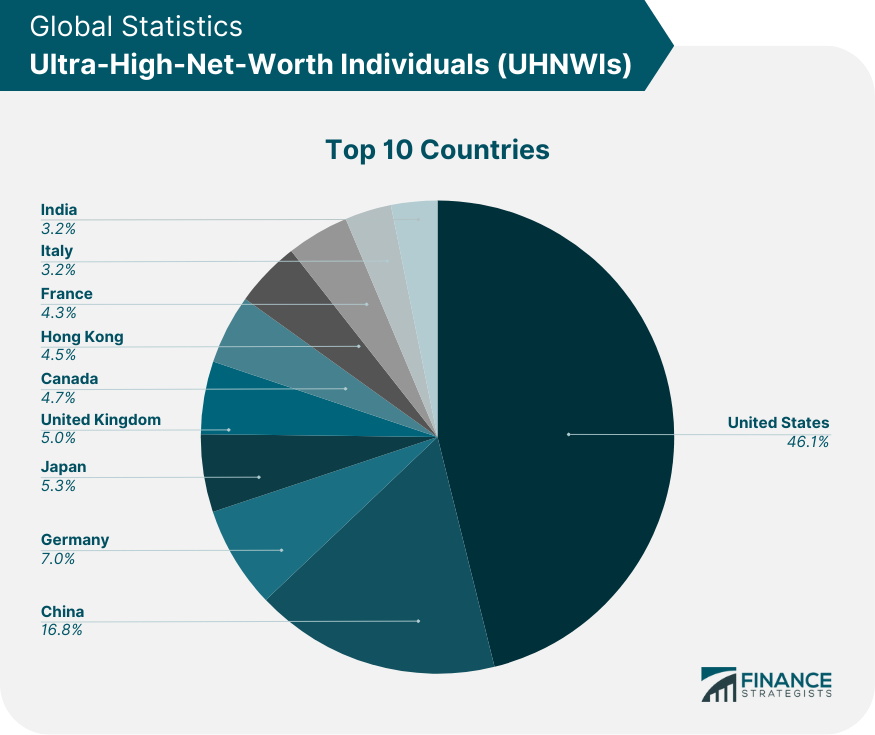

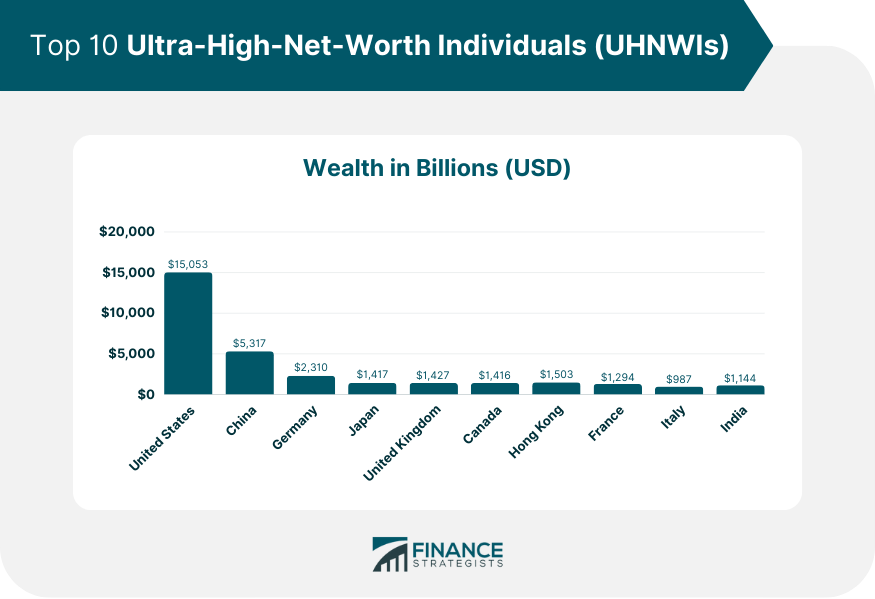

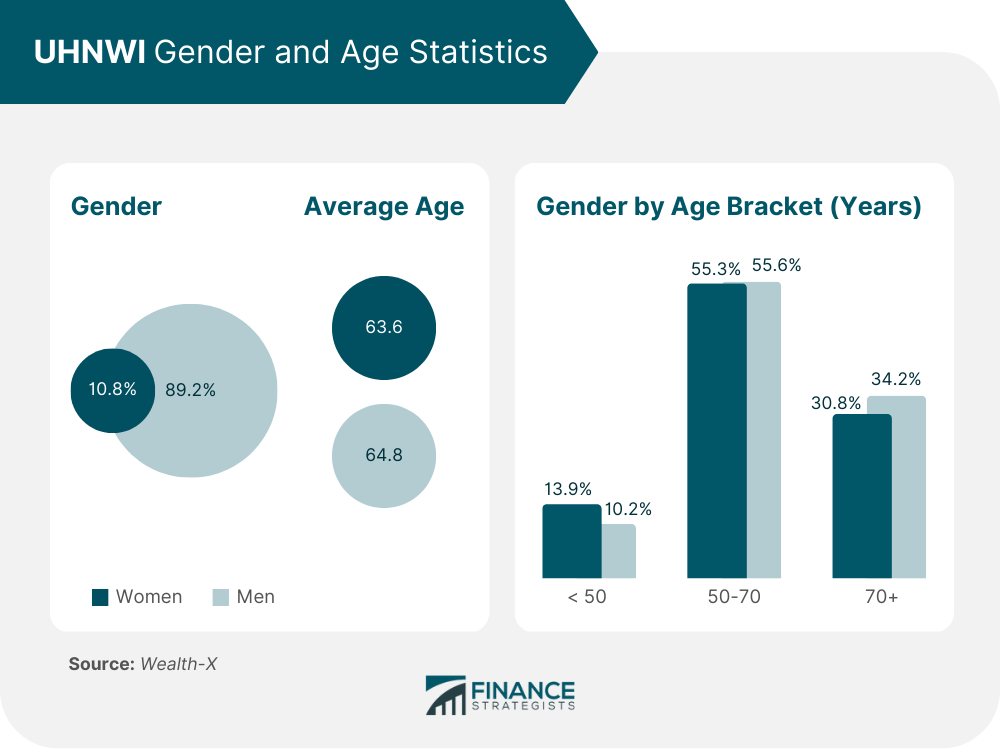

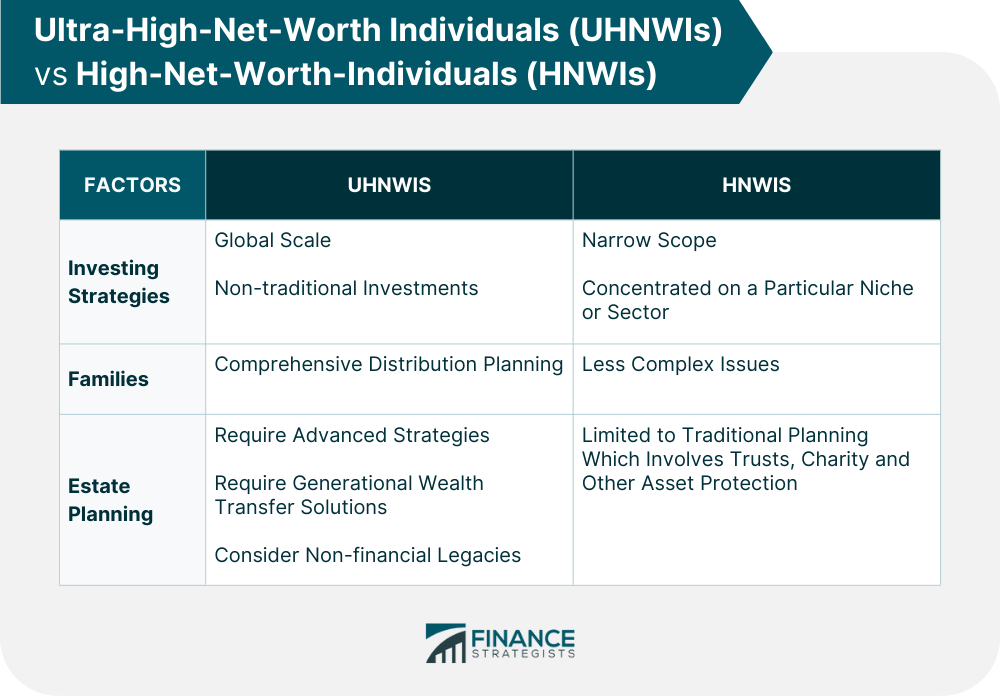

An individual with a net worth of more than $30 million is considered an ultra-high-net-worth individual (UHNWI). The assessment may include various assets from cash, stocks, bonds, investment funds, and other liquid and investable assets. Individuals with extremely high net worth can become wealthy through a company, investments, or inheriting money from a family member. Wealth managers, financial planners, and others in the financial services industry use a general UHNWI classification to pinpoint the wealthiest possible customer group. The Securities and Exchange Commission (SEC) does not use a UHNWI definition. A member of this group can participate in any legitimate investment opportunity and is treated the same as any other high-net-worth individual (HNWI) or accredited investor. According to the World Ultra Wealth Report published by Wealth-X – an Altrata company, globally, the number of ultra-high-net-worth individuals reached 395,070 in 2022. They own $45.4 trillion in wealth, making up 0.005% of the world's population. This group includes well-known billionaires like Amazon's Jeff Bezos and Microsoft's Bill Gates and multi-millionaires such as American investors Warren Buffett and Mark Zuckerberg. The United States is home to 129,665 UHNWIs, accounting for 46.1% of the top 10 UHNWIs globally, followed by China with 47,190 and Germany with 19,590. Japan, Hong Kong, the United Kingdom, Canada, France, Italy, and India made it to the top 10 countries with the most UHNWIs. As might be expected, the more UHNWIs in a country, the greater the equivalent wealth. The United States has recorded $15,053 billion, followed by China with $5,317 billion and Germany with $2,310 billion. The corresponding wealth for the rest of the top 10 countries is shown below: The statistics on the UHNWI population by gender and age reveal more men (89.2%) UHNWI than women (10.8%). The average age of the UHNWI population is 64.8 and 63.6 for men and women, respectively. Whereas, the wealthiest age bracket falls under 50-70. Being able to differentiate between the ultra-high-net-worth individual and a high-net-worth individual is essential when giving financial advice. Understanding these terms' differences can help financial advisors better cater to their client's needs and offer more tailored guidance. UHNWIs are likely candidates for higher-risk investments. Due to the complexity or potential risks associated with such investments, the SEC will only grant access to private equity funds, hedge funds, and other vehicles to an accredited investor. To qualify as an accredited investor, you need to meet any one of the following: You have qualifications, distinctions, or professional certificates that attest to your investing expertise. You have a net worth of $1 million, excluding the value of your primary residence. You earned $200,000 during the last two years, wherein the ceiling rises to $300,000 when joined with a spouse. Suppose someone has gone beyond HNWI status and become a UHNWI. In that case, it makes no difference to the SEC - they will remain eligible to invest in risky or complex investments. UHNWIs and HNWIs have different investing strategies, family distribution planning, and estate planning needs. UHNWIs typically have sufficient wealth to fund multiple generations and manage investments on a global scale. They may also require more complex investments, such as alternative asset classes, private equity, real estate, and hedge funds. Conversely, HNWIs usually have less capital value, so their investment strategies are narrower in scope and less likely to generate fast returns. They might be more successful in concentrating their investments in a particular niche or sector. UHNWI usually has more assets, particularly in business investments, real estate holdings, and other illiquid assets, requiring more comprehensive distribution planning among familial heirs. In contrast, HNWI may face less complex issues, such as choosing between giving cash, investing in 529s for college savings, or finding the right balance between asset protection and flexibility for future generations. UHNWIs often have complex portfolios much more significant than their HNWI counterparts, including real estate holdings, international investments, and other assets. Because of this, UHNWIs benefit more from advanced strategies such as asset protection trusts, offshore entities, and similar measures designed to mitigate tax liability while preserving one’s wealth. Furthermore, UHNWIs may also need to consider generational wealth transfer solutions that focus on factors such as liquidity challenges and potential generational lifestyle changes. This includes considerations for non-financial legacies such as intellectual property or philanthropic missions. Such complex strategies are less likely necessary for their HNWI peers, given the typically more straightforward nature of their investments. Ultra-high-net-worth individuals are those with more than $30 million in net worth. According to a recent report by Wealth-X, the UHWNI population totaled 395,070 in 2022. The major countries with the most UHNWIs are the United States, China, Germany, Japan, Hong Kong, and the UK. Compared with HNWI, they require more comprehensive solutions than ever - from investing strategies and family wealth distribution planning to complex estate planning. Those professionals providing services to UHNWI must remain aware of the latest information and trends on wealthy individuals and align with best practice standards. Undoubtedly, the ultra-wealthy has become a key focus for many businesses worldwide - paving the way for an exciting new paradigm of wealth management services success.What Is an Ultra-High-Net-Worth Individual (UHNWI)?

Ultra-High-Net-Worth Individual (UHNWI) Statistics

Importance of Comparing UHNWI & HNWI

UHNWI vs HNWI

Investing Strategies

Families

Estate Planning

Final Thoughts

Ultra-High-Net-Worth Individual (UHNWI) FAQs

An Ultra-High-Net-Worth Individual (UHNWI) has a net worth of at least $30 million or more, excluding primary residence.

According to a Wealth-X report, there were an estimated 395,070 UHNWIs in the world in 2022.

The United States is home to 129,665 UHNWIs, accounting for 46.1% of the top 10 UHNWIs globally, followed by China with 47,190 and Germany with 19,590.

According to a Wealth-X report, the age group with the most wealth falls under the 50-70 age bracket. The average age of the UHNWI population is 64.8 and 63.6 for men and women, respectively.

An ultra-high-net-worth individual has at least a $30 million net worth, whereas a high-net-worth individual has a net worth of at least $1 million. Their approaches to investing, family wealth distribution, and estate planning vary.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.