Workplace financial education refers to the provision of financial knowledge, tools, and resources to employees by their employers. The goal of these initiatives is to help employees better understand and manage their personal finances, make informed financial decisions, and ultimately achieve financial well-being. Financial education in the workplace is essential for employees to navigate the increasingly complex financial landscape. It is also an important factor in promoting employee satisfaction, reducing financial stress, and increasing overall productivity. The primary objectives of workplace financial education are to enhance financial literacy, promote responsible financial behavior, and support employees in achieving their financial goals. Employees who participate in workplace financial education programs gain the knowledge and skills necessary to improve their overall financial well-being. This includes understanding how to budget, save, and invest their money wisely. Financially educated employees are more likely to feel satisfied in their jobs, as they are better equipped to manage their personal finances and focus on their professional growth. Employees with a strong financial foundation are less likely to be distracted by financial stress, allowing them to be more focused and productive at work. Workplace financial education programs can help employees alleviate financial stress by providing the tools and resources necessary to manage their finances effectively. Employees who feel supported in their personal financial growth are more likely to remain loyal to their employer, leading to increased employee retention rates. By offering financial education programs, companies demonstrate their commitment to employee well-being, which can enhance their reputation among potential employees and customers. Financial education in the workplace contributes to a more engaged workforce, as employees feel more confident in their ability to manage their finances and achieve financial security. Workplace financial education promotes a culture of financial responsibility and supports the overall well-being of employees, fostering a positive work environment. Employees must understand basic financial concepts, such as compound interest, inflation, and the time value of money, in order to make informed financial decisions. Workplace financial education should include guidance on creating budgets, setting financial goals, and establishing healthy saving habits. Employees need to be educated about the importance of long-term investing and retirement planning, including the various investment options available to them. Financial education programs should help employees understand the components of their compensation packages, including salary, bonuses, and other forms of remuneration. Employees should be educated on how to maximize the value of their employee benefits, such as health insurance, retirement plans, and stock options. Workplace financial education should include information on tax implications related to employee compensation and benefits, as well as strategies for tax-efficient financial planning. Financial education programs should cover the various types of debt, including credit card debt, student loans, and mortgages, and their respective interest rates and repayment terms. Employees should be provided with effective strategies for managing and paying off their debt, while also maintaining a healthy balance between saving and debt repayment. Workplace financial education should teach employees how to avoid accumulating excessive debt in the future and maintain a debt-free lifestyle. Employees need to be educated on the potential financial risks they may face, such as income loss, unexpected expenses, or emergencies, and how to prepare for these events. Workplace financial education should provide guidance on selecting the right insurance coverage, including life, health, disability, and property insurance, to protect against potential financial risks. Employees should be taught how to incorporate insurance into their overall financial plan to ensure comprehensive protection and financial stability. Employers should conduct surveys to assess employees' financial knowledge, identify their financial education needs, and tailor programs accordingly. Focus groups can provide valuable insights into the specific financial challenges employees face and help employers design targeted financial education initiatives. Offering one-on-one financial consultations can help identify individual employee needs and provide personalized financial guidance. Employers can offer in-person or virtual workshops and seminars to provide comprehensive financial education in a group setting. Online courses and webinars allow employees to access financial education at their own pace and on their own schedule. Personalized financial coaching sessions can offer employees individualized support and guidance to address their unique financial situations. Encouraging peer-to-peer learning can promote a culture of financial literacy and support within the workplace. Employers should establish success metrics, such as improvements in employee financial well-being, to evaluate the effectiveness of workplace financial education programs. Gathering feedback from program participants can help identify areas for improvement and ensure that workplace financial education initiatives remain relevant and impactful. Tracking employees' financial well-being over time can help employers understand the long-term impact of their financial education programs and make data-driven decisions about program adjustments. Employers should continuously assess and modify their workplace financial education programs to address changing employee needs and maintain program effectiveness. Successful workplace financial education programs require strong support and commitment from management to ensure employee participation and program effectiveness. Financial education initiatives should be tailored to the specific demographics and needs of the employee population, taking into account factors such as age, income, and financial goals. Employers should collaborate with financial experts and organizations to develop high-quality, relevant financial education content and resources. Maintaining confidentiality and trust is essential in workplace financial education programs, as employees must feel comfortable discussing their personal financial situations. Workplace financial education should promote a culture of continuous learning and skill development, empowering employees to take control of their financial futures. Workplace financial education programs offer long-term benefits for both employees and employers, promoting financial well-being, job satisfaction, and overall productivity. By providing employees with the tools and resources needed to manage their personal finances, employers contribute to the creation of a healthier, more supportive workplace environment. As the benefits of workplace financial education become increasingly apparent, it is essential for organizations of all sizes and industries to adopt and promote financial education initiatives for their employees.What Is Workplace Financial Education?

Importance of Financial Education in the Workplace

Objectives of Workplace Financial Education

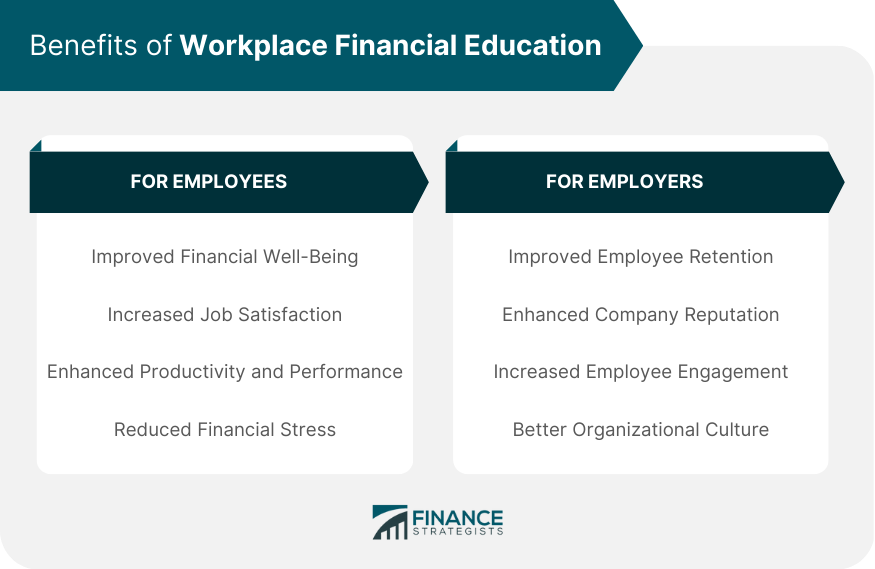

Benefits of Workplace Financial Education

For Employees

Improved Financial Well-Being

Increased Job Satisfaction

Enhanced Productivity and Performance

Reduced Financial Stress

For Employers

Improved Employee Retention

Enhanced Company Reputation

Increased Employee Engagement

Better Organizational Culture

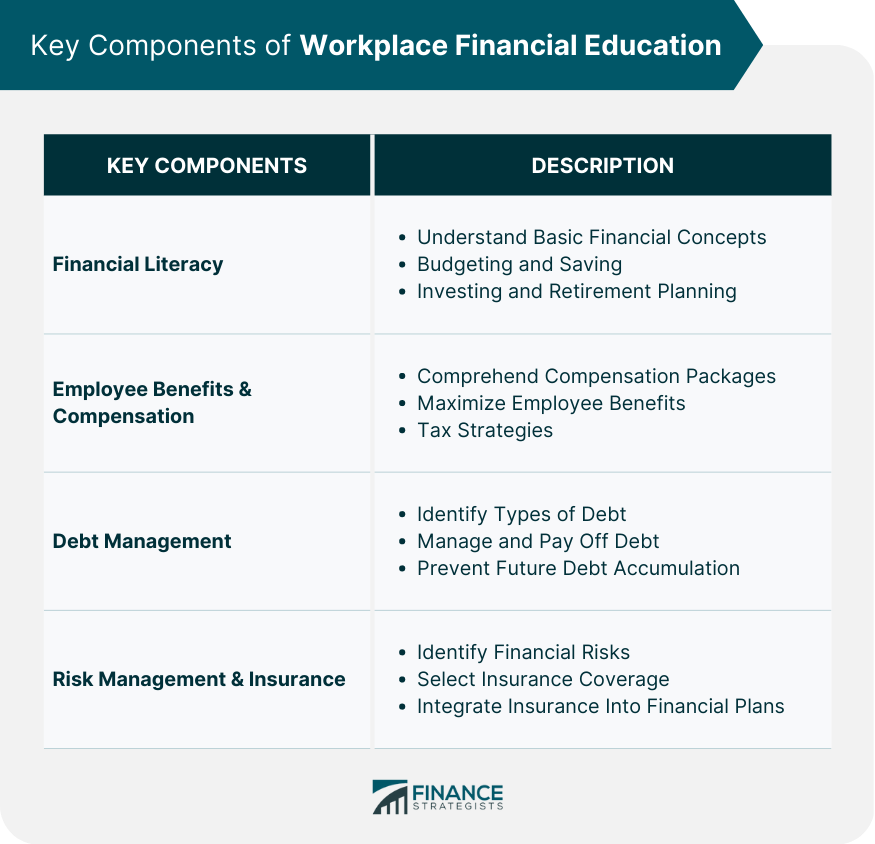

Key Components of Workplace Financial Education

Financial Literacy

Basic Financial Concepts

Budgeting and Saving

Investing and Retirement Planning

Employee Benefits and Compensation

Understanding Compensation Packages

Maximizing Employee Benefits

Tax Implications and Strategies

Debt Management

Understanding Different Types of Debt

Strategies for Paying Off Debt

Preventing Future Debt Accumulation

Risk Management and Insurance

Identifying Potential Financial Risks

Selecting Appropriate Insurance Coverage

Insurance as a Component of a Financial Plan

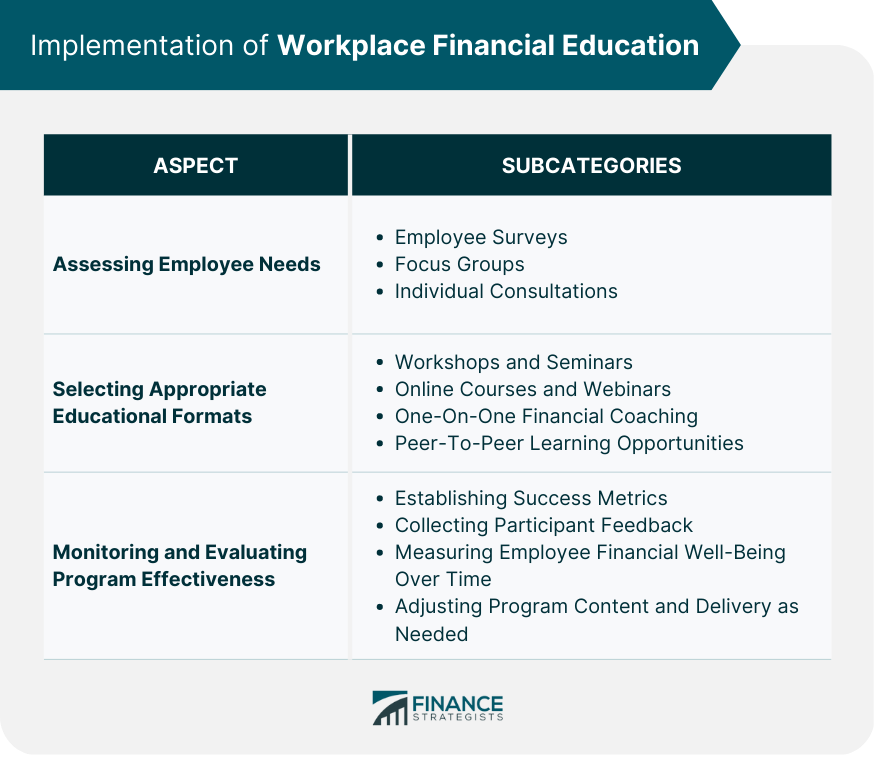

Implementation of Workplace Financial Education

Assessing Employee Needs

Employee Surveys

Focus Groups

Individual Consultations

Selecting Appropriate Educational Formats

Workshops and Seminars

Online Courses and Webinars

One-on-One Financial Coaching

Peer-to-Peer Learning Opportunities

Monitoring and Evaluating Program Effectiveness

Establishing Success Metrics

Collecting Participant Feedback

Measuring Employee Financial Well-Being Over Time

Adjusting Program Content and Delivery as Needed

Best Practices for Workplace Financial Education

Management Support and Commitment

Tailoring Programs to Employee Demographics and Needs

Collaborating With Financial Experts and Organizations

Ensuring Confidentiality and Trust

Encouraging Ongoing Learning and Skill Development

The Bottom Line

Workplace Financial Education FAQs

Workplace financial education programs aim to enhance employees' financial literacy, promote responsible financial behavior, and support employees in achieving their financial goals. By offering these programs, employers contribute to a healthier, more supportive work environment.

Workplace financial education benefits employees by improving their overall financial well-being, increasing job satisfaction, enhancing productivity and performance, and reducing financial stress. Employers benefit from improved employee retention, an enhanced company reputation, increased employee engagement, and a better organizational culture.

A successful workplace financial education program should cover financial literacy (including basic financial concepts, budgeting, saving, investing, and retirement planning), employee benefits and compensation, debt management, and risk management and insurance.

Employers can effectively implement workplace financial education programs by assessing employee needs through surveys, focus groups, and individual consultations; selecting appropriate educational formats such as workshops, seminars, online courses, webinars, and one-on-one financial coaching; and continuously monitoring and evaluating program effectiveness to ensure ongoing relevance and impact.

Best practices for successful workplace financial education initiatives include obtaining management support and commitment, tailoring programs to employee demographics and needs, collaborating with financial experts and organizations, ensuring confidentiality and trust, and encouraging ongoing learning and skill development.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.