Private Activity Bonds (PABs) are a unique financing mechanism that enables private entities to access tax-exempt debt for projects that serve a public purpose. These bonds play a crucial role in funding infrastructure projects across the United States. Private activity bonds have evolved over time as the needs for infrastructure financing have changed. Legislation and regulations have shaped the landscape for these bonds, with two key pieces of legislation playing a significant role. The Tax Reform Act of 1986 established private activity bonds as a separate category of tax-exempt bonds. It also imposed limits on the issuance of PABs and defined qualified projects eligible for this type of financing. The Tax Cuts and Jobs Act of 2017 retained the tax exemption for private activity bonds, despite initial proposals to eliminate it. This decision reinforced the importance of PABs in financing critical infrastructure projects. There are several types of private activity bonds, each catering to specific sectors and purposes. Exempt facility bonds are used to finance various types of projects, including: These bonds finance the construction and improvement of airport facilities. Exempt facility bonds can also fund mass commuting facilities like public transportation systems and rail networks. These bonds support the development of affordable housing projects for low- and moderate-income households. Exempt facility bonds can finance the construction and maintenance of water and sewer infrastructure. Qualified mortgage bonds provide financial assistance to first-time homebuyers, enabling them to secure low-interest mortgage loans. These bonds fund projects that aim to revitalize economically distressed areas through redevelopment efforts. These bonds cater to nonprofit organizations, allowing them to access tax-exempt financing for eligible projects. State and local governments typically issue private activity bonds, while private entities, such as businesses or nonprofit organizations, are the recipients. Projects eligible for private activity bond financing must serve a public purpose, such as infrastructure development, affordable housing, or pollution control. Projects seeking PAB financing must obtain approval from the appropriate governmental authority and follow a strict allocation process, which includes meeting certain requirements and complying with regulations. Interest earned on private activity bonds is generally exempt from federal income taxes. However, there are limitations and exceptions, such as the Alternative Minimum Tax (AMT). PABs offer lower interest rates than conventional financing, making them an attractive option for private entities looking to fund eligible projects. Private activity bonds can spur economic growth by providing funding for critical infrastructure projects that create jobs and enhance communities. PABs foster collaboration between the public and private sectors, leveraging the strengths of both to achieve shared goals. Many private activity bond-funded projects generate positive social and environmental outcomes, such as affordable housing, pollution control, and improved public transportation. Critics argue that PABs can be misused, with private entities benefiting from tax exemptions without providing adequate public benefits. Some argue that the benefits of private activity bonds are disproportionately concentrated among wealthier individuals or corporations, exacerbating existing inequalities. There is an ongoing debate about the appropriateness of providing tax exemptions for private activity bonds, with some arguing that the lost tax revenue could be better utilized elsewhere. Critics contends that private activity bonds can blur the line between public and private interests, potentially leading to conflicts or undermining public objectives. The use of private activity bonds for financing infrastructure projects continues to grow, reflecting their importance as a funding source in the face of constrained public budgets. Future legislation and regulatory changes could impact the role of private activity bonds in infrastructure financing, either by expanding their scope or imposing new restrictions. As new needs and opportunities emerge the scope of private activity bonds may evolve to include innovative financing solutions for emerging industries and sectors. The future of private activity bonds will be shaped by the balance between addressing concerns and criticisms while leveraging the benefits they provide in funding essential infrastructure projects. Private activity bonds play a significant role in financing critical infrastructure projects across the United States. Their unique structure enables private entities to access tax-exempt financing for projects that serve a public purpose. While there are valid concerns and criticisms, PABs offer numerous benefits, including stimulating economic growth, fostering public-private partnerships, and addressing social and environmental challenges. The future of private activity bonds will be influenced by ongoing debates, potential legislative changes, and emerging opportunities in infrastructure financing.What Is Private Activity Bonds?

History and Background of Private Activity Bond

Tax Reform Act of 1986

Tax Cuts and Jobs Act of 2017

Types of Private Activity Bonds

Exempt Facility Bonds

Airports

Mass Commuting Facilities

Residential Rental Properties

Water and Sewer Facilities

Qualified Mortgage Bonds

Qualified Redevelopment Bonds

Qualified 501(c)(3) Bonds

Eligibility and Issuance Process

Issuers and Recipients

Qualifying Projects and Activities

Approval and Allocation Process

Tax Exemption Status and Limitations

Benefits of Private Activity Bonds

Financial Advantages for Borrowers

Stimulating Economic Growth and Development

Public-Private Partnerships

Social and Environmental Benefits

Criticisms and Controversies

Potential for Misuse and Abuse

Inequitable Distribution of Benefits

Tax Exemption Concerns

Public vs. Private Interests

Future of Private Activity Bonds

Recent Trends and Developments

Potential Legislative and Regulatory Changes

Innovations and New Applications

Challenges and Opportunities

Conclusion

Private Activity Bonds (PABs) FAQs

Private Activity Bonds (PABs) are tax-exempt bonds issued by state or local governments to finance projects by private entities that serve a public purpose. They play a crucial role in funding infrastructure projects, promoting economic growth, and supporting public-private partnerships.

Unlike traditional municipal bonds, which are issued to fund public projects, Private Activity Bonds are issued to finance private projects that serve a public purpose. The interest earned on PABs is generally tax-exempt, providing a financial advantage for borrowers and attracting investors seeking tax-free income.

Private Activity Bonds can be used to finance a wide range of projects, including airports, mass commuting facilities, residential rental properties, water and sewer facilities, first-time homebuyer mortgage loans, redevelopment initiatives in economically distressed areas, and projects by nonprofit organizations.

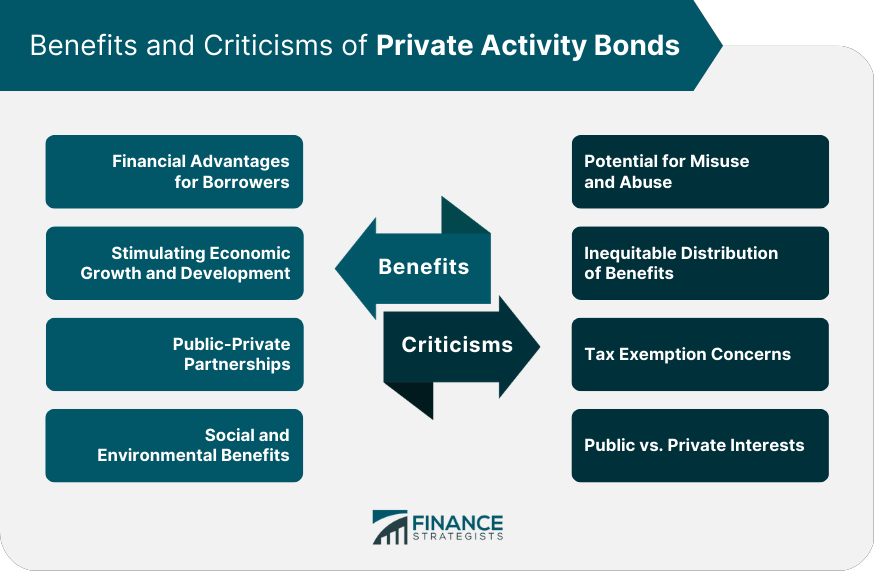

Benefits of using Private Activity Bonds include lower interest rates for borrowers, stimulating economic growth and development, fostering public-private partnerships, and generating social and environmental benefits. Criticisms include the potential for misuse and abuse, an inequitable distribution of benefits, concerns about tax exemptions, and conflicts between public and private interests.

The future of Private Activity Bonds will be shaped by recent trends, potential legislative and regulatory changes, innovations in financing, and the balance between addressing concerns and leveraging their benefits. PABs are likely to remain an important tool for funding essential infrastructure projects, with their role potentially expanding to include new sectors and industries.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.