The Government Pension Offset is a regulation in the United States that affects Social Security spousal and survivor benefits for individuals who receive a government pension based on work not covered by Social Security. The GPO reduces the amount of spousal or survivor benefits a person can receive if they also have a government pension from non-covered employment. The GPO aims to equalize the treatment of workers with pensions from non-covered government employment and those who receive Social Security benefits from private-sector employment. It prevents "double-dipping" by ensuring that public-sector employees do not receive full spousal or survivor benefits in addition to their government pensions. The GPO may significantly reduce or even eliminate Social Security benefits that a spouse or surviving spouse would otherwise be eligible for. This may have a considerable impact on the financial situation of those affected. The GPO was introduced in 1977 as a part of the Social Security Amendments of that year. The legislation aimed to address the perceived unfairness of public-sector employees receiving both government pensions and full Social Security spousal or survivor benefits. Since its inception, the GPO has undergone several changes in its rules and regulations. These changes have been made to address concerns about the GPO's impact on various groups, such as public-sector employees and their spouses. Notable amendments to the GPO include the introduction of a two-thirds rule, which determines the offset amount, and the addition of exceptions and exemptions for certain groups of public-sector employees. The GPO offset is calculated by reducing the Social Security spousal or survivor benefit by two-thirds of the government pension amount. This means two-thirds of their government pension reduces a person's Social Security benefit. The GPO can significantly reduce or even eliminate the Social Security benefits that spouses or surviving spouses are entitled to receive. This may lead to financial hardship for some individuals, particularly those who rely on these benefits as their primary source of income. Suppose a person receives a $900 monthly government pension from non-covered employment. The GPO offset would be $600 (two-thirds of $900). If they were entitled to a $700 Social Security spousal benefit, their actual spousal benefit would be reduced to $100 ($700 - $600). The GPO amount depends on the size of the government pension and the Social Security spousal or survivor benefit. Other factors, such as exceptions and exemptions, may also influence the GPO. Several exceptions and exemptions to the GPO can affect its application. These include the Last-Day Rule, government pensions from non-covered jobs, and mandatory Social Security coverage for federal, state, or local government workers. The Last-Day Rule, which was abolished in 2004, exempted public-sector employees from the GPO if they switched from a non-covered job to a covered job for the last day of their employment. This exception is no longer applicable. Individuals who receive a government pension from a non-covered job and are also eligible for Social Security benefits based on their own covered employment may be exempt from the GPO. Federal, state, or local government workers with mandatory Social Security coverage may be exempt from the GPO. This applies to those who have consistently paid Social Security taxes throughout their employment. Public sector employees who receive pensions from non-covered employment may experience reduced Social Security spousal or survivor benefits due to the GPO. The GPO may also affect spouses and survivors of public sector employees, as their Social Security benefits may be reduced or eliminated due to their spouse's government pension. The GPO may disproportionately affect women, as they are more likely to outlive their spouses and rely on survivor benefits. Moreover, women are more likely to work in public sector jobs that provide government pensions. Individuals affected by the GPO can take steps to minimize its impact on their financial situation, such as understanding the implications of the GPO on their personal finances, planning for retirement with the GPO in mind, and seeking professional advice and resources. Critics argue that the GPO is an unfair policy that disproportionately affects certain groups, such as women and public sector employees. They contend that the GPO may cause financial hardship for individuals who rely on Social Security benefits as their primary source of income. The GPO has been criticized for unfairly penalizing public-sector employees who have paid Social Security taxes on their private-sector employment. Critics argue that these individuals should be entitled to their full Social Security benefits without being subjected to the GPO. There have been proposals to reform or replace the GPO with alternative policies that are more equitable and fair. These proposals aim to address the concerns surrounding the GPO's impact on public sector employees, spouses, and survivors. The GPO is governed by the Social Security Act and its subsequent amendments. These laws establish the framework for the GPO's application and enforcement. Several bills have been proposed in Congress to amend or repeal the GPO. While none of these bills have been passed into law, they reflect ongoing efforts to address the concerns and criticisms surrounding the GPO. Ongoing legal debates and controversies surround the GPO, particularly regarding its fairness and impact on public sector employees, spouses, and survivors. Individuals affected by the GPO must understand its implications on their personal finances. This includes being aware of how the GPO may affect their Social Security benefits and taking steps to minimize its impact on their financial situation. Planning for retirement with the GPO in mind can help individuals make informed decisions about their financial future. This may involve adjusting their retirement savings strategy or exploring alternative sources of income. Individuals affected by the GPO can benefit from seeking professional advice and resources, such as financial planners or retirement specialists. These professionals can provide guidance on navigating the GPO and creating a comprehensive retirement plan. Various tools and calculators are available online to help individuals estimate the potential impact of the GPO on their Social Security benefits. These tools can better understand how the GPO may affect their financial situation and help make informed decisions. The Government Pension Offset is a regulation that affects Social Security spousal and survivor benefits for individuals who receive a government pension from non-covered employment. The GPO aims to equalize the treatment of workers with pensions from non-covered government employment and those who receive Social Security benefits from private-sector employment. However, it has faced criticism for its impact on public sector employees, spouses, and survivors and for its perceived unfairness. The debate over the fairness and effectiveness of the GPO continues, with proposed amendments and bills seeking to reform or replace it. The concerns surrounding the GPO's impact on various groups, especially women and public sector employees, remain at the forefront of these discussions. Individuals affected by the GPO should be informed about its implications on their personal finances and take steps to minimize its impact on their financial situation. This includes understanding the GPO's effect on Social Security benefits, planning for retirement with the GPO in mind, and seeking professional advice and resources. By being proactive and informed, individuals can better navigate the challenges posed by the GPO and make sound financial decisions for their future.What Is the Government Pension Offset (GPO)?

History of the Government Pension Offset

Inception of GPO

Evolution of GPO Rules and Regulations

Key Amendments to the GPO Over Time

GPO Calculation

The Two-Thirds Rule

GPO's Effect on Social Security Spousal and Survivor Benefits

Examples of GPO Calculations

Factors Influencing the GPO

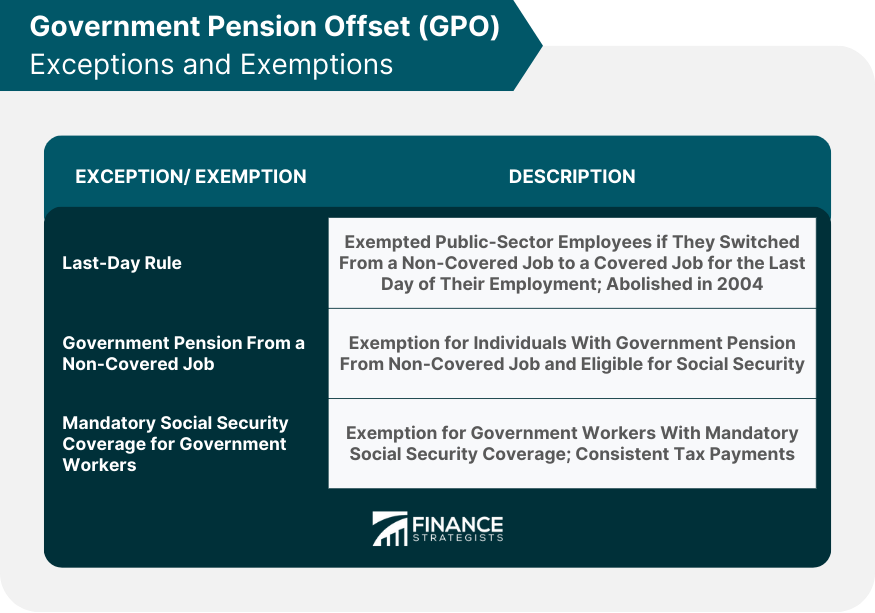

GPO Exceptions and Exemptions

Last-Day Rule

Government Pension From a Non-Covered Job

Mandatory Social Security Coverage

Impact of GPO on Various Groups

Public Sector Employees

Spouses and Survivors of Public Sector Employees

Gender Disparities in the Impact of GPO

Strategies to Minimize the Effects of GPO

Criticisms of the Government Pension Offset

Arguments Against GPO

Fairness Concerns in the Application of GPO

Proposed Reforms and Alternatives to GPO

GPO Legislation and Legal Developments

Existing GPO-Related Laws

Proposed Amendments and Bills

Current Legal Debates and Controversies

Navigating the Government Pension Offset

Understanding GPO Implications on Personal Finance

Planning for Retirement With GPO in Mind

Seeking Professional Advice and Resources

Tools and Calculators for GPO Estimation

Conclusion

Government Pension Offset (GPO) FAQs

The Government Pension Offset (GPO) is a provision that affects spousal or survivor benefits under the Social Security system when the recipient also receives a government pension based on work not covered by Social Security.

The Government Pension Offset (GPO) applies to individuals who receive a government pension based on work not covered by Social Security, such as employment in federal, state, or local government agencies.

The Government Pension Offset (GPO) reduces spousal or survivor benefits under Social Security by an amount equal to two-thirds of the individual's government pension. The reduction applies if the person is eligible for both a government pension and Social Security benefits.

No, there are no exemptions or exceptions to the Government Pension Offset (GPO). It applies to all individuals who receive a government pension based on work not covered by Social Security.

Yes, in some cases, the Government Pension Offset (GPO) can result in the complete elimination of spousal or survivor benefits under Social Security. If the individual's government pension exceeds two-thirds of the Social Security benefit amount, the offset will reduce the benefits to zero.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.