Retirement can be an exciting time filled with new opportunities, but it can also bring about unique challenges and stressors. These stressors can include financial concerns, social isolation, and a loss of identity or purpose. Understanding these common stressors and how to address them can help retirees make a smoother transition into retirement and maintain a fulfilling and satisfying lifestyle. For many individuals, their careers play a significant role in defining their sense of self. The transition to retirement can lead to feelings of loss and uncertainty as they adjust to their new status. Working life often provides a sense of purpose and direction. Upon retirement, individuals may struggle to find new ways to derive meaning and fulfillment from their daily lives. Retirement often involves a reduction in social interactions, which can lead to feelings of isolation and loneliness, particularly for those who have primarily relied on their work environment for social connections. The slower pace of retirement may initially be appealing, but some individuals may struggle with boredom and finding ways to fill their time meaningfully. Some retirees may have unrealistic expectations about their retirement, which can result in disappointment and dissatisfaction when these goals are not met. A gap between the idealized vision of retirement and the actual experience can contribute to feelings of stress and unhappiness. Inadequate financial planning can leave individuals unprepared for the expenses they will face during retirement, leading to financial stress and potential hardships. Rising inflation and the cost of living can further strain the financial resources of retirees, making it challenging to maintain their desired lifestyle. Unexpected healthcare expenses can put significant pressure on retirees' finances, especially if they lack adequate insurance coverage. Financial obligations towards adult children or aging parents can create additional stress for retirees who may already be struggling to manage their own expenses. Market fluctuations can directly impact retirees' investment portfolios, causing uncertainty and concern about their financial security. Retirees may feel overwhelmed by the need to make critical investment decisions, particularly if they have limited financial knowledge or experience. The prevalence of chronic illnesses often increases with age, creating additional physical and emotional stress for retirees. Retirees may face mobility and functional limitations that can impact their ability to engage in activities they once enjoyed, leading to frustration and decreased quality of life. Retirement can be a trigger for depression and anxiety, particularly for individuals who are struggling with the transition or facing other stressors. Cognitive decline is a common concern among older adults, and retirees may experience stress related to the fear of losing their mental abilities. A lack of adequate insurance coverage can create anxiety for retirees who may worry about their ability to afford necessary medical care. Retirees may face challenges accessing specialized care in their communities, particularly in rural or underserved areas. Retirement can require couples to navigate new dynamics in their relationship, such as finding a balance between individual and shared interests. Open communication is essential during the retirement transition, as couples must discuss their needs and expectations to maintain a healthy and fulfilling partnership. Retirees may need to make a conscious effort to maintain connections with former colleagues to prevent feelings of isolation and loss. Building new social networks can help retirees to feel connected and engaged in their communities, reducing feelings of loneliness and boredom. Engaging in thorough financial planning before and during retirement can help to alleviate financial stressors and provide a sense of security. Setting personal and professional goals for retirement can give individuals a sense of purpose and direction, helping them to find meaning in their post-work lives. Retirees can stay engaged and stave off boredom by pursuing hobbies and interests that bring them joy and fulfillment. Participating in volunteer activities and community events can provide retirees with a sense of purpose, social connections, and opportunities for personal growth. Maintaining a healthy lifestyle through regular exercise and a balanced diet can help to mitigate health-related stressors and improve overall well-being. Seeking mental health support and resources, such as therapy or support groups, can help retirees manage emotional stressors and maintain a healthy mental state. Fostering open communication with partners and family members can help to address relationship stressors and ensure that everyone's needs and expectations are met. Actively seeking out new social connections and joining groups can help retirees build a supportive network that can ease feelings of loneliness and isolation. Navigating the challenges of retirement requires a proactive approach to address the various stressors that can arise during this phase of life. Emotional stressors, such as loss of identity and fear of boredom, can be mitigated by setting personal goals, pursuing hobbies, and engaging in community activities. Financial stressors can be managed through thorough planning, professional advice, and realistic expectations. Health-related stressors can be tackled by maintaining a healthy lifestyle, seeking mental health support, and ensuring access to healthcare. Lastly, relationship stressors can be alleviated by fostering open communication, finding a balance between individual and shared interests, and expanding social networks. By taking these steps, retirees can successfully navigate the challenges of retirement and enjoy a fulfilling and meaningful post-work life.What Are Retirement Stressors?

Emotional Stressors

Loss of Identity and Purpose

Fear of Boredom and Loneliness

Managing Expectations

Financial Stressors

Insufficient Retirement Savings

Unforeseen Expenses

Investment and Market Risks

Health-Related Stressors

Physical Health Challenges

Mental Health Concerns

Access to Healthcare

Relationship Stressors

Adjusting to a New Lifestyle With a Partner

Maintaining Social Connections

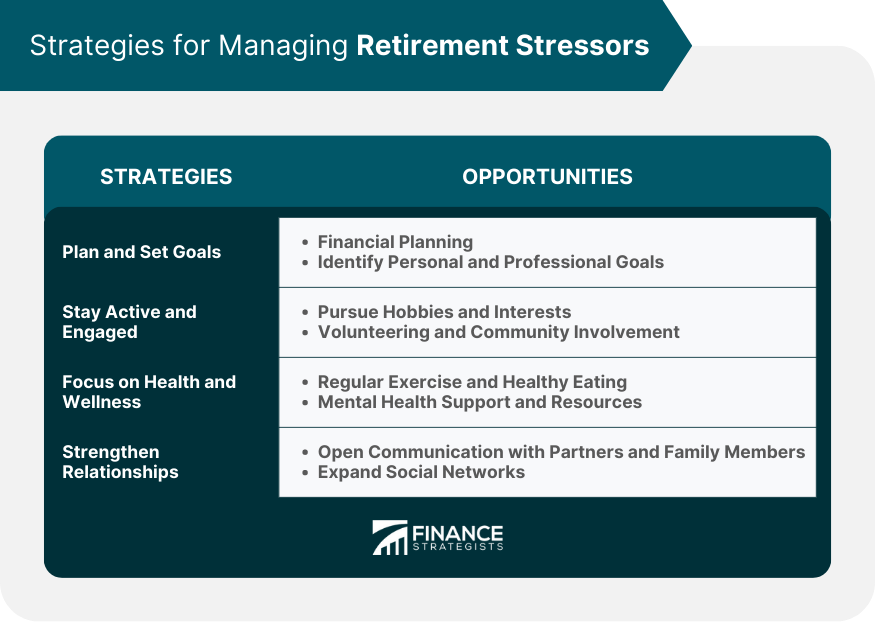

Strategies for Managing Retirement Stressors

Planning and Goal-Setting

Financial Planning

Identifying Personal and Professional Goals

Staying Active and Engaged

Pursuing Hobbies and Interests

Volunteering and Community Involvement

Focusing on Health and Wellness

Regular Exercise and Healthy Eating

Mental Health Support and Resources

Strengthening Relationships

Open Communication with Partners and Family Members

Expanding Social Networks

Conclusion

Retirement Stressors FAQs

Common retirement stressors include emotional challenges like loss of identity and purpose, financial concerns such as insufficient savings and unforeseen expenses, health-related issues like physical health challenges and mental health concerns, and relationship stressors that arise from adjusting to a new lifestyle and maintaining social connections.

Retirees can cope with emotional retirement stressors by setting personal and professional goals, pursuing hobbies and interests, engaging in volunteer activities, and actively seeking new social connections to build a supportive network.

Strategies for managing financial retirement stressors include thorough financial planning, adjusting lifestyle expectations to match financial resources, seeking professional financial advice, and staying informed about investment and market risks.

Retirees can address health-related retirement stressors by focusing on regular exercise, maintaining a healthy diet, seeking mental health support and resources, and ensuring adequate access to healthcare and insurance coverage.

To mitigate relationship retirement stressors, retirees should foster open communication with their partners and family members, find a balance between individual and shared interests, and actively expand their social networks by joining groups and participating in community events.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.