Annual Notices are essential communication tools between retirement plan sponsors, administrators, and participants. They provide critical information regarding the performance, investment options, fees, and rights and responsibilities of participants. Ensuring compliance with legal requirements and regulatory bodies governing Annual Notices is crucial for maintaining the tax-advantaged status of a retirement plan and avoiding potential fines and penalties. The Summary Annual Report is a condensed version of the retirement plan's Form 5500, which provides a financial overview of the plan's operations. It includes information on the plan's assets, liabilities, income, and expenses. This notice informs participants about the plan's default investment option when they do not actively choose an investment. The QDIA Notice describes the investment's objectives, risk, and return characteristics, and fees. For plans that feature automatic enrollment, this notice explains the default contribution rate, the right to opt-out or change contribution amounts, and the plan's investment options. A Safe Harbor Notice is required for retirement plans that choose to satisfy certain nondiscrimination testing requirements through employer contributions. The notice informs participants about the plan's contribution structure, vesting provisions, and withdrawal restrictions. The Fee Disclosure Notice provides detailed information on the fees and expenses associated with the retirement plan, including investment management fees, administrative fees, and any other charges that participants may incur. This notice gives participants information about the specific investment options available within the plan, including performance data, risk levels, fees, and any applicable restrictions. An Annual Notice should include a summary of the retirement plan's performance, including investment returns, assets, and liabilities. The notice must outline the rights and responsibilities of participants, such as the ability to direct investments, request loans, or make withdrawals, as well as any applicable restrictions or limitations. The Annual Notice should detail the available investment options, including performance data, risk levels, and fees associated with each option. It is essential to include relevant deadlines and important dates for participants, such as enrollment periods, contribution change deadlines, and distribution dates. The notice should provide contact information for plan administrators and fiduciaries, enabling participants to ask questions or request additional information. There are two primary methods for distributing Annual Notices: electronic delivery and mailed paper copies. Plan sponsors and administrators must ensure that the chosen method complies with applicable regulations and reaches all plan participants. Annual Notices must be distributed to participants within specific time frames, depending on the type of notice. Plan sponsors and administrators must be vigilant in adhering to these deadlines to maintain compliance. Proper recordkeeping and documentation are crucial for demonstrating compliance with Annual Notice requirements. Plan sponsors and administrators should maintain records of notice distribution, participant receipt, and any updates or revisions. Failure to comply with Annual Notice requirements may result in fines and penalties imposed by regulatory authorities. Non-compliance with Annual Notice requirements may jeopardize a retirement plan's tax-advantaged status, potentially leading to additional taxes and penalties. Inadequate communication or failure to provide Annual Notices may expose plan sponsors and administrators to participant lawsuits and liability, potentially resulting in significant financial and reputational damage. Plan sponsors and administrators should regularly review and update the content of Annual Notices to ensure accuracy, completeness, and compliance with current regulations. Staying informed of changes to retirement plan regulations and guidance is essential for maintaining compliance. Plan sponsors and administrators should monitor updates from regulatory bodies, such as the Internal Revenue Service (IRS) and the Department of Labor (DOL). Regularly conducting internal compliance reviews and audits can help identify potential issues and ensure ongoing adherence to Annual Notice requirements. Working with professional advisors and consultants knowledgeable in retirement plan compliance can provide valuable insights and guidance to help navigate complex regulatory requirements. Educating participants about the importance of Annual Notices and their retirement plans can foster engagement, promote informed decision-making, and reduce the likelihood of misunderstandings or disputes. Annual Notices play a pivotal role in promoting transparency and effective communication between retirement plan sponsors, administrators, and participants. With a variety of notices, such as the Summary Annual Report, Qualified Default Investment Alternative Notice, Automatic Enrollment Notice, Safe Harbor Notice, Fee Disclosure Notice, and Participant-Level Investment and Fee Disclosure Notice. These essential documents ensure that participants are well-informed about their plan's performance, investment options, fees, and their rights and responsibilities. By distributing notices using compliant methods and adhering to established deadlines, plan sponsors and administrators can maintain retirement plan compliance and protect the plan's tax-advantaged status. Implementing best practices, such as engaging with professional advisors, conducting regular compliance reviews, and educating participants, further supports the plan's integrity and helps participants achieve their retirement goals.Annual Notice Overview

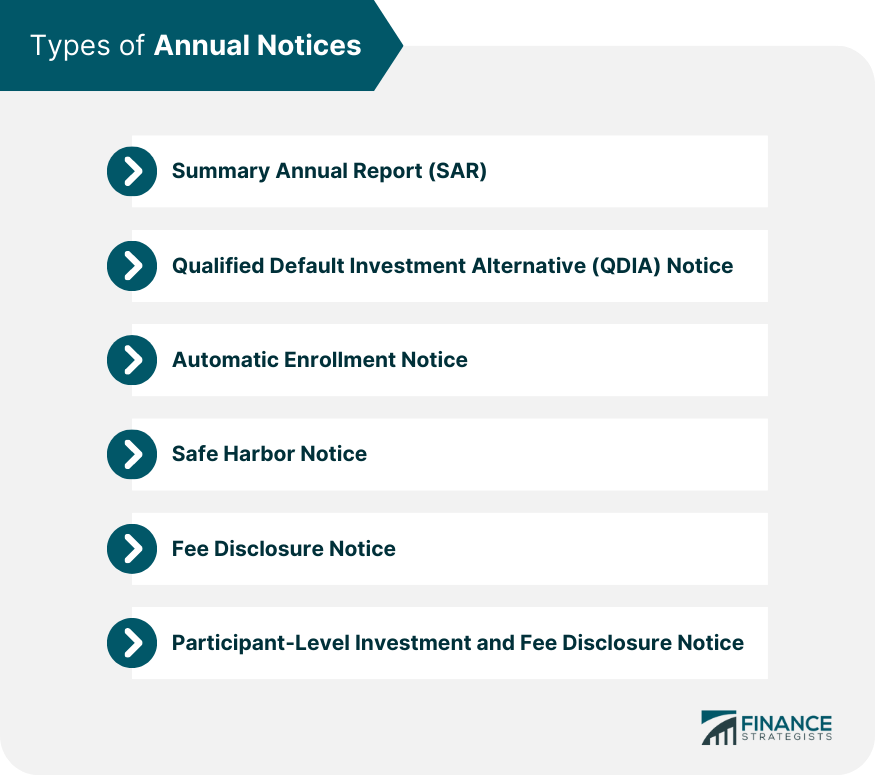

Types of Annual Notices

Summary Annual Report (SAR)

Qualified Default Investment Alternative (QDIA) Notice

Automatic Enrollment Notice

Safe Harbor Notice

Fee Disclosure Notice

Participant-Level Investment and Fee Disclosure Notice

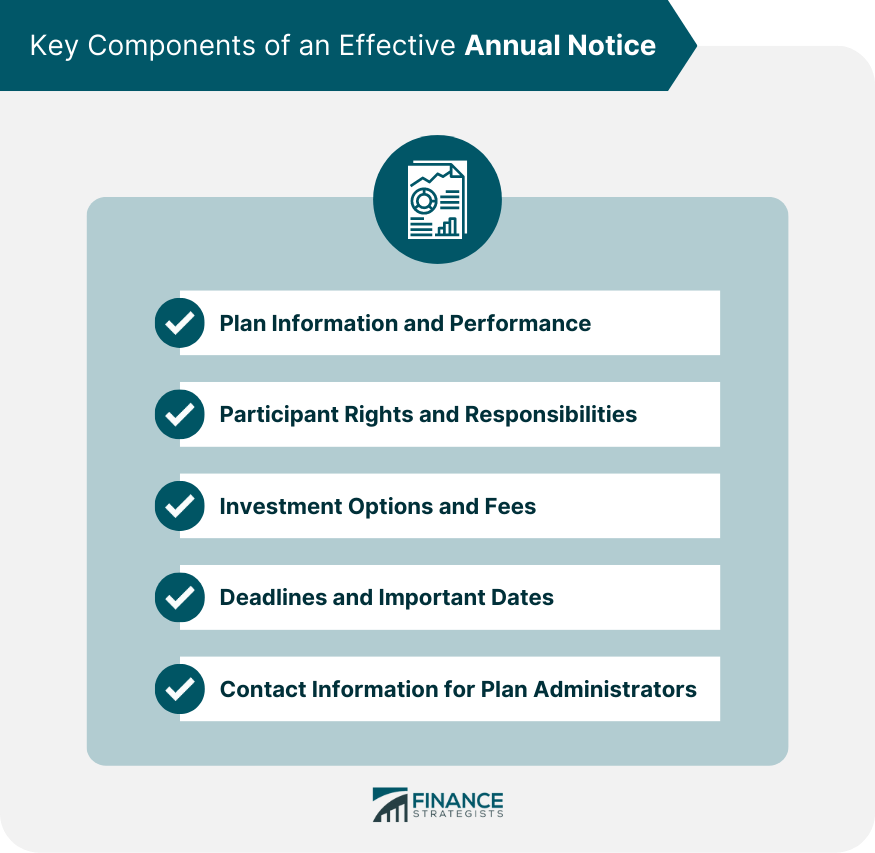

Key Components of an Effective Annual Notice

Plan Information and Performance

Participant Rights and Responsibilities

Investment Options and Fees

Deadlines and Important Dates

Contact Information for Plan Administrators and Fiduciaries

Distribution of Annual Notices

Methods of Distribution

Timing and Frequency of Distribution

Recordkeeping and Documentation

Consequences of Non-Compliance with Annual Notice Requirements

Fines and Penalties

Loss of Plan Qualification Status

Participant Lawsuits and Liability

Best Practices for Retirement Plan Sponsors and Administrators

Ensuring Accuracy and Completeness of Information

Monitoring Regulatory Updates and Changes

Conducting Periodic Compliance Reviews and Audits

Engaging with Professional Advisors and Consultants

Educating Participants about Their Retirement Plan and Annual Notices

Final Thoughts

Annual Notice FAQs

An Annual Notice serves as a communication tool between retirement plan sponsors, administrators, and participants. It provides essential information about the plan's performance, investment options, fees, and participant rights and responsibilities, ensuring compliance with legal requirements and regulatory bodies.

There are six common types of Annual Notices: Summary Annual Report (SAR), Qualified Default Investment Alternative (QDIA) Notice, Automatic Enrollment Notice, Safe Harbor Notice, Fee Disclosure Notice, and Participant-Level Investment and Fee Disclosure Notice. Each notice serves a specific purpose and contains different information relevant to plan participants.

There are two primary methods for distributing Annual Notices: electronic delivery and mailed paper copies. Plan sponsors and administrators must ensure the chosen method complies with applicable regulations and effectively reaches all plan participants.

Non-compliance with Annual Notice requirements can result in fines and penalties, loss of a plan's tax-advantaged status, and potential participant lawsuits and liability. Compliance is crucial for maintaining the plan's financial and legal standing.

To ensure compliance, plan sponsors and administrators should regularly review and update Annual Notices, monitor regulatory updates and changes, conduct periodic compliance reviews and audits, engage with professional advisors and consultants, and educate participants about their retirement plans and Annual Notices.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.