Philanthropy in retirement refers to the act of giving one's time, skills, resources, or financial support to charitable causes during retirement. This may involve volunteering, donating money, or using one's unique skills and talents to contribute to the greater good. The retirement phase of life offers individuals more free time and flexibility, which can be channeled towards making a difference in their communities and beyond. Philanthropy in retirement is an excellent opportunity for retirees to maintain a sense of purpose, engage with their communities, and stay active. By supporting causes that align with their values and interests, retirees can find fulfillment and continue making a positive impact on society after they have left the workforce. Philanthropy in retirement is important for various reasons. It allows retirees to maintain a sense of purpose and engagement with the world around them. By contributing to causes they care about, retirees can maintain their well-being and feel connected to their communities. Furthermore, philanthropy in retirement can create a lasting legacy and inspire others to follow suit. In addition to personal benefits, philanthropy in retirement has a broader societal impact. Retirees can contribute to filling gaps in social services, strengthening the nonprofit sector, and helping address pressing issues such as poverty, education, health, and environmental conservation. As the aging population grows, the potential for retirees to make a substantial impact through philanthropy is increasing. Engaging in philanthropy during retirement can provide retirees with a sense of emotional satisfaction. It allows them to experience a sense of accomplishment and pride in their contributions to society. Moreover, it helps retirees feel valued and appreciated by the community for their efforts. The act of giving can also evoke feelings of happiness and gratitude, as retirees recognize the positive impact they are making on the lives of others. This emotional satisfaction can contribute to an overall increased sense of well-being and personal fulfillment during retirement. Participating in philanthropic activities during retirement can help retirees maintain and develop new social connections. Through volunteering or working with nonprofit organizations, retirees can interact with diverse groups of people, including other volunteers, staff members, and beneficiaries. These interactions can lead to the formation of new friendships and support networks. Additionally, social interaction through philanthropic activities can help retirees combat loneliness and isolation, which are common issues faced by older adults. By staying engaged with their communities and connecting with others, retirees can enhance their quality of life and overall well-being. Philanthropy in retirement can contribute to retirees' overall well-being by promoting physical, mental, and emotional health. Participating in volunteer activities, for example, can help retirees stay physically active and maintain their cognitive abilities. Moreover, the emotional satisfaction derived from giving can contribute to improved mental health. Furthermore, philanthropy can provide retirees with a sense of purpose and meaning in their lives, which can contribute to increased life satisfaction and happiness. As a result, retirees who engage in philanthropic activities may experience enhanced well-being compared to those who do not. Retirees who engage in philanthropy can help improve their communities by addressing pressing social, environmental, or cultural issues. Their efforts can contribute to the development of community resources, such as schools, libraries, parks, and health care facilities. Additionally, their involvement can help build social cohesion and foster a sense of community pride. By participating in philanthropy, retirees can help create a positive environment for future generations to thrive in. Their contributions can lead to lasting improvements in the quality of life for community members and inspire others to take action. Philanthropy in retirement can have a significant positive social impact by addressing various societal challenges. Retirees can use their skills, experience, and resources to support causes such as poverty alleviation, education, health care, environmental conservation, and cultural preservation. Their contributions can lead to meaningful change and create a better world for all. Moreover, retirees who engage in philanthropy can inspire others to do the same, multiplying the impact of their efforts. By setting an example, they can encourage younger generations to prioritize giving back and make a lasting difference in society. The involvement of retirees in philanthropy can help strengthen the nonprofit sector by providing valuable resources and expertise. As many nonprofits face funding challenges and resource constraints, retirees can play a crucial role in supporting their missions and ensuring their sustainability. With their unique skills and experiences, retirees can contribute to the growth and development of nonprofit organizations by serving as volunteers, board members, or consultants. Their support can help nonprofits expand their reach, enhance their impact, and improve their overall effectiveness in addressing societal challenges. While many retirees may be eager to engage in philanthropy, financial constraints can pose a significant challenge. Some retirees may have limited income or savings, making it difficult for them to donate money or cover the costs associated with volunteering, such as transportation and supplies. To overcome this challenge, retirees can explore alternative forms of philanthropy that do not require significant financial resources, such as skills-based volunteering or advocating for their chosen causes. Additionally, they can seek out opportunities that provide financial support for volunteers, such as stipends or expense reimbursements. Although retirement generally offers individuals more free time, some retirees may still struggle to find the time to engage in philanthropy. This can be due to various reasons, such as caregiving responsibilities, personal health issues, or other commitments. To address this challenge, retirees can explore flexible volunteer opportunities that fit their schedules and preferences. This can include short-term projects, virtual volunteering, or opportunities that allow them to determine their level of commitment and time investment. Finding suitable philanthropic opportunities that align with a retiree's interests, skills, and values can be challenging. It may take time and effort to research and identify organizations and initiatives that are a good fit. To overcome this challenge, retirees can leverage resources such as volunteer match websites, local nonprofit directories, and community centers. Networking with friends, family, and other retirees can also help uncover opportunities that might not be widely advertised. Age-related barriers, such as physical limitations, health issues, or age discrimination, can hinder retirees' ability to engage in philanthropy. These barriers may make it difficult for retirees to find suitable opportunities or fully participate in certain activities. To address these challenges, retirees can seek out age-friendly volunteer opportunities that accommodate their unique needs and abilities. Additionally, they can advocate for inclusive practices within nonprofit organizations and work to break down age-related stereotypes. Community service is a common form of philanthropy that involves volunteering one's time and efforts to support local initiatives and organizations. Retirees can participate in community service activities such as neighborhood cleanups, mentoring programs, food drives, or tutoring. By engaging in community service, retirees can make a direct impact on their local communities and help address pressing issues. This form of philanthropy can be both personally fulfilling and beneficial for the community as a whole. Retirees can become involved with nonprofit organizations in various capacities, such as serving as board members, consultants, or regular volunteers. This involvement allows retirees to leverage their unique skills, experiences, and connections to support the organization's mission and contribute to its success and growth. Involvement with nonprofit organizations can provide retirees with a sense of purpose and allow them to make a meaningful difference in the lives of others. Furthermore, it can offer opportunities for personal growth, networking, and collaboration with other like-minded individuals. Skills-based volunteering is a form of philanthropy that involves retirees using their specific skills, knowledge, and expertise to support charitable causes. This can include offering professional services, such as accounting, marketing, or project management, to nonprofit organizations that may otherwise struggle to access these resources. By engaging in skills-based volunteering, retirees can make a significant impact on the organizations they support, helping them to achieve their goals and enhance their effectiveness. Additionally, skills-based volunteering can be a fulfilling way for retirees to continue using their professional skills in a meaningful way. Charitable giving involves donating money to support nonprofit organizations, initiatives, or causes that align with a retiree's values and interests. This can include making one-time donations, setting up recurring gifts, or contributing to specific fundraising campaigns. Charitable giving allows retirees to make a financial impact on the causes they care about, helping to provide crucial resources and support for those in need. It can also be an important component of a retiree's overall philanthropic strategy, complementing other forms of engagement such as volunteering or advocacy. Donating to nonprofit organizations is another method of philanthropy that involves providing financial support, resources, or in-kind contributions to charitable organizations. This can include donating items such as clothing, food, or supplies, as well as providing services or facilities. By donating to nonprofit organizations, retirees can help address resource gaps and support the overall sustainability of the organizations they care about. This form of philanthropy can be particularly impactful for smaller or under-resourced organizations that rely on community support to carry out their work. Establishing a charitable foundation is a more formalized approach to philanthropy that involves creating a separate legal entity to manage and distribute funds to support charitable causes. This can be an appealing option for retirees who have significant financial resources and wish to create a lasting legacy of giving. A charitable foundation can provide a structured and strategic approach to philanthropy, allowing retirees to focus their efforts on specific issues or causes that align with their values and passions. This method of philanthropy can also offer tax benefits, depending on the jurisdiction and structure of the foundation. Planned giving is a method of philanthropy that involves incorporating charitable donations into a retiree's overall financial and estate planning strategy. This can include making provisions for charitable gifts in a will, establishing a charitable trust, or designating a nonprofit organization as the beneficiary of a life insurance policy or retirement account. Planned giving allows retirees to make a lasting impact on the causes they care about, even after their lifetime. This form of philanthropy can also offer tax benefits and help retirees manage their overall estate planning strategy. To engage in effective philanthropy during retirement, it is important for retirees to establish clear goals for their giving. This can involve identifying the issues or causes they are most passionate about, determining the level of impact they wish to achieve, and setting specific objectives for their philanthropic efforts. Having well-defined goals can help retirees focus their efforts, measure their progress, and adapt their strategies as needed. This can ultimately lead to more meaningful and impactful philanthropy. Before committing to support a specific nonprofit organization or cause, retirees should conduct thorough research to ensure their efforts will be well-directed and effective. This can involve evaluating the organization's mission, track record, financial health, and overall effectiveness in addressing the issue of interest. By researching nonprofit organizations, retirees can gain a better understanding of the organization's work and how their support can make a difference. This can help retirees make informed decisions about where to direct their resources and efforts, ultimately leading to more impactful philanthropy. Collaborating with others, such as family members, friends, or fellow retirees, can enhance the effectiveness of philanthropy during retirement. Working together can pool resources, skills, and knowledge, leading to more significant and sustained impact on the causes and organizations being supported. Collaboration can also provide opportunities for networking, learning, and personal growth, as retirees engage with others who share their passions and interests. Furthermore, collaborating with others can amplify the overall impact of philanthropy, inspiring more individuals to participate in giving back to their communities. To ensure a smooth transition into philanthropic activities during retirement, it is important for retirees to incorporate their philanthropic goals into their overall retirement planning strategy. This can involve setting aside funds for charitable giving, creating a schedule for volunteer activities, or identifying opportunities for skills-based volunteering that align with their interests and expertise. By integrating philanthropy into retirement planning, retirees can ensure they have the necessary resources and time to support their chosen causes. This proactive approach can help retirees transition seamlessly into their new philanthropic roles, maximizing their impact and personal fulfillment. Philanthropy in retirement plays a crucial role in maintaining a sense of purpose, well-being, and connection to the community for retirees. It offers various benefits, including emotional satisfaction, increased social interaction, and enhanced well-being, while also strengthening the nonprofit sector and creating positive social impact. Despite potential challenges such as financial constraints, lack of time, and age-related barriers, there are numerous methods for engaging in philanthropy during retirement. By establishing goals, researching nonprofit organizations, collaborating with others, and incorporating philanthropy into retirement planning, retirees can maximize their effectiveness and impact. Retirees are encouraged to explore the various methods of philanthropy available to them and to find opportunities that align with their passions, skills, and values. By engaging in philanthropy, retirees can continue to make a meaningful difference in the world, contribute to the greater good, and create a lasting legacy. As more individuals choose to participate in philanthropy during their retirement, the cumulative impact on society can be substantial. What Is Philanthropy in Retirement?

Importance of Philanthropy in Retirement

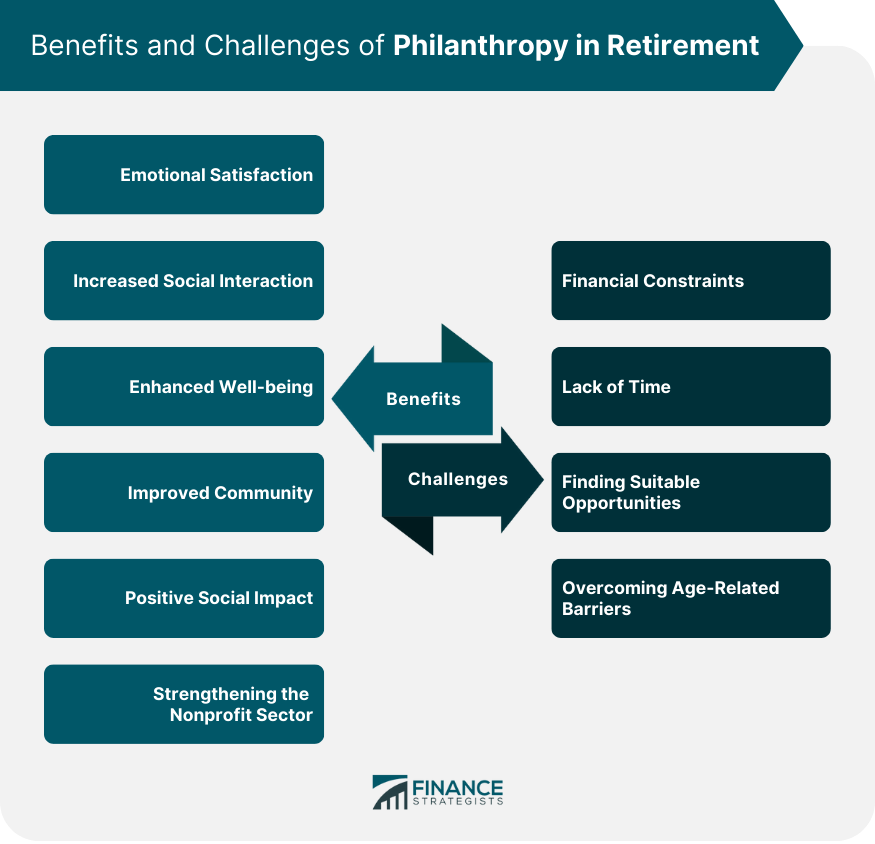

Benefits of Philanthropy in Retirement

Emotional Satisfaction

Increased Social Interaction

Enhanced Well-being

Improved Community

Positive Social Impact

Strengthening the Nonprofit Sector

Challenges of Philanthropy in Retirement

Financial Constraints

Lack of Time

Finding Suitable Opportunities

Overcoming Age-Related Barriers

Methods of Philanthropy in Retirement

Community Service

Nonprofit Organization Involvement

Skills-Based Volunteering

Charitable Giving

Donating to Nonprofit Organizations

Establishing a Charitable Foundation

Planned Giving

Strategies for Effective Philanthropy in Retirement

Establishing Goals

Researching Nonprofit Organizations

Collaborating With Others

Incorporating Philanthropy Into Retirement Planning

Bottom Line

Philanthropy in Retirement FAQs

Philanthropy in retirement refers to the act of giving time, money, or resources to charitable causes during one's retirement years.

Philanthropy in retirement can bring emotional satisfaction, increased social interaction, and enhanced well-being. It also has a positive social and community impact.

The challenges of philanthropy in retirement may include financial constraints, lack of time, finding suitable opportunities, and overcoming age-related barriers.

Retirees can engage in philanthropy through volunteering, charitable giving, and planned giving. They can also establish a charitable foundation or donate to nonprofit organizations.

Retirees can engage in effective philanthropy by establishing goals, researching nonprofit organizations, collaborating with others, and incorporating philanthropy into their retirement planning.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.