Expat retirees are individuals who have chosen to spend their retirement years living abroad. This lifestyle allows them to explore new cultures and experiences while enjoying their golden years. People opt for expat retirement for various reasons, such as a lower cost of living, better quality of life, and unique cultural experiences. Additionally, retirees may be attracted to more favorable weather conditions and potential tax advantages. Before deciding on expat retirement, it is crucial to consider factors such as financial stability, healthcare availability, visa requirements, language barriers, and social support networks. These factors can significantly impact the overall success and enjoyment of an expat retirement experience. Costa Rica: Costa Rica is known for its beautiful landscapes, friendly locals, and affordable living. This country is a popular choice for expat retirees seeking a peaceful and relaxed lifestyle. Panama: Panama offers a modern infrastructure, excellent healthcare, and a favorable tax environment, making it an attractive destination for expat retirees. Its thriving expat community also provides ample social support. Mexico: Mexico boasts a rich cultural history, diverse landscapes, and a lower cost of living. The country's proximity to the United States makes it a convenient option for retirees who want to maintain close connections with friends and family back home. Ecuador: Ecuador is famous for its stunning natural beauty, pleasant climate, and affordable living expenses. The country's diverse environment, from coastal towns to Andean highlands, offers various lifestyle options for expat retirees. Portugal: Portugal is an increasingly popular destination for expat retirees, thanks to its warm climate, affordable living, and rich cultural heritage. The country also offers an attractive residency program for retirees and other foreign investors. Spain: Spain's sunny climate, beautiful beaches, and affordable living make it a popular choice for expat retirees. The country's well-established expat communities provide excellent support for newcomers adjusting to life in Spain. France: France's world-class cuisine, picturesque countryside, and rich cultural history attract many expat retirees. While the cost of living can be higher in urban areas, more affordable options are available in rural regions. Italy: Italy's stunning architecture, vibrant culture, and delicious food make it an alluring destination for expat retirees. The country offers a mix of urban and rural living, catering to various preferences and budgets. Thailand: Thailand is a popular expat retirement destination due to its tropical climate, beautiful landscapes, and affordable cost of living. The country's well-developed infrastructure and welcoming culture make it an attractive option for retirees. Malaysia: Malaysia offers a high standard of living, diverse culture, and excellent healthcare facilities. The country's Malaysia My Second Home (MM2H) program makes it easy for expat retirees to obtain long-term residency. Vietnam: Vietnam is known for its vibrant culture, stunning natural beauty, and low cost of living. The country's rapidly improving infrastructure and healthcare system make it an increasingly popular choice for expat retirees. Philippines: Philippines boasts beautiful beaches, a warm climate, and a low cost of living. Its strong ties to the United States and widespread English proficiency make it a convenient option for American retirees. Before deciding on a retirement destination, it is essential to thoroughly research the country's culture, cost of living, healthcare system, and other factors. This research will help retirees make an informed decision and set realistic expectations for their expat experience. Proper financial planning and budgeting are crucial for a successful expat retirement. Retirees should consider factors such as currency exchange rates, local taxes, and potential fluctuations in their retirement income sources. Access to quality healthcare is an important consideration for expat retirees. Retirees should research the healthcare system in their chosen destination and consider purchasing an international health insurance policy to cover any gaps in coverage. Understanding the visa and residency requirements of a chosen retirement destination is crucial for a smooth transition. Retirees should consult with local authorities or immigration experts to ensure they have the appropriate documentation and meet all requirements. Adapting to a new language and culture can be challenging for expat retirees. Taking language classes and participating in local events can help retirees acclimate to their new surroundings and foster a sense of belonging in their adopted community. Joining expat communities and clubs can help retirees build a support network and make friends with like-minded individuals. These organizations often provide valuable resources and information to help newcomers settle into their new surroundings. Participating in local activities and events can help expat retirees become more integrated into their new community. These experiences can lead to new friendships, a deeper understanding of the local culture, and a greater sense of belonging. Volunteering can provide expat retirees with a sense of purpose and an opportunity to contribute positively to their new community. This engagement can also help retirees forge meaningful connections with locals and fellow expats. Building relationships with locals can enhance the expat retirement experience by providing insight into the local culture and customs. These connections can also lead to lasting friendships and valuable support networks. One significant benefit of expat retirement is the potential for a lower cost of living. Many popular expat destinations offer affordable housing, food, and other necessities, allowing retirees to stretch their retirement savings further. Expat retirees often enjoy an improved quality of life due to better weather conditions, a slower pace of life, and access to various amenities and activities. This can lead to increased overall happiness and well-being during retirement. Living in a new country offers retirees the opportunity to immerse themselves in a different culture, leading to personal growth and a broader perspective on life. This exposure can enrich their retirement years and create lasting memories. Many expat retirees choose to live in countries with more favorable weather and climate conditions, such as warmer temperatures and less extreme seasonal changes. This can positively impact both their physical health and overall well-being. Depending on the retiree's country of origin and their chosen destination, expat retirement may offer tax advantages. It is essential to consult with a tax professional to understand the specific implications and potential benefits. One challenge expat retirees may face is the distance from family and friends in their home country. This separation can lead to feelings of isolation and homesickness, which can be difficult to manage. Adapting to new cultural norms and customs can be challenging for expat retirees. It may take time and effort to adjust to different social etiquette, traditions, and ways of life. Language barriers can be a significant obstacle for expat retirees, making it difficult to communicate and establish connections with locals. Learning the local language can alleviate these issues and enhance the overall retirement experience. Access to quality healthcare can be a concern for expat retirees, particularly in countries with less-developed healthcare systems. It is essential to research healthcare options in the chosen destination and consider obtaining international health insurance coverage. Political stability and safety concerns can impact the quality of life for expat retirees. It is crucial to stay informed about local conditions and consider these factors when choosing a retirement destination. Adopting a flexible and open-minded attitude can help expat retirees adapt to new environments and overcome challenges. This approach can also foster personal growth and enrich the overall retirement experience. Embracing the local culture and customs can lead to a more immersive and fulfilling expat retirement experience. This engagement can also help retirees develop a deeper appreciation and understanding of their new home. Scheduling regular visits to one's home country can help expat retirees maintain connections with family and friends. These visits can provide a sense of comfort and continuity while allowing retirees to share their experiences and adventures abroad. Staying informed about local laws and regulations is essential for a successful expat retirement. This knowledge can help retirees avoid potential legal issues and ensure they remain compliant with local requirements. Consulting with professionals, such as financial advisors, tax consultants, and immigration specialists, can help expat retirees navigate the complexities of living abroad. This expert guidance can contribute to a smoother and more enjoyable retirement experience. Expat retirees refer to people who have opted to reside in a foreign country during their retirement years. This way of life provides them with the opportunity to discover different cultures and engage in novel experiences as they relish their later years in life. Expat retirement offers many benefits, including a lower cost of living, improved quality of life, and unique cultural experiences. However, it also presents challenges, such as adjusting to new cultural norms and maintaining connections with loved ones. Thorough planning and research are crucial for a successful expat retirement experience. By investigating potential destinations, financial considerations, healthcare options, and visa requirements, retirees can make informed decisions and set realistic expectations. Expat retirement offers retirees the opportunity to explore new cultures, meet new people, and create lasting memories. By embracing this unique lifestyle, retirees can enjoy an exciting and fulfilling retirement experience that enriches their golden years. To ensure a smooth transition into expat retirement, it is highly recommended that retirees seek professional advice and support. Retirement planning services can provide valuable guidance and resources to help retirees navigate the complexities of living abroad and make the most of their retirement years.What Are Expat Retirees?

Popular Expat Retirement Destinations

Central and South America

Europe

Asia

How to Prepare for Expat Retirement

Research Potential Destinations

Conduct Financial Planning and Budgeting

Consider Access to Quality Healthcare

Understand Visa and Residency Requirements

Familiarize Language and Culture

Building a Social Network as an Expat Retiree

Joining Expat Communities and Clubs

Engaging in Local Activities and Events

Volunteering and Giving Back to the Community

Establishing Relationships with Locals

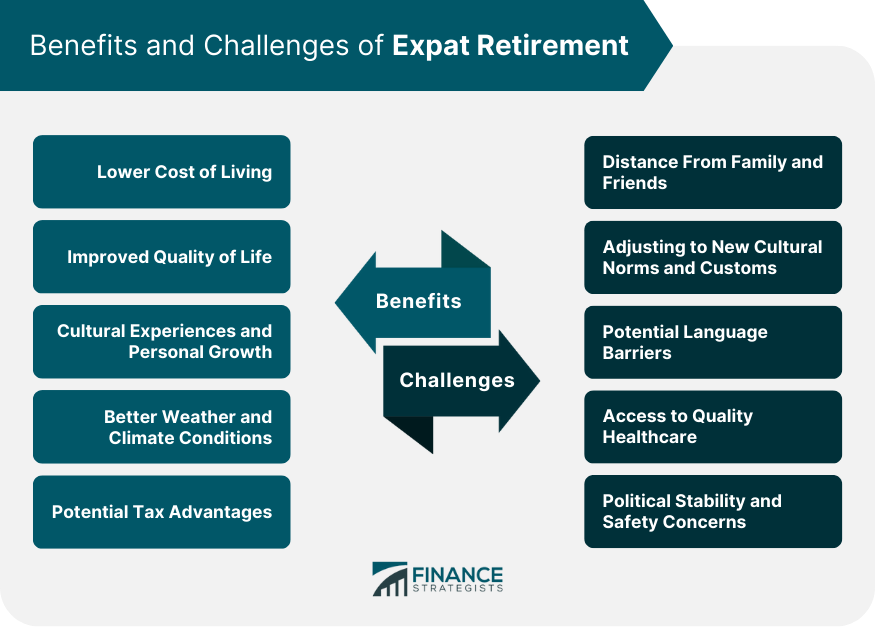

Benefits of Expat Retirement

Lower Cost of Living

Improved Quality of Life

Cultural Experiences and Personal Growth

Better Weather and Climate Conditions

Potential Tax Advantages

Challenges and Potential Drawbacks of Expat Retirement

Distance from Family and Friends

Adjusting to New Cultural Norms and Customs

Potential Language Barriers

Access to Quality Healthcare

Political Stability and Safety Concerns

Tips for a Successful Expat Retirement

Maintain a Flexible and Open-Minded Attitude

Embrace the Local Culture and Customs

Plan Regular Visits to Your Home Country

Stay Informed About Local Laws and Regulations

Seek Professional Advice When Needed

Final Thoughts

Expat Retirees FAQs

Expat retirees often choose to live abroad for a lower cost of living, improved quality of life, unique cultural experiences, better weather and climate conditions, and potential tax advantages.

Expat retirees can build a social network by joining expat communities and clubs, engaging in local activities and events, volunteering and giving back to the community, and establishing relationships with locals.

Popular expat retirement destinations include Central and South America (Costa Rica, Panama, Mexico, Ecuador), Europe (Portugal, Spain, France, Italy), and Asia (Thailand, Malaysia, Vietnam, the Philippines).

Expat retirees may face challenges such as distance from family and friends, adjusting to new cultural norms and customs, potential language barriers, access to quality healthcare, and political stability and safety concerns.

To enjoy a successful expat retirement, retirees should maintain a flexible and open-minded attitude, embrace the local culture and customs, plan regular visits to their home country, stay informed about local laws and regulations, and seek professional advice when needed.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.