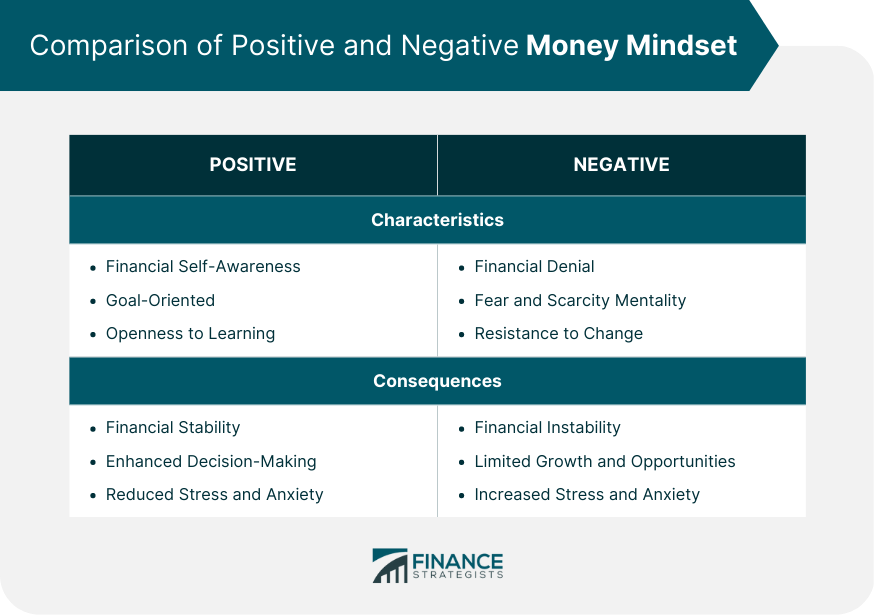

A money mindset refers to an individual's attitudes, beliefs, and values surrounding money and personal finance. This mindset affects how people make financial decisions and how they perceive their financial situation. Financial beliefs are crucial as they influence an individual's financial habits, choices, and overall well-being. Developing a healthy money mindset can lead to better financial management and increased financial stability. Cultural background plays a significant role in shaping an individual's money mindset. Different cultures have varying attitudes toward money, savings, debt, and financial success, which can influence a person's financial beliefs and behaviors. Family upbringing is another critical factor that impacts an individual's money mindset. Financial habits and attitudes are often passed down from parents to children, shaping their beliefs and approach to money management. Personal experiences, such as financial successes or setbacks, can also shape an individual's money mindset. These experiences can either reinforce existing beliefs or prompt a reevaluation of one's financial attitudes and behaviors. Socioeconomic status can influence an individual's money mindset by shaping their access to financial resources, education, and opportunities. People from different socioeconomic backgrounds may have distinct financial beliefs and behaviors based on their experiences. Media and societal influences can shape an individual's money mindset by promoting certain financial norms, expectations, and behaviors. Exposure to advertising, social media, and peer pressure can impact a person's financial beliefs and choices. Financial self-awareness is a key characteristic of a positive money mindset. It involves understanding one's financial strengths and weaknesses, as well as being aware of one's financial habits, needs, and goals. A goal-oriented approach is another characteristic of a positive money mindset. This means setting financial goals and working consistently towards achieving them, resulting in a sense of purpose and direction in financial matters. Individuals with a positive money mindset are open to learning about personal finance and are proactive in seeking knowledge and resources to improve their financial management skills. A positive money mindset can lead to greater financial stability by promoting healthy financial habits, such as budgeting, saving, and investing, which help build a strong financial foundation. Improved financial decision-making is another benefit of a positive money mindset. Individuals with a healthy financial perspective are more likely to make informed choices, considering both short-term and long-term consequences. Developing a positive money mindset can also reduce financial stress and anxiety. By cultivating a healthy relationship with money, individuals can feel more in control of their finances and experience greater peace of mind. Financial denial is a common characteristic of a negative money mindset. It involves ignoring or avoiding financial realities, such as mounting debt or insufficient savings, which can exacerbate financial problems. A fear and scarcity mentality is another trait of a negative money mindset. This mindset is characterized by viewing money as a limited resource, leading to feelings of insecurity and a focus on short-term survival instead of long-term financial well-being. Resistance to change is also indicative of a negative money mindset. Individuals with this mindset may be reluctant to adapt their financial habits or explore new strategies, potentially limiting their financial growth. A negative money mindset can result in financial instability, as it often promotes unhealthy financial habits such as overspending, failing to save, or accumulating high-interest debt. A negative money mindset can hinder personal and financial growth, as it may prevent individuals from pursuing new opportunities or making necessary changes to improve their financial situation. Financial stress and anxiety can be exacerbated by a negative money mindset, as individuals may feel overwhelmed by their financial challenges and struggle to find solutions. To develop a healthy money mindset, it is essential to first assess one's current financial beliefs and attitudes, as this can help identify areas for improvement and growth. Once the current money mindset is assessed, identifying limiting beliefs and barriers is crucial for growth. By recognizing and challenging these beliefs, individuals can begin to shift their mindset towards a healthier perspective on money. Setting clear financial goals and priorities is an important step in developing a healthy money mindset. This process encourages individuals to focus on their financial objectives and align their habits with their long-term vision. Adopting a growth mindset in personal finance involves recognizing that financial skills and knowledge can be developed over time, and that setbacks and challenges can serve as valuable learning opportunities. Working with a financial advisor or seeking support from knowledgeable friends and family members can be helpful in developing a healthy money mindset, as it provides access to valuable expertise and advice. Financial literacy plays a crucial role in shaping an individual's money mindset, as it equips them with the knowledge and skills necessary to make informed financial decisions and develop healthy financial habits. Budgeting and saving are essential components of financial literacy. Understanding how to create and maintain a budget, as well as effectively save money, helps individuals achieve financial stability and reach their financial goals. Investing is another key aspect of financial literacy. Knowledge about various investment options, risks, and strategies empowers individuals to grow their wealth and achieve long-term financial success. Debt management is a critical element of financial literacy. Understanding how to responsibly use credit, manage debt, and develop a plan to pay off outstanding balances contributes to a healthy financial foundation. Retirement planning is an important part of financial literacy. By learning about retirement savings options, social security, and pension plans, individuals can plan for a financially secure future. Improving financial literacy can involve self-education through books, articles, and online resources, as well as attending workshops, seminars, or enrolling in financial education courses. It may also include seeking guidance from financial professionals. Money mindset and financial beliefs have a significant impact on an individual's financial well-being. The factors that influence one's money mindset, such as cultural background, family upbringing, personal experiences, socioeconomic status, and media and societal influences, can shape one's financial habits and beliefs. Developing a positive money mindset characterized by financial self-awareness, goal-orientedness, and openness to learning can lead to financial stability, enhanced decision-making, and reduced stress and anxiety. Conversely, a negative money mindset characterized by financial denial, fear and scarcity mentality, and resistance to change can result in financial instability, limited growth and opportunities, and increased stress and anxiety. Strategies for developing a healthy money mindset include assessing current beliefs and mindset, identifying limiting beliefs and barriers, establishing financial goals and priorities, embracing a growth mindset, and seeking professional guidance and support. Improving financial literacy is also essential in developing a healthy money mindset, and it involves budgeting and saving, investing, debt management, and retirement planning.What Are Money Mindset and Financial Beliefs?

Factors Influencing Money Mindset and Financial Beliefs

Cultural Background

Family Upbringing

Personal Experiences

Socioeconomic Status

Media and Societal Influences

Positive Money Mindset and Financial Beliefs

Characteristics

Financial Self-Awareness

Goal-Oriented

Openness to Learning

Benefits

Financial Stability

Enhanced Decision-Making

Reduced Stress and Anxiety

Negative Money Mindset and Financial Beliefs

Characteristics

Financial Denial

Fear and Scarcity Mentality

Resistance to Change

Consequences

Financial Instability

Limited Growth and Opportunities

Increased Stress and Anxiety

Strategies for Developing a Healthy Money Mindset

Assessing Current Beliefs and Mindset

Identifying Limiting Beliefs and Barriers

Establishing Financial Goals and Priorities

Embracing a Growth Mindset

Seeking Professional Guidance and Support

Importance of Financial Literacy

Role in Shaping Money Mindset

Elements of Financial Literacy

Budgeting and Saving

Investing

Debt Management

Retirement Planning

Strategies for Improving Financial Literacy

Final Thoughts

Money Mindset and Financial Beliefs FAQs

Money mindset refers to an individual's attitudes, beliefs, and values surrounding money, while financial beliefs are specific ideas about money management. Both are intertwined and play a crucial role in shaping a person's financial habits, choices, and overall well-being.

Cultural background and family upbringing are significant factors that shape an individual's money mindset and financial beliefs. Different cultures and families have distinct attitudes towards money, savings, and debt, which can be passed down from one generation to the next, influencing financial behaviors.

A positive money mindset and financial beliefs are characterized by financial self-awareness, goal-oriented behavior, and openness to learning. These traits contribute to better financial management and increased financial stability.

Strategies for developing a healthier money mindset and financial beliefs include assessing current beliefs and mindset, identifying limiting beliefs and barriers, establishing financial goals and priorities, embracing a growth mindset, and seeking professional guidance and support.

Financial literacy equips individuals with the knowledge and skills necessary to make informed financial decisions and develop healthy financial habits. By improving financial literacy, individuals can develop a better understanding of their financial situation and cultivate a healthier money mindset and financial beliefs.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.