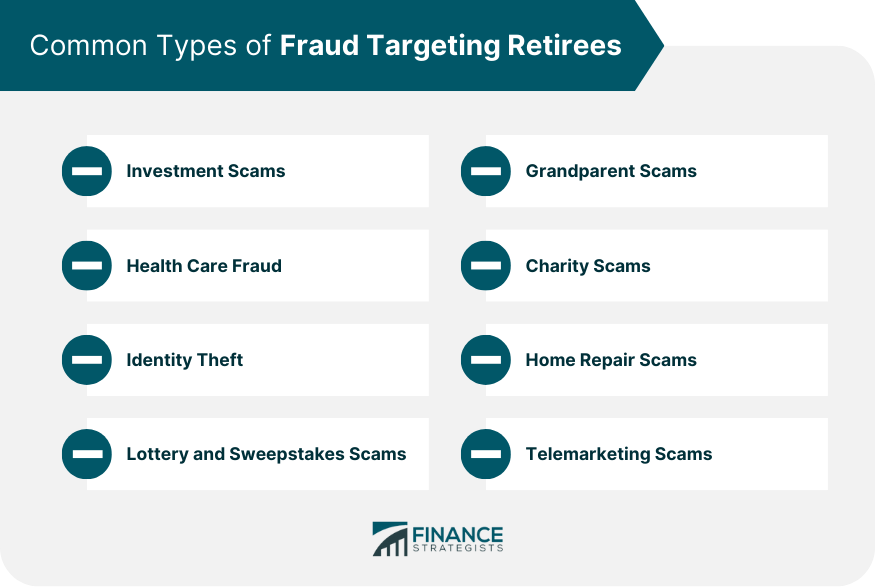

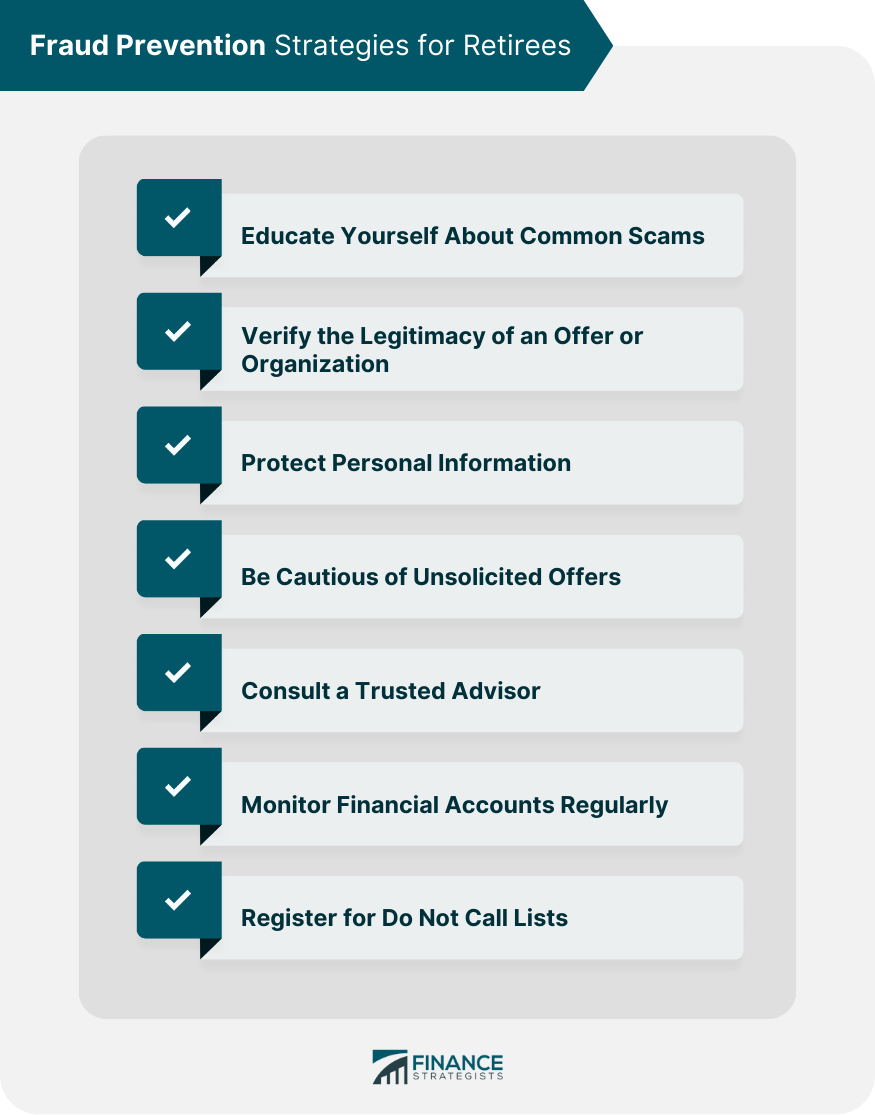

Fraud prevention for retirees refers to the various strategies and precautions taken to safeguard retired individuals from falling prey to scams, identity theft, and other fraudulent activities. Fraud is a deliberate deception or misrepresentation made for personal gain, often resulting in financial losses for victims. Unfortunately, fraudsters frequently target retirees due to their perceived vulnerability and accumulated savings. Ponzi schemes involve a fraudulent investment operation where returns are paid to existing investors using funds contributed by new investors. These schemes eventually collapse when there are not enough new investors to pay returns to earlier investors. In pump-and-dump schemes, fraudsters buy a large amount of low-priced stock and then spread false or misleading information to inflate the stock's price. Once the price has risen, they sell their shares for a profit, causing the stock price to plummet and leaving investors with significant losses. These scams involve fraudulent billing for medical services or equipment or offers of free medical equipment or services in exchange for personal information. Scammers often target Medicare beneficiaries and use their personal information to submit fraudulent claims. Fraudsters may sell counterfeit or expired prescription drugs at discounted prices, posing a serious risk to the health and well-being of retirees who rely on these medications. Phishing scams use fraudulent emails, texts, or phone calls to trick retirees into providing sensitive information, such as Social Security numbers, bank account information, or login credentials. This type of identity theft occurs when a scammer uses a retiree's personal information to file a fraudulent tax return and claim a refund. These scams involve notifying retirees that they have won a lottery or sweepstakes but must first pay taxes or fees before receiving their prize. Scammers posing as grandchildren in distress call or email retirees, requesting money to help with an emergency, such as legal trouble or medical bills. Fraudsters solicit donations for fake charities or use high-profile disasters to take advantage of retirees' generosity. Scammers offer unsolicited home repair services, often demanding payment upfront and then failing to complete the work or providing substandard services. Fraudsters use high-pressure tactics to sell overpriced or nonexistent products and services over the phone, targeting retirees who may be more likely to trust unknown callers. Be wary of aggressive sales tactics, such as limited-time offers or threats of missed opportunities. If an investment sounds too good to be true, it probably is. Exercise caution when receiving unsolicited offers, as they may be fraudulent. Legitimate organizations will not ask for sensitive information over the phone or email. Always verify the credentials of anyone offering investment or financial services. Avoid making cash payments or wire transfers, as these methods are difficult to trace. Awareness of common scams can help retirees recognize and avoid potential fraud. Research the organization or individual offering a product or service before making a decision. Use strong, unique passwords for online accounts and enable two-factor authentication when available. Shred documents containing personal information before discarding them. Treat unsolicited offers with skepticism and verify their legitimacy before engaging. Discuss financial decisions with a trusted family member, friend, or professional advisor. Regularly review credit card and bank statements to detect any unauthorized transactions. Sign up for the National Do Not Call Registry to reduce the number of telemarketing calls received. Reporting fraud not only helps protect oneself but also aids in preventing the scammer from victimizing others. Retirees can file a complaint with the Federal Trade Commission (FTC) through their online complaint assistant. The FTC works to prevent fraudulent activities and provides resources to help consumers protect themselves from scams. Retirees who suspect investment fraud can report it to Financial Industry Regulatory Authority (FINRA), a non-profit organization authorized by the US government to regulate investment firms and professionals. Retirees can contact their state attorney general's office to report any fraudulent activity they have experienced. Many state attorney general's offices have consumer protection divisions dedicated to investigating and prosecuting fraud. Retirees can also report any fraud-related incidents to their local police department. While they may not have the jurisdiction to investigate complex fraud cases, they can take steps to ensure that the incident is reported to the appropriate authorities. Notify your financial institutions, place a fraud alert on your credit reports, and monitor your accounts for further suspicious activity. Seek support from friends, family, or professional counselors to cope with the emotional impact of fraud. Sign up for credit monitoring services to keep an eye on your credit reports and detect any fraudulent activity. Place a fraud alert on your credit reports to prevent unauthorized accounts from being opened in your name. Consider enrolling in identity theft protection services to help prevent future instances of identity theft and assist in recovery efforts. Work diligently to restore your credit and reputation by disputing fraudulent items on your credit reports, paying bills on time, and maintaining low credit card balances. Fraud prevention for retirees involves various strategies and precautions taken to safeguard retired individuals from falling prey to scams, identity theft, and other fraudulent activities. Fraudsters frequently target retirees due to their perceived vulnerability and accumulated savings. Common types of fraud targeting retirees include investment scams, health care fraud, identity theft, lottery and sweepstakes scams, grandparent scams, charity scams, home repair scams, and telemarketing scams. Retirees should be aware of warning signs of fraud, such as high-pressure sales tactics, promises of high returns with little or no risk, unsolicited offers, requests for personal information, unlicensed or unregistered sellers, and payment in cash or wire transfers. Retirees can protect themselves from fraud by educating themselves about common scams, verifying the legitimacy of an offer or organization, protecting personal information, being cautious of unsolicited offers, consulting a trusted advisor, and monitoring financial accounts regularly. Retirees should report fraud to authorities such as the Federal Trade Commission (FTC), Financial Industry Regulatory Authority (FINRA), state attorney general offices, and local law enforcement. Recovery from fraud involves emotional support and counseling, financial recovery, and rebuilding credit and reputation.Overview of Fraud Prevention for Retirees

Common Types of Fraud Targeting Retirees

Investment Scams

Ponzi Schemes

Pump-and-Dump Schemes

Health Care Fraud

Medicare Scams

Fake Prescription Drug Scams

Identity Theft

Phishing Scams

Tax Identity Theft

Lottery and Sweepstakes Scams

Grandparent Scams

Charity Scams

Home Repair Scams

Telemarketing Scams

Warning Signs of Fraud

High-Pressure Sales Tactics

Promises of High Returns with Little or No Risk

Unsolicited Offers

Requests for Personal Information

Unlicensed or Unregistered Sellers

Payment in Cash or Wire Transfers

Fraud Prevention Strategies for Retirees

Educate Yourself About Common Scams

Verify the Legitimacy of an Offer or Organization

Protect Personal Information

Secure Online Presence

Dispose of Sensitive Documents Properly

Be Cautious of Unsolicited Offers

Consult a Trusted Advisor

Monitor Financial Accounts Regularly

Register for Do Not Call Lists

Reporting Fraud

Recognizing the Importance of Reporting Fraud

Resources for Reporting Fraud

Federal Trade Commission (FTC)

Financial Industry Regulatory Authority (FINRA)

State Attorney General Offices

Local Law Enforcement

Steps to Take After Reporting Fraud

Recovery from Fraud

Emotional Support and Counseling

Financial Recovery

Credit Monitoring

Fraud Alerts

Identity Theft Protection Services

Rebuilding Credit and Reputation

Conclusion

Fraud Prevention for Retirees FAQs

Fraud prevention for retirees refers to the measures taken to protect retired individuals from falling victim to scams and fraudulent activities.

Retirees should be wary of common types of fraud, such as phishing emails, investment scams, identity theft, sweepstakes scams, and grandparent scams.

Retirees can protect themselves from fraud by regularly reviewing their bank and credit card statements, never sharing personal information online, verifying the legitimacy of any unsolicited offers, and being cautious of high-pressure sales tactics.

Retirees can report suspected fraud to their bank, credit card company, local law enforcement, or the Federal Trade Commission (FTC) through their online complaint assistant.

Some warning signs of fraud prevention for retirees include high-pressure sales tactics, promises of high returns with little or no risk, unsolicited offers, requests for personal information, unlicensed or unregistered sellers, and payment in cash or wire transfers.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.