A futures commission merchant (FCM) is critical in allowing customers to participate in futures markets. An FCM serves as an intermediary between a trader and the markets, enabling traders to leverage the required capital to carry out their trading activities. They are responsible for many functions within this complex market, such as clearing trades, offering customer support, entering orders into the exchange, maintaining customer margins, and settling trades. As a regulated organization, they are subject to the oversight of the Commodity Futures Trading Commission (CFTC) or National Futures Association (NFA). Futures Commission Merchants must adhere to regulations and laws set forth by the CFTC, such as the following: To maintain segregated customer funds To provide clear financial disclosure statements To secure customers' proprietary trading information To execute restrictions to prevent churning, scalping, or other disruptive practices To document complaints and conflicts of interest between customers and employees To promptly disclose important non-public information To submit to CFTC audits to comply with federal regulations The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 increased the number and severity of the laws and regulations that apply to FCMs. As the futures industry continues to expand and evolve, financial institutions must understand and comply with all regulatory requirements in registering as such. The FCM registration has requirements not only for the FCMs but also for Principals and Associated Persons (AP) working with them. First, designate a Security Manager to gain access to the NFA's Online Registration System (ORS). Then, complete Form 7-R and the NFA membership application, as well as satisfy any compliance requirements that may be needed. In addition, complete an annual questionnaire. Finalize the process by paying a $500 non-refundable application fee and the non-refundable FCM membership dues. Following these instructions carefully will guarantee the successful completion of the registration process. Registration of principals and associated persons of FCMs is a vital requirement to ensure that legal and ethical standards are upheld. Applicants must file Form 8-R online, submit their fingerprint cards, demonstrate proficiency in their respective fields, and pay a non-refundable application fee of $85 for each principal or AP. Those already registered with the CFTC or listed as a principal of a current CFTC registrant do not have to pay the application fee. Furthermore, applicants applying as both an AP and a principal must only submit one fee. Compliance with these regulations serves to protect all parties in these transactions. After the registration of a Futures Commission Merchant is approved, several filing requirements must be satisfied. FCMs must maintain an accounting system that complies with U.S. Generally Accepted Accounting Principles (GAAP). The reports are made on an accrual basis and are kept up-to-date. While some of these rules are more stringent than GAAP concerning the classification of current and non-current assets, both NFA Financial Requirements and CFTC Regulation 1.17 provide definitions that FCMs must familiarize themselves with. Adjusted net capital is an essential requirement for each FCM to maintain since it is a measure of financial resources available to cover contractual obligations while ensuring the safety and soundness of FCMs. The formula for adjusted net capital is: Current assets are subtracted with liabilities and any charges against capital when calculating adjusted net capital. However, firms may exclude certain liabilities if they enter into a subordination agreement approved by the NFA. Subordinated loan agreements must be submitted to NFA through WinJammer at least ten days before taking effect and will only be considered satisfactory once NFA has accepted them. The net capital requirements for FCMs are set out in NFA Financial Requirements Sections 1 and 2 and determine the necessary level of equity capital that FCMs must hold at all times. If an FCM's adjusted net capital falls below its minimum requirement, it must notify the appropriate agencies according to Section 1. Furthermore, additional reporting requirements may be imposed if it falls below the early warning capital level, possibly leading to prohibitions on guaranteeing Introducing Brokers (IBs). In cases where adjusted net capitals fall to a restrictive level, actions such as withdrawal of capital or repayment of SLA may be prohibited because FCMs must maintain equity capital of at least 30%. To ensure FCMs meet the reporting standards, NFA has outlined specific requirements on what must be filed, when it must be submitted, and how. If such documents are not sent within the timeframes stipulated, then late filing fees of $1,000 can be incurred for each business day of delay. Should those fees remain unpaid after 30 days from the due date, a request to withdraw from NFA membership may be processed under its Bylaw 1303. FCMs must comply with specific segregation requirements in the Commodity Exchange Act (CEA) and CFTC Regulation 1.20 to guarantee that customer funds are entirely segregated from the FCM's funds. In addition, CFTC Regulations 30.7 and 22.2 create additional rules for foreign futures and options customer funds and cleared swaps customer collateral, respectively. FCMs must complete a segregated funds calculation for each business day by noon of the following day as specified in three regulations. To ensure compliance, acknowledgment letters from entities such as depositories and other FCMs are essential to their regulatory framework. Furthermore, FCMs and their depositories must file a copy of each acknowledgment letter with the NFA as proof of CEA adherence. Establishing and following a Risk Management Program is essential to meeting the CFTC Regulation 1.11 requirements for FCM holding customer funds. Their system of policies and procedures must identify any potential risks that the FCMs may experience, which should be monitored and managed when discovered. A Risk Exposure Report (RER) should be provided to their senior management team and governing board at least once every quarter if any material changes in risk exposure arise before the next report filing. All RER documents must be submitted to WinJammer within five business days of being given to senior management. Otherwise, penalties may apply. A Risk Assessment Report is an important piece of documentation that all FCMs must submit annually to meet their CFTC Regulation 1.15 requirements. This report contains vital components, such as a copy of the firm's organizational chart, financial and operational policies and procedures documents, and fiscal year-end consolidated financial statements for any applicable affiliates. It is also required that any material changes made to the organizational chart or policies and procedures within any fiscal quarter be reported 60 days after the end of the quarter in question. This critical document helps to ensure FCMs are up-to-date and compliant with current regulations set forth by the CFTC. The chief compliance officer (CCO) of an FCM must produce an annual report under regulations set forth by CFTC Regulation 3.3(e). The report must be submitted to CFTC at most 90 days after the fiscal year-end, along with a certification form completed and signed by either the CCO or CEO regarding the accuracy and completeness of the report. The FCM must ensure that the CCO is designated as one of its principals and their name is reflected on the firm's registration. CMs can submit their report using WinJammer, an efficient software endorsed to simplify this process. FCMs are required to stay up-to-date with an array of regulations and requirements. The process entails reviewing the FCM's written information systems security program (ISSP) by engaging an independent third-party information security specialist or with in-house personnel with the appropriate knowledge. There are two sets of questionnaires to be completed: NFA’s Annual Questionnaire and Self-Examination Questionnaire. If a notification is received via NFA’s dashboard, accomplish the electronic annual registration update in NFA’s ORS. To comply with the necessary regulations, particularly those related to the USA PATRIOT Act 314(a) information requests, FCMS must send out privacy policies and stay up-to-date with their Point of Contact information. When another FCM or IB introduces the customer's account on a fully disclosed basis, then the former can be exempt from providing such an annual assessment. To ensure compliance with all relevant regulations and exemptions, FCMS should remain attentive to these parameters. Finally, make arrangements for an audit of the company's year-end financial statements to be done by a certified public accountant. On the FCM's registration anniversary date, pay NFA dues, including a $100 registration records maintenance charge for each type of registration. Evaluate your disaster recovery plan, then modify it as needed. Give ethical instructions following the FCM's formal ethics training guidelines. Conduct an audit of AML policies and training and anti-money laundering (AML) training for the appropriate workers. A Futures Commission Merchant is a financial intermediary that assists producers and consumers in trading futures contracts and options markets. There are distinct registration requirements for FCM and Principal and Associate Persons of FCM. They must adhere to regulations and laws set forth by the CFTC. As an FCM, businesses must register with the CFTC and fulfill both registration and annual requirements. FCMs also need to routinely submit reporting forms associated with their operations - including daily balance sheets and monthly financial statements – to confirm their ongoing compliance. With these rules in place, both investors and the public can have faith in the integrity of the futures market.What Is a Futures Commission Merchant (FCM)?

Futures Commission Merchant Regulations

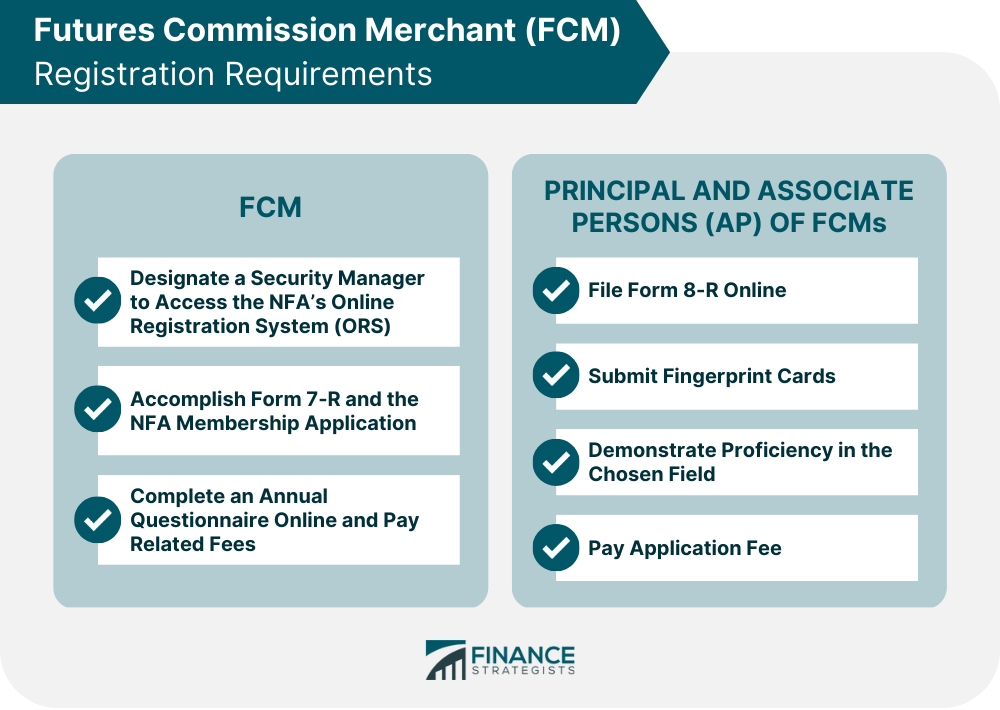

Futures Commission Merchant Registration Requirements

For FCMs

For Principal and Associated Persons (AP) of FCMs

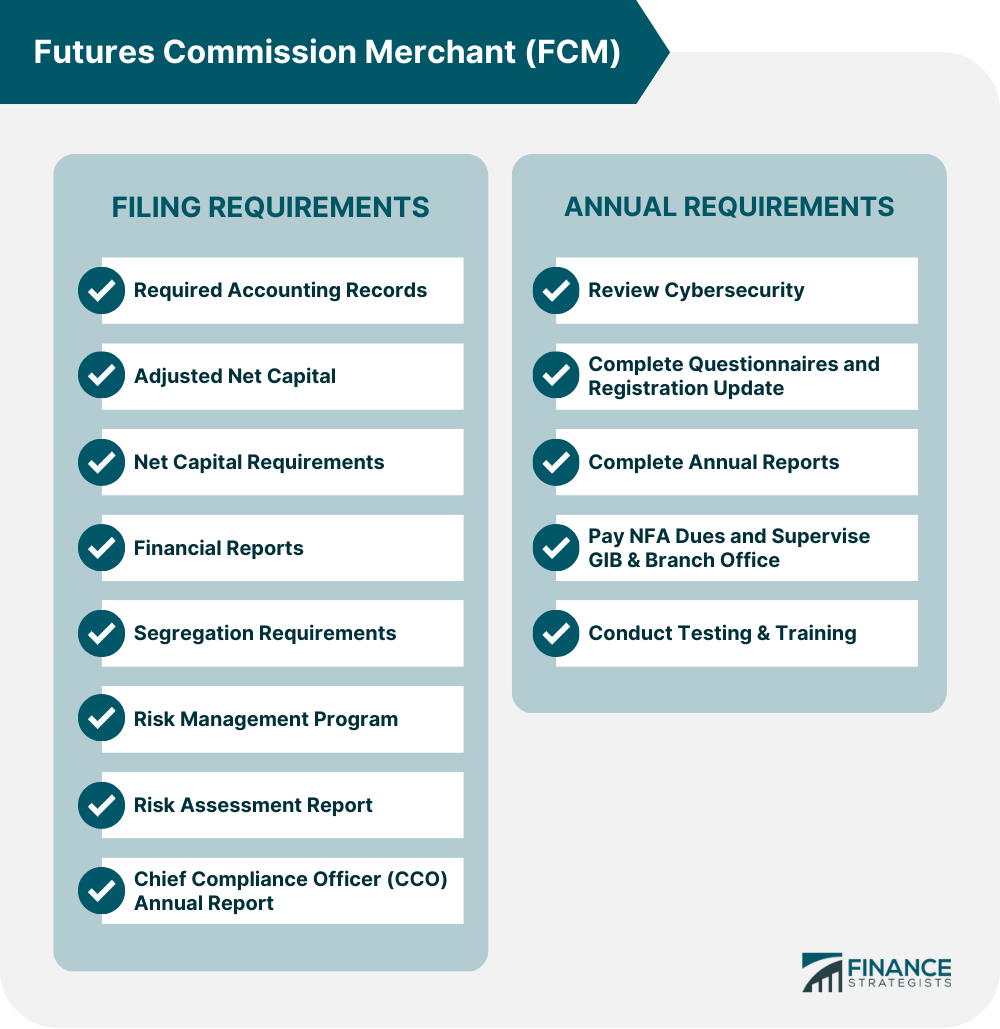

Futures Commission Merchant Filing Requirements

Required Accounting Records

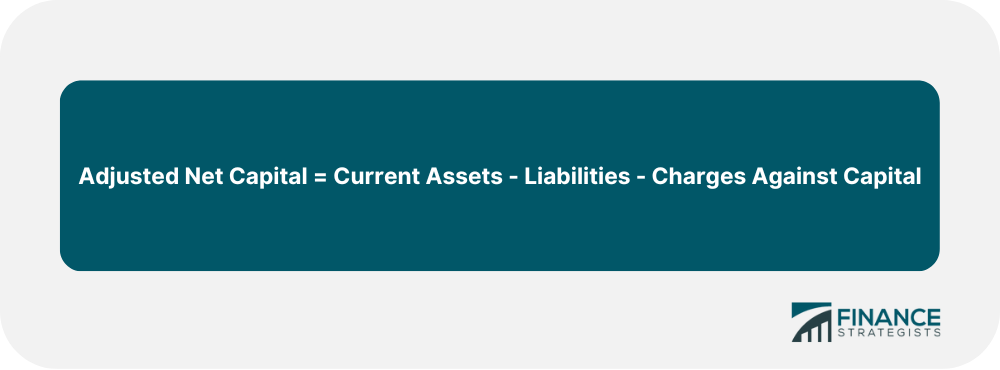

Adjusted Net Capital

Net Capital Requirements

Financial Reports

Segregation Requirements

Risk Management Program

Risk Assessment Report

Chief Compliance Officer (CCO) Annual Report

Futures Commission Merchant Annual Requirements

Review Cybersecurity

Complete Questionnaires and Registration Update

Complete Annual Reports

Pay NFA Dues and Supervise GIB & Branch Office

Conduct Testing & Training

Final Thoughts

Futures Commission Merchant (FCM) FAQs

The Commodity Futures Trading Commission (CFTC) is the primary regulator of FCMs in the United States. The National Futures Association (NFA) is also responsible for monitoring and enforcing compliance with applicable laws, rules, and regulations governing their activities.

Yes, FCMs are permitted to hold customer funds in special accounts segregated from the FCM's own money. This protects customers' funds from any losses incurred by the firm due to business failure or bankruptcy.

FCMs must review their risk management programs annually and document any changes made during this review process. Additionally, the CFTC may require additional reviews or updates to the program.

FCMs must perform a calculation of their customer-segregated funds at least daily. This calculation helps to ensure that customers' funds are appropriately accounted for and protected in the event of the FCM's business failure or bankruptcy.

No, it is illegal for an FCM to extend margin credit or otherwise loan money directly to its customers for use in futures trading. Customers must provide adequate capital or collateral to meet the minimum initial margin requirements set by the CFTC.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.