A Chartered Market Technician (CMT) is a professional designation that recognizes individuals who have demonstrated mastery in the field of technical analysis. Technical analysis is the study of past market data, primarily price and volume, to predict future market behavior. CMTs use technical analysis to identify trends and patterns in financial markets, which they use to make informed investment decisions. Becoming a CMT requires a deep understanding of technical analysis and the ability to apply that knowledge to real-world situations. The designation is highly respected in the financial industry and is recognized globally as a symbol of excellence in technical analysis. CMTs are considered experts in their field and are often sought out by investors, traders, and financial institutions for their expertise. Have a question for a Chartered Market Technician? Click here. To obtain the CMT designation, candidates must meet the following requirements: To be eligible for the CMT designation, candidates must have a bachelor's degree or equivalent work experience. A degree in finance, economics, or a related field is preferred, as it provides a strong foundation in the concepts and principles of finance and investment analysis. However, candidates without a degree may still be eligible if they have equivalent work experience. Candidates must also have at least three years of experience in the investment industry or a related field. This experience can include work in portfolio management, trading, research, or other relevant roles. The CMT Association recognizes a wide range of professional experience as long as it demonstrates a strong understanding of the financial markets and investment analysis. The CMT exam is a rigorous three-part exam that tests candidates on their knowledge of technical analysis. The first exam covers the fundamentals of technical analysis, including chart construction, trend analysis, and indicators. The second exam covers intermediate technical analysis, including momentum, cycles, and volatility. The third exam covers advanced technical analysis, including Elliott Wave Theory, behavioral finance, and intermarket analysis. The exams are computer-based and are offered in testing centers around the world. Candidates must pass all three exams within five years of their first attempt. The exams are challenging and require a significant amount of preparation and study. Candidates for the CMT designation must agree to abide by the CMT Association's Code of Ethics and Standards of Professional Conduct. The code of ethics is designed to ensure that CMTs maintain the highest standards of professional conduct and act in the best interests of their clients and the financial industry as a whole. Candidates must become members of the CMT Association and pay annual dues. Membership provides access to a wide range of resources and networking opportunities, including conferences, webinars, and other professional development opportunities. Membership also displays a commitment to professionalism and excellence in the field of technical analysis. Chartered Market Technicians have a variety of roles and responsibilities within the investment industry. One of their primary responsibilities is to conduct research and analysis of financial markets using technical analysis tools and techniques. CMTs use charts, graphs, and other data visualizations to identify market trends and patterns, which they use to make informed investment decisions. In addition to conducting research and analysis, CMTs also develop investment strategies for their clients. They may work with portfolio managers, traders, and other investment professionals to develop strategies that meet their clients' specific investment goals and risk profiles. CMTs must have a deep understanding of risk management and portfolio optimization to develop effective investment strategies. Another key responsibility of CMTs is to communicate their findings and recommendations to clients. This may involve preparing reports, giving presentations, and answering clients' questions about their investments. Effective communication is essential for building trust and maintaining strong relationships with clients. Becoming a Chartered Market Technician requires a wide range of skills and knowledge in the field of technical analysis. They must be able to interpret complex data and identify trends and patterns that are relevant to investment decisions. Attention to detail is also critical, as even small errors in analysis can have significant consequences for investment outcomes. CMTs must be able to think outside the box and develop innovative investment strategies that take advantage of market trends and opportunities. They must also have strong communication skills, as they must be able to explain their findings and recommendations to clients in a clear and concise manner. Proficiency in statistical software is also essential for CMTs. They must be able to work with large amounts of data and use advanced statistical techniques to identify patterns and trends. Knowledge of financial markets and investment products is also critical, as CMTs must understand the various investment options available to clients and the risks and benefits associated with each. CMTs have a wide range of career opportunities within the investment industry. They may work for investment banks, hedge funds, asset management firms, or other financial institutions. Some CMTs may also work as independent consultants or advisors, providing their expertise to a range of clients. CMTs may work in a variety of roles, including portfolio manager, trader, analyst, financial advisor, and risk manager. Each of these roles requires a unique set of skills and expertise, but all require a deep understanding of technical analysis and the ability to make informed investment decisions. CMTs may also work in related fields such as market research, quantitative analysis, or algorithmic trading. The demand for CMTs is expected to continue to grow as more investors recognize the importance of technical analysis in making informed investment decisions. Overall, a career as a CMT can be both challenging and rewarding, with ample opportunities for professional growth and advancement. Becoming a Chartered Market Technician offers a number of benefits for those interested in a career in investment analysis. Here are some reasons why you should consider becoming a CMT: Firstly, the CMT designation is recognized as a mark of excellence in the field of technical analysis. It is an internationally recognized credential that demonstrates your expertise and commitment to the profession. Employers and clients are more likely to trust your advice and rely on your expertise if you hold the CMT designation. This can open up more opportunities for career advancement and increase your earning potential. Secondly, the CMT designation can help you build your professional network. As a member of the CMT Association, you will have access to a global community of professionals in the investment industry. You can attend events, participate in online forums, and network with other CMTs. This can help you build relationships with other professionals in the field, learn about new job opportunities, and stay up-to-date on the latest trends and developments in technical analysis. Finally, becoming a CMT can help you stay competitive in a rapidly changing industry. The investment industry is constantly evolving, and new technologies and techniques are emerging all the time. By obtaining the CMT designation, you demonstrate your commitment to staying current with the latest developments in the field. This can help you stand out from other candidates when applying for jobs or working with clients. A CMT is a professional who has demonstrated proficiency in technical analysis by meeting specific education and experience requirements and passing a rigorous exam. A CMT's roles and responsibilities include conducting research and analysis of financial markets. They also develop investment strategies and communicate their findings and recommendations to clients. To succeed in this career, a CMT must possess a range of skills, including strong analytical ability, attention to detail, critical thinking, and strong communication skills. Becoming a CMT requires a significant amount of dedication and hard work, but the benefits of obtaining this designation are numerous. Some of the benefits of becoming a CMT include increased job opportunities, higher earning potential, and the ability to provide clients with expert technical analysis. Furthermore, the CMT designation is recognized as a mark of excellence in the investment industry, which can help CMTs build their professional network and stay competitive in a rapidly changing industry. A CMT designation allows professionals to demonstrate their commitment to staying current with the latest developments in the field and gain a competitive edge in the job market.Definition of Chartered Market Technician

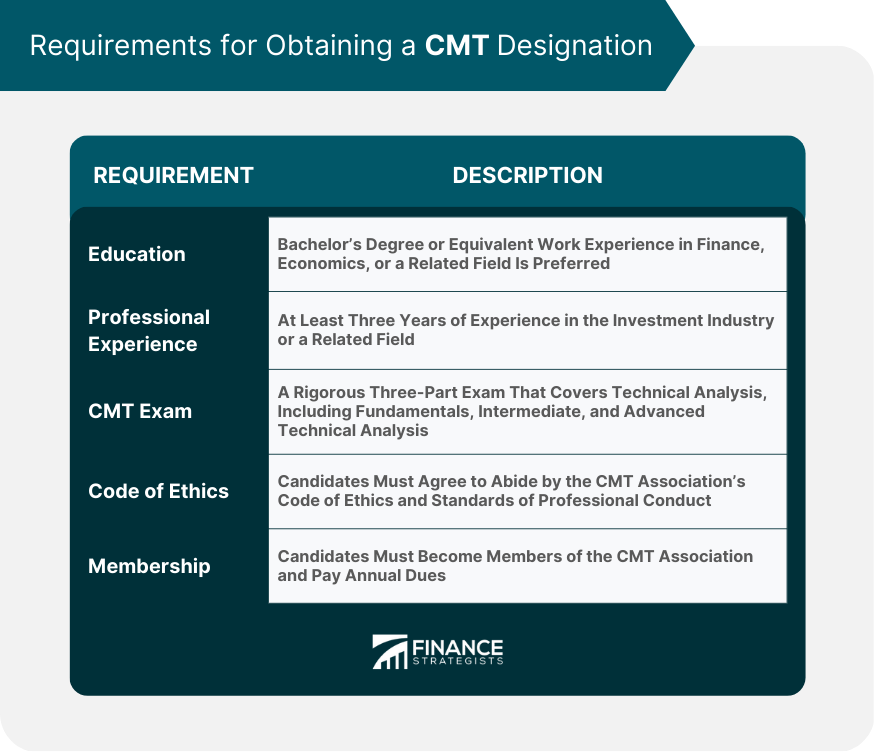

Requirements for Obtaining a CMT Designation

Education

Professional Experience

CMT Exam

Code of Ethics

Membership

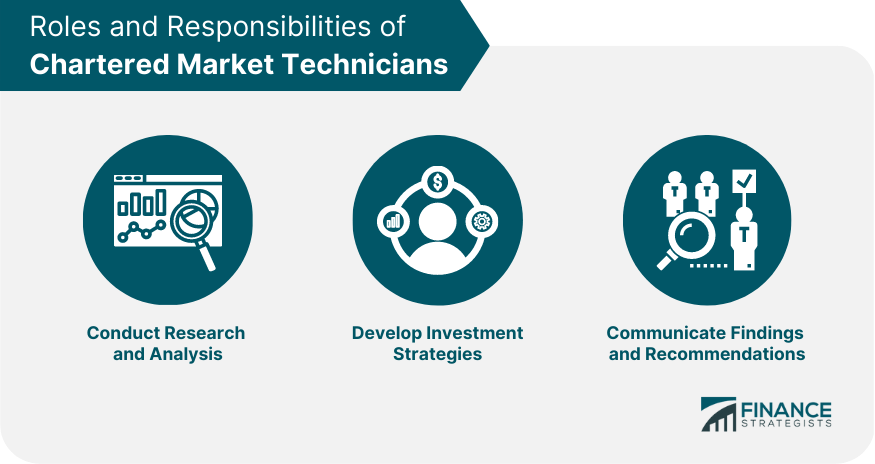

Roles and Responsibilities of Chartered Market Technicians

Conduct Research and Analysis

Develop Investment Strategies

Communicate Findings and Recommendations

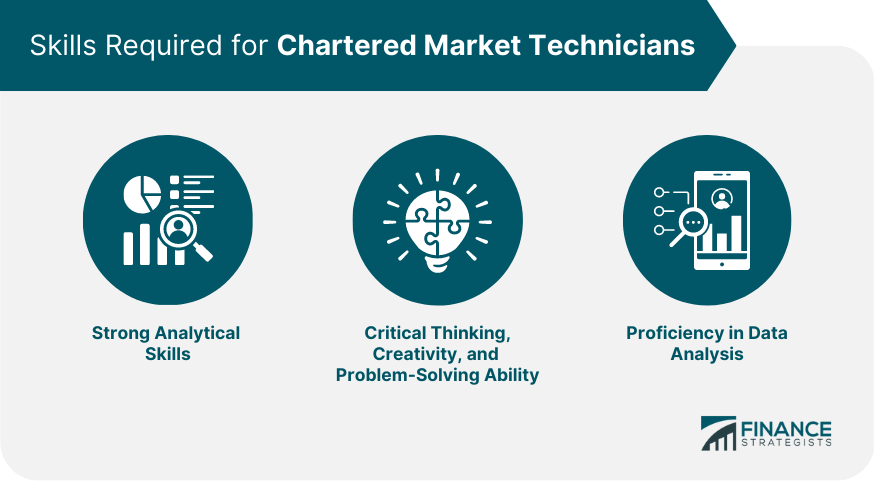

Skills Required for Chartered Market Technicians

Strong Analytical Skills

Critical Thinking, Creativity, and Problem-Solving Ability

Proficiency in Data Analysis

Career Opportunities for Chartered Market Technicians

Why Should You Become a Chartered Market Technician?

Provides a Mark of Excellence

Builds Professional Network

Increases Career Opportunities

Final Thoughts

Chartered Market Technician (CMT) FAQs

A CMT is a professional who has demonstrated proficiency in technical analysis by meeting specific education and experience requirements and passing a rigorous exam.

Candidates must have a bachelor's degree or equivalent work experience, at least three years of experience in the investment industry or a related field, and pass a rigorous three-part exam. They must also agree to abide by the CMT Association's Code of Ethics and become members of the association.

CMTs conduct research and analysis of financial markets using technical analysis tools and techniques, develop investment strategies for clients, and communicate their findings and recommendations to clients.

Strong analytical ability, attention to detail, critical thinking, creativity, problem-solving ability, strong communication skills, proficiency in data analysis and statistical software, and knowledge of financial markets and investment products.

Increased job opportunities, higher earning potential, the ability to provide clients with expert technical analysis, and the ability to stay competitive in a rapidly changing industry.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.