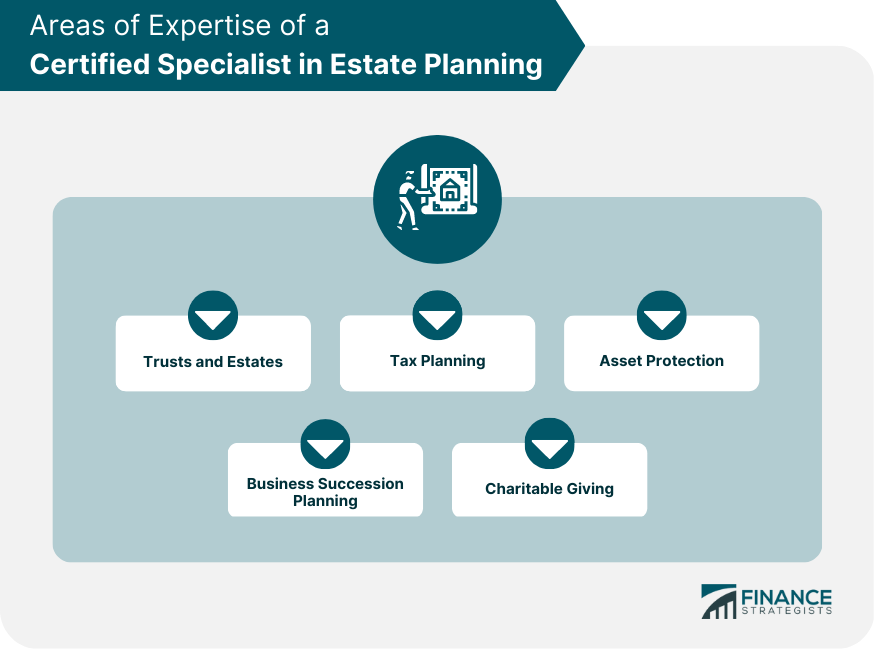

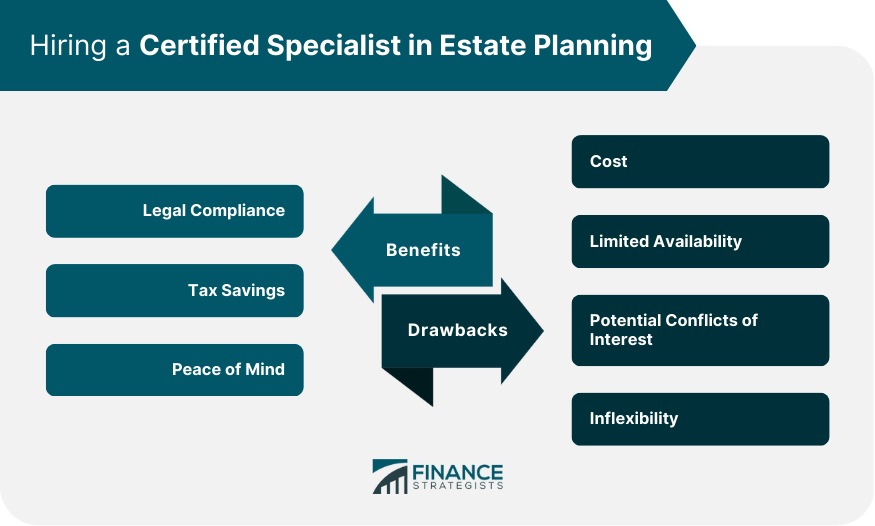

A certified specialist in estate planning is a legal professional who has completed specialized education and training in the field of estate planning. To become a certified specialist, individuals must meet specific educational requirements, such as completing a Juris Doctor degree and passing a state bar examination. Certification programs are available for estate planning specialists. These programs provide advanced training and education in various areas of estate planning, including trusts and estates, tax planning, asset protection, business succession planning, and charitable giving. Estate planning is a multifaceted area of law that encompasses a wide range of legal and financial matters. A certified specialist in estate planning should have a comprehensive understanding of the various areas of estate planning, including: A trust is a legal instrument used to manage and distribute assets to beneficiaries after the death of the trust creator. A certified specialist in estate planning should be familiar with the various types of trusts and how they can be used to accomplish specific estate planning goals. Tax planning is a critical aspect of estate planning, and a certified specialist in estate planning should have a thorough understanding of tax laws and regulations. They can help clients maximize tax benefits and minimize tax liability through various strategies, such as gifting, charitable giving, and creating trusts. Asset protection is essential for individuals who want to safeguard their assets from potential creditors or legal actions. A certified specialist in estate planning can help clients protect their assets through various legal structures, such as trusts, limited liability companies, and asset protection trusts. Business owners need to plan for the transfer of their business assets after their passing. A certified specialist in estate planning can help business owners create a comprehensive business succession plan that ensures a smooth transition of the business to the next generation of owners. Charitable giving is an essential aspect of estate planning for individuals who want to leave a lasting legacy. A certified specialist in estate planning can help clients create a charitable giving plan that aligns with their philanthropic goals and maximizes tax benefits. A certified specialist in estate planning has a crucial role in helping clients create a comprehensive estate plan that meets their unique needs and goals. Their responsibilities include: A certified specialist in estate planning works with clients to create an estate plan that reflects their wishes and values. They can help clients identify their goals and develop strategies to achieve them. Estate planning involves various legal and financial matters, and a certified specialist in estate planning can provide clients with expert advice on these matters. They can help clients navigate complex tax laws, estate planning documents, and legal structures. Estate planning often requires collaboration with other professionals, such as financial planners and accountants. A certified specialist in estate planning can work with these professionals to ensure that a client's estate plan is comprehensive and meets their unique needs. Working with a certified specialist in estate planning offers several benefits, including: A certified specialist in estate planning can help clients create an estate plan that meets all legal requirements and is comprehensive, addressing all aspects of their assets and wishes. It can give clients peace of mind, knowing that their estate plan will be executed according to their wishes. A certified specialist in estate planning can help clients identify strategies to minimize tax liability and maximize tax benefits, such as utilizing charitable giving or creating trusts. This can save clients significant amounts of money in taxes. Creating an estate plan can be a stressful and overwhelming process, but working with a certified specialist in estate planning can provide clients with peace of mind. Clients can feel confident that their estate plan is thorough and will be executed according to their wishes, providing a sense of security for both them and their families. While hiring a certified specialist in estate planning offers many benefits, there are also some drawbacks to consider. These drawbacks include: Working with a certified specialist in estate planning can be expensive, as their services often come with a high hourly rate or a flat fee. Clients should carefully consider whether the cost of hiring a specialist is worth the potential benefits. There may be a limited number of certified specialists in estate planning in a given area, making it challenging to find one that meets your needs. This can lead to longer wait times for appointments or difficulties in scheduling meetings. Certified specialists in estate planning may also work for law firms that handle other legal matters, such as litigation or real estate transactions. This can create a conflict of interest if the law firm is also representing parties who are adverse to the client's interests. Certified specialists in estate planning may have a rigid approach to estate planning that may not align with a client's unique needs and goals. Clients may find that a specialist's recommendations do not adequately address their specific situation. Finding a qualified estate planning specialist can seem like a daunting task, but there are several ways to locate one, including: Many professional organizations offer directories of certified specialists in estate planning, such as the American Bar Association and the National Association of Estate Planners & Councils. Referral networks can be an excellent way to find a qualified estate planning specialist. Ask for referrals from friends, family, or other professionals, such as accountants or financial advisors. When evaluating potential estate planning specialists, consider their education, certification, and experience. Look for a specialist who has experience working with clients with similar needs and goals to yours. Estate planning is a crucial process that requires the assistance of a certified specialist in estate planning. These specialists have the education, training, and experience necessary to help clients create a comprehensive estate plan that meets their unique needs and goals. Working with a certified specialist in estate planning offers several benefits, including ensuring that an estate plan meets legal requirements, maximizing tax benefits, and providing peace of mind for clients and their families. When searching for a qualified estate planning specialist, consider professional organizations, referral networks, and evaluating credentials and experience. Consult a financial advisor for more information and guidance on these specialists and other estate planning concerns.What Is a Certified Specialist in Estate Planning?

Certified Specialist in Estate Planning Areas of Expertise

Trusts and Estates

Tax Planning

Asset Protection

Business Succession Planning

Charitable Giving

Responsibilities of a Certified Specialist in Estate Planning

Estate Plan Creation

Advise on Legal and Financial Matters

Collaboration With Other Professionals

Benefits of Hiring a Certified Specialist in Estate Planning

Legal Compliance

Tax Savings

Peace of Mind

Drawbacks of Hiring a Certified Specialist in Estate Planning

Cost

Limited Availability

Potential Conflicts of Interest

Inflexibility

How to Find a Certified Specialist in Estate Planning

Professional Organizations

Referral Networks

Evaluating Credentials and Experience

Final Thoughts

Certified Specialist in Estate Planning FAQs

A certified specialist in estate planning is a legal professional who has completed specialized education and training in the field of estate planning. These specialists are recognized by state bar associations as having achieved a high level of expertise in the area of estate planning law.

To become a certified specialist in estate planning, a legal professional must typically have completed a Juris Doctor degree and passed a state bar examination. They must also have completed additional coursework and training in various areas of estate planning, such as trusts and estates, tax planning, asset protection, business succession planning, and charitable giving. Certification programs are available for estate planning specialists, and these programs provide advanced training and education in various areas of estate planning.

Working with a certified specialist in estate planning can provide several benefits, such as ensuring that an estate plan meets legal requirements, maximizing tax benefits, and providing peace of mind for clients and their families.

Some potential drawbacks of hiring a certified specialist in estate planning include cost, limited availability, potential conflicts of interest, and inflexibility in their approach to estate planning.

Clients can find certified specialists in estate planning by searching through professional organizations and referral networks or by evaluating the credentials and experience of potential specialists.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.