Bunching deductions is a tax planning strategy that involves strategically timing the payment of deductible expenses to maximize itemized deductions in a specific tax year. By doing so, individuals can potentially reduce their taxable income and lower their overall tax liability for that specific year. It is important to note that the Tax Cuts and Jobs Act of 2017 significantly increased the standard deduction, making it more challenging for some taxpayers to exceed it and benefit from itemized deductions. Bunching deductions can be a valuable strategy for those who may not consistently exceed the standard deduction each year but have certain expenses that can be timed strategically. The bunching strategy involves accumulating deductible expenses in a single tax year to maximize itemized deductions, allowing taxpayers to benefit from a higher deduction than the standard deduction. Taxpayers should analyze their deductible expenses and identify those that can be timed or bunched, such as medical expenses, charitable contributions, and state and local taxes. The bunching strategy relies on the effective timing of deductible expenses. Taxpayers must plan and schedule payments to bunch deductions in the desired tax year. Bunching deductions can significantly reduce taxable income in the tax year when itemized deductions are maximized. This strategy may result in lower tax liability for that year. Taxpayers should periodically review their deductible expenses and financial situation to ensure the bunching deductions strategy remains effective and appropriate. Changes in personal finances, tax laws, or deductible expenses may necessitate adjustments to the strategy. As tax laws evolve, the benefits of the bunching deductions strategy may change. Taxpayers should stay informed about tax law changes and adjust their tax planning strategies accordingly to maximize deductions and minimize tax liability. Collaborating with a tax services professional can help taxpayers monitor and adjust their bunching deductions strategy as needed. Tax professionals can provide expert guidance on optimizing deductions and adapting to changing tax laws or personal financial situations. The bunching deductions strategy should be considered as part of a comprehensive financial plan. Taxpayers should integrate the strategy into their long-term financial planning goals, ensuring that it aligns with their overall objectives and does not conflict with other financial priorities. The effectiveness of the bunching strategy may vary depending on the taxpayer's income level and tax bracket. Taxpayers in higher tax brackets may benefit more from bunching deductions. Bunching deductions may not be beneficial if the taxpayer expects a significant increase in income or deductible expenses in the following tax year. Tax laws may change, affecting the effectiveness of the bunching strategy. Taxpayers should monitor potential changes and adapt their tax planning strategies accordingly. Bunching deductions can impact financial planning goals, such as retirement savings or education funding. Taxpayers should consider the broader implications of this strategy on their financial goals. Certain limitations apply to itemized deductions, such as the SALT deduction cap, medical expense deduction threshold, charitable contribution limits, and miscellaneous deduction restrictions. Taxpayers should be aware of these limitations when planning to bunch deductions. Taxpayers can use various charitable giving strategies, such as donor-advised funds, charitable trusts, and qualified charitable distributions, to maximize the tax benefits of bunching deductions. Different giving strategies have distinct tax implications, and taxpayers should evaluate the tax benefits of each option when bunching deductions. Taxonomies should carefully plan their charitable giving strategy to maximize tax savings while bunching deductions. This may involve contributing to multiple charities or using a donor-advised fund to distribute donations over time. Instead of bunching deductions, taxpayers can increase their retirement contributions to reduce taxable income. This strategy may be more advantageous for taxpayers who cannot effectively time deductible expenses or are subject to itemized deduction limitations. Contributing to Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs) can also help reduce taxable income. These accounts allow taxpayers to save pre-tax dollars for eligible medical expenses, providing tax benefits without the need to bunch deductions. Tax loss harvesting involves selling underperforming investments to realize losses and offset capital gains, reducing taxable income. This strategy can be an alternative to bunching deductions for taxpayers with investment portfolios. Tax-efficient investing strategies, such as investing in tax-exempt municipal bonds or tax-managed mutual funds, can help reduce taxable income without the need to bunch deductions. These strategies focus on minimizing the tax impact of investment income and capital gains. Bunching deductions is a tax planning strategy that can help taxpayers maximize their itemized deductions in specific tax years, reducing their overall tax liability. While bunching deductions can be beneficial, it's important to consider factors such as income level, tax bracket, future income and deductions, tax law changes, and financial planning goals. Taxpayers should evaluate the effectiveness of the bunching deductions strategy based on their individual circumstances and consult a tax professional for personalized advice to develop a comprehensive tax planning strategy.What Are Bunching Deductions?

This strategy is particularly advantageous for taxpayers whose itemized deductions surpass the standard deduction in one year but are expected to fall below it in the following year.

The key idea behind bunching deductions is to concentrate or "bunch" deductible expenses into a single tax year, allowing taxpayers to exceed the standard deduction threshold and itemize their deductions instead. Bunching Deductions Strategy

In the following tax year, taxpayers can take advantage of the standard deduction, which may be more beneficial than itemizing deductions.Identifying Deductions for Bunching

Timing of Deductions

Impact on Taxable Income

Monitoring and Adjusting the Bunching Deductions Strategy

Regular Review of Deductible Expenses

Adapting to Changes in Tax Laws

Working With a Tax Professional

Incorporating Bunching Deductions Into Long-Term Financial Planning

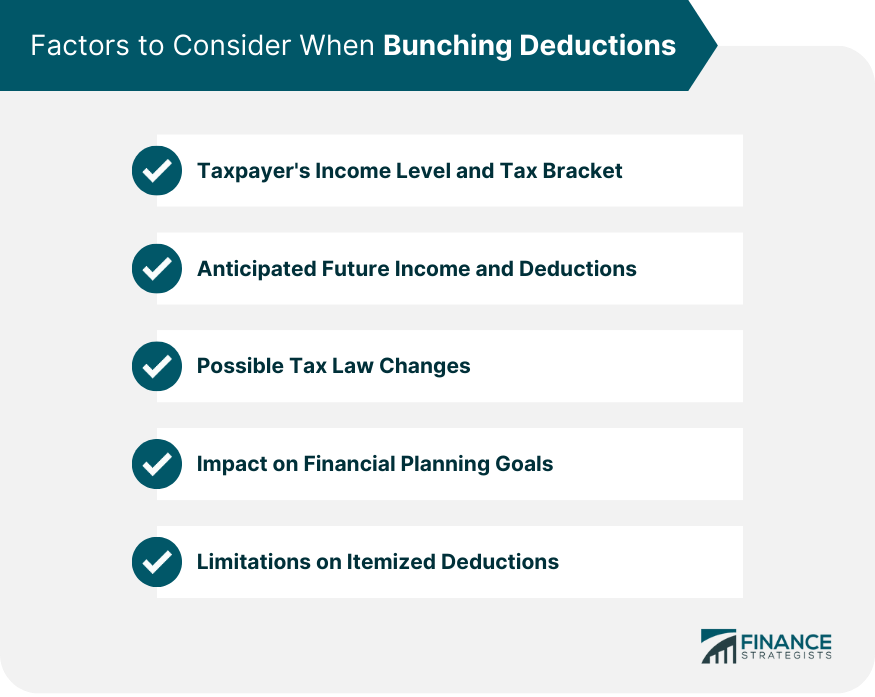

Factors to Consider When Bunching Deductions

Taxpayer's Income Level and Tax Bracket

Anticipated Future Income and Deductions

Possible Tax Law Changes

Impact on Financial Planning Goals

Limitations on Itemized Deductions

Bunching Deductions and Charitable Contributions

Charitable Giving Strategies

Tax Implications of Different Giving Strategies

Maximizing Tax Savings Through Strategic Giving

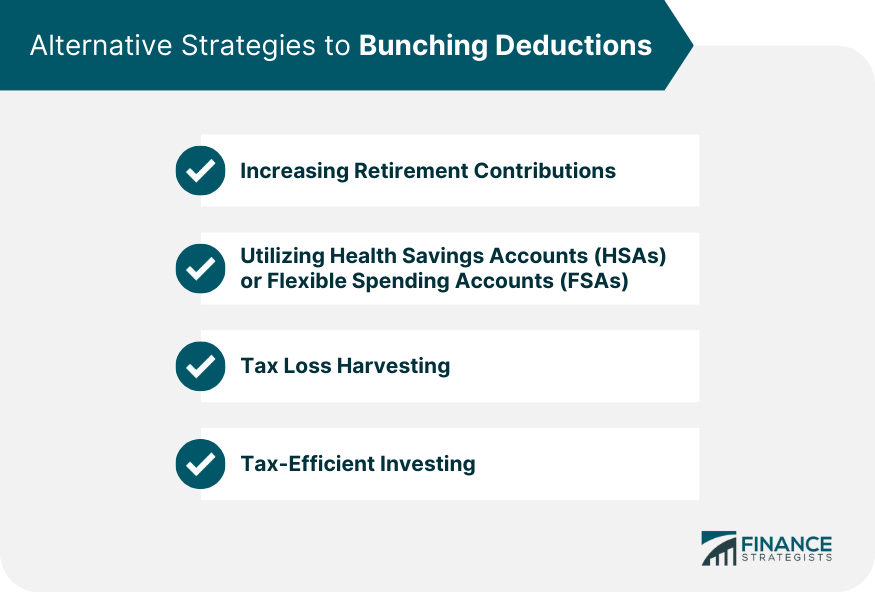

Alternative Strategies to Bunching Deductions

Increasing Retirement Contributions

Utilizing Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs)

Tax Loss Harvesting

Tax-Efficient Investing

Conclusion

It is essential to understand the difference between standard and itemized deductions and identify which expenses can be bunched effectively.

Alternative strategies, such as increasing retirement contributions, utilizing HSAs or FSAs, tax loss harvesting, and tax-efficient investing, may also help reduce taxable income.

Bunching Deductions FAQs

Bunching deductions is a tax planning strategy that involves accumulating deductible expenses in a specific tax year to maximize itemized deductions, which can result in a lower tax liability. This approach is beneficial when itemized deductions exceed the standard deduction in one year and fall below it in the following year.

Bunching deductions can help you save on taxes by strategically timing deductible expenses to maximize itemized deductions in a particular tax year. This results in a higher total deduction than the standard deduction, which can lead to a lower tax liability for that year.

Common expenses that can be included in bunching deductions are medical expenses, state and local taxes, mortgage interest, and charitable contributions. These expenses can be timed or combined in a specific tax year to maximize itemized deductions.

Yes, there are limitations to consider when using the bunching deductions strategy, such as caps on state and local tax deductions, medical expense deduction thresholds, and limits on charitable contributions. Additionally, the strategy's effectiveness depends on the taxpayer's income level, tax bracket, and future income and deductions expectations.

To incorporate bunching deductions into your overall tax planning strategy, begin by identifying deductible expenses that can be bunched together, and plan their timing accordingly. You should also consider alternative tax-saving strategies, such as increasing retirement contributions or utilizing HSAs/FSAs. Consulting a tax professional can help you develop a comprehensive tax planning strategy that maximizes deductions and tax liability.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.