An Individual Benefit Statement (IBS) is a crucial document that outlines the various benefits an employee receives from their employer. This comprehensive statement provides an overview of employees' various financial and non-financial perks, including salary, retirement plans, insurance coverage, and other benefits. An IBS helps foster transparency and trust between employers and employees. By clearly presenting the benefits provided, employers demonstrate their commitment to the well-being of their workforce. Employees can feel confident that they have a complete understanding of their compensation and are being fairly rewarded for their efforts. An IBS also helps employees understand the complete value of their compensation package and make informed decisions about their financial planning. An IBS typically includes the following personal information: The employee's full name is listed to ensure that the statement corresponds to the correct individual. The employee's Social Security Number (SSN) is included to uniquely identify the individual and maintain accurate records for tax and benefits purposes. The employee's date of birth is necessary to calculate the age-based benefits, such as Social Security or pension eligibility. The employment information section provides details about the employee's job and salary, including: The date on which the employee was hired is essential for determining the employee's eligibility for various benefits and calculating their length of service. The employee's job title is included to provide context for their position within the organization. The employee's base salary, along with any bonuses, commissions, or other forms of compensation, is listed in this section to understand their total income clearly. One of the most critical aspects of an IBS is the retirement benefits section. This part of the statement outlines the various retirement plans available to the employee, including: Pension plans are retirement benefits an employer provides to help employees save for their future. There are two main types of pension plans: A defined benefit plan is a traditional pension plan where an employee receives a predetermined monthly benefit upon retirement, based on their salary and years of service. In a defined contribution plan, the employee and employer contribute a specified amount to the employee's retirement account. The employee's retirement benefit is based on their contributions and investment returns. Social Security is a government-administered retirement program that benefits eligible individuals. An IBS typically includes estimates of the following Social Security benefits: This section estimates the monthly retirement benefits the employee may receive based on their work history and earnings. Survivor benefits are payable to the employee's spouse, children, or other eligible dependents upon the employee's death. Disability benefits provide financial support to employees who become disabled and are unable to work. The health and insurance benefits section of an IBS outlines the various insurance coverages available to the employee, including: Health insurance benefits provide medical coverage for employees and their dependents. An IBS typically includes the following details: This section outlines the specific medical services covered by the employee's health insurance plan. Premium contributions are the amounts the employee and employer paid towards the health insurance plan. Deductibles and out-of-pocket limits are the amounts that employees must pay before their insurance coverage begins. Life insurance provides a financial benefit to the employee's beneficiaries in the event of their death. An IBS typically includes the following information: The type of life insurance policy, such as term or permanent, is outlined in this section. The amount of life insurance coverage provided to the employee is listed in this section, typically as a multiple of their annual salary or as a fixed amount. The names and relationships of the designated beneficiaries for the life insurance policy are included in the IBS. Disability insurance provides financial protection for employees who become disabled and are unable to work. There are two types of disability insurance: Short-term disability insurance provides income replacement for a temporary period, usually ranging from a few weeks to a few months. Long-term disability insurance offers income replacement for an extended period, often lasting several years or until the employee reaches retirement age. In addition to the primary insurance coverages, an IBS may also include information about other insurance benefits, such as dental and vision coverage. In addition to financial benefits, an IBS includes information about non-monetary benefits that employees receive from their employer, such as: Paid time off is an essential component of an employee's compensation package and typically includes vacation, sick, and personal days. Flexible work arrangements allow employees to modify their work schedules or locations to accommodate personal or family needs. These arrangements can include remote work, flexible schedules, and compressed work weeks. Employers may offer education and professional development benefits to support employees in advancing their careers. These benefits can include tuition reimbursement, training programs, and professional certifications. Other perks and benefits that may be included in an IBS are employee assistance programs (EAPs), childcare benefits, and wellness programs. When preparing and maintaining an IBS, it is essential to consider the following legal and regulatory factors: Employers must ensure that employees’ personal information is protected and secure, adhering to relevant privacy laws and data security best practices. An IBS must comply with all applicable federal and state laws governing employee benefits, taxation, and reporting requirements. Employers are responsible for ensuring that the information provided in an IBS is accurate and up-to-date. Employees should also review their statements regularly to verify the correctness of the information. Employees should know how to read and understand the information to maximize their IBS. Here are some steps to follow: Employees should carefully review their IBS to ensure that all personal and employment information is correct. Any discrepancies should be reported to the employer for correction. By reviewing their IBS, employees can identify areas where they may want to change or improve their benefits package. For example, they may decide to increase their retirement plan contributions, adjust their insurance coverage, or take advantage of professional development opportunities. An IBS can help employees track their progress towards their financial goals, such as retirement savings, emergency funds, or debt repayment. Regularly reviewing and updating their IBS allows employees to adjust their financial plans as needed to stay on track. An Individual Benefit Statement is a valuable tool for employees to understand the full scope of their compensation package and make informed decisions about their personal financial planning. By reviewing their IBS regularly and making any necessary adjustments, employees can ensure that they maximize their benefits and work towards their financial goals. Employers also play a crucial role in providing accurate and up-to-date information and complying with legal and regulatory requirements. Ultimately, a well-maintained IBS can contribute to employee satisfaction and financial well-being.What Is an Individual Benefit Statement?

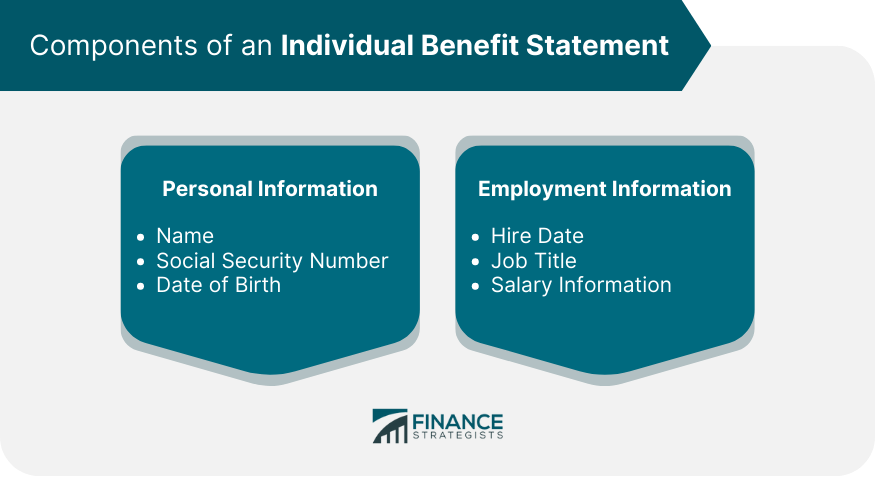

Components of an Individual Benefit Statement

Personal Information

Name

Social Security Number

Date of Birth

Employment Information

Hire Date

Job Title

Salary Information

Retirement Benefits

Pension Plans

Defined Benefit Plans

Defined Contribution Plans

Social Security Benefits

Estimated Retirement Benefits

Survivor Benefits

Disability Benefits

Health and Insurance Benefits

Health Insurance

Coverage Details

Premium Contributions

Deductibles and Out-of-Pocket Limits

Life Insurance

Policy Type

Coverage Amount

Beneficiary Information

Disability Insurance

Short-Term Disability

Long-Term Disability

Other Insurance Benefits

Non-Monetary Benefits

Paid Time Off

Flexible Work Arrangements

Education and Professional Development

Additional Perks and Benefits

Legal and Regulatory Considerations of Individual Benefit Statement

Privacy and Security of Personal Information

Compliance With Federal and State Laws

Accuracy and Currency of Information

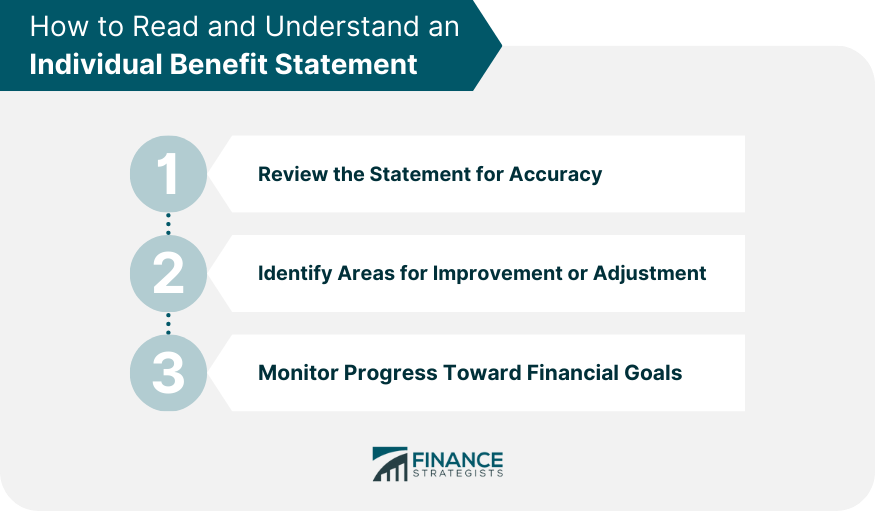

How to Read and Understand an Individual Benefit Statement

Review the Statement for Accuracy

Identify Areas for Improvement or Adjustment

Monitor Progress Toward Financial Goals

Conclusion

Individual Benefit Statement FAQs

An Individual Benefit Statement is a document that outlines an employee's total compensation package, including salary, bonuses, benefits, and retirement contributions.

Employers provide Individual Benefit Statements to help employees understand their compensation package's full value and make informed decisions about their finances and retirement planning.

Individual Benefit Statements are typically provided annually or upon request.

Yes, an Individual Benefit Statement can be used to negotiate a salary increase by clearly understanding the value of an employee's contributions and the company's investment in their compensation package.

An Individual Benefit Statement typically includes an employee's base salary, bonuses, retirement contributions, and the value of any additional benefits, such as health insurance, life insurance, and vacation time.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.