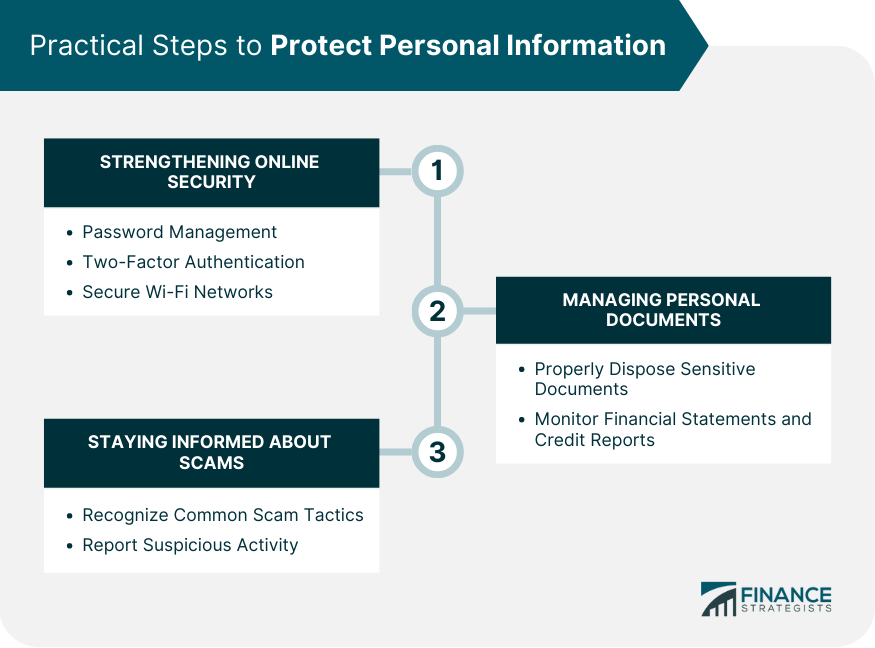

Retirement planning and identity theft protection are two essential components of financial security. Retirement planning involves setting aside money in a tax-advantaged account, such as a 401(k) or IRA, to ensure a comfortable retirement. Identity theft protection, on the other hand, involves taking proactive measures to safeguard personal and financial information from cybercriminals who seek to steal identities for fraudulent purposes. This includes monitoring credit reports, using strong passwords, and being vigilant for phishing scams. Both retirement planning and identity theft protection require careful consideration and planning to ensure a secure financial future. One of the most significant risks during retirement is Social Security fraud. Criminals can use your Social Security number to collect benefits or even file taxes in your name. It is essential to protect your Social Security number and be cautious when sharing it with anyone. Medical identity theft occurs when someone uses your personal information to receive medical care or prescriptions or even file false insurance claims. This type of fraud can impact your access to healthcare and potentially ruin your medical history. Retirees are often targets of various financial scams, such as investment schemes or fake lottery winnings. These scams can lead to significant financial losses and damage to your credit score. As technology becomes more prevalent; retirees must be aware of Internet and email scams. Phishing emails, fake websites, and online scams can lead to identity theft and significant financial losses. Identity theft can have severe financial consequences, particularly during retirement when your income may be limited. If a cybercriminal gains access to your personal information and drains your retirement account, it can put your financial security in jeopardy. By securing your identity, you can safeguard your retirement savings, ensuring that you can enjoy your golden years without financial stress. Identity theft can damage your credit score and financial reputation, making it difficult to obtain loans or credit cards. Protecting your identity helps maintain your financial standing, ensuring that you can access the financial products and services you need during retirement. Identity theft can cause emotional and mental stress, particularly for retirees who may be more vulnerable to scams and fraud. By taking preventative measures and securing your identity, you can enjoy a worry-free retirement, free from the stress and anxiety that come with identity theft. Identity theft can lead to legal issues if criminals use your information to commit crimes. This can lead to a lengthy and costly legal process, which can be particularly challenging during retirement. Protecting your identity helps to avoid potential legal complications and ensures that you can enjoy your retirement years without legal troubles. Use strong, unique passwords for all your online accounts, and consider using a password manager to store and generate secure passwords. Enable two-factor authentication on your accounts to add an extra layer of security. Ensure that your home Wi-Fi network is password-protected and secure, and avoid using public Wi-Fi networks for sensitive transactions. Shred or destroy sensitive documents, such as bank statements and tax forms, before disposing of them. Regularly review your financial statements and credit reports for any suspicious activity or unauthorized transactions. Educate yourself about common scams and learn to recognize the warning signs. Report any suspicious activity to the appropriate authorities, such as the Federal Trade Commission (FTC). Consider subscribing to credit monitoring services to receive alerts for any changes to your credit reports. Identity theft insurance can help cover the costs associated with recovering from identity theft, such as legal fees and lost wages. Place a fraud alert or credit freeze on your credit reports to make it more difficult for criminals to open new accounts in your name. Consult with financial advisors, attorneys, or other professionals to ensure that your identity and assets are protected. Make sure your estate planning documents, such as wills, trusts, and beneficiary designations, are up-to-date and accurately reflect your wishes. Review and update your will and power of attorney documents regularly to ensure they accurately represent your current situation and preferences. Retirement planning and identity theft protection are critical components of financial security. Retirees are vulnerable to various identity theft risks, including Social Security fraud, medical identity theft, financial fraud, and internet and email scams. Protecting your identity can safeguard your retirement savings, financial reputation, and mental well-being. Practical steps to protect personal information include strengthening online security, managing personal documents, and staying informed about scams. Additional identity theft protection services, such as credit monitoring, identity theft insurance, fraud alert, and credit freeze options, can offer additional layers of protection. Seeking professional advice, ensuring proper estate planning, and regularly updating wills and power of attorney documents can also help protect retirees from potential legal and financial issues. By taking proactive measures to protect their identities, retirees can enjoy a worry-free retirement with peace of mind.Retirement and Identity Theft Protection Overview

Common Identity Theft Risks During Retirement

Social Security Fraud

Medical Identity Theft

Financial Fraud

Internet and Email Scams

Importance of Identity Theft Protection in Retirement

Protecting Retirement Savings

Safeguarding Credit and Financial Reputation

Ensuring a Stress-Free Retirement

Preventing Potential Legal Issues

Practical Steps to Protect Personal Information

Strengthening Online Security

Password Management

Two-Factor Authentication

Secure Wi-Fi Networks

Managing Personal Documents

Properly Disposing of Sensitive Documents

Monitoring Financial Statements and Credit Reports

Staying Informed About Scams

Recognizing Common Scam Tactics

Reporting Suspicious Activity

Additional Identity Theft Protection Services

Credit Monitoring Services

Identity Theft Insurance

Fraud Alert and Credit Freeze Options

Legal and Financial Considerations

Seeking Professional Advice

Ensuring Proper Estate Planning

Updating Wills and Power of Attorney

Conclusion

Retirement and Identity Theft Protection FAQs

During retirement, common identity theft risks include Social Security fraud, medical identity theft, financial fraud, and internet and email scams. It is essential to be aware of these risks and take appropriate measures to protect your personal information.

Identity theft protection is crucial during retirement because it helps protect retirement savings, safeguard credit and financial reputation, ensure a stress-free retirement, and prevent potential legal issues. Taking proactive measures can help secure your personal information and financial assets.

Retirees can strengthen their online security by using strong passwords, enabling two-factor authentication, and securing their Wi-Fi networks. Additionally, they can manage personal documents by properly disposing of sensitive documents and monitoring financial statements and credit reports. Staying informed about scams and reporting suspicious activity is also essential.

Retirees can use credit monitoring services, identity theft insurance, and fraud alert or credit freeze options to enhance their identity theft protection during retirement. These services can help detect potential identity theft early and limit the damage caused by unauthorized access to personal information.

To ensure identity theft protection during retirement, retirees should seek professional advice from financial advisors or attorneys, ensure proper estate planning, and regularly update their wills and power of attorney documents. These steps can help protect retirees' personal information and financial assets from potential identity theft.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.