Retirement plan consolidation refers to the process of combining multiple retirement accounts into a single account to simplify account management and streamline retirement savings. This process often involves transferring or rolling over funds from one or more retirement accounts, such as 401(k) plans from previous employers, into a single retirement account, such as an individual retirement account (IRA) or a current employer's 401(k) plan. The goal of consolidation is to reduce the complexity of managing multiple accounts, improve investment oversight, and potentially reduce fees. Consolidation can offer several benefits, including easier tracking of investment performance, a more cohesive investment strategy, and reduced administrative paperwork. Additionally, it may help individuals avoid missing required minimum distributions (RMDs) from multiple accounts. However, before proceeding with consolidation, individuals should carefully consider factors such as investment options, fees, tax implications, and the potential loss of certain benefits associated with employer-sponsored plans. Consolidating retirement plans can simplify your financial management by reducing the number of accounts you need to track and maintain. Having fewer accounts can make it easier to monitor your investments and assess your overall progress toward your retirement goals. Some retirement plans charge administrative fees and other expenses that can eat away at your investment returns over time. By consolidating your retirement plans, you can reduce these fees and keep more of your hard-earned money working for you. Consolidating your retirement plans may also give you access to a wider range of investment options, allowing you to create a more diversified portfolio that better suits your risk tolerance and investment objectives. By consolidating your retirement plans, you can gain greater control over your asset allocation, making it easier to adjust your investments as your financial situation and goals change over time. Traditional IRA Rollover: You can roll over your existing retirement accounts into a Traditional IRA, which may provide a wider range of investment options and lower fees than your current plan. Roth IRA Conversion: Converting your pre-tax retirement accounts to a Roth IRA allows for tax-free withdrawals in retirement, but requires paying taxes on the converted amount. Check with your new employer to determine if you can transfer assets from your previous retirement plans into them. Before transferring assets, compare the investment options, fees, and other features of your new employer's plan with your existing accounts to ensure it's the best choice for your financial goals. Be aware of any fees or costs associated with transferring assets to a new employer's plan. Combining Multiple 401(k)s: If you have multiple 401(k) accounts from different employers, you can consolidate them into a single account, making it easier to manage your investments and potentially reducing fees. Merging Different IRA Accounts: You can consolidate multiple IRA accounts (Traditional, Roth, SEP, and SIMPLE) of the same type to streamline your financial management and reduce fees. Evaluate the investment options available in your current retirement accounts and any potential consolidated accounts. Consider factors such as investment performance, risk, and diversification. Compare the fees and costs associated with your current retirement accounts and any potential consolidated accounts, including administrative fees, expense ratios, and any fees for transferring assets. Consider the tax implications of consolidating your retirement accounts, such as the potential for increased taxes due to a Roth IRA conversion or the loss of tax benefits if you move assets from a tax-advantaged employer plan to a taxable account. Understand how consolidating your retirement accounts may affect your required minimum distributions once you reach the age of 73. RMDs are calculated differently for different types of retirement accounts and can impact your tax liability. Review the legal protections offered by different types of retirement accounts, as some accounts, such as 401(k)s, may offer greater protection from creditors than IRAs. Consider the accessibility of your funds in different types of retirement accounts, as some accounts may have more restrictive rules for withdrawals and loans than others. Evaluate how consolidating your retirement accounts may affect your estate planning goals, including the impact on beneficiaries, taxes, and the ability to stretch distributions over a longer period. Gather information on all of your current retirement accounts, including balances, investment options, fees, and any special features or restrictions. Consider your financial goals, time horizon, and risk tolerance when evaluating your retirement plan consolidation options. Compare the investment options, fees, and other features of your current retirement accounts with those of any potential consolidated accounts to determine which option best aligns with your financial goals. Decide on the best consolidation strategy for your situation, whether it's rolling over assets into an IRA, transferring assets to a new employer's plan, or consolidating within the same plan type. Contact the financial institutions that hold your retirement accounts to initiate the transfer or rollover process. Be prepared to provide any necessary documentation and follow their instructions carefully to avoid penalties or tax consequences. After consolidating your retirement accounts, monitor your investments regularly and adjust as needed to stay on track with your financial goals. Retirement plan consolidation can offer several benefits, including simplification of financial management, potential cost savings, improved investment options, and increased asset allocation flexibility. Individuals can consolidate retirement plans by rolling over into an IRA, transferring assets to a new employer's plan, or consolidating within the same plan type. To perform a retirement plan consolidation, individuals should review their current retirement accounts, assess their financial goals and risk tolerance, compare investment options and fees, determine the best consolidation strategy, initiate the transfer or rollover process, and monitor and manage consolidated accounts regularly. However, before proceeding with consolidation, individuals should carefully consider factors such as investment options, fees, tax implications, and the potential loss of certain benefits associated with employer-sponsored plans. What Is Retirement Plan Consolidation?

Reasons for Retirement Plan Consolidation

Simplification of Financial Management

Potential Cost Savings

Improved Investment Options

Increased Asset Allocation Flexibility

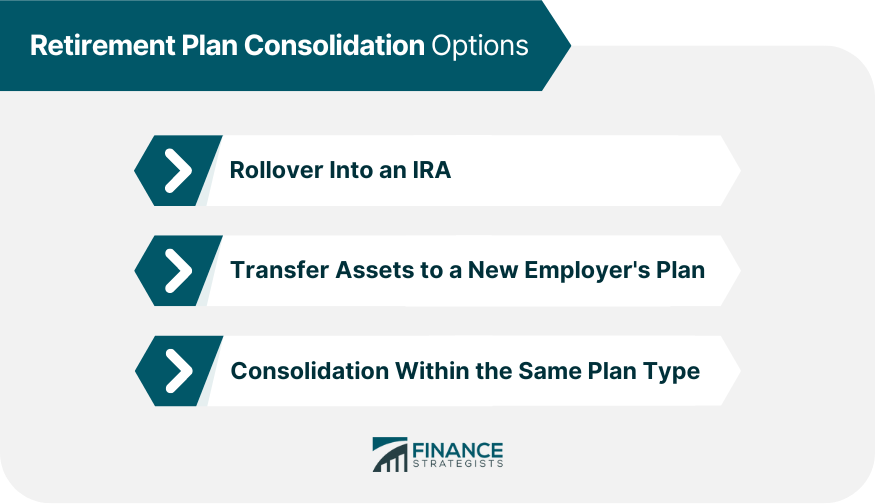

Retirement Plan Consolidation Options

Rollover Into an IRA

Transfer Assets to a New Employer's Plan

Consolidation Within the Same Plan Type

Factors to Consider Before Performing Retirement Plan Consolidation

Investment Options

Costs and Fees

Tax Implications

Required Minimum Distributions (RMDs)

Legal Protections

Access to Funds

Estate Planning Considerations

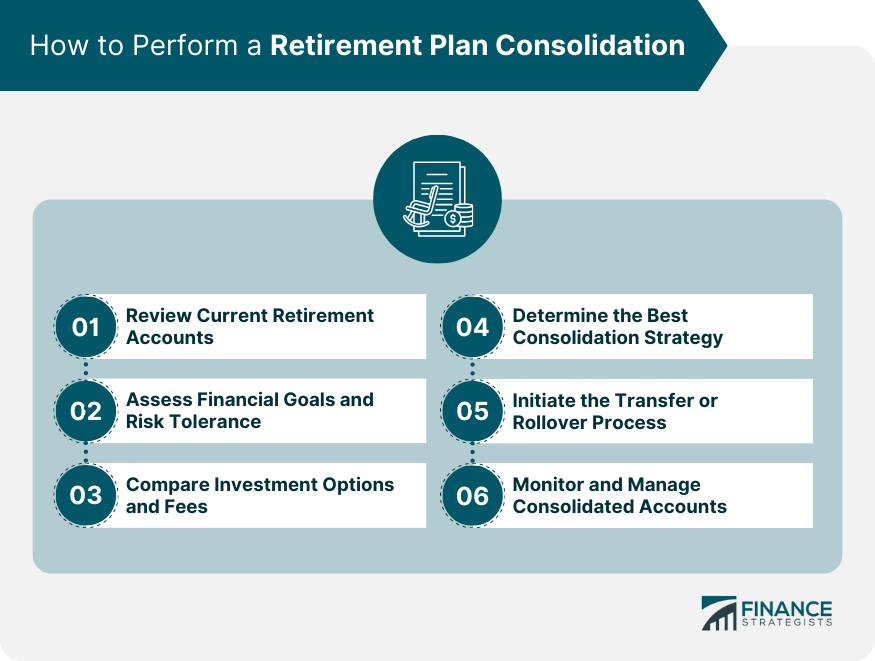

How to Perform a Retirement Plan Consolidation

Review Current Retirement Accounts

Assess Financial Goals and Risk Tolerance

Compare Investment Options and Fees

Determine the Best Consolidation Strategy

Initiate the Transfer or Rollover Process

Monitor and Manage Consolidated Accounts

Conclusion

Retirement Plan Consolidation FAQs

Retirement plan consolidation refers to the process of combining multiple retirement accounts, such as 401(k)s or IRAs, into a single account to simplify management and save on fees.

Consolidating your retirement plans can make it easier to manage your investments, reduce paperwork, and simplify retirement planning. Additionally, consolidating may result in lower fees and higher returns.

To perform a retirement plan consolidation, you need to review your current retirement accounts, assess your financial goals and risk tolerance, compare investment options and fees, determine the best consolidation strategy, initiate the transfer or rollover process, and monitor and manage consolidated accounts regularly.

The important factors to consider before performing retirement plan consolidation include investment options, costs and fees, tax implications, required minimum distributions (RMDs), legal protections, access to funds, and estate planning considerations.

The retirement plan consolidation options available include rolling over into an IRA, transferring assets to a new employer's plan, and consolidating within the same plan type.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.