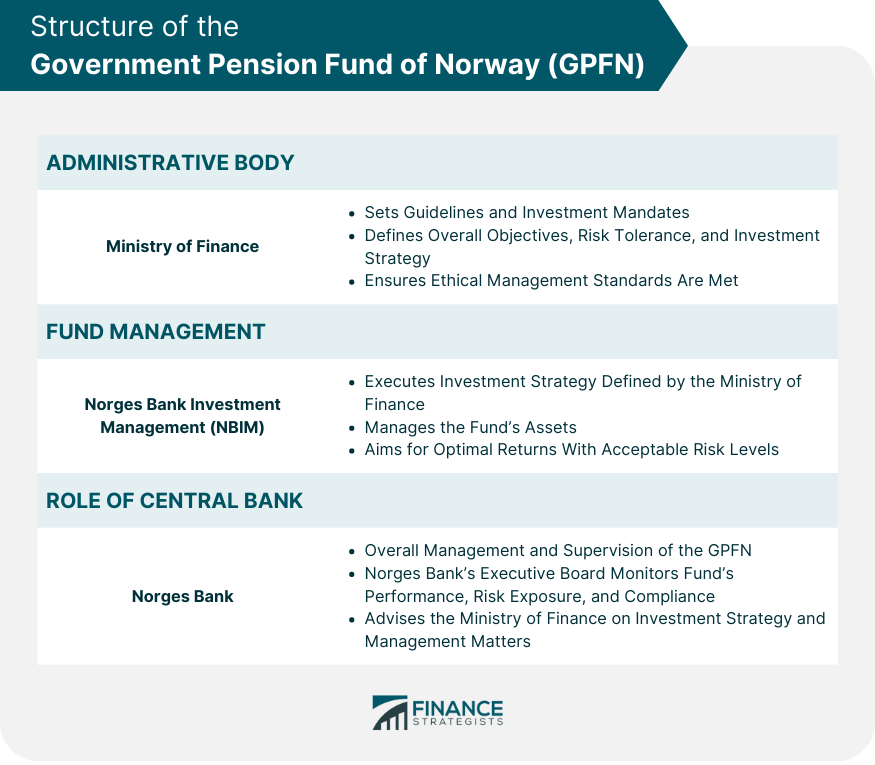

The Government Pension Fund of Norway (GPFN) is a sovereign wealth fund established in 1990 to manage Norway's oil and gas revenues for future generations. It is overseen by the Ministry of Finance and managed operationally by Norges Bank Investment Management (NBIM). The GPFN consists of two components: the Government Pension Fund Global (GPFG), which invests internationally, and the GPFN, which focuses on domestic investments. The fund plays a crucial role in Norway's economy, providing financial stability, acting as a buffer against oil price fluctuations, and contributing to the country's long-term wealth and public spending. The GPFN follows ethical guidelines, integrates Environmental, Social, and Governance (ESG) factors into its investment decisions, and promotes responsible business practices. The Ministry of Finance oversees the GPFN, setting guidelines and investment mandates for the fund. The Ministry defines the fund's overall objectives, risk tolerance, and investment strategy while ensuring its management meets the highest ethical standards. The operational management of the GPFN is entrusted to Norges Bank Investment Management, a separate division of Norway's central bank, Norges Bank. NBIM is responsible for executing the investment strategy defined by the Ministry of Finance, managing the fund's assets, and ensuring optimal returns with acceptable risk levels. NBIM is also charged with implementing the ethical guidelines set by the Ministry of Finance for the GPFN. Norges Bank, as the country's central bank, plays a crucial role in the overall management and supervision of the GPFN. Besides the operational management through NBIM, Norges Bank's Executive Board is responsible for monitoring the fund's performance, risk exposure, and compliance with investment mandates and ethical guidelines. The central bank also advises the Ministry of Finance on matters related to the GPFN's investment strategy and management. The Government Pension Fund Global is the largest and most well-known component of the GPFN. The GPFG invests in international financial markets, including equities, fixed income, and real estate. The fund's diversified portfolio comprises assets in over 70 countries, reflecting its long-term investment horizon and risk management strategy. The GPFN is the smaller national component of the overall fund. It primarily invests in domestic equities and fixed-income securities, promoting long-term capital appreciation and income generation for the Norwegian economy. The GPFN is subject to different investment mandates and risk profiles than the GPFG, reflecting its more domestic-oriented investment strategy. The GPFN's investment philosophy is centered around long-term, sustainable growth with a focus on preserving wealth for future generations. The fund's management emphasizes diversification, risk management, and ethical investment practices to achieve these goals. The GPFN adheres to the principles of responsible investing, considering environmental, social, and governance factors when selecting its investments. The GPFN's asset allocation is determined by the Ministry of Finance, aiming to achieve a well-diversified portfolio that balances risk and return. The fund invests primarily in equities, fixed income, and real estate, with a target allocation of 70% equities, 30% fixed income, and up to 7% real estate. These allocations are subject to regular review and adjustment, reflecting changes in market conditions and risk appetite. Risk management is a critical aspect of the GPFN's investment strategy. The fund employs a systematic approach to risk management, which includes defining risk parameters, regularly monitoring and reviewing risk exposures, and taking corrective actions when necessary. The aim is to ensure that the fund's investments align with its risk tolerance, providing a stable return over the long term. The GPFN has a significant impact on Norway's economy. As one of the world's largest sovereign wealth funds, it provides a substantial buffer against economic shocks, contributing to Norway's financial stability. The fund's investment returns also supplement the state budget, supporting public spending and helping to maintain Norway's generous social welfare system. Globally, the GPFN is a significant player in international financial markets due to its size and global investment portfolio. Its investment decisions often influence market trends and can impact the performance of individual companies and sectors. Moreover, the fund's commitment to ESG principles has encouraged other investors to adopt more sustainable and responsible investment practices. The GPFN also plays a critical role in Norway's fiscal policy. The government restricts the use of the fund's income to a certain percentage, known as the fiscal rule, to ensure the wealth is shared with future generations. This practice allows Norway to maintain a balanced budget without relying too heavily on oil and gas revenues, promoting long-term fiscal sustainability. The GPFN follows a set of ethical guidelines established by the Ministry of Finance, which direct its investment practices. These guidelines prohibit the fund from investing in companies involved in activities that violate human rights, cause severe environmental damage, or produce certain types of weapons. The fund also excludes companies involved in tobacco production or those that derive a significant portion of their income from coal-based activities. The GPFN is a global leader in sustainable investing. It integrates ESG considerations into its investment decision-making process and actively engages with the companies in its portfolio to promote responsible business practices. The fund also contributes to developing international standards and norms for sustainable investing. Through its active ownership policy, the GPFN uses its influence as a large institutional investor to promote responsible business practices. The fund votes at shareholder meetings, dialogues with company management, and collaborates with other investors to address ESG issues. These efforts aim to improve the long-term performance of the fund's investments and contribute to sustainable global development. Since its inception, the GPFN has delivered solid returns, significantly contributing to Norway's national wealth. The fund's long-term investment horizon, diversified portfolio, and robust risk management practices have enabled it to weather market volatility and generate positive returns. The GPFN's performance is inevitably affected by global economic events. During global financial crises, such as the 2008 financial crisis and the COVID-19 pandemic, the fund experienced significant losses. However, due to its long-term investment strategy and effective risk management, the fund has been able to recover from these setbacks and continue to grow. Compared to other sovereign wealth funds, the GPFN stands out for its transparency, ethical investment practices, and active role in promoting sustainable development. In terms of financial performance, the fund's returns have been comparable to those of other large sovereign wealth funds. The GPFN's long-term, risk-adjusted returns are generally considered satisfactory, given its mandate and risk tolerance. Despite its ethical guidelines, the GPFN has faced criticism for some of its investments. Critics argue that the fund's investments in fossil fuels contradict its commitment to sustainability, even though these investments meet the fund's formal criteria for inclusion. The fund has also been criticized for investing in companies accused of human rights violations, raising questions about the effectiveness of its ethical screening process. Some critics have raised concerns about the governance and management of the GPFN. There have been debates about the transparency of the fund's investment decisions, the effectiveness of its active ownership practices, and the adequacy of its risk management systems. These concerns highlight the challenges of managing a fund of GPFN's size and complexity. One of the main criticisms of the GPFN is the risk of over-reliance on the oil and gas sector. Although the fund was established to manage the country's oil wealth, its significant investments in the fossil fuel industry could expose it to financial risks in the face of a global transition to cleaner energy sources. This risk underscores the need for the GPFN to diversify its investment portfolio and align its strategy with global sustainability trends. The Government Pension Fund of Norway is a vital component of Norway's economy, serving as a strategic tool to manage the country's oil and gas revenues for the benefit of future generations. The oversight of the Ministry of Finance, operational management by Norges Bank Investment Management, and supervision by Norges Bank characterize the structure of the GPFN. The fund comprises two components: the GPFG and the GPFN, which enable diversification and a focus on international and domestic investments. The GPFN's significance lies in its contribution to financial stability, safeguarding against oil price fluctuations and supporting long-term wealth creation. Committing to ethical investment practices, the fund integrates environmental, social, and governance factors into its decision-making process and promotes responsible business practices. Overall, the Government Pension Fund of Norway is a testament to prudent management, responsible investing, and a long-term vision for sustainable wealth preservation and growth.Overview of the Government Pension Fund of Norway

Structure of the Government Pension Fund of Norway

Administrative Body

Fund Management

Role of Norway's Central Bank

Components of the Government Pension Fund of Norway

Global Component

National Component

Investment Strategy of the Government Pension Fund of Norway

Investment Philosophy

Asset Allocation

Risk Management

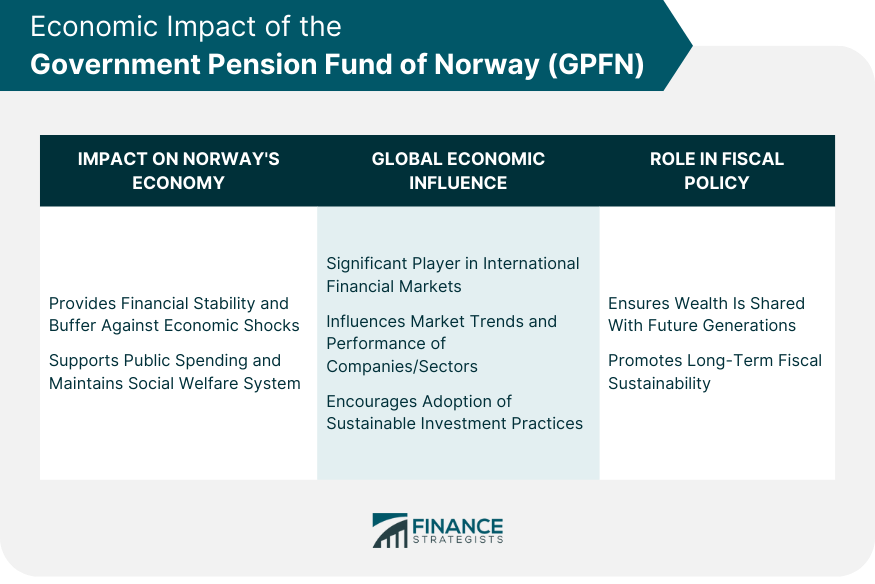

Economic Impact of the Government Pension Fund of Norway

Impact on Norway's Economy

Global Economic Influence

Role in Fiscal Policy

Ethical Guidelines of the Government Pension Fund of Norway

Ethical Investment Policies

Sustainable Investment Practices

Role in Promoting Responsible Business Practices

Performance and Returns of the Government Pension Fund of Norway

Historical Performance

Impact of Global Economic Events

Comparison With Other Sovereign Wealth Funds

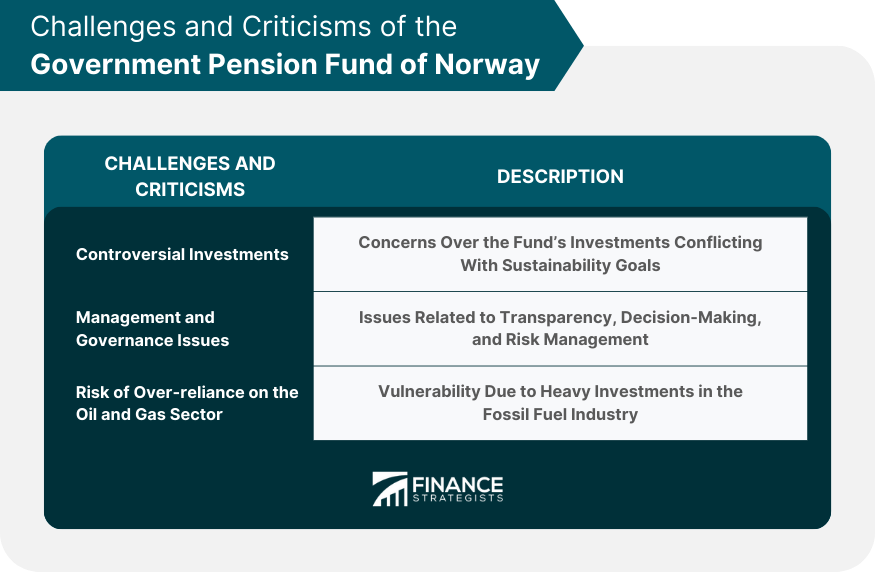

Challenges and Criticisms of the Government Pension Fund of Norway

Controversial Investments

Management and Governance Issues

Risk of Over-Reliance on the Oil and Gas Sector

Conclusion

Government Pension Fund of Norway (GPFN) FAQs

The Government Pension Fund of Norway, or GPFN, is a sovereign wealth fund established in 1990 to manage Norway's oil and gas revenues for future generations.

The GPFN plays a crucial role in Norway's economy by providing financial stability, acting as a buffer against oil price fluctuations, and contributing to the country's long-term wealth and public spending.

The GPFN is overseen by the Ministry of Finance, managed operationally by Norges Bank Investment Management (NBIM), and supervised by Norway's central bank, Norges Bank.

The GPFN consists of two components: the Government Pension Fund Global (GPFG), which invests internationally, and the Government Pension Fund Norway (GPFN), which focuses on domestic investments.

Yes, the GPFN follows ethical guidelines set by the Ministry of Finance. It integrates environmental, social, and governance (ESG) factors into its investment decisions, promotes responsible business practices, and avoids investments in companies involved in activities that violate human rights or cause severe environmental damage.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.