Withdrawal credits in a pension plan are an essential aspect of retirement planning, as they represent the accumulated value of an employee's pension benefits at the time they leave their job or retire. These credits ensure that employees receive fair and accurate retirement benefits based on their years of service and contributions to the plan. The actual amount of withdrawal credits is determined based on the pension plan's provisions and may depend on factors such as the employee's years of service, salary history, and the specific vesting schedule set by the plan. It's important to note that not all pension plans allow for withdrawal before the retirement age, and those that do may apply significant penalties or reductions to the benefit amount. In some cases, instead of a lump-sum withdrawal, the employee may opt for a deferred pension, receiving the benefits as a regular payment upon reaching retirement age. As with any aspect of pension plans, the specifics of withdrawal credits can vary widely from plan to plan. Pension plans can be broadly categorized into two types: defined benefit pension plans and defined contribution pension plans. Both types of plans have different structures and implications for withdrawal credits. In a defined benefit pension plan, the employer guarantees a specific retirement benefit based on a formula that usually considers factors such as years of service, salary history, and age at retirement. Withdrawal credits in this type of plan are calculated by applying the plan's formula to the employee's service and salary information at the time of withdrawal. Determine the formula Each defined benefit pension plan may have its own formula to calculate withdrawal credits. The formula typically takes into account the employee's contributions and years of service. Let's assume the formula is as follows: Withdrawal Credits = (Employee's Contributions + Interest) x Service factor Gather the necessary information Collect the relevant data required for the calculation. This includes the employee's total contributions made to the pension plan, the accrued interest on those contributions, and the years of service. Let's assume the employee has made contributions of $50,000, the accrued interest is $5,000, and the years of service are 10. Determine the service factor The service factor is a predetermined number that represents the percentage of the withdrawal credits the employee will receive for each year of service. The service factor can vary depending on the plan. Calculate the withdrawal credits Substitute the values into the formula to calculate the withdrawal credits. Withdrawal credits = ($50,000 + $5,000) x 0.02 x 10 = $11,000 In this example, the calculated withdrawal credits amount to $11,000. This means that if the employee chooses to leave the defined benefit pension plan before reaching retirement age, they would be entitled to receive $11,000. It's important to note that the actual calculation of withdrawal credits can be more complex and may involve additional factors such as vesting schedules and plan rules. It's always best to refer to the specific plan documents or consult a qualified financial professional for an accurate calculation. Several factors can influence the calculation of withdrawal credits in a defined benefit pension plan. These factors may vary depending on the plan's rules and regulations. Here are some common factors that can influence withdrawal credits: Employee's Contributions: The total amount of contributions made by the employee to the pension plan is a significant factor in calculating withdrawal credits. Typically, the higher the contributions, the higher the withdrawal credits. Accrued Interest: If the pension plan provides for interest on the employee's contributions, the accrued interest will contribute to the calculation of withdrawal credits. Years of Service: The length of the employee's service with the employer is an important factor. Generally, the longer the years of service, the higher the withdrawal credits. Plan Rules: Each defined benefit pension plan has its own set of rules and provisions that can affect withdrawal credits. These rules may include provisions related to vesting schedules, early retirement reductions, benefit caps, and other specific plan features. A defined contribution pension plan is based on individual accounts, with the retirement benefit determined by the account balance at the time of retirement. In this type of plan, both the employer and employee contribute to the account, and the balance grows through investment earnings. Withdrawal credits are less of a factor in defined contribution plans, as the account balance directly reflects the employee's accumulated retirement savings. Withdrawal credits in a defined contribution pension plan may come into play when an employee changes jobs and has the option to transfer their account balance to a new plan or roll it over into an individual retirement account (IRA). In this case, withdrawal credits represent the amount of the account balance eligible for transfer or rollover. Employees in a defined contribution pension plan should carefully consider the withdrawal options available to them, as different options may have different tax implications and may affect the growth potential of their retirement savings. Rolling over the account balance into an IRA or a new employer's plan can help preserve the tax-deferred status of the funds and provide additional investment opportunities. Withdrawal credits are subject to various eligibility criteria, including vesting period, age, and employment status. Understanding these criteria is essential for employees to ensure they receive the appropriate withdrawal credits when they leave their job or retire. The vesting period refers to the length of time an employee must work for an employer before they have a non-forfeitable right to their pension benefits. In other words, an employee must be "vested" in their pension plan to be eligible for withdrawal credits. The vesting period varies depending on the pension plan but typically ranges from three to seven years. Age is another factor that can affect an employee's eligibility for withdrawal credits. Most pension plans have a minimum age requirement for accessing pension benefits, which is typically around 59 and a half or 65 years, depending on the plan's rules and regulations. Employees should review their pension plan documents to understand the specific age requirements and restrictions related to their withdrawal credits. An employee's employment status may also impact their eligibility for withdrawal credits. In most cases, employees must leave their job, retire, or experience a qualifying event, such as disability or death, to be eligible for withdrawal credits. Some pension plans may also allow employees to access a portion of their withdrawal credits in specific situations, like financial hardship or the purchase of a primary residence. It is crucial for employees to be aware of their plan's rules and limitations concerning withdrawal credits based on their employment status. Withdrawal credits can significantly impact an employee's pension benefits, especially in the case of early withdrawal, deferred retirement, or reemployment. Understanding these impacts can help employees make informed decisions about their retirement planning and withdrawal strategies. Withdrawing pension benefits before reaching the plan's designated retirement age can result in reduced benefits. In a defined benefit pension plan, early withdrawal may result in a lower retirement benefit due to the application of early retirement reduction factors. In a defined contribution plan, early withdrawal means having a penalty that can lead to a smaller account balance and diminished investment growth potential. Additionally, early withdrawals may be subject to tax penalties, further reducing the value of the withdrawal credits. On the other hand, deferring retirement can result in increased pension benefits. In a defined benefit pension plan, waiting to retire can increase withdrawal credits due to additional years of service, salary increases, or cost-of-living adjustments. In a defined contribution pension plan, deferring retirement allows the account balance to continue growing through investment earnings and additional contributions, potentially resulting in a larger retirement benefit. Reemployment after receiving withdrawal credits can also impact an employee's pension benefits. In some cases, reemployment may allow employees to restore previously forfeited withdrawal credits or accrue additional credits based on their new job's pension plan. Employees should review their pension plan documents and consult with a financial professional to understand how reemployment may affect their withdrawal credits and overall pension benefits. Withdrawal credits in a pension plan can have significant tax implications, and understanding these implications can help employees plan their retirement strategy more effectively. When an employee withdraws funds from their pension plan, the withdrawal is generally considered a taxable event. The withdrawn amount is subject to federal and, in some cases, state income taxes. The specific tax treatment of withdrawal credits depends on the type of pension plan and the employee's age, withdrawal method, and other factors. Early withdrawals from pension plans can result in a 10% additional tax penalty on the withdrawn amount, on top of the regular income taxes. This penalty applies to withdrawals made before the age of 59 and a half, although some exceptions may apply, such as in cases of disability or financial hardship. Employees should carefully consider the tax implications of early withdrawals when planning their retirement strategy. Several strategies can help minimize tax liabilities associated with withdrawal credits, including rolling over the funds into an IRA or another qualified retirement plan, opting for a lump-sum distribution, or choosing an annuity payout options. Each strategy has its advantages and disadvantages, and employees should consult with a financial professional to determine the best approach for their individual circumstances. Employees can access and manage their withdrawal credits in a pension plan through several avenues, including reviewing pension plan statements, obtaining information from the Pension Benefit Guaranty Corporation (PBGC), and seeking professional guidance. Pension plan statements are an essential source of information about an employee's withdrawal credits. These statements typically provide a summary of the employee's pension benefits, including the accrued withdrawal credits, vesting status, and other relevant information. Employees should regularly review their pension plan statements to monitor their withdrawal credits and ensure they are on track to meet their retirement goals. The Pension Benefit Guaranty Corporation is a federal agency that insures defined benefit pension plans in the United States. The PBGC can provide valuable information and resources for employees seeking to understand their withdrawal credits, particularly if their pension plan is underfunded or has been terminated. In some cases, the PBGC may take over the administration of a terminated pension plan and become responsible for paying the withdrawal credits to eligible employees. Given the complexities of pension plans and the various factors that can impact withdrawal credits, employees may benefit from seeking the guidance of a financial professional. A financial planner, retirement consultant, or pension specialist can help employees navigate their pension plan's rules and regulations, assess their withdrawal options, and develop a retirement strategy that maximizes their pension benefits while minimizing tax liabilities. Understanding withdrawal credits in a pension plan is critical for employees as they plan for their retirement. Withdrawal credits represent the accumulated value of an employee's pension benefits, and their proper management can significantly impact an individual's retirement income. The specifics of how these withdrawal credits are calculated can vary depending on the plan's provisions and may be based on factors such as years of service and salary history. The purpose of withdrawal credits is to ensure that employees retain some or all of their pension benefits even if they terminate their employment early. They represent an important aspect of pension plans, providing security and promoting fairness for employees. However, individuals should carefully review their pension plan's specific rules about withdrawal credits, as accessing these funds early could come with penalties or tax implications. By considering factors such as vesting period, age, employment status, tax implications, and the different types of pension plans, employees can make informed decisions about their withdrawal strategies and optimize their financial planning for a comfortable and secure retirement.Definition of Withdrawal Credits in a Pension Plan

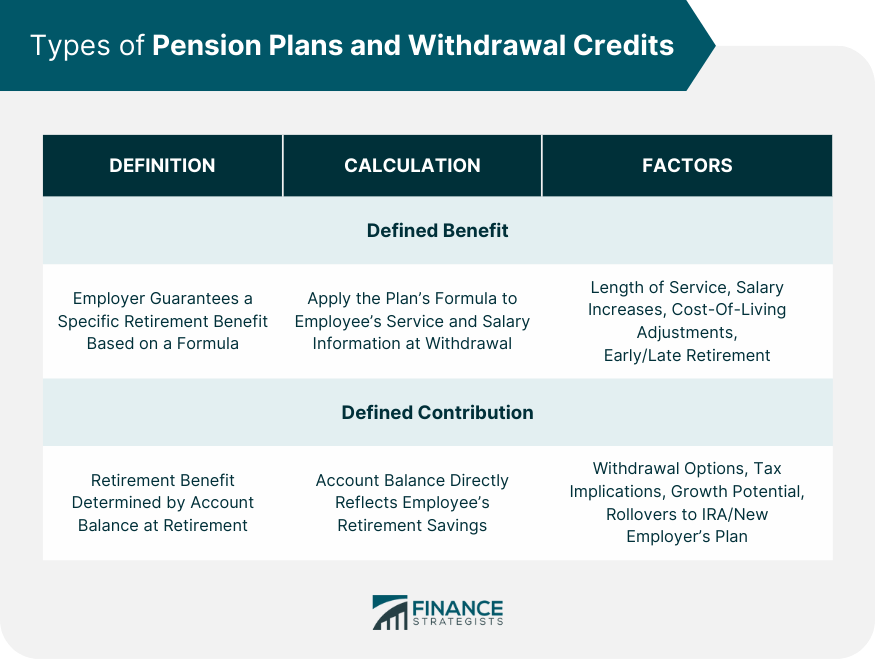

Types of Pension Plans and Their Withdrawal Credits

Defined Benefit Pension Plans

Calculating Withdrawal Credits

Let's assume the service factor is 2%.Factors Influencing Withdrawal Credits

The interest amount can vary based on the plan's interest rate or investment performance.

The service factor in the withdrawal credit formula determines how much weight is given to each year of service.Defined Contribution Pension Plans

Role of Withdrawal Credits

Withdrawal Options and Their Impact on Credits

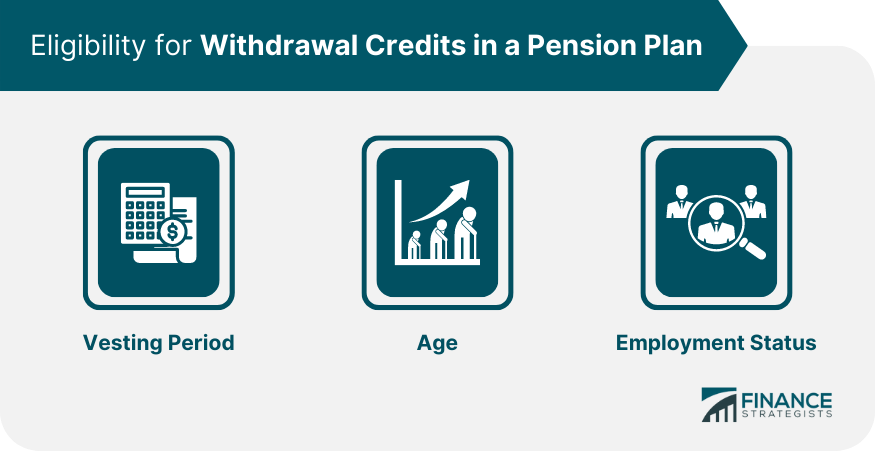

Eligibility for Withdrawal Credits in a Pension Plan

Vesting Period

Age

Employment Status

Impact of Withdrawal Credits on Pension Benefits

Early Withdrawal and Reduced Benefits

Deferred Retirement and Increased Benefits

Reemployment and Withdrawal Credits

Tax Implications of Withdrawal Credits in a Pension Plan

Taxable Events

Early Withdrawal Penalties

Strategies to Minimize Tax Liabilities

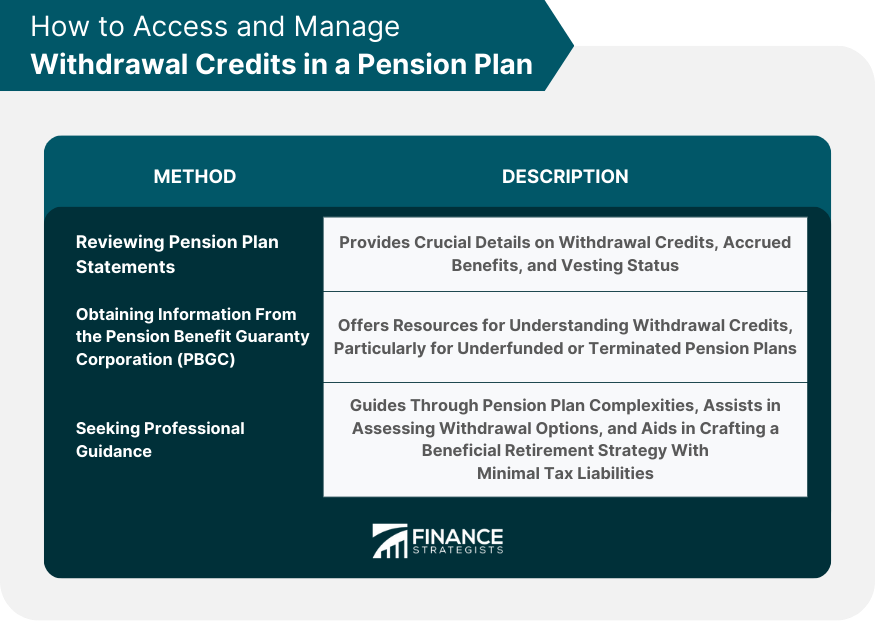

How to Access and Manage Withdrawal Credits in a Pension Plan

Reviewing Pension Plan Statements

Obtaining Information From the Pension Benefit Guaranty Corporation (PBGC)

Seeking Professional Guidance

Conclusion

Withdrawal Credits, Pension Plan FAQs

Withdrawal Credits in a Pension Plan represent the accumulated value of an employee's pension benefits at the time they leave their job or retire, ensuring that employees receive fair and accurate retirement benefits based on their years of service and contributions.

In a Defined Benefit Pension Plan, Withdrawal Credits are calculated by applying the plan's formula, typically based on factors like years of service, salary history, and age at retirement, to the employee's service and salary information at the time of withdrawal.

In Defined Contribution Pension Plans, Withdrawal Credits are less of a factor, as the account balance directly reflects the employee's accumulated retirement savings. However, they may come into play when transferring an account balance to a new plan or rolling it over into an individual retirement account (IRA).

Eligibility for Withdrawal Credits in a Pension Plan is determined by various factors, including the vesting period, age, and employment status. Employees must be vested in their pension plan, meet minimum age requirements, and typically leave their job or retire to be eligible for withdrawal credits.

Withdrawal Credits in a Pension Plan can have significant tax implications. Generally, withdrawals are subject to federal and potentially state income taxes. Early withdrawals, before the age of 59 and a half, may also incur a 10% additional tax penalty. Strategies like rolling over funds into an IRA or another qualified retirement plan can help minimize tax liabilities.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.