An unfunded pension plan, also known as a pay-as-you-go plan, is a retirement scheme where the employer does not set aside funds specifically for future pension liabilities. Instead, the benefits are paid directly from the company's current revenues or other assets. The primary obligation of the employer is to pay the promised retirement benefits when they become due. Unfunded pension plans are primarily used by employers as a means of providing additional retirement benefits to key executives or employees. These plans serve as an attractive component of an executive compensation package, helping to attract, retain, and motivate top talent. They offer a variety of benefits, including tax deferral opportunities, flexible plan design, and the ability to provide significant retirement income. Unlike funded pension plans, where assets are set aside and invested to meet future pension obligations, unfunded plans rely on the company's ongoing ability to generate income. When an employee retires, their pension benefits are paid directly from the company's current revenues or other assets. Unfunded pension plans are often targeted towards a select group of management or highly compensated employees. This exclusivity is part of what makes these plans attractive to high-ranking executives. The calculation of benefits in an unfunded pension plan typically depends on factors such as the employee's salary, years of service, and the specific terms of the plan. Unlike traditional pension plans, there are no regulatory limits on the amount of benefits that can be provided under an unfunded plan. Pay-as-you-go pension plans are a type of unfunded plan where the employer pays retirement benefits out of current income. These plans offer a high degree of flexibility, as the employer can adjust the benefit amounts and other plan terms to meet changing circumstances. Non-qualified deferred compensation (NQDC) plans are another type of unfunded plan. These plans allow executives to defer a portion of their compensation until a later date, typically after retirement, when their tax rate may be lower. The deferred amounts are not set aside in a separate fund but are rather a promise by the employer to pay the benefits in the future. The primary difference between unfunded and funded pension plans lies in their funding mechanisms and the associated risks. In a funded plan, assets are set aside and invested to meet future pension obligations, reducing the risk of the employer's default. In contrast, in an unfunded plan, the risk of the employer's insolvency is borne by the employees, as their benefits depend on the company's future financial health. There are significant tax differences between unfunded and funded pension plans. In a funded plan, employer contributions are tax-deductible when made, and the investment earnings on the fund's assets are tax-deferred. In an unfunded plan, the employer does not get a tax deduction until the benefits are paid, but the employees do not have to pay tax on the benefits until they receive them. Unfunded pension plans offer several advantages, such as flexibility in plan design and the ability to provide substantial retirement benefits. They also provide tax deferral opportunities for employees. However, they come with a higher risk due to the reliance on the company's future financial health. On the other hand, funded pension plans offer more security for employees, as the benefits are backed by a separate fund. Unfunded pension plans are typically exempt from many of the requirements of the Employee Retirement Income Security Act (ERISA) that apply to funded pension plans. However, they must still comply with certain ERISA provisions, such as those regarding reporting and disclosure. Non-compliance with these requirements can result in significant penalties. While unfunded pension plans offer significant tax advantages, they must be carefully structured to comply with tax regulations. For instance, they must meet the requirements of the Internal Revenue Code Section 409A, which governs non-qualified deferred compensation plans. Failure to comply with these requirements can result in severe tax consequences for the employees. Despite their advantages, unfunded pension plans come with certain limitations and restrictions. For instance, they cannot be used to provide benefits to rank-and-file employees. Also, the benefits under these plans are generally subject to the company's creditors in the event of bankruptcy. The company's board of directors plays a crucial role in the administration and governance of an unfunded pension plan. They are responsible for the strategic oversight of the plan, including its design, implementation, and funding strategy. This often involves making complex decisions that balance the interests of the company, its shareholders, and the plan participants. While some companies choose to administer their unfunded pension plans in-house, many engage third-party administrators. These specialists can provide valuable expertise in areas such as plan design, compliance, and communication, helping to ensure that the plan runs smoothly and effectively. Transparent communication is critical in the administration of unfunded pension plans. Companies must clearly communicate the terms and conditions of the plan to the participants. They must also meet certain disclosure requirements under ERISA and securities laws, particularly if the company is publicly traded. Unfunded pension plans, which are primarily pay-as-you-go schemes or non-qualified deferred compensation plans, are an integral part of an attractive executive compensation package. They enable employers to offer substantial retirement benefits to key executives without setting aside specific funds for future pension liabilities. The funding mechanism, eligibility criteria, and benefit calculation form the key characteristics of these plans. The type of unfunded pension plan, whether a pay-as-you-go scheme or a non-qualified deferred compensation plan, can vary based on the company's needs and the specific circumstances of the executive. Each type comes with its own set of advantages, and the choice between the two should be made carefully. While unfunded pension plans offer numerous benefits, they also come with potential risks and challenges. These plans must be carefully designed and administered to comply with legal and regulatory requirements and to align with the company's strategic objectives. Navigating the complexities of unfunded pension plans can be challenging. Whether you're an executive considering such a plan or a company looking to implement one, seeking professional advice can be invaluable. What Is an Unfunded Pension Plan?

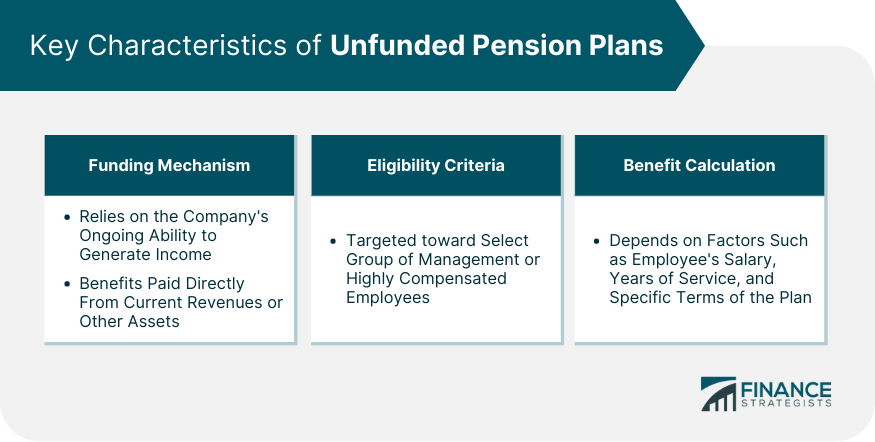

Key Characteristics of Unfunded Pension Plans

Funding Mechanism

Eligibility Criteria

Benefit Calculation

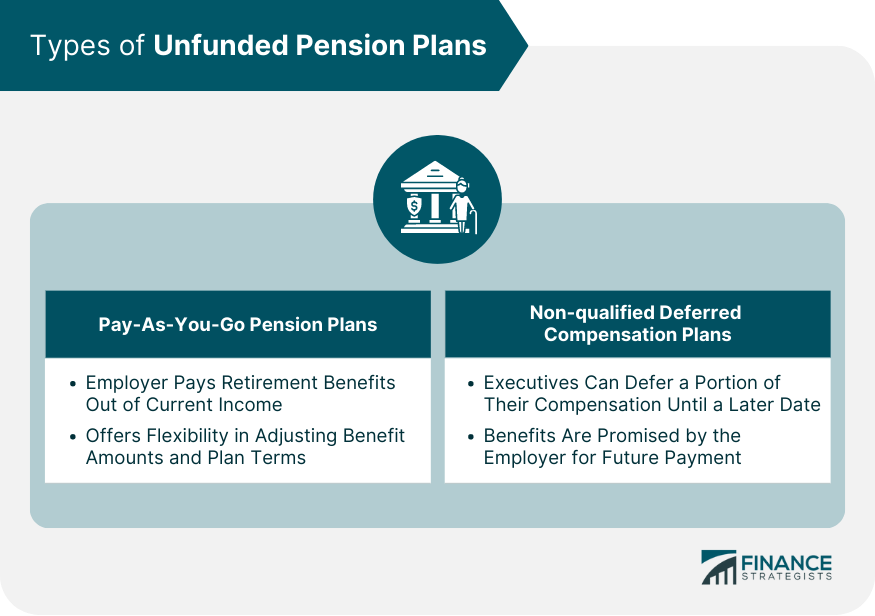

Types of Unfunded Pension Plans

Pay-As-You-Go Pension Plans

Non-qualified Deferred Compensation Plans

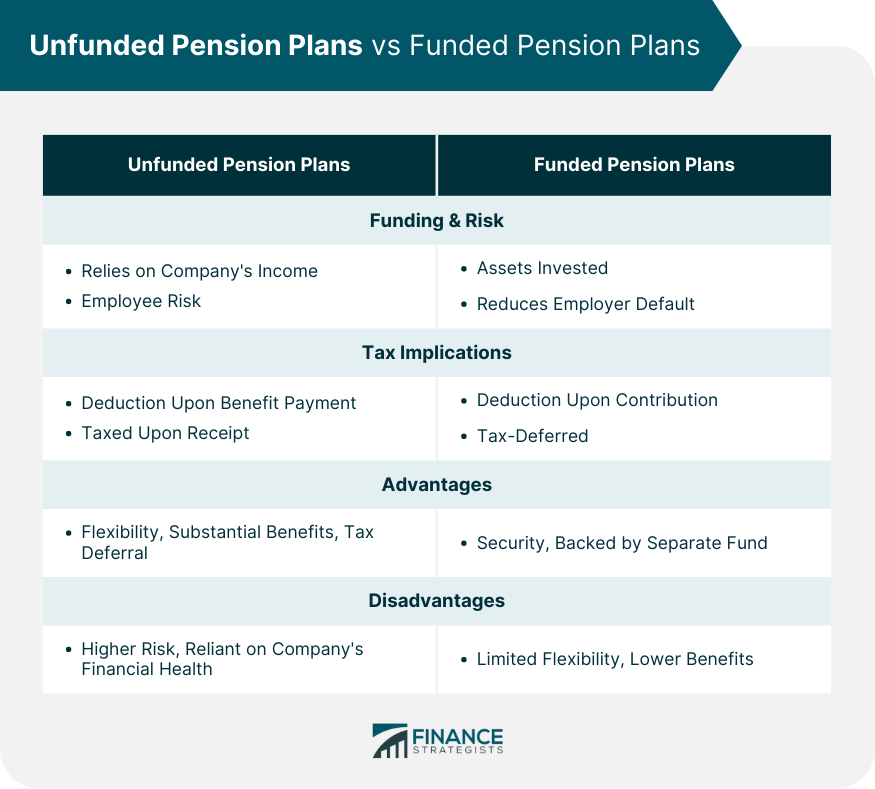

Comparison: Unfunded Pension Plans vs Funded Pension Plans

Differences in Funding and Risk

Tax Implications

Advantages and Disadvantages of Each Type

Legal and Regulatory Considerations

Compliance with the Employee Retirement Income Security Act (ERISA)

Tax Regulations

Potential Limitations and Restrictions

SERP Administration and Governance

Role of the Company's Board of Directors

Engagement of Third-Party Administrators

Communication and Disclosure Requirements

Final Thoughts

Unfunded Pension Plan FAQs

An unfunded pension plan is a type of retirement plan where the employer does not set aside specific funds to meet future pension liabilities. Instead, the retirement benefits are paid directly from the company's current revenues or other assets when they become due.

Unfunded pension plans are typically targeted toward a select group of key employees or executives. They are often used as part of an attractive compensation package to attract, retain, and motivate top talent within an organization.

The calculation of benefits in unfunded pension plans usually depends on various factors, such as the employee's salary, years of service, and specific terms of the plan. Unlike traditional pension plans, there are no regulatory limits on the amount of benefits that can be provided under an unfunded plan.

Unfunded pension plans offer flexibility in design, the ability to provide significant retirement benefits, and tax deferral opportunities for employees. However, the benefits under these plans are subject to the company's financial health and are generally subject to the company's creditors in the event of bankruptcy.

Yes, unfunded pension plans must comply with certain regulations, including provisions of the Employee Retirement Income Security Act (ERISA) and the Internal Revenue Code. Failure to comply with these regulations can result in significant penalties and tax consequences.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.