A plan participant portal is a secure online platform that allows users to access and manage their benefit plans, such as retirement accounts, health savings accounts, or insurance policies. The portal provides a centralized location for users to review their accounts, make changes, and monitor their investments. The primary purpose of a plan participant portal is to empower users to take control of their benefits and financial future. The portal simplifies the process of managing multiple accounts and provides a user-friendly way to access important information. It also promotes transparency and accountability, helping users make informed decisions about their benefits and investments. Plan participant portals come in various forms, each designed to cater to specific benefits and user requirements. The most common types include: These portals are dedicated to managing retirement accounts such as 401(k)s, 403(b)s, pensions, and profit-sharing plans. They allow users to view their account balances, monitor investment performance, change contribution levels, and select from a range of investment options. HSA portals enable users to manage their health savings accounts effectively. Users can track their account balances, view transaction history, submit claims for eligible medical expenses, and manage investments within their HSA. FSA portals are designed to help users manage their flexible spending accounts for healthcare and dependent care expenses. Users can monitor their account balances, track spending, submit claims for reimbursement, and access information on eligible expenses. These portals focus on managing various insurance products and benefits, such as life, health, disability, and long-term care insurance. Users can access their policy details, review coverage information, update personal information, and submit claims through these platforms. For individuals with education savings plans like 529 plans or Coverdell Education Savings Accounts (ESAs), dedicated portals provide a means to manage their accounts, track investment performance, and make contributions. The account summary and dashboard provide users with a snapshot of their account balances, investment performance, and other key metrics. This component serves as the main hub for users to review their financial situation and make informed decisions about their benefits and investments. Plan participant portals often include detailed information about available investment options, including historical performance, fees, and risk profiles. This component helps users make informed decisions about their investment strategy and ensures they are aware of the risks and potential rewards associated with each option. Contribution management features allow users to easily review, modify, and track their contributions to their accounts. This component is particularly important for retirement accounts, where regular contributions are essential for long-term financial success. The ability to update personal and beneficiary information is a crucial component of a plan participant portal. This feature ensures that users can easily make changes to their accounts, such as updating their addresses, adding or removing beneficiaries, and adjusting their marital status. Retirement planning tools and calculators are often integrated into plan participant portals, enabling users to estimate their retirement needs, calculate potential savings, and develop a personalized retirement plan. These tools provide valuable insights and help users to take a proactive approach to their financial future. Access to customer support and communication channels is an essential component of a plan participant portal. This can include live chat, email support, or phone support, ensuring users have access to assistance when needed. Additionally, communication features such as newsletters, announcements, and educational resources keep users informed and engaged with their benefits. A plan participant portal should provide users with easy access to compliance and regulatory information related to their benefits and investments. This component ensures users stay informed about legal requirements and helps them understand the potential implications of their decisions. Successful implementation of a plan participant portal requires careful data migration and system compatibility planning. This process involves transferring existing data to the new platform, ensuring that all information is accurate and complete, and addressing any technical issues that may arise during the transition. Implementing a plan participant portal demands a strong focus on security and privacy considerations. Organizations must ensure that the portal adheres to industry standards and regulatory requirements and that users' sensitive financial and personal information is protected at all times. To ensure the success of a plan participant portal, it is essential to invest in training and user adoption initiatives. This can include providing users with comprehensive training materials, hosting workshops or webinars, and offering ongoing support to help users become familiar with the platform and its features. Plan participant portals require ongoing maintenance and updates to ensure they remain secure, user-friendly, and aligned with industry best practices. Regular updates may include adding new features, enhancing the user interface, or addressing any security vulnerabilities that may arise. A well-designed plan participant portal offers a user-friendly interface, making it easy for users to navigate and access information. This feature is crucial in encouraging users to actively engage with their benefits, investments, and financial planning. Plan participant portals prioritize security and privacy, ensuring that users' sensitive financial and personal information remains protected. This is achieved through features such as encryption, two-factor authentication, and secure socket layer (SSL) technology. Real-time updates in a plan participant portal allow users to stay informed about the current status of their accounts and investments. This feature promotes proactive decision-making and helps users to respond quickly to changes in the market or their personal circumstances. Centralized information management is a key feature of plan participant portals, enabling users to access all their benefits and account information in one place. This feature simplifies the process of managing multiple accounts and ensures that users have a clear and comprehensive overview of their financial situation. Customization and personalization features allow users to tailor their plan participant portal experience to their unique needs and preferences. This can include adjusting the dashboard layout, setting up alerts and notifications, or accessing personalized financial advice. Data privacy is a significant concern for plan participant portals, as these platforms store and manage sensitive personal and financial information. Organizations must ensure that they comply with relevant data protection regulations and implement robust security measures to safeguard user information. Technological barriers can present challenges for the implementation and use of plan participant portals. These barriers may include limited access to the internet, outdated software or hardware, or a lack of digital literacy among users, which can hinder the adoption and success of the portal. User resistance to change can be a major obstacle when introducing a plan participant portal. Users may be hesitant to adopt new technology, particularly if they are accustomed to traditional methods of managing their benefits. It is crucial to invest in user training and support to overcome this resistance. Complying with legal and regulatory requirements is a significant challenge for plan participant portals. Organizations must ensure that their portals adhere to relevant industry standards and regulations, such as the Employee Retirement Income Security Act (ERISA) and the Health Insurance Portability and Accountability Act (HIPAA). A plan participant portal is an online platform that empowers users to access and manage their benefit plans securely, including retirement accounts, health savings accounts, and insurance policies. The portal simplifies the process of managing multiple accounts and promotes transparency and accountability, helping users make informed decisions about their benefits and investments. Different types of plan participant portals cater to specific benefits and user requirements, such as employee retirement plan portals, health savings account portals, flexible spending account portals, insurance and benefits management portals, and education savings plan portals. The key components of a plan participant portal include an account summary and dashboard, investment options and performance, contribution management, beneficiary, and personal information updates, retirement planning tools and calculators, and others. However, implementing a plan participant portal requires careful planning for data migration, system compatibility, security and privacy considerations, training and user adoption, and ongoing maintenance and updates. Plan participant portals offer user-friendly interfaces, secure access, real-time updates, centralized information management, customization, and personalization features. On the other hand, such portals also face challenges and limitations, such as data privacy concerns, technological barriers, user resistance to change, and legal and regulatory compliance.What Is Plan Participant Portal?

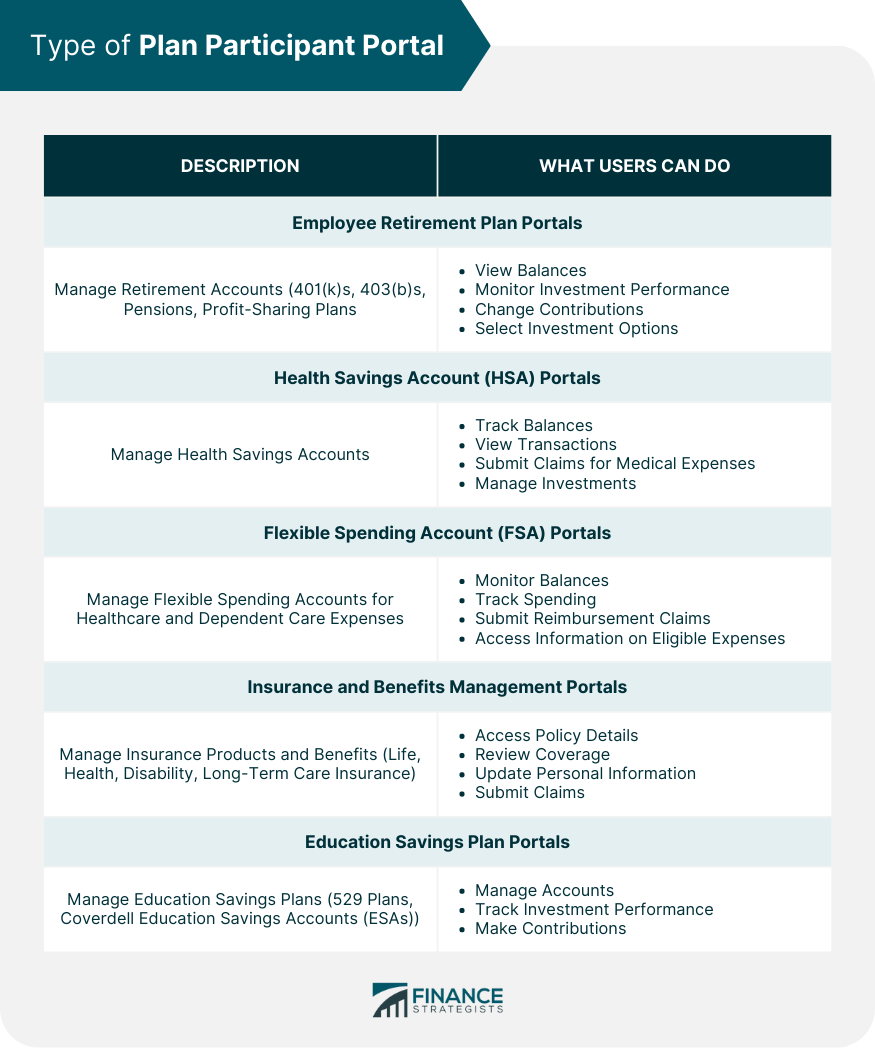

Types of Plan Participant Portals

Employee Retirement Plan Portals

Health Savings Account (HSA) Portals

Flexible Spending Account (FSA) Portals

Insurance and Benefits Management Portals

Education Savings Plan Portals

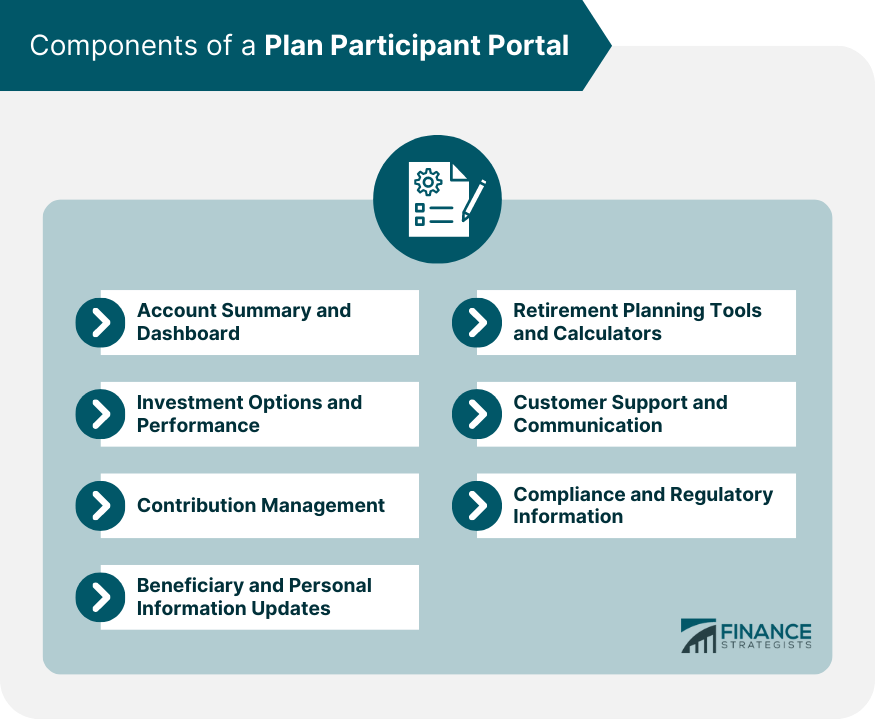

Components of a Plan Participant Portal

Account Summary and Dashboard

Investment Options and Performance

Contribution Management

Beneficiary and Personal Information Updates

Retirement Planning Tools and Calculators

Customer Support and Communication

Compliance and Regulatory Information

Implementation and Integration of Plan Participant Portal

Data Migration and System Compatibility

Security and Privacy Considerations

Training and User Adoption

Ongoing Maintenance and Updates

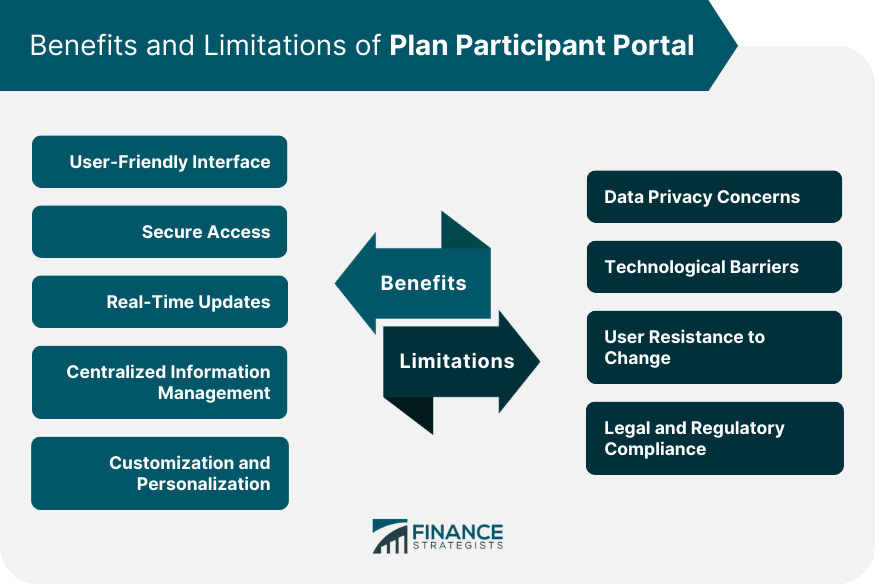

Features and Benefits of Plan Participant Portal

User-Friendly Interface

Secure Access

Real-Time Updates

Centralized Information Management

Customization and Personalization

Challenges and Limitations of Plan Participant Portals

Data Privacy Concerns

Technological Barriers

User Resistance to Change

Legal and Regulatory Compliance

Final Thoughts

Plan Participant Portal FAQs

A plan participant portal is a secure online platform that allows users to access and manage their benefit plans, such as retirement accounts, health savings accounts, or insurance policies. It is important because it simplifies the management of multiple accounts, promotes transparency, and empowers users to make informed decisions about their benefits and investments.

Key features of a plan participant portal include a user-friendly interface, secure access, real-time updates, centralized information management, and customization and personalization options. These features make it easy for users to navigate the portal and access important information about their benefits.

To ensure the security and privacy of your information on a plan participant portal, make sure the portal utilizes encryption, two-factor authentication, and secure socket layer (SSL) technology. Additionally, always use strong, unique passwords and be cautious when accessing the portal from public Wi-Fi networks.

Common use cases for plan participant portals include managing employee retirement plans, health savings accounts (HSAs), flexible spending accounts (FSAs), and insurance and benefits management. These portals provide a centralized location for users to review their accounts, make changes, and monitor their investments.

Future trends in plan participant portals may include integration with mobile and wearable devices, artificial intelligence and automation for personalized financial advice, and enhanced security and privacy measures. These advancements will likely provide users with even greater convenience and control over their benefits and investments.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.