Phased retirement is an arrangement that enables employees nearing the end of their careers to gradually reduce their work hours, instead of making a sudden shift from full-time employment to complete retirement. This approach offers a smoother transition for both employees and employers, as it allows older workers to maintain some level of professional activity while adapting to their new lifestyle. Phased retirement can take many forms, depending on the specific needs and preferences of the individuals and organizations involved. Generally, these arrangements involve reduced work schedules, job-sharing, or temporary assignments with lower responsibilities. They provide workers with the opportunity to remain engaged in the workforce while enjoying more leisure time and making preparations for their eventual retirement. The primary purpose of phased retirement is to provide a more flexible approach to the traditional retirement process. It recognizes that many older workers may not be ready or willing to give up their careers entirely, and that employers can benefit from retaining the knowledge and expertise of experienced employees. Phased retirement arrangements enable workers to gradually disengage from their professional roles, allowing them to maintain a sense of purpose and identity while transitioning into retirement. Moreover, phased retirement can help organizations address workforce challenges such as skill gaps and labor shortages. By offering phased retirement options, employers can retain valuable older workers and facilitate the transfer of knowledge to younger employees. This approach can be particularly useful in industries facing an aging workforce and a scarcity of new talent. Gradual retirement is a type of phased retirement in which employees slowly reduce their working hours over a certain period. This approach allows workers to remain in their current roles while adapting to a more flexible work schedule. Gradual retirement can be beneficial for both employees and employers, as it eases the transition to full retirement and enables organizations to retain experienced staff members. In a gradual retirement arrangement, employees may reduce their work hours by a predetermined percentage or set number of hours per week. This reduction could occur in stages, with work hours being further reduced at regular intervals until the employee reaches full retirement. The specifics of the arrangement will depend on the needs and preferences of both parties involved. Flexible retirement is a form of phased retirement that allows employees to modify their work schedules and responsibilities to better suit their needs as they approach retirement. This might involve shifting to part-time work, job-sharing, or taking on temporary assignments with less demanding requirements. Flexible retirement can provide employees with more control over their work-life balance, while still enabling them to contribute to their organization. In a flexible retirement arrangement, employees and employers work together to develop a customized plan that accommodates the changing needs and priorities of the worker. This could involve adjusting work hours, job responsibilities, or even the location of work. The ultimate goal is to create a mutually beneficial arrangement that supports the employee's transition to retirement while maintaining their engagement with the organization. Partial retirement is a type of phased retirement in which employees transition from full-time work to part-time or occasional work, while still maintaining a connection to their organization. This option can be particularly appealing for individuals who wish to remain engaged in their profession or industry but desire more flexibility and free time as they approach retirement. In a partial retirement arrangement, employees may continue working in their current roles or take on new responsibilities that are better suited to their desired work-life balance. Partial retirement can be an effective way for organizations to retain the valuable knowledge and experience of older workers while providing them with the freedom and flexibility they desire in their pre-retirement years. Phased retirement can offer significant financial benefits for both employees and employers. For employees, continuing to work part-time can provide additional income, allowing them to delay drawing on their retirement savings and potentially increasing their overall retirement income. Moreover, a longer working life can lead to higher Social Security benefits, as well as increased pension and retirement plan contributions. For employers, phased retirement can help reduce turnover costs and retain experienced staff, which can ultimately contribute to increased productivity and cost savings. By retaining older workers, organizations can maintain a skilled workforce while fostering knowledge transfer and reducing the expenses associated with hiring and training new employees. Phased retirement can have positive effects on the physical and mental health of employees. The gradual transition to retirement can help reduce stress levels associated with sudden lifestyle changes, while allowing individuals to maintain a sense of purpose and identity. Studies have shown that remaining active and engaged in meaningful work can contribute to better overall well-being, lower rates of depression, and improved cognitive function among older adults. Moreover, phased retirement arrangements can provide employees with more time to focus on their health and well-being, potentially leading to a healthier and more enjoyable retirement. By offering employees the opportunity to balance work and leisure, phased retirement can support a more active and fulfilling lifestyle. Phased retirement can offer significant social benefits for both employees and their organizations. For employees, the opportunity to remain engaged with their professional community can help them maintain a sense of belonging and connection. This social interaction can be particularly important for individuals who may otherwise experience feelings of isolation and loneliness upon leaving the workforce. For employers, phased retirement can facilitate the transfer of knowledge and skills from older workers to their younger colleagues. By retaining experienced employees, organizations can create mentoring opportunities and foster an intergenerational exchange of ideas, leading to a more diverse and innovative workforce. Implementing phased retirement arrangements can pose legal challenges for both employees and employers. Organizations must ensure that their phased retirement policies comply with federal and state employment laws, such as the Age Discrimination in Employment Act and the Employee Retirement Income Security Act. Employers should consult with legal counsel to develop policies that are both legally compliant and beneficial to all parties involved. In addition to legal compliance, employers must also be mindful of potential discrimination claims. To minimize the risk of such claims, phased retirement policies should be applied consistently and fairly to all eligible employees, regardless of age, race, gender, or other protected characteristics. Phased retirement requires careful financial planning on the part of both employees and employers. Employees must carefully consider how reduced work hours and income will impact their overall retirement savings and financial security. This may involve consulting with financial advisors to develop a comprehensive plan that accounts for changes in income, expenses, and investment strategies. For employers, implementing phased retirement arrangements can have financial implications as well. Organizations must consider the costs associated with retaining older workers, including potential increases in healthcare and benefit expenses. Employers should conduct a thorough cost-benefit analysis to determine the financial feasibility of offering phased retirement options to their employees. Phased retirement arrangements can raise various concerns for both employees and employers. Employees may worry about the potential loss of income, benefits, or job security as they transition to part-time work. Employers, on the other hand, may be concerned about maintaining productivity levels, managing the transfer of knowledge, and addressing potential resentment among younger employees who may perceive phased retirement as preferential treatment for older workers. To address these concerns, it is essential for organizations to establish clear policies and guidelines for phased retirement arrangements, ensuring that all parties have a mutual understanding of their rights and responsibilities. Open communication and transparency are crucial to building trust and fostering a positive work environment that supports phased retirement initiatives. Effective communication is essential for the successful implementation of phased retirement arrangements. Organizations should develop clear, concise, and transparent policies that outline the eligibility criteria, benefits, and responsibilities associated with phased retirement. Employees should be well-informed about the available options and the potential impacts on their financial security and career trajectory. Regular meetings and open dialogue between employees and their supervisors can facilitate a smooth transition to phased retirement. By discussing individual needs, goals, and expectations, both parties can work together to develop a mutually beneficial arrangement that supports the employee's transition to retirement while maintaining their engagement with the organization. To create a successful phased retirement program, organizations must develop comprehensive policies and guidelines that are consistent with legal requirements and best practices. These policies should address key elements such as eligibility criteria, application procedures, work schedule adjustments, and changes to compensation and benefits. In addition to outlining the terms and conditions of phased retirement arrangements, organizations should also establish a process for evaluating and monitoring the effectiveness of their phased retirement programs. This may involve tracking metrics such as employee satisfaction, productivity levels, and knowledge transfer to ensure that phased retirement initiatives are achieving their intended goals. Phased retirement arrangements should not compromise the performance expectations and standards applied to all employees. Organizations should establish clear performance objectives for employees transitioning to phased retirement, ensuring that they continue to contribute effectively to the organization's goals and objectives. Performance evaluations should be conducted regularly to assess the employee's progress and identify any areas for improvement or adjustment. By maintaining a focus on performance and results, organizations can ensure that phased retirement arrangements support both individual and organizational success. Phased retirement is a flexible approach to retirement that allows employees to gradually reduce their work hours and responsibilities, offering a smoother transition from full-time work to retirement. There are several types of phased retirement, including gradual retirement, flexible retirement, and partial retirement. Phased retirement offers numerous advantages, such as financial benefits, health benefits, and social benefits. However, it also presents challenges, including legal issues, financial planning, and employee and employer concerns. The significance of phased retirement lies in its potential to address the changing needs and preferences of an aging workforce while offering organizations the opportunity to retain valuable knowledge and experience. By adopting phased retirement programs, employers can support the well-being of their older workers, foster a more diverse and inclusive work environment, and maintain a skilled and knowledgeable workforce. As the workforce continues to age and traditional retirement patterns shift, phased retirement is likely to become an increasingly important strategy for both employees and employers.What Is Phased Retirement?

Purpose of Phased Retirement

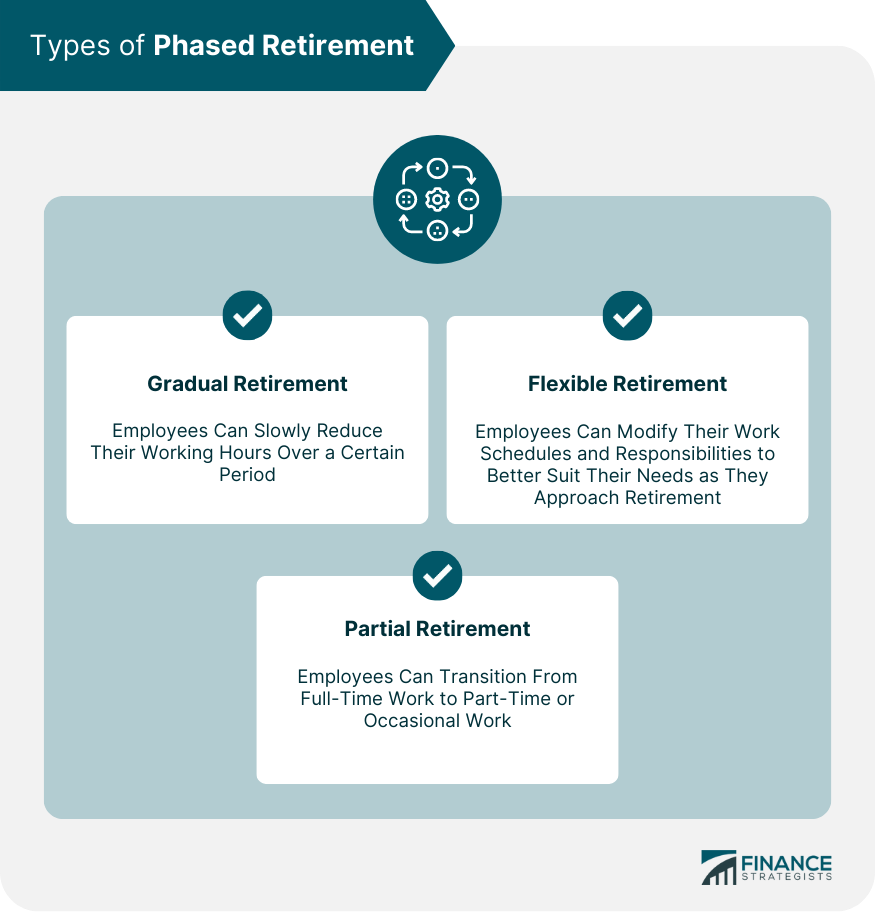

Types of Phased Retirement

Gradual Retirement

Flexible Retirement

Partial Retirement

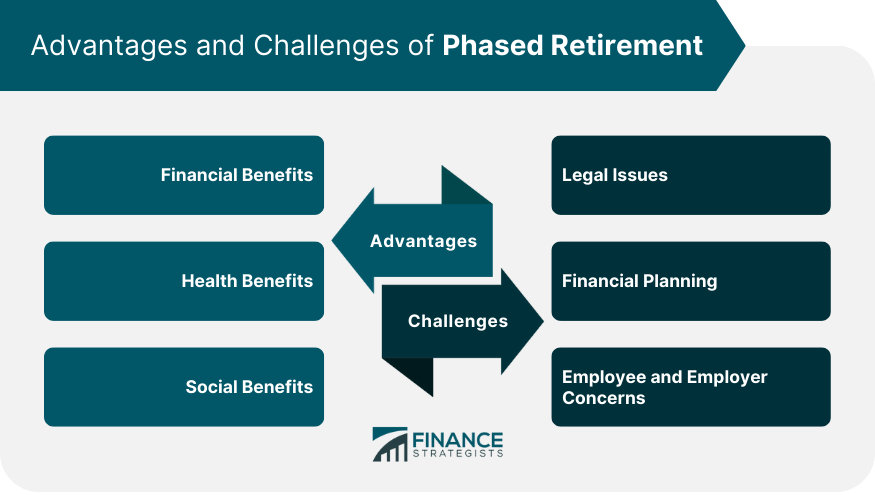

Advantages of Phased Retirement

Financial Benefits

Health Benefits

Social Benefits

Challenges of Phased Retirement

Legal Issues

Financial Planning

Employee and Employer Concerns

Strategies for Implementing Phased Retirement

Communication

Policy Development

Performance Management

Conclusion

Phased Retirement FAQs

Phased retirement is a flexible work arrangement that allows employees to gradually transition from full-time work to retirement.

Phased retirement can provide financial benefits, such as a smoother transition to retirement, and health and social benefits, such as maintaining social connections and reducing stress.

The types of phased retirement include gradual retirement, flexible retirement, and partial retirement.

Some challenges of phased retirement include legal issues, financial planning, and concerns from both employees and employers.

Strategies for implementing phased retirement include effective communication, policy development, and performance management.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.