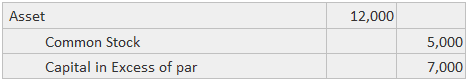

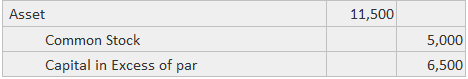

A corporation may issue stock in exchange for an operating asset (tangible and intangible). There are two approaches used to determine the cost of an asset obtained in this type of acquisition. The first approach uses the value given up by the firm to determine the cost of the asset. This amount constitutes the value foregone by not selling the shares of stock and equals their market value less the costs of issuing them. The second approach assumes that the new stockholder holds claims equivalent to the fair market value of the asset. If the stock's market value is uncertain, advocates of the "value given up" approach substitute the value received by the corporation as a best approximation. Conversely, if the value of the asset is not known with certainty, advocates of the "value received" approach substitute the market value of the stock issued as a best approximation. Thus, both positions are pragmatically the same. They both result in using either the value of the stock or the asset, whichever is more certain. If neither figure is known with certainty, all that can be done is to record an estimated figure. This may have to be revised in the future if better information becomes available. A brief reflection, however, should indicate that it would be unusual for a buyer and seller to reach an agreement on an exchange without some idea of the value of the assets or stock. As an example of a stock transaction, suppose that a company issues 1,000 shares of $5 par common stock to obtain an asset worth around $12,000. If there is no reliable measure of the market value of the shares (apart from this transaction), the entry would be: On the other hand, if valid transactions had recently occurred (thereby establishing a market value of, for example, $11.50 per share), the entry would be: If the stock is sold on the market, the net inflow would be less than $11.50 per share due to brokerage and legal fees. For this reason, if you plan to use the stock's value as the measurement, it should be modified to reflect the issuance costs. The asset should also be recorded at a lower cost.Explanation

Example

Acquisition of Assets in Exchange of Stock FAQs

The term acquisition refers to an event in which a corporation issues stocks in exchange for another entity's assets.

In a reverse acquisition, the company issuing stock is typically the larger of the two entities involved. In an acquisition of assets in exchange for stock, both companies are usually of roughly equal size.

There are two methods used to determine the value of assets received when a company issues stocks in exchange for said assets. The first approach is the value given up, which is the equity value plus transaction costs. The second approach assumes that all new shareholders receive shares with an equivalent value to the fair market value of the acquired asset(s).

An example would be if company a (the acquiring company) was issuing 1,000 new shares in exchange for $5 mn worth of assets from company b. Company a does not have a current market value for its shares, but company b's shares are currently trading at $11.50 Each. Using the first approach, you would then take 1,000 x ($11.50 - Transaction costs) =~$11.25 As a fair price to use as an approximation of the new shares. Using the second approach, you would take 1,000 x ($5 mn worth of assets) =~$10.25 As a fair price to use as an approximation of the new shares.

Both transactions occur when one company acquires another. The only difference is that with a business combination, there is often an exchange of stock, but no transfer of assets occurs.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.