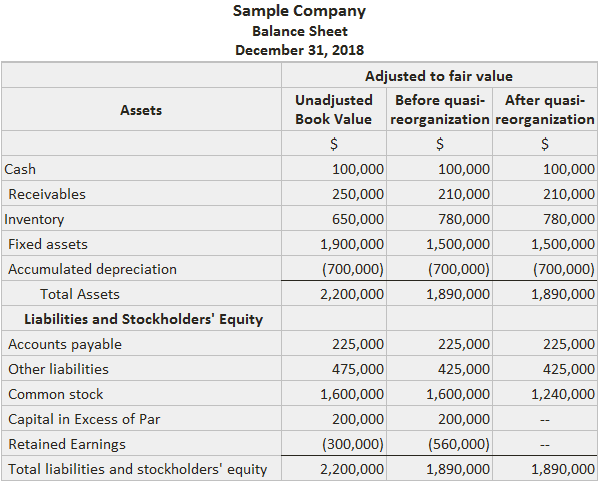

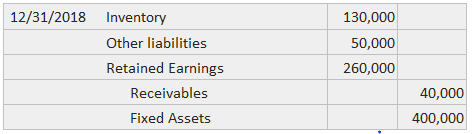

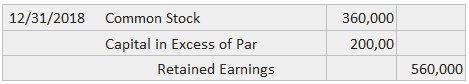

The overall objective of accounting is to provide information to investors and creditors, helping them assess the likelihood, amounts, and timing of the firm's cash flows. Accountants argue that this objective is most easily achieved if financial statements are presented in accordance with GAAP. However, if it is known that compliance with the usual accounting practice will produce misleading statements, departures can be allowed. In these cases, full disclosure of the deviation in practice must be provided. One of these departures is the implementation of a quasi-reorganization. The general circumstances that surround a quasi-reorganization encompass one or both of the following conditions: In this case, financial statements prepared in accordance with GAAP will not provide a reasonable description of the firm because assets are overstated. For example, depreciation in future years will be too high. Also, the deficit may make the firm appear to be unprofitable, highlighting again the fact that preparing financial statements strictly according to GAAP may be unsuitable. For example, a firm may incur losses as it develops new products and distribution channels; however, its stockholders must wait to receive dividends until future profits exceed the deficit, even though the cash is available. One solution in these cases is a formal reorganization in which the old firm's assets are sold to a new corporation whose shares are distributed to the old stockholders. To avoid the costs of doing this, a quasi-reorganization may be carried out. Approval may have to be obtained from stockholders, state authorities, and the auditor before the process can be initiated. When a quasi-reorganization is implemented, the following three steps are undertaken: Regarding the last point, if the deficit in Retained Earnings exceeds the balances in Additional Paid-In Capital and Capital in Excess of Par, the stock's par value must be altered or shares retired. When the above three steps have been accomplished, the firm can have the "fresh start" it needs. A balance sheet for Sample Company is shown below. The revaluation of assets and liabilities is accomplished through the following journal entry: After the entry is posted, the account balances equal the amounts shown in the second column. Notice that inventory could be increased and other liabilities decreased because the larger declines in receivables and fixed assets prevented a net write-up of assets which would have resulted in an increase of the stockholders' equity. The deficit in Retained Earnings is now $560,000, which exceeds the balance in Capital in Excess of Par; consequently, the par value of the stock will need to change. The quick approach is to alter the charter so that the stock has no-par value. This entry would close the Retained Earnings account and the recapitalization: After this entry, the account balances are the same as those shown in the third column of Sample Company's balance sheet. Balance sheets or statements of stockholders' equity, if prepared after quasi-reorganization, must disclose the following: In most countries, you can stop disclosing this on the balance sheet after 10 years, possibly even sooner if the information loses significance due to the company's success. If future developments indicate that the write-down of an asset during a quasi-reorganization was excessive, gains achieved over the new carrying value should be credited directly to Paid-In Capital rather than reported on the income statement. The purpose of this requirement is to prevent companies from using excessive write-downs to disclose higher income in the future from lower depreciation expenses and larger gains on disposal.

Example

Next Actions

Quasi-Reorganization FAQs

Quasi-reorganization (QR) is a process where the equity interests of existing shareholders in an entity are restructured by changing their legal, economic and beneficial ownership without affecting its assets, liabilities and obligations. The purpose of quasi reorganization is to remove the ineffective capital structure and set new equity structure of the company.

The main objective of a quasi reorganization is to help companies create new equity structure with large shareholding base for better shareholder value creation. Quasi-reorganization helps in cleansing capital structure by preferential allotment, increase in paid up capital using free reserves, reduction in share capital using free reserves, rights issue etc.

Sectors where QR can be used are insurance, banking, capital markets and nbfc companies. Quasi reorganization in banks will help in unlocking stress asset in the books by converting it into Equity Shares which banks can sell to investors at a premium.

Quasi reorganization is not related with any profit or loss unlike recapitalization where the issuer must achieve financial targets before they pay out bonus share capital. Recapitalizations are done through private placements while quasi reorganization is done through rights issue. Quasi-reorganization does not create any impact on the balance sheet of the issuer while recapitalizations are considered as cash transactions by market regulator sebi.

Quasi-reorganizations provide an opportunity for companies to wipe out poor performing subsidiaries and unlisted investments from their books. This allows them to list the remaining shares on the stock exchange at a higher price, thereby increasing profits and shareholder value.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.