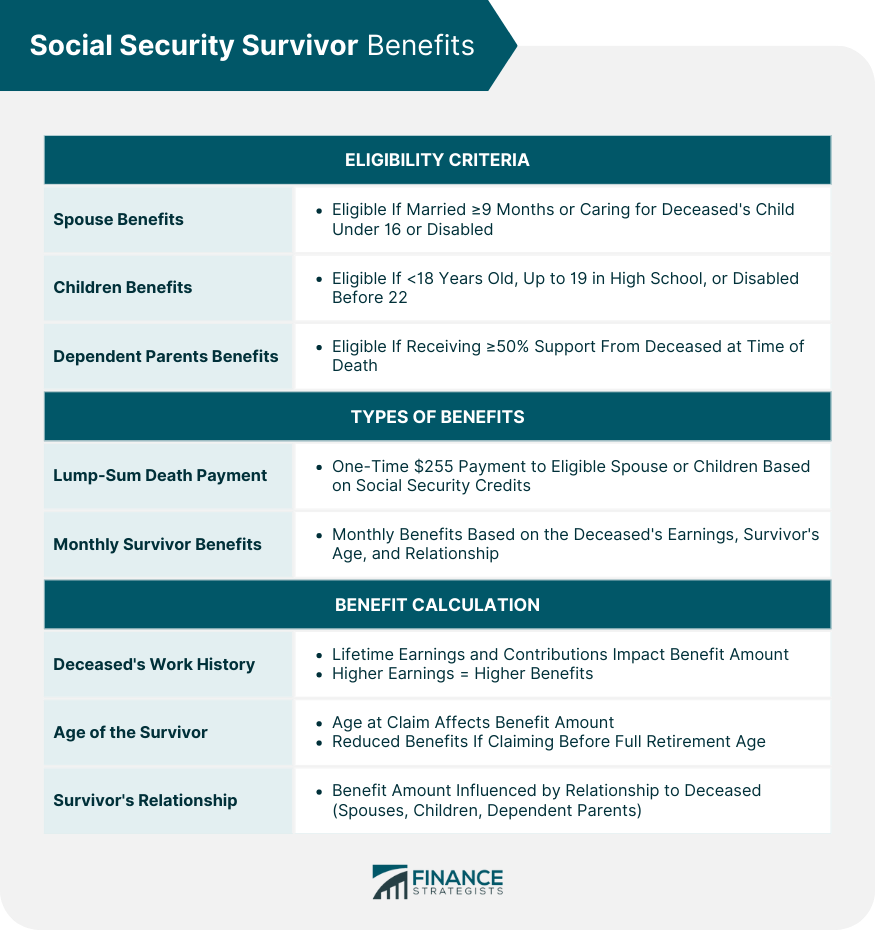

Social Security survivor planning refers to the process of understanding and maximizing the benefits available to surviving family members upon the death of a Social Security-covered worker. This process involves assessing the financial needs of survivors, identifying the available benefits, and creating a plan to ensure optimal financial support in the event of the worker's death. Survivor planning is crucial because it helps families maintain financial stability in the face of an unexpected loss. By understanding and utilizing available benefits, surviving family members can maintain their standard of living, cover essential expenses, and secure their financial future. Furthermore, survivor planning reduces stress during a difficult time and ensures that survivors make informed decisions about their financial resources. Social Security offers various benefits to eligible survivors, including spouses, children, and dependent parents. These benefits may be in the form of lump-sum death payments or monthly survivor benefits. In addition, there are several strategies for maximizing these benefits, such as choosing the right time to claim benefits and coordinating them with other income sources. The eligibility criteria for survivor benefits depend on the relationship between the survivor and the deceased worker, as well as the survivor's age and other factors. A surviving spouse may be eligible for benefits if they were married to the deceased worker for at least nine months before the worker's death, or if they are caring for the worker's child who is under 16 or disabled. Children of the deceased worker may be eligible for benefits if they are under 18, up to 19 and still in high school, or disabled before the age of 22. Dependent parents of the deceased worker may be eligible for benefits if they were receiving at least half of their support from the worker at the time of the worker's death. Survivor benefits may come in the form of a one-time payment or ongoing monthly benefits. A one-time payment of $255 may be made to the surviving spouse or children of the deceased worker if certain conditions are met, such as the worker having enough Social Security credits. Ongoing monthly benefits may be available to eligible survivors, with the amount depending on the deceased worker's earnings and the survivor's age and relationship to the worker. The amount of survivor benefits is influenced by several factors, including the deceased worker's work history, the survivor's age, and the survivor's relationship to the worker. The worker's lifetime earnings and Social Security contributions directly impact the amount of survivor benefits, with higher earnings generally resulting in higher benefits. The survivor's age at the time of claiming benefits affects the benefit amount, with reduced benefits available for survivors who claim before their full retirement age. The relationship between the survivor and the deceased worker also influences the benefit amount, with spouses, children, and dependent parents potentially receiving different benefit percentages based on their relationship with the worker. The decision of when to claim survivor benefits can significantly impact the amount received, with options including claiming at full retirement age or opting for early or delayed retirement. Claiming survivor benefits at full retirement age allows the survivor to receive 100% of the deceased worker's benefit, ensuring maximum financial support. Survivors may choose to claim benefits before their full retirement age, resulting in reduced benefits, or they may delay claiming benefits to increase their monthly benefit amount. There are various claiming strategies that can help survivors maximize their benefits, such as coordinating widow(er)'s benefits with their own retirement benefits and utilizing restricted applications. Survivors may be eligible for both widow(er)'s benefits and their own retirement benefits. They can choose to claim one benefit first and switch to the other later, allowing them to maximize their total benefits. Some survivors may be eligible to file a restricted application, allowing them to claim only widow(er)'s benefits while allowing their own retirement benefits to continue growing. This strategy can be advantageous for those who expect to have a higher retirement benefit based on their own work history. Working while receiving survivor benefits can impact the benefit amount, depending on the survivor's age and earnings. Understanding the earnings test and its impact on benefits is essential for making informed decisions. The Social Security earnings test applies to survivors who work and receive benefits before their full retirement age. Depending on their earnings, some or all of their benefits may be withheld, but this reduction is temporary, and benefits will be recalculated at full retirement age to account for the withheld amounts. Continuing to work while receiving survivor benefits can have both positive and negative effects on benefit amounts. While the earnings test may result in temporary reductions, higher lifetime earnings can also lead to increased benefits in the long run, especially for survivors with a strong work history. Integrating survivor benefits into retirement planning is a crucial step for individuals who have lost a spouse or partner and are looking to secure their financial future. It involves assessing financial needs, identifying income sources, and considering other financial assets and insurance products to supplement Social Security survivor benefits. The first step in integrating survivor benefits into retirement planning is assessing financial needs. Survivors should consider their living expenses, including essential and discretionary expenses, to determine how much income they will need during retirement. Creating a detailed budget can help survivors understand their financial needs and plan accordingly. Survivors should also identify various income sources, such as Social Security benefits, pensions, and personal savings, to provide a clear picture of their available financial resources during retirement. Social Security survivor benefits are a crucial source of income for survivors, and it is essential to understand how these benefits work and how to optimize them. Survivors should also consider other financial assets and insurance products to supplement their Social Security survivor benefits and ensure financial stability. Life insurance can provide a tax-free death benefit to beneficiaries, offering additional financial support and helping cover expenses such as funeral costs and debts. Annuities can provide a steady stream of income during retirement, helping to supplement Social Security benefits and reduce the risk of outliving one's savings. A well-diversified investment portfolio can generate income and capital appreciation, helping to ensure financial stability throughout retirement. Effectively coordinating Social Security benefits with other financial resources can optimize income and minimize tax liabilities. Understanding the tax implications of various income sources, including Social Security benefits, can help survivors minimize their tax burden and maximize their net income. Strategically coordinating the timing and sequence of income sources can also help optimize total retirement income and ensure financial stability. Proper legal and estate planning is essential to protect survivors' interests and ensure that their wishes are carried out. Drafting or updating a will ensures that the deceased's assets are distributed according to their wishes and can help prevent potential disputes among family members. Designating beneficiaries for financial accounts, such as retirement accounts and life insurance policies, ensures that these assets are transferred directly to the intended recipients without going through the probate process. Establishing trusts can provide additional control over asset distribution, offer potential tax benefits, and protect assets from creditors or legal disputes. Powers of attorney and advance healthcare directives ensure that the individual's wishes regarding financial and medical decisions are respected if they become incapacitated. Integrating Social Security survivor benefits into retirement planning is crucial for those who have lost a spouse or partner. Survivors should assess their financial needs, identify income sources, and consider other financial assets and insurance products to supplement Social Security survivor benefits. Effective coordination of Social Security benefits with other financial resources can optimize income and minimize tax liabilities. Proper legal and estate planning is also essential to protect survivors' interests and ensure that their wishes are carried out. Survivors must understand the tax implications of various income sources, including Social Security benefits, and strategically coordinate the timing and sequence of income sources to optimize total retirement income and ensure financial stability. By following these steps, survivors can secure their financial future and maintain their standard of living, covering essential expenses and achieving financial stability. Seeking the assistance of financial professionals, legal experts, and government resources can help individuals navigate the complexities of Social Security survivor planning.What Is Social Security Survivor Planning?

Understanding Social Security Survivor Benefits

Eligibility Criteria

Spouse Benefits

Children Benefits

Dependent Parents Benefits

Types of Survivor Benefits

Lump-Sum Death Payment

Monthly Survivor Benefits

Benefit Calculation Factors

Deceased's Work History and Earnings

Age of the Survivor

Survivor's Relationship to the Deceased

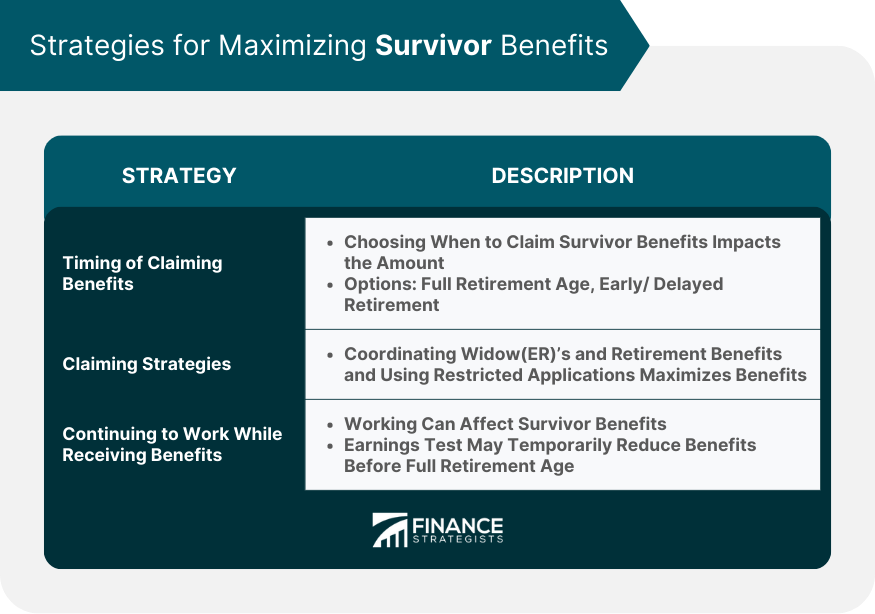

Strategies for Maximizing Survivor Benefits

Timing of Claiming Benefits

Full Retirement Age

Early or Delayed Retirement

Claiming Strategies

Widow(er)'s Benefits and Own Retirement Benefits

Restricted Application

Continuing to Work While Receiving Benefits

Earnings Test

Impact on Benefit Amounts

Integrating Survivor Benefits into Retirement Planning

Assessing Financial Needs in Retirement

Identifying Income Sources

Considering Other Financial Assets and Insurance

Coordinating Social Security Benefits with Other Financial Resources

Legal and Estate Planning Considerations

Final Thoughts

Social Security Survivor Planning FAQs

Social Security survivor planning involves understanding and maximizing the benefits available to surviving family members upon the death of a Social Security-covered worker. It is essential to maintain financial stability for survivors, reduce stress during difficult times, and ensure informed decisions about their financial resources are made.

Eligibility for Social Security survivor benefits depends on your relationship to the deceased worker, your age, and other factors. Spouses, children, and dependent parents may be eligible for benefits under specific conditions. Understanding these eligibility criteria is a crucial aspect of Social Security survivor planning.

Integrating Social Security survivor planning into your retirement strategy involves assessing financial needs, identifying income sources, considering other financial assets and insurance products, and coordinating Social Security benefits with other financial resources. Proper planning helps optimize income and ensures financial stability in retirement.

Addressing legal and estate planning considerations, such as drafting or updating wills, designating beneficiaries for financial accounts, establishing trusts, and creating powers of attorney and advance healthcare directives, is crucial for protecting survivors' interests and ensuring their wishes are carried out.

Numerous resources are available to assist with Social Security survivor planning, including the Social Security Administration (SSA) through their official website and local offices, financial professionals like Certified Financial Planners and accountants, and legal professionals such as estate planning and elder law attorneys. These experts can provide valuable guidance and help you develop a comprehensive survivor plan.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.