Participant education is the process of educating individuals about retirement planning, including retirement plan features and benefits, investment options, and retirement income sources and strategies. It refers to the comprehensive effort made by plan sponsors, often in collaboration with financial professionals, to provide employees with the information and tools they need to make informed decisions about their retirement savings and investment strategies. The goal of participant education is to help individuals understand the features and benefits of their retirement plan, including how to enroll, how much to contribute, and how to choose appropriate investment options. Participant education is critical in retirement planning, as it can help individuals make informed decisions about their retirement savings and investments, as well as manage their retirement income and expenses effectively. Participant education can help increase retirement readiness by providing individuals with the knowledge and tools they need to make informed decisions about their retirement planning. Participant education can enhance financial literacy by teaching individuals about financial concepts, such as investing and risk management, that are essential for successful retirement planning. Participant education can encourage active engagement in retirement planning by providing individuals with the resources and support they need to take an active role in their retirement planning. Participant education can improve investment decision-making by providing individuals with information about retirement plan investment options and strategies, as well as teaching them how to evaluate investment performance and risk. Participant education should provide individuals with a comprehensive understanding of their retirement plan features and benefits, including contribution limits, vesting schedules, and distribution options. Participant education should provide individuals with information about retirement savings and investment options, such as 401(k) plans, IRAs, and mutual funds, as well as guidance on how to select appropriate investment options. Participant education should provide individuals with information about retirement income sources and strategies, such as Social Security benefits, retirement plan benefits, and annuities, as well as guidance on how to maximize retirement income. Participant education should provide individuals with information about risk management and asset protection strategies, such as insurance and estate planning, to help protect retirement savings and assets. Customization and personalization are essential for effective participant education in retirement planning. Retirement plan sponsors should recognize that each participant has unique needs, preferences, and goals. By customizing and personalizing participant education, retirement plan sponsors can tailor the education to meet the specific needs of individual participants. This can include providing education on topics that are most relevant to each participant, such as retirement savings strategies or investment options. Retirement plan sponsors should use multiple communication channels to reach participants and provide them with the information and support they need. Communication channels can include online resources, workshops, one-on-one consultations, webinars, and mobile applications. By using multiple communication channels, retirement plan sponsors can increase the reach of participant education and ensure that participants have access to education in a format that works best for them. Technology can be a powerful tool for participant education in retirement planning. Retirement plan sponsors should leverage technology to provide participants with interactive and engaging educational experiences. This can include online tools and calculators that help participants to estimate their retirement income needs, assess their investment risk tolerance, and develop retirement savings plans. Retirement plan sponsors can also use technology to provide participants with personalized feedback and recommendations based on their unique retirement goals and circumstances. Participant education should be monitored and evaluated on an ongoing basis to ensure that it is meeting the needs of participants and achieving its goals. Retirement plan sponsors should regularly assess the effectiveness of participant education through surveys, focus groups, and other feedback mechanisms. Based on the feedback received, retirement plan sponsors can make adjustments to the participant education program to better meet the needs of participants. Ongoing monitoring and evaluation are critical for ensuring that participant education is relevant, effective, and up-to-date with current retirement planning trends and strategies. Participant education is a critical component of retirement planning. It helps individuals make informed decisions about their retirement savings and investments, as well as manage their retirement income and expenses effectively. The role of participant education in retirement planning includes increasing retirement readiness, enhancing financial literacy, encouraging active engagement, and improving investment decision-making. The components of participant education in retirement planning include retirement plan features and benefits, retirement savings and investment options, retirement income sources and strategies, and risk management and asset protection. Best practices for participant education include customization and personalization, use of multiple communication channels, leveraging technology, and ongoing monitoring and evaluation. Retirement plan sponsors should implement these best practices to ensure that participant education is relevant, effective, and up-to-date with current retirement planning trends and strategies. Ultimately, by empowering individuals through participant education, retirement plan sponsors can help ensure that participants are better prepared for a financially secure retirement.Definition of Participant Education

The Role of Participant Education in Retirement Planning

Increasing Retirement Readiness

Enhancing Financial Literacy

Encouraging Active Engagement in Retirement Planning

Improving Investment Decision-Making

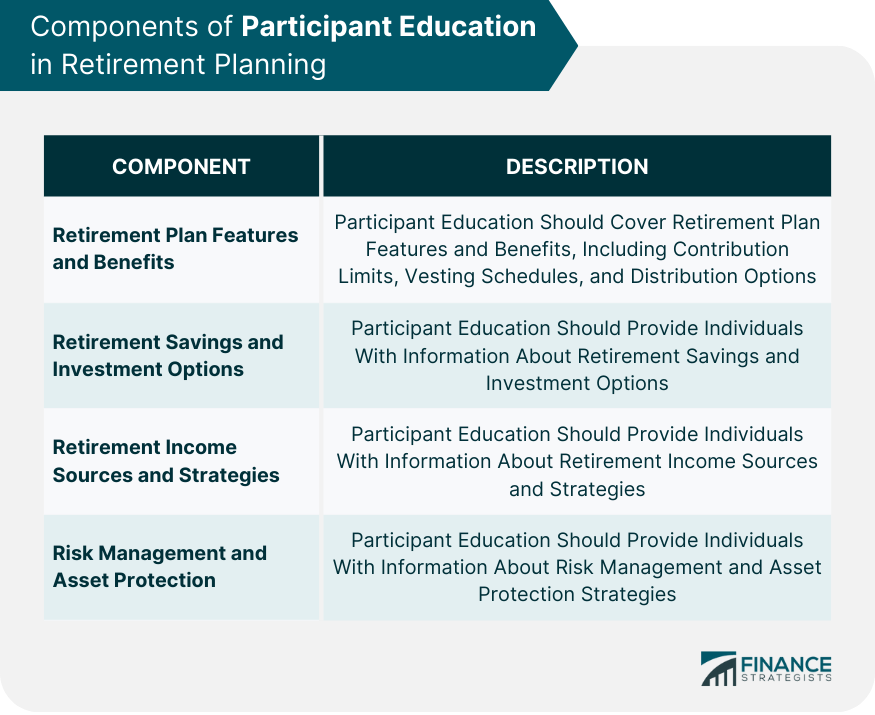

Components of Participant Education in Retirement Planning

Retirement Plan Features and Benefits

Retirement Savings and Investment Options

Retirement Income Sources and Strategies

Risk Management and Asset Protection

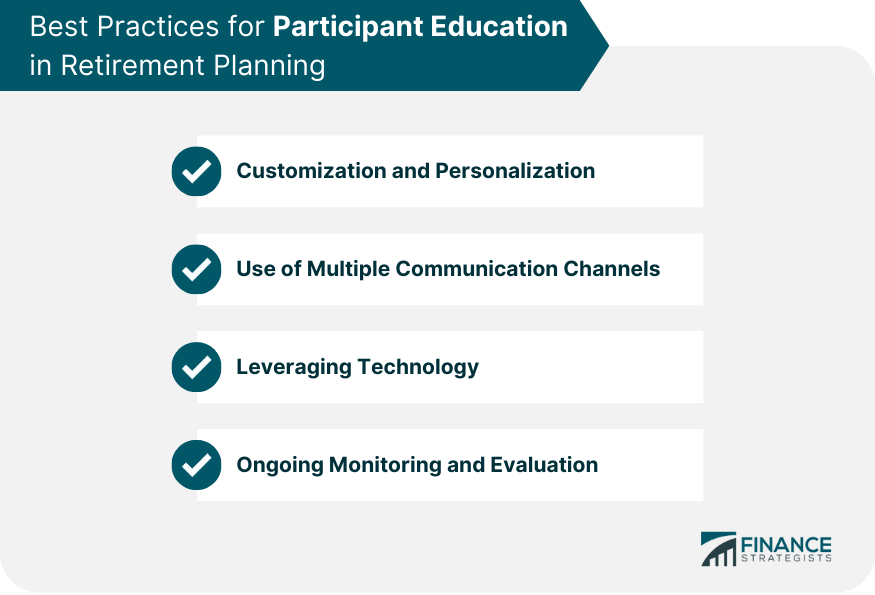

Best Practices for Participant Education in Retirement Planning

Customization and Personalization

Use of Multiple Communication Channels

Leveraging Technology

Ongoing Monitoring and Evaluation

Conclusion

Participant Education FAQs

Participant education in retirement planning refers to the process of educating retirement plan participants on financial and retirement-related topics to improve their financial literacy and increase their readiness for retirement.

Participant education is important in retirement planning because it helps individuals to make informed decisions about saving, investing, and planning for their retirement. It also increases their confidence in their ability to achieve their retirement goals.

The components of participant education in retirement planning include retirement plan features and benefits, retirement savings and investment options, retirement income sources and strategies, and risk management and asset protection.

Retirement plan sponsors can provide participant education through customized and personalized communications, multiple communication channels, leveraging technology, and ongoing monitoring and evaluation.

Yes, participant education can improve retirement outcomes by increasing retirement readiness, enhancing financial literacy, encouraging active engagement in retirement planning, and improving investment decision-making.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.