Medicaid stands as a joint venture between federal and state governments. It aims to offer health coverage primarily to low-income individuals, a broad category that includes adults, children, pregnant women, the elderly, and individuals with disabilities. However, when one of these individuals also has private or employer-sponsored health insurance, the intricacy of Medicaid's interaction with other insurance emerges. The essence of Medicaid lies in its mission to ensure that no individual remains without health coverage due to financial constraints. Even for those who possess health insurance, there might be segments of healthcare, certain treatments, or medications not covered. Medicaid often steps in to ensure these individuals aren't left in a lurch, promising comprehensive care even when their primary insurance falls short. It's not as simple as having two separate pots of insurance money to pull from. When someone holds Medicaid and another insurance simultaneously, these two entities must liaise. This collaboration ensures no duplication in benefit payouts, and each payer contributes its pre-determined share, avoiding overcharges and ensuring correct fund allocation. In a dual insurance situation, one typically takes precedence. The primary insurance, often a private one, addresses the bills first. Only after this does Medicaid, acting as the secondary payer, examine and cover the outstanding balances. This hierarchical system ensures organized and systematic payment distribution. Some find themselves hovering just above the Medicaid eligibility income threshold. For these individuals, there's a mechanism known as "spend-down." Conceptually, it mirrors an insurance deductible. These individuals can offset their incomes with medical expenses, allowing them to dip below the eligibility line and access Medicaid benefits, enhancing their health coverage canvas. Many insurance policies, while broad, might not stretch far enough to cover specific treatments or medications. Medicaid often serves as a safety net, stepping in to ensure these gaps don't transform into healthcare voids, guaranteeing comprehensive healthcare provision. Insurance doesn't always mean zero medical expenses. Often, individuals grapple with bills and co-pays. Medicaid can significantly ease this burden. By acting as supplementary coverage, it can cut down these out-of-pocket costs, offering financial reprieve. Beyond standard treatments, Medicaid extends its coverage net to envelop specialized services. Some of these might include non-emergency medical transport or niche home care treatments, areas that conventional insurance might overlook. Balancing two insurance plans isn't straightforward. It requires understanding, coordinating, and leveraging both simultaneously. Individuals must ensure that health providers are well-informed about both to avoid billing errors and payment disputes. Dual insurance doesn't just mean double the benefits; it also means double the paperwork. Any change, no matter how minor in the primary insurance, must be promptly reported to Medicaid. These frequent updates can be tedious but are crucial to maintaining the balance between the two coverage systems. When two players are in the field, coordination can sometimes lag. This can lead to slower reimbursement rates, especially if there's ambiguity about which insurance should address a bill first. Such delays can, at times, strain the patient-provider relationship. Before diving into dual coverage, it's vital to weigh the advantages. Assessing the collective benefits of both insurance plans can offer clarity about whether the dual coverage amplifies health care benefits or just adds administrative overhead. Medicaid is beneficial, but it also has its strings attached. In certain states, once a Medicaid recipient passes away, there's a mechanism for the state to retrieve funds from the deceased's estate. This recovery process can have implications on inheritance and asset distribution. With Medicaid, continuous vigilance is crucial. Even minor income surges can impact Medicaid eligibility. It's imperative to keep a close watch on financial fluctuations, promptly reporting them to ensure consistent and undisrupted coverage. Medicaid plays a pivotal role in the healthcare landscape, offering a lifeline to low-income individuals, including those with existing private or employer-sponsored insurance. It serves as a valuable safety net by filling coverage gaps, reducing out-of-pocket expenses, and granting access to specialized services that traditional insurance may not cover. However, the decision to enroll in Medicaid alongside other insurance requires careful consideration of the associated complexities. Navigating dual coverage can be challenging, involving coordination, reporting, and potential reimbursement delays. It's essential to evaluate the combined benefits of both plans and be aware of Medicaid estate recovery implications in certain states. Monitoring changes in income and eligibility is crucial to maintaining uninterrupted coverage. In making informed healthcare choices, individuals should weigh the advantages and drawbacks of having Medicaid alongside existing insurance, ensuring they strike the right balance to maximize their healthcare benefits while managing administrative requirements effectively.What Is Medicaid and Its Interaction With Other Insurance?

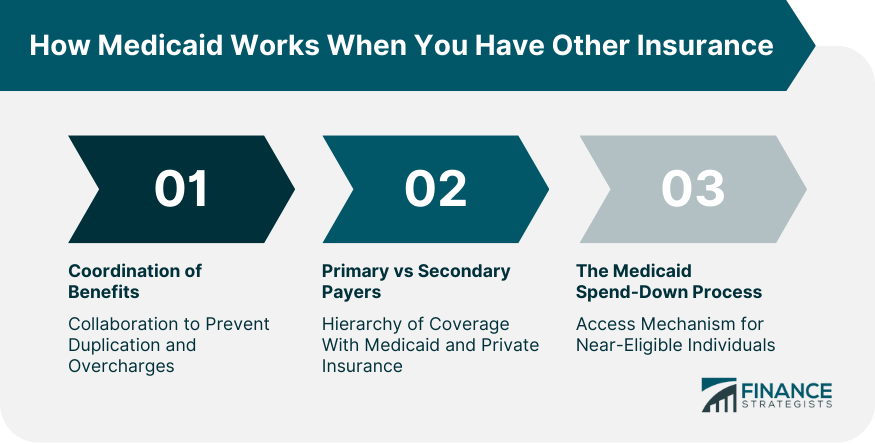

How Medicaid Works When You Have Other Insurance

Coordination of Benefits

Determining Primary vs Secondary Payers

Medicaid Spend-Down Process

Benefits of Having Medicaid Alongside Other Insurance

Filling Coverage Gaps

Reducing Out-Of-Pocket Expenses

Specialized Service Access

Drawbacks of Having Medicaid With Another Insurance

Navigating Dual Coverage Complexities

Reporting and Compliance Requirements

Potential Reimbursement Delays

Key Considerations When Enrolling in Medicaid With Existing Insurance

Evaluating Combined Coverage Benefits

Being Aware of Medicaid Estate Recovery

Monitoring Changes in Income and Eligibility

Conclusion

Can You Get Medicaid if You Have Insurance? FAQs

Yes, you can have both Medicaid and private insurance to enhance your healthcare coverage.

Medicaid steps in to cover gaps in coverage, ensuring comprehensive care, even when primary insurance falls short.

In dual insurance situations, the primary insurance (often private) addresses bills first, followed by Medicaid as the secondary payer.

Yes, drawbacks include complexities in managing dual coverage, reporting requirements, and potential reimbursement delays.

Consider evaluating the combined benefits, being aware of Medicaid estate recovery, and monitoring income changes for eligibility.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.