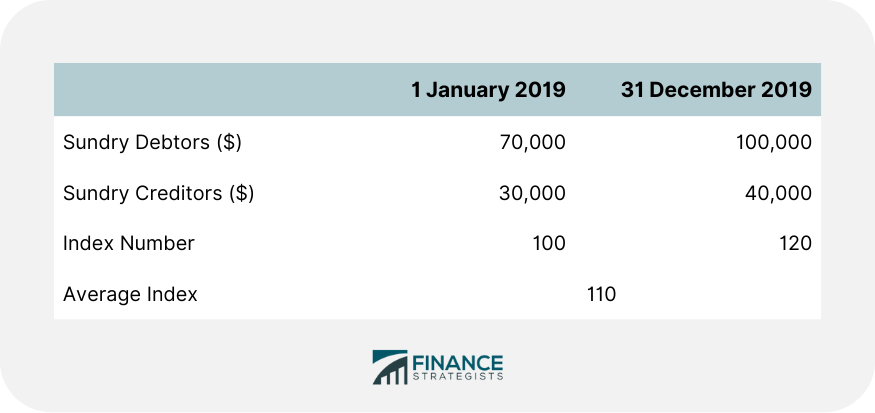

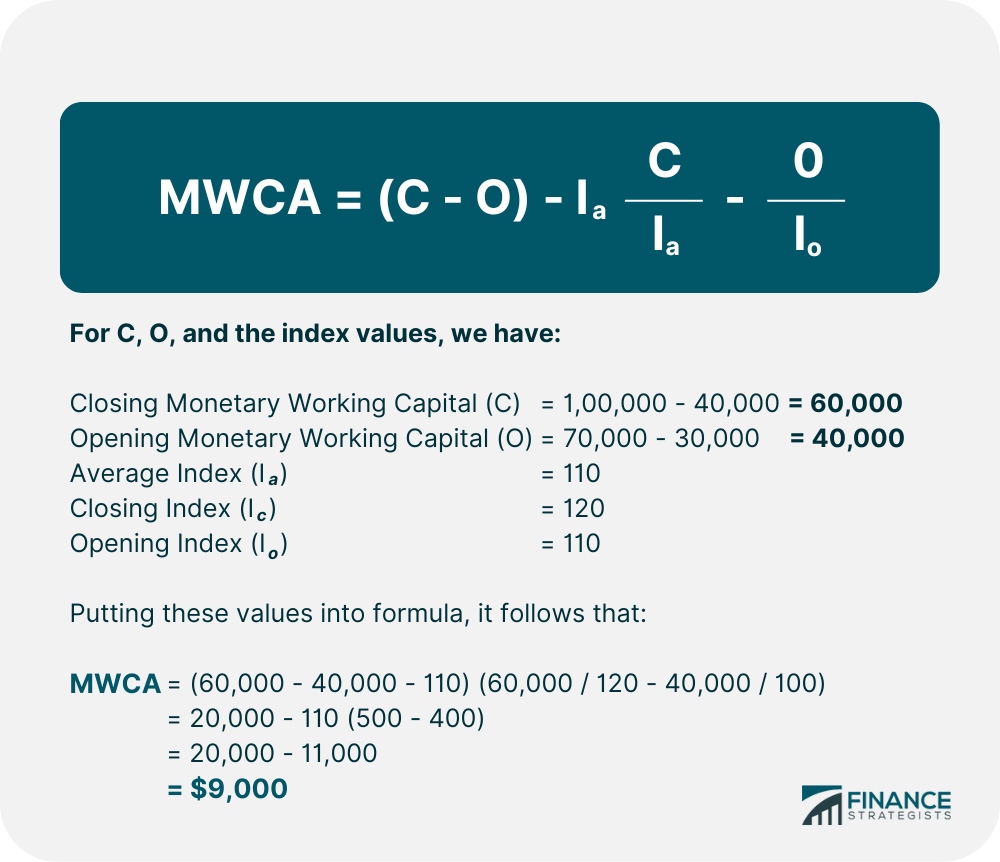

Working capital is the part of a company's capital that is needed to meet the day-to-day expenses of the business, as well as to hold the current assets required for normal operations. It is referred to as the excess of current assets over current liabilities. Changes in price levels disturb the working capital position of a concern. The current cost accounting (CCA) method requires financial adjustments to be made to reflect the effects of changing prices on net monetary items. This leads to a loss from holding net monetary assets or to gain from holding net monetary liabilities when prices are rising, and vice-versa, in order to maintain the monetary working capital of the enterprise. The adjustment reflects the amount of additional finance needed to maintain the same working capital due to the changes to price levels. The method of calculating the so-called Monetary Working Capital Adjustment (MWCA) is the same as that of the Current Cost of Sales Adjustment (COSA). The following formula yields a value for MWCA: Calculate the MCWA from the following data: To calculate the MCWA, the following formula is applied:Monetary Working Capital Adjustment: Definition

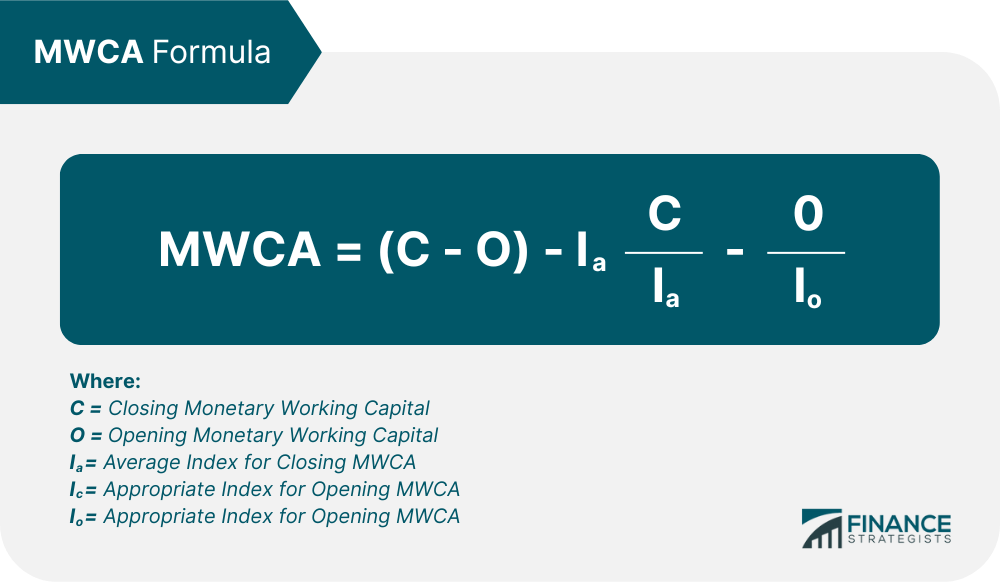

Formula to Calculate Monetary Working Capital Adjustment

An application of the MWCA formula is given in the next section.Example

Solution

Monetary Working Capital Adjustment (MWCA) FAQs

The present value of a future amount refers to how much money, as of the current date, would be required today in order to receive a certain future payment or income.

No, the formula for mwca is different from that of cosa.

Change in the price levels changes the value of current assets and liabilities, which results in a change to Working Capital, as well as to Retained Earnings. The formula for monetary Working Capital adjustment applies this effect to each of the three types of Working Capital.

Net monetary assets refer to current items which are not easily turned into cash, such as inventories, prepaid expenses, etc., Minus debts due within one year. Also called short-term investments or current liabilities.

Recognizing the effects of a change in price levels allows management to adjust its current operations and strategies accordingly. It is important to know how changes in price levels affect Working Capital so that it could be managed better.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.