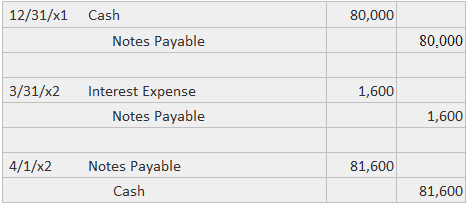

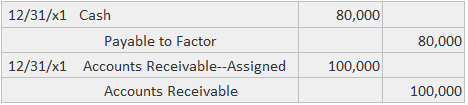

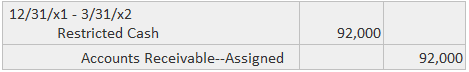

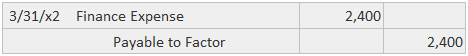

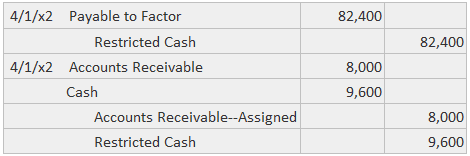

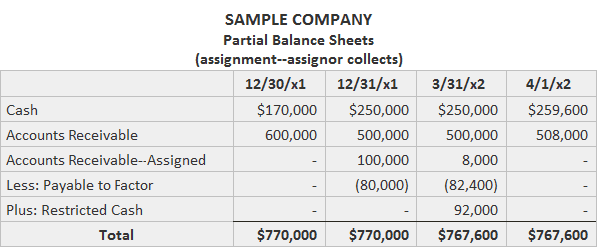

Pledging accounts receivable is essentially the same as using any asset as collateral for a loan. Cash is obtained from a lender by promising to repay. If the loan is not repaid, the collateral will be converted to cash, and the cash will be used to retire the debt. The receivables can be either an identified set of notes and accounts or a general group in which new ones can be added and old ones retired. The collection of a pledged receivable has no impact on the loan balance. The pledging agreement usually calls for the substitution of another receivable for the one collected. As an example, suppose that Sample Company borrows $80,000 on 31 December 2023, and agrees to pay back $81,600 on 1 April 2024. Further, it pledges $100,000 of trade receivables for the loan. The company would make three journal entries as follows: The last two entries can be combined, but they are shown separately here to facilitate a comparison of pledging with the other approaches. The only financial statement disclosures provided for pledged receivables are notes or parenthetical comments. A similar notation is provided for the notes payable. As an alternative to pledging, the company may decide to assign its receivables to a lending institution. Under this arrangement, the original holder essentially transfers title to the third party but agrees to collect the receivables and pay the cash to the factor. Suppose that Sample Company obtains $80,000 cash on 31 December 2023 by assigning $100,000 of its trade receivables. The company agrees to place the collections in a special restricted checking account from which it will repay the original $80 000 plus a $2,400 finance charge on April 1, 2024. These journal entries would be made as follows: To record partial collection of the assigned accounts: To accrue the finance charge: To reclassify the uncollected accounts and unrestricted cash: The disclosures that would be provided on various balance sheet dates are shown in the following example, under the simplifying assumption that no other activity took place. Notice that the payable to the factor is contra to the assigned accounts. Any restricted cash balance is, in turn, contra to the payable account. Most arrangements of this type call for more frequent payments than the example shows. The net result of the assignment is that Sample Company obtained $80,000 by giving up $82,400 of receivables.Definition and Explanation

Assignor Collects

Example

Pledging Accounts Receivable FAQs

Pledging Accounts Receivable means that a business gives up some of its rights to an asset in order to borrow money. For example, you could pledge your car title as collateral for a loan. If the loan isn't repaid, the lender can take possession of your car.

There are no Special Journal entries required when you pledge your Accounts Receivable as collateral for a loan. The lender still has to approve giving up your Accounts Receivable before making the loan.

Accounts Receivable are money owed to a company by their customers for products they've already received. Accounts are recorded in the balance sheet as assets.

The entry to record assignment of Accounts Receivable as collateral would be a credit to cash, and a debit to assign Accounts Receivable. The cash account is debited because the company gave up the assigned receivables. The assign Accounts Receivable account is credited because they still owe this money to their customers.

The three main Financial Statements in an assignment of Accounts Receivable are the income statement, balance sheet, and Cash Flow statement. The income statement and Cash Flow statements would report the repayments on the receivables.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.