Social Security break-even age is the age at which the total amount of Social Security benefits received by an individual, who has chosen to claim their benefits at a certain age, equals the total amount they would have received if they had claimed their benefits at a different age. In simpler terms, it is the point at which the decision to claim benefits early, at full retirement age, or later, neither gains nor loses money compared to the other options. A proper understanding of the break-even age can help retirees optimize their lifetime income, balance financial risks, and plan more effectively for a secure retirement. Social Security benefits can be claimed as early as age 62, but doing so will result in permanently reduced benefits. This reduction can be significant, depending on the individual's full retirement age and the number of months until their full retirement age when they begin claiming benefits. The full retirement age, also known as the "normal retirement age," is the age at which an individual is eligible to receive their full Social Security benefits. The full retirement age varies depending on the individual's birth year, ranging from 65 to 67. Individuals can choose to delay claiming Social Security benefits past their full retirement age, up to age 70. For each year they wait, their benefits will increase by a certain percentage, resulting in a larger monthly benefit once they start claiming. An individual's health plays a critical role in determining their break-even age, as those in good health and with a longer life expectancy may benefit more from delaying their benefits. Genetic factors and family medical history can provide insight into an individual's potential life expectancy, which can be a crucial factor when considering the optimal claiming age for Social Security benefits. Social Security benefits are calculated based on an individual's 35 highest-earning years. A higher average lifetime income will generally result in higher benefits, which can impact the break-even age calculation. The length of an individual's employment history and the number of years they contributed to Social Security can also affect their benefit amount and break-even age. Individuals should consider their overall financial situation, including savings, investments, and other sources of retirement income when deciding when to claim Social Security benefits. An individual's health and family history can play a significant role in determining the most appropriate claiming strategy. If an individual has a shorter life expectancy due to health or family history, they may choose to claim benefits earlier. Married couples should take into account spousal and survivor benefits when making decisions about when to claim Social Security. Coordinating claiming strategies can help maximize the total benefits received by both spouses. Individuals who plan to work during retirement should consider the impact of their earnings on their Social Security benefits, as there are limits to how much one can earn without affecting benefit amounts. When deciding when to claim Social Security benefits, individuals should also consider other sources of retirement income, such as pensions, investments, and savings, to ensure a well-rounded retirement plan. There are various online tools and calculators available to help individuals estimate their break-even age for Social Security benefits, taking into account their personal circumstances, such as earnings history, claiming age, and life expectancy. By comparing the total amount of benefits received under different claiming age scenarios, individuals can identify the break-even age and make informed decisions about when to start claiming benefits. Evaluating various claiming age scenarios can help individuals determine the optimal claiming strategy that maximizes their lifetime benefits and minimizes financial risks associated with longevity. Delaying retirement can result in higher Social Security benefits, as individuals continue to contribute to the system and accrue additional delayed retirement credits. Understanding and coordinating spousal benefits can help married couples maximize their combined Social Security income and optimize their break-even age. Depending on an individual's income, a portion of their Social Security benefits may be subject to federal income tax. Understanding the tax implications of different claiming strategies can help retirees make more informed decisions about their break-even age and overall financial planning. Working while receiving Social Security benefits can affect the amount of benefits an individual receives, particularly if they have not yet reached their full retirement age. Being aware of these potential reductions can help retirees make informed decisions about when to claim benefits and how employment may impact their break-even age. Life events, such as unexpected health issues, changes in marital status, or significant financial changes, can alter an individual's break-even age calculation and may require adjustments to their retirement planning. Future changes to the Social Security system, such as adjustments to the full retirement age or benefit calculation formulas, can impact an individual's break-even age and may necessitate a reevaluation of their claiming strategy. Economic conditions and market fluctuations can influence investment returns and retirement savings, which may affect an individual's break-even age calculation and overall retirement planning. Understanding the Social Security break-even age is a crucial aspect of retirement planning, as it helps individuals make informed decisions about when to claim their benefits. Factors such as claiming age, life expectancy, and employment history significantly influence the break-even age calculation. Utilizing online tools and comparing different claiming age scenarios can help individuals estimate their break-even age and optimize their Social Security benefits. Additionally, implementing strategies such as delaying retirement, coordinating spousal benefits, and considering taxation can maximize lifetime benefits. It is essential to recognize that each individual's circumstances are unique, and personalized financial planning is necessary to ensure a secure and comfortable retirement. Finally, taking into account limitations and uncertainties such as unpredictable life events, changes to the Social Security system, and market fluctuations is vital for a comprehensive retirement strategy that incorporates break-even age analysis.Definition of Social Security Break-Even Age

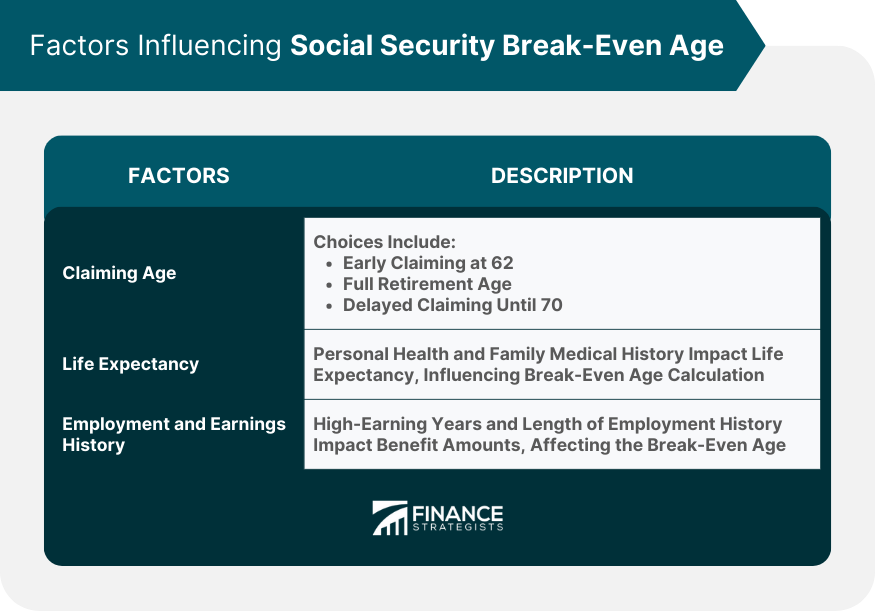

Factors Influencing Social Security Break-Even Age

Claiming Age

Early Claiming at 62

Full Retirement Age

Delayed Claiming Until 70

Life Expectancy

Personal Health

Family Medical History

Employment and Earnings History

High-Earning Years

Impact on Benefits Calculation

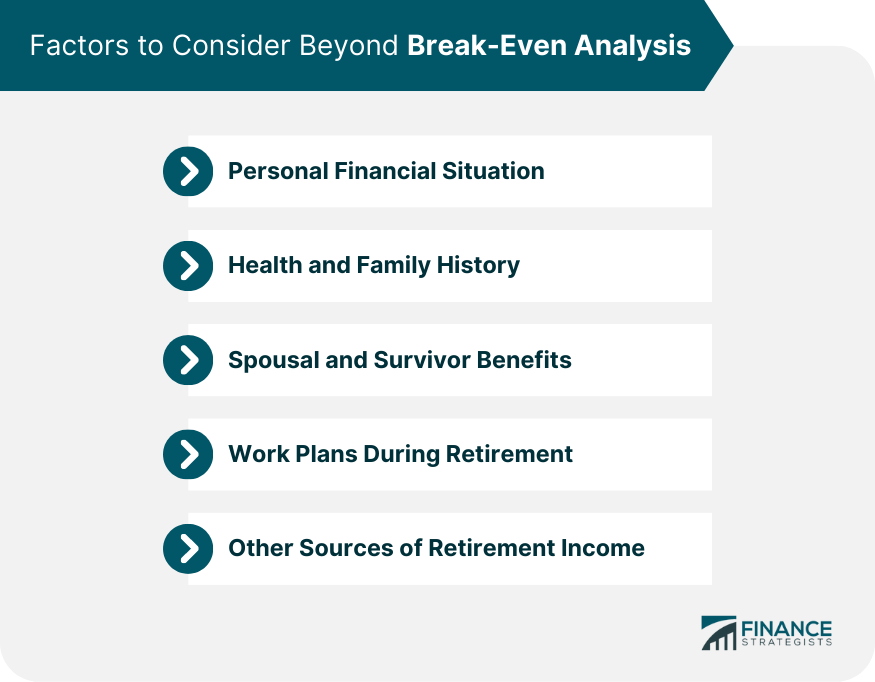

Factors to Consider Beyond Break-Even Analysis

Personal Financial Situation

Health and Family History

Spousal and Survivor Benefits

Work Plans During Retirement

Other Sources of Retirement Income

Calculating Social Security Break-Even Age

Using Online Tools and Calculators

Estimating Lifetime Benefits

Total Benefits Received

Comparing Scenarios with Different Claiming Ages

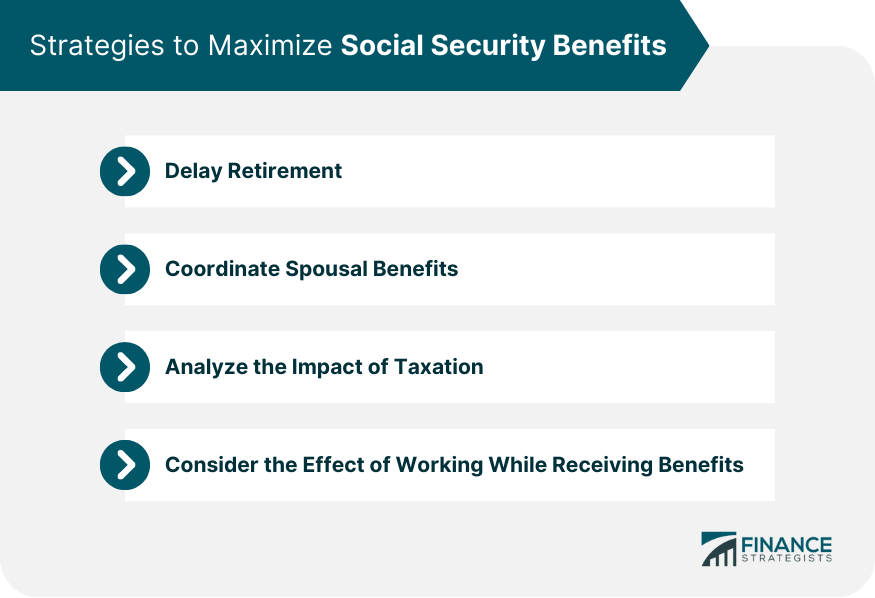

Strategies to Maximize Social Security Benefits

Delaying Retirement

Coordinating Spousal Benefits

Analyzing the Impact of Taxation

Considering the Effect of Working While Receiving Benefits

Limitations and Uncertainties of Break-Even Age Analysis

Unpredictable Life Events

Changes to the Social Security System

Market Fluctuations and Investment Returns

Final Thoughts

Social Security Break-Even Age FAQs

The Social Security break-even age is the point at which the total amount of benefits received by an individual, based on their chosen claiming age, equals the total amount they would have received if they had claimed benefits at a different age. Understanding the break-even age is crucial for retirement planning as it helps retirees make informed decisions about when to start claiming benefits, and optimizing their lifetime income, and financial security.

Life expectancy plays a significant role in determining an individual's break-even age, as those with a longer life expectancy may benefit more from delaying their Social Security benefits. Factors such as personal health and family medical history can provide insight into potential life expectancy, influencing the optimal claiming age for Social Security benefits.

Strategies to maximize Social Security benefits and optimize the break-even age include delaying retirement, coordinating spousal benefits, analyzing the impact of taxation, and considering the effect of working while receiving benefits. These strategies can help individuals make more informed decisions about when to claim benefits and maximize their lifetime income.

Limitations and uncertainties of relying solely on the break-even age for retirement planning include unpredictable life events, changes to the Social Security system, and market fluctuations and investment returns. These factors can impact an individual's break-even age calculation and may require adjustments to their retirement planning.

Individuals can estimate their break-even age using various online tools and calculators that take into account factors such as earnings history, claiming age, and life expectancy. By comparing the total amount of benefits received under different claiming age scenarios, individuals can identify the break-even age and make informed decisions about when to start claiming benefits.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.