An overfunded pension plan occurs when a company's pension plan has more assets than it needs to cover the present value of the retirement benefits it has promised to its employees. In essence, it's the opposite of underfunding, where the plan lacks sufficient assets to meet its obligations. The financial health of a pension plan is critical, affecting employees, employers, and the broader economy. Pension plans are established by employers as part of their benefits package to provide income to employees after retirement. These plans are vital because they play a significant role in ensuring financial security for employees in their post-work years. They also serve as a recruitment and retention tool for employers, providing a competitive edge in the labor market. A pension plan becomes overfunded when its investments perform exceptionally well or when the actuarial assumptions used to calculate the plan's liabilities change in a way that reduces those liabilities. For instance, if the plan's investments in the stock market yield return significantly above expectations, the assets of the plan may exceed the anticipated liabilities, leading to overfunding. Several factors can contribute to a pension plan becoming overfunded. These include: Excellent Investment Performance: If the investments made using the pension fund perform exceptionally well, they could increase the fund's assets beyond the expected obligations. Lower Than Expected Inflation: Lower inflation rates can decrease the amount the company needs to meet future pension obligations, leading to overfunding. Increased Life Expectancy: If the life expectancy of pensioners decreases, the plan may end up overfunded as it has set aside more money than is needed for pensions. Actuarial assumptions play a pivotal role in pension overfunding. These assumptions regarding factors such as employee lifespan, salary growth, and investment returns are used to estimate the plan's future liabilities. If these assumptions prove overly conservative, the plan can end up overfunded. An overfunded pension plan, while somewhat counterintuitive, can offer a range of benefits for the involved parties. The pros mostly lie in providing a financial safety net and offering increased security. For employees, an overfunded pension plan can act as a strong pillar of financial security. Its benefits stretch beyond the obvious monetary advantage, influencing the psychological and overall well-being of employees. An overfunded pension plan provides a safety net for employees. In situations of financial market fluctuations or unexpected changes in life expectancy trends, an overfunded plan is more likely to meet its obligations. This security assures employees that they will receive their promised benefits regardless of external factors. Knowing that their pension plan is overfunded can also aid employees in their personal financial planning. It can provide peace of mind, allowing them to plan their post-retirement life with more certainty. An overfunded pension plan can increase employees' trust in the financial stability of their employer, thereby enhancing their job satisfaction and loyalty. For companies, an overfunded pension plan can serve as a useful financial tool. It can act as a financial buffer, provide tax advantages, and even enhance the company's reputation. Overfunded pension plans can serve as a financial buffer for companies. In certain circumstances, they can use surplus pension assets for other corporate purposes, such as funding retiree health benefits or reducing pension contributions in the future. This flexibility can provide significant financial relief, especially in economically challenging times. Overfunded pension plans can also offer tax advantages. For instance, in the U.S., under specific conditions, companies can use surplus pension assets to fund retiree health benefits, potentially leading to tax deductions. A company managing an overfunded pension plan is often seen as financially robust and responsible. This image can enhance the company's reputation among investors, potential employees, and the general public, providing a competitive edge in the marketplace. While overfunded pension plans can provide notable benefits, they also come with their own set of potential drawbacks. The negative implications primarily revolve around the inherent risks and challenges for both the employees and the company. Overfunded pension plans, despite their apparent advantages, can sometimes pose risks for employees. These risks primarily relate to the company's financial stability and the utilization of the pension fund's surplus. One of the key risks arise when a company becomes insolvent. If the company has used the overfunded assets for other corporate purposes, employees might face the unfortunate possibility of losing their pension benefits. This could significantly impact their financial stability, particularly for those nearing or in retirement. In some cases, companies might use the overfunded status of a pension plan as a reason to reduce future contributions or to modify the benefits structure. This could potentially lead to lower-than-expected benefits for employees in the future. For companies, managing an overfunded pension plan is not without challenges. These are largely centered around restrictions on surplus asset usage and the unpredictability of financial markets. The first challenge arises from the restrictions placed on the use of surplus pension assets. Typically, these assets are limited to pension-related uses, hindering the company's financial flexibility. For example, a company cannot easily use these surplus funds to invest in new business ventures or to boost cash flow during economic downturns. The second challenge stems from the volatility of financial markets. Investments that form a significant part of pension plan assets are subject to market fluctuations. In a bullish market, these investments may perform exceptionally well, leading to an overfunded status. However, a bearish market or a financial crisis could quickly wipe out this surplus, turning an overfunded plan into an underfunded one. This volatility requires careful and proactive management to safeguard the pension plan's health. In the United States, the Employee Retirement Income Security Act (ERISA) governs pension plans, including overfunded plans. ERISA restricts the use of surplus pension assets for non-pension purposes. However, the Pension Protection Act of 2006 allows companies to use surplus pension assets to fund retiree health benefits under certain conditions. Internationally, regulations on overfunded pension plans vary. In the UK, for example, regulations are less stringent, allowing companies to withdraw surplus funds under certain conditions. However, most countries maintain tight controls on overfunded pension assets to protect the interests of the plan's beneficiaries. Overfunded pension plans can also have tax implications. In the U.S., any reversion of surplus pension assets to the company is subject to both income tax and an excise tax. However, if the surplus is used to fund retiree benefits, the excise tax may be waived. Plan sponsors can use several strategies to manage overfunded pension plans effectively. These include: Maintaining a Conservative Investment Strategy: This helps to protect the plan against market volatility. Using Surplus Assets to Fund Retiree Benefits: This can improve the company's overall financial health without jeopardizing the plan's future obligations. Regularly Reviewing Actuarial Assumptions: Ensuring that these assumptions accurately reflect current trends can prevent excessive overfunding. Plan participants, on the other hand, should ensure that they understand their rights under the pension plan. If a plan is overfunded, participants may wish to inquire about how the surplus assets are being managed and whether the plan sponsor has a strategy in place for protecting those assets against potential risks. An overfunded pension plan occurs when a company's pension assets exceed the present value of promised retirement benefits. Factors contributing to overfunding include excellent investment performance, lower-than-expected inflation, and increased life expectancy. An overfunded plan offers benefits such as increased security, enhanced financial planning, and increased trust in the company for employees. For companies, it serves as a financial buffer, provides tax advantages, and enhances reputation. However, potential risks for employees include uncertainties in company insolvency and the risk of benefit reduction. Challenges for companies involve restrictions on surplus asset usage and market volatility. Legal and regulatory aspects, including the ERISA in the US, international regulations, and tax implications, must be considered. Effective strategies for managing overfunded pension plans include a conservative investment strategy, using surplus assets for retiree benefits, and regular review of actuarial assumptions. Plan participants should understand their rights and inquire about asset management strategies.What Is an Overfunded Pension Plan?

Understanding Overfunding

Explanation of How a Pension Plan Becomes Overfunded

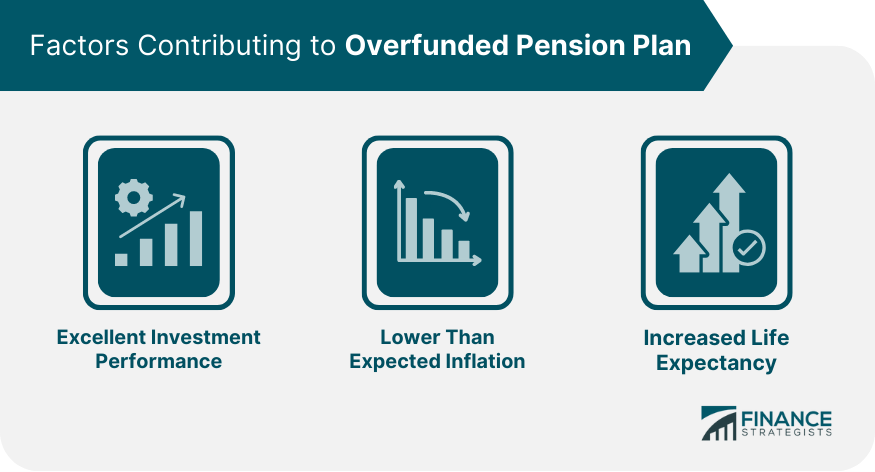

Factors Contributing to Overfunded Pension Plan

Role of Actuarial Assumptions in Pension Overfunding

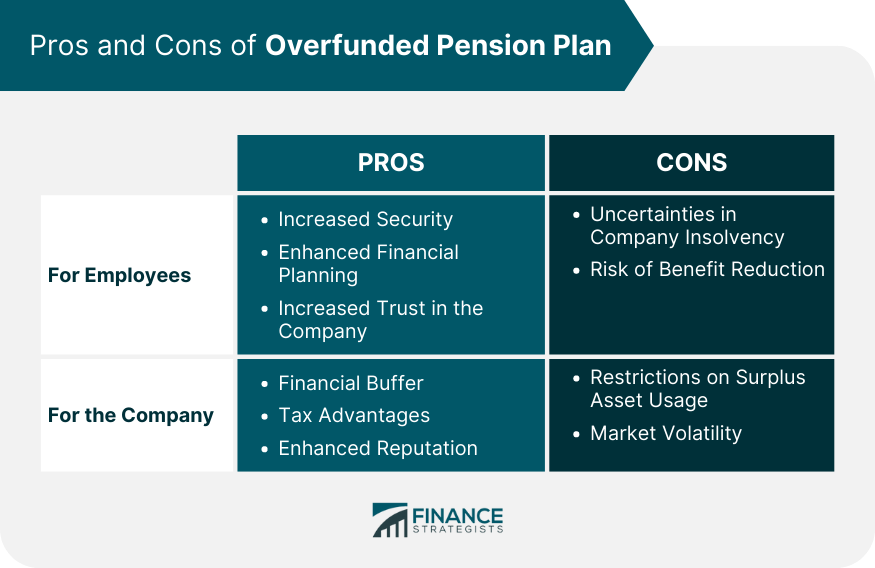

Pros of Overfunded Pension Plans

Benefits for the Employees

Increased Security

Enhanced Financial Planning

Increased Trust in the Company

Benefits for the Company

Financial Buffer

Tax Advantages

Enhanced Reputation

Cons of Overfunded Pension Plans

Potential Risks and Challenges for Employees

Uncertainties in Company Insolvency

Risk of Benefit Reduction

Potential Risks and Challenges for the Company

Restrictions on Surplus Asset Usage

Market Volatility

Legal and Regulatory Aspects of Overfunded Pension Plans

U.S. Regulations on Overfunded Pension Plans

International Regulations on Overfunded Pension Plans

Tax Implications of Overfunded Pension Plans

Strategies for Managing Overfunded Pension Plans

For Plan Sponsors

For Plan Participants

Final Thoughts

Overfunded Pension Plan FAQs

An overfunded pension plan is a situation where a company's pension plan has more assets than it needs to cover the present value of the retirement benefits it has promised to its employees. This usually occurs when the plan's investments perform exceptionally well or the actuarial assumptions used to calculate the plan's liabilities change favorably.

An overfunded pension plan can provide increased security for employees as it is more likely to meet its obligations, ensuring that employees receive their promised benefits. For companies, an overfunded pension plan can serve as a financial buffer and, under certain circumstances, the surplus pension assets can be used for other corporate purposes, such as funding retiree health benefits.

Overfunded pension plans offer benefits but carry risks. Employee risk includes losing benefits if the company misuses surplus assets, while companies face restricted flexibility and market volatility turning over funding into underfunding.

ERISA regulates overfunded pension plans in the U.S., limiting non-pension use of surplus assets. The Pension Protection Act permits using surplus assets for retiree health benefits. Internationally, regulations safeguard beneficiaries by tightly controlling overfunded pension assets.

Companies can manage overfunded pension plans effectively by maintaining a conservative investment strategy, using surplus assets to fund retiree benefits, and regularly reviewing actuarial assumptions. It's also important for companies to adhere to regulations that govern the use of surplus pension assets to protect the interests of the plan's beneficiaries.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.