A retroactive plan amendment refers to a change in an employee benefit plan that applies not only to future events but also to those that occurred before the amendment took effect. This allows employers to modify plans based on past events or circumstances. The primary purpose of a retroactive plan amendment is to address errors or omissions, update plan provisions to comply with regulatory changes, enhance benefits for employees, or address changes in company structure or ownership. This flexibility can benefit both employers and employees. Various employee benefit plans can be amended retroactively, including retirement plans, health and welfare plans, and other types of benefit plans. Retirement plans are designed to provide income to employees after they retire. These plans can be amended retroactively, including defined benefit plans and defined contribution plans. Defined benefit plans guarantee a specific retirement benefit based on factors like years of service and salary. Retroactive amendments in these plans might involve changes in the benefit formula or eligibility requirements. Defined contribution plans allow employees and employers to contribute to individual accounts, with retirement benefits based on the account's value. Retroactive amendments might include changes in contribution rates or matching formulas. Health and welfare plans provide benefits like health insurance, disability insurance, and life insurance. Retroactive amendments in these plans can modify eligibility, coverage, or cost-sharing provisions. Other employee benefit plans, such as fringe benefit plans or cafeteria plans, can also be amended retroactively. These amendments may involve changes in benefits offered or eligibility criteria. Retroactive plan amendments must comply with various legal and regulatory frameworks, including Internal Revenue Service (IRS) regulations, the Employee Retirement Income Security Act (ERISA), Department of Labor (DOL) guidelines, and other relevant laws and regulations. This section will discuss these frameworks. The IRS sets rules for tax-qualified employee benefit plans, including limits on retroactive amendments. Employers must ensure amendments comply with these regulations to maintain the plan's tax-qualified status. ERISA establishes minimum standards for employee benefit plans, including rules for plan amendments. Employers must comply with ERISA requirements when making retroactive plan amendments to avoid penalties and potential litigation. The DOL enforces certain provisions of ERISA and provides guidance on employee benefit plan administration. Employers should consult DOL guidelines when considering retroactive plan amendments to ensure compliance with applicable laws. Other laws and regulations, such as the Affordable Care Act (ACA) for health and welfare plans, may also impact retroactive plan amendments. Employers should review all relevant laws and consult with legal counsel to ensure compliance. There are various reasons why employers may choose to implement a retroactive plan amendment such as the following: Retroactive plan amendments can be used to correct errors or omissions in plan documents or administration. These corrections help ensure compliance with applicable laws and regulations and maintain the plan's tax-qualified status. Regulatory changes may require updates to plan provisions, and retroactive plan amendments can be used to bring plans into compliance. This helps employers avoid penalties and potential litigation associated with non-compliance. Employers may choose to implement retroactive plan amendments to improve benefits for employees, such as increasing retirement plan contributions or enhancing health and welfare plan coverage. This can help boost employee satisfaction and retention. Changes in company structure or ownership, such as mergers or acquisitions, may necessitate adjustments to employee benefit plans. Retroactive plan amendments can be used to align plans with the new organizational structure and ensure that employees continue to receive the intended benefits. The first step in implementing a retroactive plan amendment is recognizing the need for a change, such as addressing a plan error, updating provisions to comply with regulatory changes, or enhancing benefits for employees. Before drafting an amendment, employers should review existing plan documents and consult relevant laws and regulations to ensure the proposed change is compliant and appropriate. Once the need for an amendment is identified and reviewed, employers should draft the amendment, ensuring it complies with applicable regulations, and obtain any necessary internal or external approvals, such as from the plan sponsor or board of directors. After drafting and approving the amendment, employers should communicate the change to affected parties, including employees, plan participants, and plan administrators, to ensure awareness and understanding of the amendment. Finally, employers must update plan administration and record-keeping systems to reflect the retroactive amendment, ensuring accurate tracking of benefits and compliance with applicable regulations. Failure to comply with relevant laws and regulations when implementing a retroactive plan amendment may result in penalties, tax consequences, or loss of the plan's tax-qualified status, making it essential for employers to ensure compliance. Retroactive plan amendments may cause confusion or dissatisfaction among employees if they perceive the changes as unfair or are not adequately informed about the reasons for the amendments and how they affect their benefits. Employees or plan participants may challenge retroactive plan amendments in court, leading to potential litigation costs and reputational damage for the employer. Retroactive plan amendments may have unintended consequences, such as financial implications for the employer or employees, if the amendments are not carefully considered and implemented. To minimize potential challenges and pitfalls, employers should follow best practices when implementing retroactive plan amendments. Employers should regularly review their employee benefit plans for compliance with applicable laws and regulations, helping to identify and address potential issues before they become significant problems. Employers should communicate openly and transparently with employees and plan participants about any proposed retroactive plan amendments, explaining the reasons for the changes and how they will affect benefits. Employers should consult with legal counsel, accountants, or benefits consultants when considering or implementing retroactive plan amendments to ensure compliance with applicable laws and regulations and avoid potential pitfalls. Employers should develop a process for regularly reviewing and updating their employee benefit plans, including provisions for addressing needed amendments, to ensure continued compliance and effectiveness. Retroactive plan amendments are changes made to an employee benefit plan that apply to past and future events. They are essential for maintaining compliant and effective benefit plans, but employers must balance the need for change with potential risks and challenges. Employers can navigate these complexities by emphasizing proactive plan management, clear communication, expert guidance, and ongoing maintenance. Thoroughly evaluating the potential impact of each amendment and taking a measured approach to implementation can minimize potential problems. Regularly reviewing and updating plan provisions, consulting with experts, and communicating with employees can prevent issues from arising and make retroactive amendments less necessary. Seeking professional retirement planning services can ensure the successful implementation, compliance, and effectiveness of benefit plans.What Are Retroactive Plan Amendments?

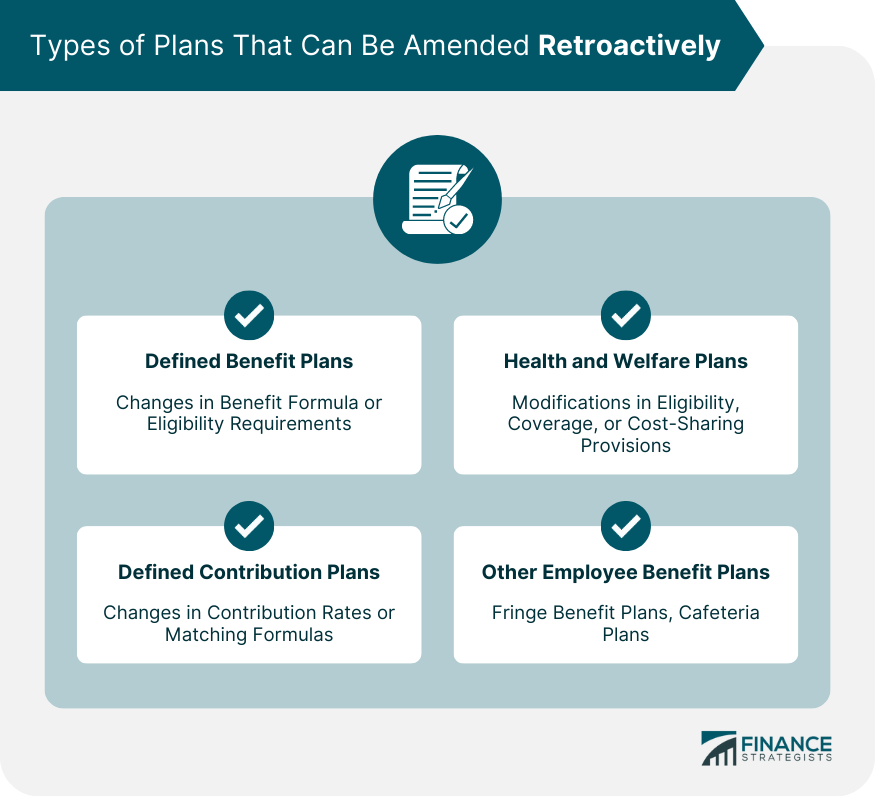

Types of Plans That Can Be Amended Retroactively

Retirement Plans

Defined Benefit Plans

Defined Contribution Plans

Health and Welfare Plans

Other Types of Employee Benefit Plans

Legal and Regulatory Framework for Retroactive Plan Amendments

Internal Revenue Service (IRS) Regulations

Employee Retirement Income Security Act (ERISA)

Department of Labor (DOL) Guidelines

Other Relevant Laws and Regulations

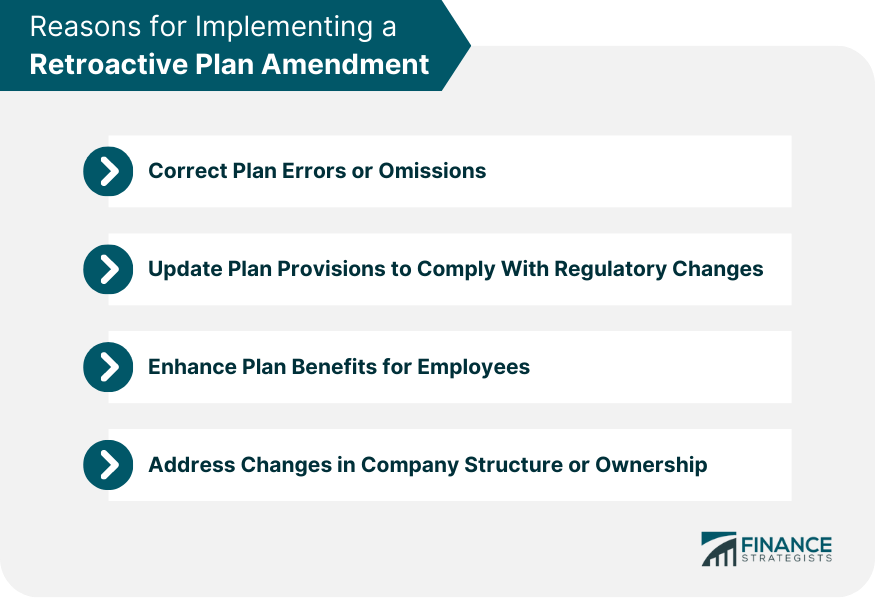

Reasons for Implementing a Retroactive Plan Amendment

Correcting Plan Errors or Omissions

Updating Plan Provisions to Comply with Regulatory Changes

Enhancing Plan Benefits for Employees

Addressing Changes in Company Structure or Ownership

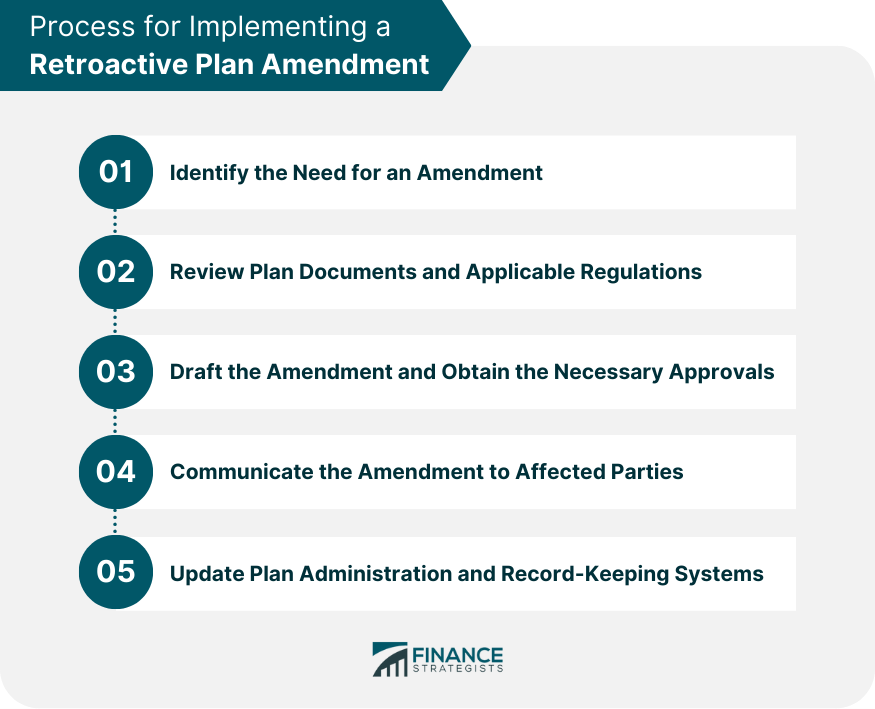

Process for Implementing a Retroactive Plan Amendment

Identifying the Need for an Amendment

Reviewing Plan Documents and Applicable Regulations

Drafting the Amendment and Obtaining Necessary Approvals

Communicating the Amendment to Affected Parties

Updating Plan Administration and Record-Keeping Systems

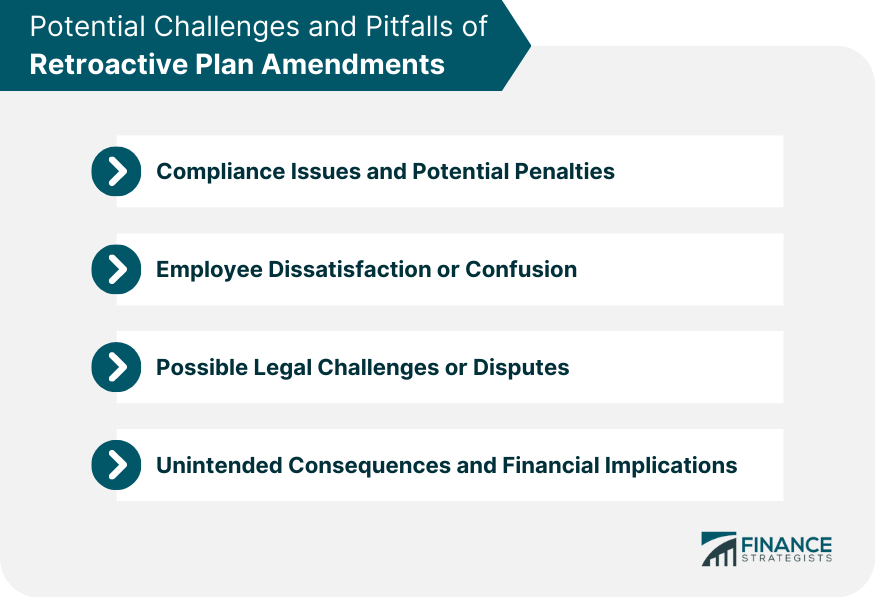

Potential Challenges and Pitfalls of Retroactive Plan Amendments

Compliance Issues and Potential Penalties

Employee Dissatisfaction or Confusion

Possible Legal Challenges or Disputes

Unintended Consequences and Financial Implications

Best Practices for Retroactive Plan Amendments

Regular Plan Compliance Reviews

Clear Communication with Employees and Plan Participants

Seeking Expert Advice from Legal Counsel, Accountants, or Benefits Consultants

Establishing a Process for Ongoing Plan Maintenance and Amendments

Final Thoughts

Retroactive Plan Amendments FAQs

Retroactive plan amendments are changes made to employee benefit plans that apply to events that occurred before the amendment's effective date. Employers may implement them to correct errors or omissions, update plan provisions to comply with regulatory changes, enhance benefits for employees, or address changes in company structure or ownership.

Employers can ensure compliance with relevant laws and regulations when making retroactive plan amendments by regularly reviewing plan documents, consulting with legal counsel, accountants, or benefits consultants, and following best practices, such as clear communication with employees and ongoing plan maintenance.

Various employee benefit plans can be amended retroactively, including retirement plans (such as defined benefit and defined contribution plans), health and welfare plans, and other types of benefit plans, like fringe benefit plans or cafeteria plans.

Potential challenges and pitfalls of implementing retroactive plan amendments include compliance issues and potential penalties, employee dissatisfaction or confusion, possible legal challenges or disputes, and unintended consequences and financial implications.

Best practices for implementing retroactive plan amendments successfully include conducting regular plan compliance reviews, communicating clearly with employees and plan participants, seeking expert advice from legal counsel, accountants, or benefits consultants, and establishing a process for ongoing plan maintenance and amendments.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.