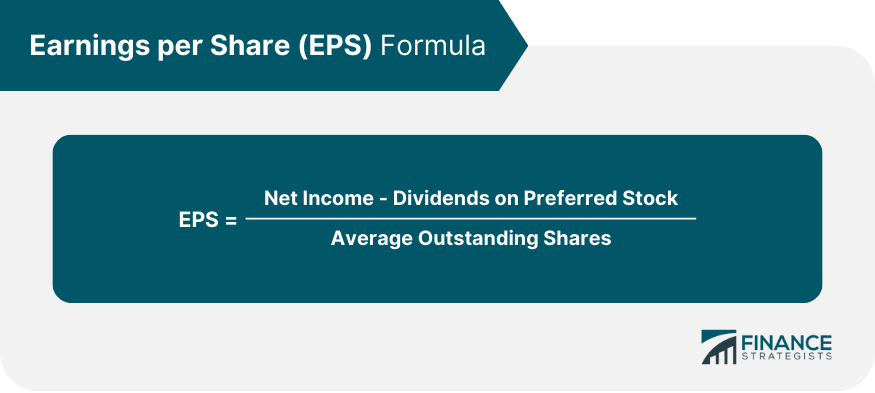

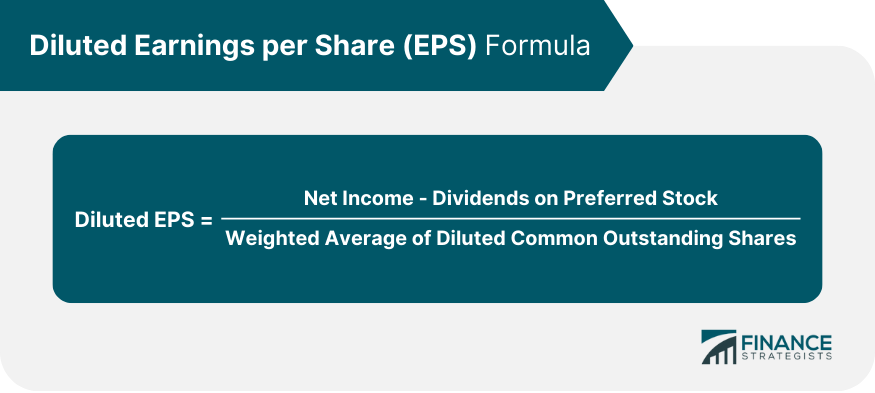

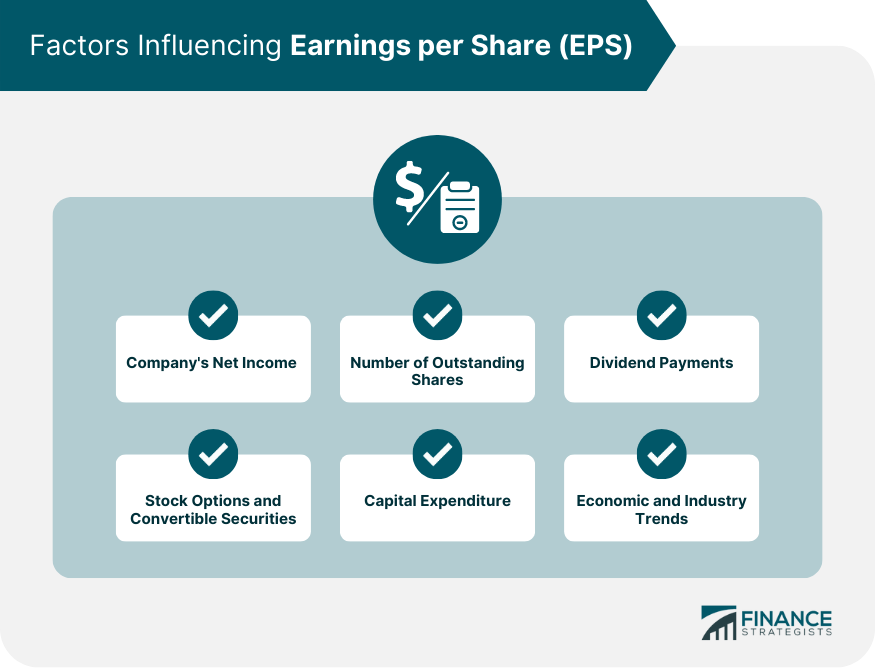

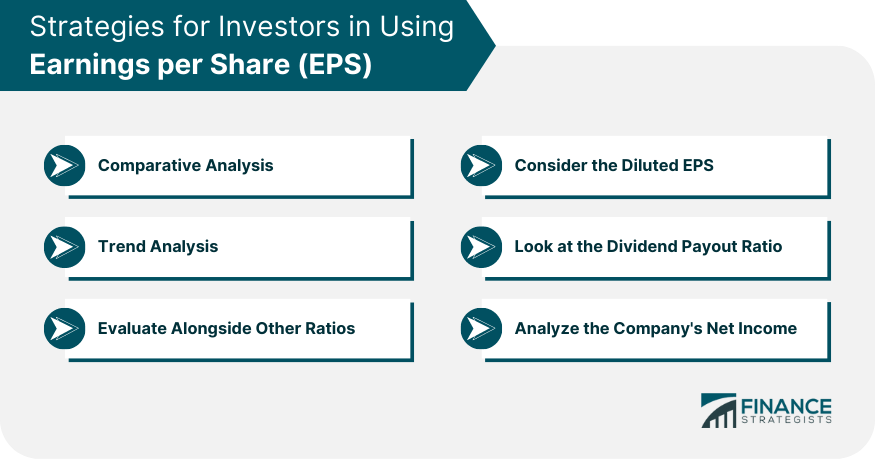

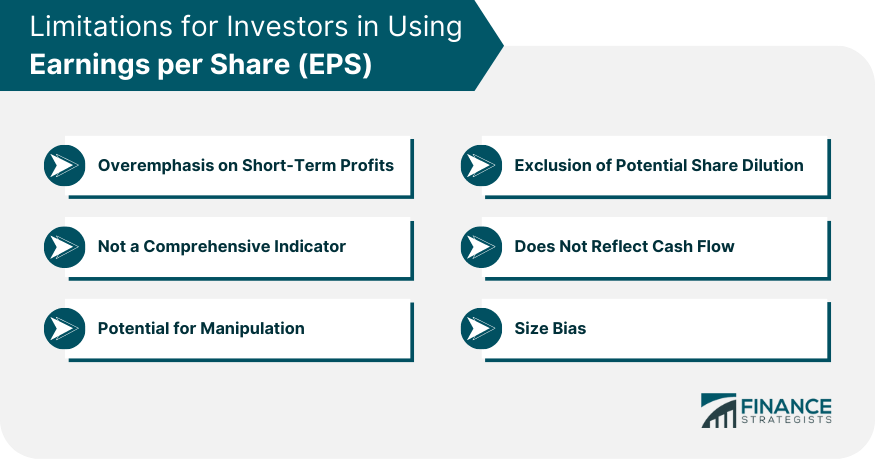

Earnings Per Share (EPS) is a vital financial metric for investors as it provides direct insight into a company's profitability. The higher the EPS, the more profitable a company is perceived to be, making its stock more attractive to investors. Additionally, EPS is a critical factor in determining a company's stock price, with stocks boasting higher EPS often valued more highly. Furthermore, EPS serves as a useful comparative tool, enabling investors to measure the profitability of different companies and facilitating better-informed decisions regarding portfolio diversification. However, it's important for investors to consider other financial indicators alongside EPS for a more comprehensive understanding of a company's financial health. Grasping the calculation process is essential to understand the true importance of EPS. The formula to calculate basic EPS is: Consider a company that earned $10 million in net income, paid out $2 million in preferred dividends, and has 4 million average outstanding shares. Using the formula above, the EPS would be ($10 million - $2 million) / $4 million = $2 per share. On the other hand, diluted EPS considers the dilutive effects of potential shares that could be issued, like stock options or convertible securities. The formula is the same, but the denominator includes these potential shares. For instance, if the company from the previous example had 500,000 potential shares from stock options, from the formula above, the diluted EPS would be ($10 million - $2 million) / (4 million + 500,000) = $1.82 per share. Understanding the factors that influence EPS is crucial for investors to make informed decisions. Here are some key factors investors should consider: EPS is directly tied to a company's net income. When a company's net income increases, the EPS typically increases, signaling higher profitability which can attract investors. A decline in net income, on the other hand, may lead to a decrease in EPS and potentially deter investors. Changes in the number of a company's outstanding shares can impact EPS. When a company issues more shares (without a proportionate increase in net income), EPS can decrease because earnings are spread over a larger number of shares. Conversely, when a company repurchases its own shares, this can increase EPS by concentrating earnings among fewer shares. Dividends on preferred stock can decrease the portion of earnings available to common shareholders, reducing the EPS. The potential conversion of stock options and convertible securities into common stock can dilute EPS. Investors need to look at both basic and diluted EPS to get a clearer picture of a company's financial health. Large capital expenditures can impact net income, affecting EPS. These are often necessary for long-term growth, so a short-term dip in EPS may not deter long-term investors. Broader economic factors and industry trends can affect a company's net income and hence its EPS. Economic downturns, shifts in consumer behavior, or changes in regulation can impact EPS. Earnings Per Share is a critical measure of a company's profitability, but it should not be used in isolation. Other financial ratios provide complementary insights, contributing to a more holistic view of a company's financial health. The Price/Earnings (P/E) ratio, for example, compares a company's market value per share with its EPS, providing a broader perspective on the company's value. A lower P/E ratio might indicate that the stock is undervalued, making it a potential investment opportunity. The Debt/Equity (D/E) ratio is another crucial metric that offers insights into a company's leverage and financial risk, providing context to the EPS. A high D/E ratio might indicate a company has taken on substantial debt, potentially threatening its financial stability despite high EPS. Finally, the Return on Equity (ROE) ratio measures a company's efficiency in generating profits from shareholders' equity, supplementing the profitability perspective provided by EPS. To effectively utilize Earnings Per Share in investment strategies, investors should consider the following: Comparative Analysis: Use EPS to compare companies within the same industry. Companies with higher EPS are generally more profitable and could be better investment options. Trend Analysis: Look at the trend of a company's EPS over several quarters or years. Consistent growth in EPS could indicate a company's ability to increase its profits over time. Evaluate Alongside Other Ratios: Don't rely solely on EPS. Use it alongside other financial metrics such as P/E ratio, D/E ratio, and ROE to get a holistic view of a company's financial health. Consider the Diluted EPS: Diluted EPS takes into account potential dilution from convertible securities, options, and warrants. This provides a more conservative estimate of EPS and can give a better understanding of a company's future earnings potential. Look at the Dividend Payout Ratio: This ratio shows what portion of earnings is being paid out as dividends. Companies with high EPS and a lower payout ratio may have more room to grow their dividends in the future. Analyze the Company's Net Income: Since EPS is largely dependent on net income, understanding factors affecting a company's net income can give insights into potential changes in EPS. Overemphasis on Short-Term Profits: Companies may focus on short-term profit generation to boost EPS, potentially at the expense of long-term strategic planning and sustainable growth. Not a Comprehensive Indicator: EPS doesn't account for a company's assets and liabilities. A company could have high EPS but also significant debt, posing a risk to its financial stability. Potential for Manipulation: Companies can artificially inflate EPS through share buybacks without a corresponding improvement in net income, presenting a distorted picture of financial health. Exclusion of Potential Share Dilution: Basic EPS doesn't consider potential share dilution from convertible securities, options, or warrants, which could result in an overestimation of a company's profitability. Does Not Reflect Cash Flow: EPS is based on net income, which can include non-cash items. It doesn't necessarily represent cash earnings, which are crucial for operations and dividends. Size Bias: EPS is often higher for larger companies, which can bias comparisons. Using EPS along with ratios like P/E can offer a more balanced comparison across companies of different sizes. Earnings per Share is a critical financial metric, informing investors of a company's profitability and influencing its stock value. Its calculation takes into account net income, outstanding shares, and dividends, among others. Factors such as net income, number of outstanding shares, dividends, potential share dilution, capital expenditure, and industry trends can significantly influence EPS. While powerful as a comparative tool and vital for trend analysis, EPS should be used alongside other financial ratios such as P/E, D/E, and ROE for a comprehensive evaluation of a company's financial health. Though EPS has limitations like an overemphasis on short-term profits, the potential for manipulation, and failure to reflect cash flow or account for size bias, it remains a pivotal metric for investors to understand the profitability and potential of a company.Why Is Earnings per Share (EPS) Important to Investors?

How EPS is Calculated

Basic EPS Calculation

Diluted EPS Calculation

Factors Influencing EPS

Company's Net Income

Number of Outstanding Shares

Dividend Payments

Stock Options and Convertible Securities

Capital Expenditure

Economic and Industry Trends

Importance of Other Financial Ratios in Conjunction With EPS

Strategies for Investors in Using EPS

Limitations of Using EPS

Bottom Line

Why Is Earnings per Share (EPS) Important to Investors? FAQs

EPS is a critical metric for investors as it provides a direct measure of a company's profitability. The higher the EPS, the more profitable the company is perceived to be, potentially making its stock more attractive to investors.

EPS serves as a useful comparative tool. It allows investors to measure and compare the profitability of different companies, enabling them to make more informed decisions when diversifying their portfolios.

While EPS provides valuable insights into a company's profitability, it doesn't provide a complete picture of the company's financial health. Therefore, it's important for investors to consider other financial indicators, such as the Price/Earnings (P/E) ratio, Debt/Equity (D/E) ratio, and Return on Equity (ROE), along with EPS.

Understanding how EPS is calculated helps investors evaluate a company's net income, dividends, and the number of outstanding shares – factors that can significantly influence EPS. Both basic and diluted EPS calculations should be understood for a comprehensive view of a company's financial health.

While EPS is an important measure of profitability, it has limitations, including an overemphasis on short-term profits, potential for manipulation, and failure to reflect cash flow or account for size bias. Therefore, it's essential for investors to understand these limitations when making investment decisions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.