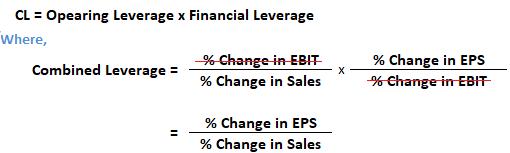

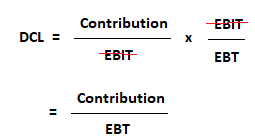

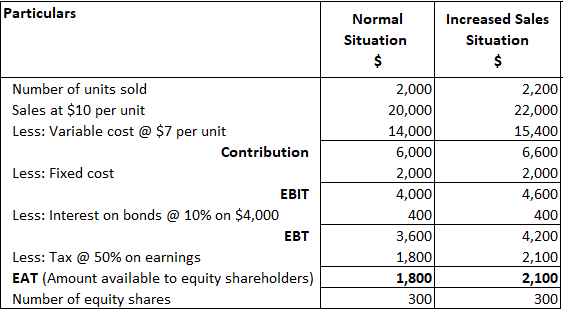

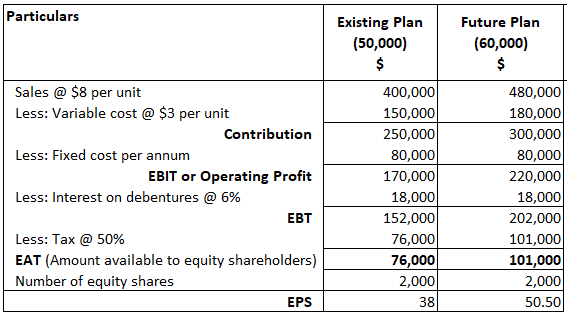

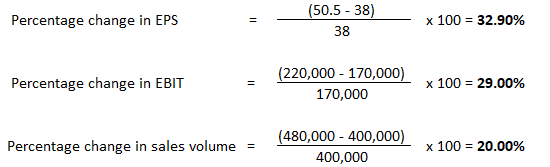

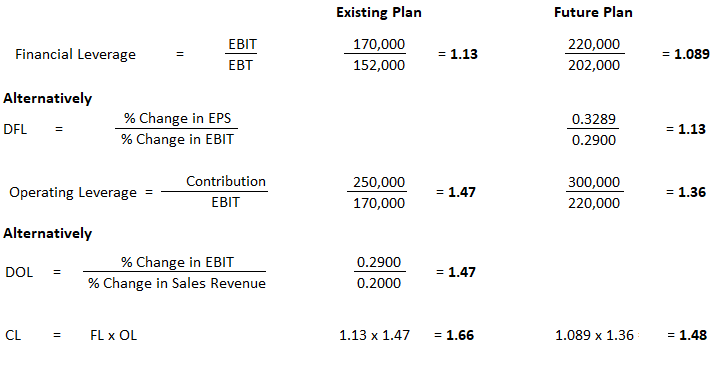

Combined leverage (OL + FL) represents a company’s total risk related to operating leverage, financial leverage, and the net effect on the EPS. Operating leverage affects the operating risk (i.e., the percentage change in EBIT due to the percentage change in sales), and financial leverage impacts the financial risk (i.e., the percentage change in EPS due to the percentage change in EBIT). Finance managers may calculate combined leverage to make more precise decisions. Calculate combined leverage using the following formula: Altenratively, calculate the degree of CL using the following: Assuming that the company has increased sales by 10%, comment on the performance. Therefore, DCL = 1.67. The percentage change in sales amounts to 10% (from 2,000 units to 2,200 units), whereas the percentage change in EPS amounts to approximately 16.67% (1/6 x 100). Thus, every 1% change in the sales level results in a 1.67% change in EPS. Positive leverage occurs as the sales and EPS positively change in the same direction, i.e., higher than the break-even level. Therefore, one can infer: Leverage helps the financial manager measure the effect of change in the volume of sales (OL) and the changes resulting from the fixed financial charge in the capital structure (FL). Calculation of EPS and leverage. Inference: The change in EPS is more substantial (32.9%) than that of EBIT (29%) and the sales volume (20%). Therefore, the future plan shows its viability. Inference: Though EPS is favorable in the future plan, the combined leverage is not. Financial leverage's influence on the combined leverage indicates the company's failure to utilize its borrowing capacity. Therefore, the manager should show caution in implementing the future plan.What Is Combined Leverage (CL)?

Formula to Calculate Combined Leverage (CL)

Example

Calculate

Calculation

Comment

Example

Solution

Calculation of Leverage

Combined Leverage FAQs

Combined leverage (ol + fl) represents a company’s total risk related to operating leverage, financial leverage, and the net effect on the eps.

The degree of combined leverage may be calculated by multiplying the degree of operating leverage and the degree of financial leverage.

Operating leverage describes a company's fixed costs in relation to its variable costs, as well as its break-even point. Financial leverage refers to the amount of debt used to finance the operations of a company.

By calculating cl, finance managers can make more precise decisions with regards to the company's overall risk. Additionally, cl can help managers identify any potential issues with the company's capital structure.

An example of combined leverage would be if a company's sales increased by 10%, while the eps increased by 16.67%. In this case, the cl would be 1.67 (Or 0.167).

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.