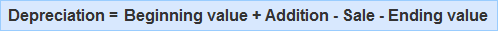

Under the revaluation method, a competent person values the company's assets at the end of each financial year and the depreciation is calculated by deducting the value at the end of the year from the value at the beginning of the year. However, adjustments are made if there are any additions to or sales of the assets made during the year. The revaluation method is especially suitable for calculating depreciation on the following assets: These assets are usually assorted and grouped under one fixed asset account. Examples of such assets include loose tools, crockery, cutlery, books, small office machines, small tools, and so on. A hotel purchased crockery on 1 January 2015 for $1,500. On 31 December 2016, it was valued by a chef at $1,250. In 2016, the hotel purchased more crockery items for $2,000. At the end of the year, the stock of crockery was valued at $2,850. Required: Calculate the amount of depreciation to be charged for 2015 and 2016. Depreciation for 2015 = Book value on 1 January 2015 - Value placed on 31 December 2015 = $1,500 - $1,250 = $250 Depreciation for 2016 = Book value on 1 January 2016 + Purchases during the year - Value placed on 31 December 2016 = $1,250 + 2,000 - $2,850 = $400 Continuing with the hotel from Example 1, let's suppose that in 2017, the hotel purchased more crockery for $2,400 and sold some worn-out crockery items for $400. At year-end, the total stock of crockery was valued at $4,050. Required: Compute the depreciation expense for 2017. Depreciation for 2017 = (Value on 1 January 2017 + Crockery purchased during the year - Crockery sold during the year) - Value placed on 31 December 2017. = ($2,850 + $2,400 - $400) - $4,050 = $800Definition and Explanation

Formula

Example 1

Solution

Example 2

Revaluation Method of Depreciation FAQs

Under the revaluation method, a competent person values the company’s assets at the end of each financial year and the depreciation is calculated by deducting the value at the end of the year from the value at the beginning of the year.

Under other methods, such as the straight-line or declining balance method, depreciation is calculated by taking into account only the original cost of the asset and its expected useful life. However, under the revaluation method, depreciation is also affected by changes in the value of the asset during the year. This method is especially suitable for calculating depreciation on assets that are small in value or prone to breakage.

The value of the assets is determined by a competent person, such as an accountant or appraiser. The value may be based on the original cost of the asset, its current market value, or some other appropriate measure.

Some advantages of using the revaluation method of depreciation include: -it provides a more accurate measure of an asset’s value. -It allows for a better matching of expenses to revenues. -It is easier to implement than other methods.

Some disadvantages of using the revaluation method of depreciation include: -it may be more difficult to value assets accurately. -Changes in the value of assets may not be accurately reflected in the depreciation expense. -The method may be less suitable for larger or more expensive assets.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.